MI-1040H_2michigan.gov documents taxes

•

1 like•128 views

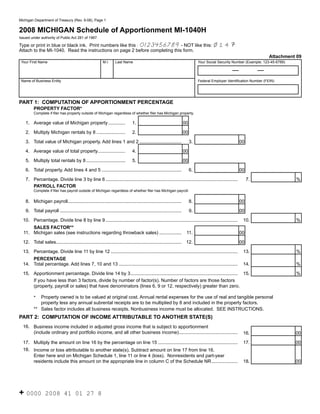

This document provides instructions for completing Michigan Schedule of Apportionment Form MI-1040H. It explains how to calculate apportionment percentages using property, payroll, and sales factors to determine the portion of business income taxable to Michigan for taxpayers with business activity both inside and outside the state. The factors are calculated by dividing the amounts in Michigan by the total amounts everywhere. It also provides definitions and rules for classifying property, payroll, and sales in Michigan or other states.

Report

Share

Report

Share

Download to read offline

Recommended

Minimum Tax worksheet

This document provides worksheets and instructions for calculating Maine's minimum tax for 2008. It includes:

1) A Maine minimum tax worksheet with lines for federal alternative minimum taxable income, Maine additions and subtractions, tentative and actual minimum tax amounts, and credits.

2) Additional worksheets for items like the standard deduction amount, income modifications, long-term care premiums, and the minimum tax on federal exclusion items.

3) Instructions for nonresidents and part-year residents to apportion the minimum tax based on Maine-source income.

The document provides the necessary forms and guidance for Maine taxpayers to determine if they owe the state's minimum tax and to correctly calculate the amount.

azdor.gov Forms .. ADOR Forms 140esi

This document provides instructions for making Arizona estimated income tax payments for individuals. It states that estimated payments must reasonably reflect the taxpayer's expected Arizona income tax liability for the year. Payments are due in four installments for calendar year taxpayers, on April 17, June 15, September 15, and January 16 of the following year. Penalties may apply for underpayment or late payment of estimated taxes.

School District Codes

This document is a Vermont captive insurance premium tax return form for the year 2007. It provides instructions for captive insurance companies to report their direct and reinsurance premiums collected in Vermont and calculate the taxes owed. Key information to report includes gross direct premiums, assumed reinsurance premiums, return premiums and deductions. Taxes owed are determined based on sliding tax rate schedules applied to net taxable premium amounts. The return is due by February 28, 2008 and must be signed and sent to the Vermont Department of Taxes.

Individual Estimated Tax Instructions (2009)

The document provides information about estimated income tax payments in Minnesota, including who must pay estimated tax, how to calculate estimated tax amounts, payment due dates and amounts. Taxpayers can pay estimated tax electronically, by credit card, or by check along with Form M14. The penalties for underpaying estimated tax are also described. Tax rates for 2009 are provided to help calculate estimated tax liabilities.

Complete Instructions

This document provides information about filing Wisconsin state tax returns for 2008:

- A new way to file state tax returns for 2008 is available online at revenue.wi.gov. It is free, secure, and accurate. Refunds are received within 5 days with direct deposit.

- Several tax law changes and credits are noted for 2008, including social security benefits no longer being taxable, an expanded medical care insurance subtraction, and new business credits.

- The document is an index to the Form 1 tax return instructions, listing various tax topics alphabetically like additions, deductions, exemptions, penalties and more.

tax.utah.gov forms current tc tc-544

This document provides instructions for paying Utah partnership tax balances. It explains that partnerships should use the payment coupon to pay balances due when filing a paper return or to pay an existing balance after filing. It includes a payment worksheet to calculate the minimum payment due, which is 90% of the current year's liability or 100% of the previous year's liability. Penalties may be assessed for underpayment or late payment. Interest accrues until the full balance is paid.

crf ksrevenue.org

This document is a Kansas Net Operating Loss Carry Forward Form used to calculate a taxpayer's net operating loss that can be carried forward to offset income in future tax years. It contains schedules to compute the Kansas net operating loss, distribute the loss amount to future years, and allocate income between spouses if filing statuses changed. The form provides instructions on how to complete the schedules for qualifying for a Kansas net operating loss carry forward based on having a federal net operating loss, Kansas tax return filed in the loss year, and Kansas source income or residency in the loss year.

M1M taxes.state.mn.us

This document provides instructions for completing Schedule M1M, which is used to determine additions and subtractions to income for Minnesota tax purposes. Specifically:

- Schedule M1M is used to reconcile federal and state taxable income by adding items excluded from federal but taxed by Minnesota income, and subtracting items taxed federally but excluded from Minnesota income.

- Items listed include interest from other states' bonds, federally tax-exempt mutual fund dividends, capital gains, depreciation adjustments, and certain deductions.

- Line-by-line instructions are provided for completing the additions and subtractions sections of Schedule M1M based on amounts reported on the federal return and other considerations.

Recommended

Minimum Tax worksheet

This document provides worksheets and instructions for calculating Maine's minimum tax for 2008. It includes:

1) A Maine minimum tax worksheet with lines for federal alternative minimum taxable income, Maine additions and subtractions, tentative and actual minimum tax amounts, and credits.

2) Additional worksheets for items like the standard deduction amount, income modifications, long-term care premiums, and the minimum tax on federal exclusion items.

3) Instructions for nonresidents and part-year residents to apportion the minimum tax based on Maine-source income.

The document provides the necessary forms and guidance for Maine taxpayers to determine if they owe the state's minimum tax and to correctly calculate the amount.

azdor.gov Forms .. ADOR Forms 140esi

This document provides instructions for making Arizona estimated income tax payments for individuals. It states that estimated payments must reasonably reflect the taxpayer's expected Arizona income tax liability for the year. Payments are due in four installments for calendar year taxpayers, on April 17, June 15, September 15, and January 16 of the following year. Penalties may apply for underpayment or late payment of estimated taxes.

School District Codes

This document is a Vermont captive insurance premium tax return form for the year 2007. It provides instructions for captive insurance companies to report their direct and reinsurance premiums collected in Vermont and calculate the taxes owed. Key information to report includes gross direct premiums, assumed reinsurance premiums, return premiums and deductions. Taxes owed are determined based on sliding tax rate schedules applied to net taxable premium amounts. The return is due by February 28, 2008 and must be signed and sent to the Vermont Department of Taxes.

Individual Estimated Tax Instructions (2009)

The document provides information about estimated income tax payments in Minnesota, including who must pay estimated tax, how to calculate estimated tax amounts, payment due dates and amounts. Taxpayers can pay estimated tax electronically, by credit card, or by check along with Form M14. The penalties for underpaying estimated tax are also described. Tax rates for 2009 are provided to help calculate estimated tax liabilities.

Complete Instructions

This document provides information about filing Wisconsin state tax returns for 2008:

- A new way to file state tax returns for 2008 is available online at revenue.wi.gov. It is free, secure, and accurate. Refunds are received within 5 days with direct deposit.

- Several tax law changes and credits are noted for 2008, including social security benefits no longer being taxable, an expanded medical care insurance subtraction, and new business credits.

- The document is an index to the Form 1 tax return instructions, listing various tax topics alphabetically like additions, deductions, exemptions, penalties and more.

tax.utah.gov forms current tc tc-544

This document provides instructions for paying Utah partnership tax balances. It explains that partnerships should use the payment coupon to pay balances due when filing a paper return or to pay an existing balance after filing. It includes a payment worksheet to calculate the minimum payment due, which is 90% of the current year's liability or 100% of the previous year's liability. Penalties may be assessed for underpayment or late payment. Interest accrues until the full balance is paid.

crf ksrevenue.org

This document is a Kansas Net Operating Loss Carry Forward Form used to calculate a taxpayer's net operating loss that can be carried forward to offset income in future tax years. It contains schedules to compute the Kansas net operating loss, distribute the loss amount to future years, and allocate income between spouses if filing statuses changed. The form provides instructions on how to complete the schedules for qualifying for a Kansas net operating loss carry forward based on having a federal net operating loss, Kansas tax return filed in the loss year, and Kansas source income or residency in the loss year.

M1M taxes.state.mn.us

This document provides instructions for completing Schedule M1M, which is used to determine additions and subtractions to income for Minnesota tax purposes. Specifically:

- Schedule M1M is used to reconcile federal and state taxable income by adding items excluded from federal but taxed by Minnesota income, and subtracting items taxed federally but excluded from Minnesota income.

- Items listed include interest from other states' bonds, federally tax-exempt mutual fund dividends, capital gains, depreciation adjustments, and certain deductions.

- Line-by-line instructions are provided for completing the additions and subtractions sections of Schedule M1M based on amounts reported on the federal return and other considerations.

740-ES Instructions for Filing Estimated Tax Vouchers - Form 42A740-S4

1) This document provides instructions for filing estimated tax vouchers in Kentucky for 2009. It notes that the standard deduction has increased to $2,190 and who must make estimated tax payments. 2) Estimated tax payments are due April 15, June 15, September 15, 2009 and January 15, 2010. Failure to pay at least 70% of the tax liability may result in penalties. 3) It provides details on calculating estimated taxes, including the family size tax credit and tax rates. Farmers have different filing requirements.

Instructions for NJ-1041

This document is a tax return form for the State of New Jersey for an Electing Small Business Trust (ESBT) for the tax year 2008. It contains sections to report the trust's income, deductions, taxes owed, and credits. Key details include:

- It reports S corporation income and non-S corporation income separately

- There are lines to calculate tax amounts owed for both types of income and claim credits for taxes paid to other jurisdictions

- Schedules are included to provide additional details on business income, capital gains, rental income, and beneficiary distributions

The form is used by ESBTs to file New Jersey gross income tax and report income from S corporations and non-S corporation sources,

state.ia.us tax forms 0841123

This document provides instructions for calculating an Iowa net operating loss (NOL) and applying the NOL to carryback or carryforward years. It contains sections to calculate the Iowa NOL, apply the NOL when it is not fully absorbed in a year, and apply the NOL when it is fully absorbed in a year. Key steps include adding back capital losses and deductions to the loss year, and recalculating itemized deductions and taxable income in the carryback/carryforward year after applying the NOL.

gov revenue formsandresources forms ESW-FID_fill-in

This document provides instructions for a 2009 Montana Fiduciary Estimated Income Tax Worksheet. It explains how to estimate income tax due for 2009 using tax due from 2008. It also provides guidance on recalculating estimated tax payments if income changes during the year, determining estimated withholding, nonresident tax payment requirements, and penalties for underpayment of estimated taxes.

Special Depreciation

- This document provides instructions for Illinois Form IL-2210, which is used to calculate penalties for failing to make timely estimated tax payments, failing to pay taxes owed by the due date, or failing to file a processable tax return by the extended due date.

- The instructions explain how to complete the six steps of Form IL-2210, including calculating required estimated tax installments, unpaid tax amounts, late payment penalties, and penalties for underpayment of estimated tax or late filing.

- Key details include penalty rates, rules for applying payments and credits, and options for using an annualized income method to potentially reduce penalty amounts for taxpayers with fluctuating incomes throughout the year.

revenue.ne.gov tax current f_1120n_inst

This document provides instructions for completing Nebraska's 2008 Corporation Income Tax return. It outlines who must file, when and where to file, income subject to Nebraska taxation, payment options including electronic funds transfer and credit cards, penalties, accounting methods, and other tax credits and deductions. Key reminders include no longer having to add back bonus depreciation and enhanced Section 179 deductions to Nebraska income and being able to reclaim portions of previous add-backs.

Instructions

This 3 sentence summary provides the essential information from the document:

The document provides instructions for completing Schedule OS to claim a credit for net income tax paid to another state. It explains who is eligible for the credit and how to calculate the credit amount based on income and taxes paid to the other state. The instructions include details on reporting income and tax amounts for different filing situations, such as composite returns filed by partnerships.

2009 Estimated Individual Income Tax Vouchers

This document provides instructions for filing estimated individual income tax payments in Mississippi for 2009. It outlines who must file estimated payments, when payments are due (in four equal installments on April 15, June 15, September 15, and January 15), and exceptions. It also lists personal exemptions, optional standard deductions, and tax rates that can be used to calculate estimated taxes. The mailing checklist provides details on how to submit estimate payments by mail.

2008 Application for Automatic Extension of Time to File

This document is Indiana's Form IT-9, which allows taxpayers to request a 60-day extension to file their state income tax return. It explains who should file, how to calculate the minimum extension payment, and where to send the completed form and payment. Key details include that the extension maintains an April 15 payment deadline to avoid penalties and interest, and the extension payment should be claimed as a credit on the eventual tax return.

Fill In

This document provides instructions for filing estimated tax declaration vouchers and making estimated tax payments for the 2008 tax year in Arkansas. Key details include:

- Taxpayers expecting to owe more than $1,000 in taxes must file a Declaration of Estimated Tax (Voucher 1) by April 15th for calendar year filers or by the 15th day of the 4th month of the fiscal year.

- The declaration estimates the taxpayer's income, deductions, credits and total tax for the year. Quarterly payments equaling at least 90% of the total tax must be made to avoid penalties for underestimating.

- Instructions are provided for completing the estimated tax worksheet to calculate the amount due, filling out

Estimated Partnership Business Tax Quarterly Payment Forms

This document provides instructions and forms for making estimated tax payments for New Hampshire partnership business taxes. It explains that partnerships must make estimated tax payments each quarter unless their annual tax is less than $200. The form is used to calculate the estimated tax amounts due for each quarter based on the partnership's taxable income. It must be submitted along with the estimated tax payment to meet the filing deadlines of April 15, June 15, September 15, and December 15. Penalties may apply for underpayment or late payment of estimated taxes.

2012 Income Tax Update

This document summarizes key 2011 individual income tax changes and tips. It discusses expanded IRS Form 1099 reporting requirements, the loss of some tax credits, a 2% payroll tax cut, and Illinois increasing its income tax rate from 3% to 5%. It provides details on new Forms 1099-K and 8949 for reporting stock basis and sales. The document also outlines various tax credits, deductions, and rates that were extended through 2012, including the alternative minimum tax exemption amounts.

Annual%20Insurance%20Return%20(Not%20for%20reporting%20Industrial%20Insurance...

This document is an annual insurance premium tax return for 2008 from an insurance company doing business in Nevada. It provides instructions for calculating various premium tax amounts owed to Nevada based on total premiums from the year. Key figures to report include total premiums, premium tax owed, potential credits for maintaining a home office or paying property taxes, and any penalties or interest owed for late filing.

schedule M wv.us taxrev forms

This document is a 2008 West Virginia tax form for reporting modifications to adjusted gross income. It lists various additions and subtractions that can modify a taxpayer's federal adjusted gross income for state tax purposes. Some key additions include tax-exempt interest from other states/localities and withdrawals from college savings plans not used for education. Key subtractions include certain retirement benefits, railroad retirement income, and senior/disability deductions. The taxpayer calculates total additions and subtractions and reports the amounts on the state tax return.

Instructions

This document provides instructions for Form 1-ES, which is used to pay estimated income tax for individuals, estates, and trusts in Wisconsin. It discusses who must pay estimated tax, when payments are due, and how to calculate the amount due. The key points are:

- You must pay estimated tax if you expect to owe at least $200 in tax and your withholding will be less than 90% of the current year's tax or 100% of the prior year's tax.

- Estimated tax payments are generally due on April 15, June 16, September 15, and January 16 of the following year. Special rules apply to farmers, fishers, and fiscal year filers.

- To calculate your

Amended Individual Income Tax Return

- The document provides instructions for filing an amended Illinois individual income tax return using Form IL-1040-X.

- It explains when an amended return should be filed, such as due to a change made on the federal return or an adjustment by the IRS.

- Detailed guidance is given on determining the filing deadline based on whether the change was state-only or resulted from federal adjustments. Supporting documentation that must be attached is also outlined.

Utility Property Tax Information Update

This document is a payment form for the New Hampshire Department of Revenue Administration's private car tax for 2007. It provides instructions for taxpayers to report their annual private car tax amount from their tax bill, make payments on any balance due including estimated tax payments, and claim overpayment credits or refunds. Taxpayers are directed to sign and submit the form along with any payment due by December 30, 2007.

azdor.gov Forms .. ADOR Forms 140ESi

1. This document provides instructions for making Arizona estimated income tax payments for 2002. It explains who must make estimated payments, how to calculate payment amounts, and payment due dates.

2. Taxpayers who had Arizona gross income over $150,000 ($75,000 for individuals) in 2001 must make estimated payments in 2002 unless their 2002 income will be lower. Payments are due in four equal installments by April 15, June 17, September 16, and January 15 of the following year.

3. Farmers, fishermen, and nonresident aliens have alternative estimated payment schedules with fewer required installments. Voluntary payments can also be made by those not otherwise required to pay estimated taxes.

4972-K - Kentucky Tax on Lump Sum Distribution - Form 42A740-S21

1) This document is a Kentucky tax form for reporting lump sum distributions from qualified retirement plans for individuals born before January 2, 1936.

2) It provides instructions for calculating the taxable and excludable portions of lump sum distributions based on information provided in federal tax forms.

3) The form walks through a multi-step process to determine the tax amount owed on lump sum distributions that must be included on the individual's state tax return.

4534_260841_7 michigan.gov documents taxes

This document is Michigan's 2008 Venture Capital Deduction Schedule. It provides instructions for taxpayers to claim a deduction for reinvesting gains from the sale of an initial equity investment in a qualified Michigan business into another qualified business within one year. Key details include requiring a minimum initial investment of $100,000, entering information about the initial and reinvestment businesses, and calculating the allowable deduction amount.

Nonrefundable Credits

This document is a Michigan Homestead Property Tax Credit Claim form for 2008. It requests information to determine eligibility for a tax credit, including the filer's home address, age, disability status, household income, property taxes paid, rent paid, and other financial information. The form provides instructions on how to calculate the potential tax credit amount and includes sections for homeowners, renters, occupants of housing where service fees are paid, and occupants of nursing homes.

Sch_NR_michigan.gov documents taxes

This document provides instructions for completing the Michigan Schedule NR form for nonresident and part-year resident taxpayers. It explains how to allocate and apportion different types of income to Michigan and other states. Key items include allocating wages, business income, capital gains, and retirement income based on residency. It also provides details on prorating exemptions and deductions for part-year residents.

More Related Content

What's hot

740-ES Instructions for Filing Estimated Tax Vouchers - Form 42A740-S4

1) This document provides instructions for filing estimated tax vouchers in Kentucky for 2009. It notes that the standard deduction has increased to $2,190 and who must make estimated tax payments. 2) Estimated tax payments are due April 15, June 15, September 15, 2009 and January 15, 2010. Failure to pay at least 70% of the tax liability may result in penalties. 3) It provides details on calculating estimated taxes, including the family size tax credit and tax rates. Farmers have different filing requirements.

Instructions for NJ-1041

This document is a tax return form for the State of New Jersey for an Electing Small Business Trust (ESBT) for the tax year 2008. It contains sections to report the trust's income, deductions, taxes owed, and credits. Key details include:

- It reports S corporation income and non-S corporation income separately

- There are lines to calculate tax amounts owed for both types of income and claim credits for taxes paid to other jurisdictions

- Schedules are included to provide additional details on business income, capital gains, rental income, and beneficiary distributions

The form is used by ESBTs to file New Jersey gross income tax and report income from S corporations and non-S corporation sources,

state.ia.us tax forms 0841123

This document provides instructions for calculating an Iowa net operating loss (NOL) and applying the NOL to carryback or carryforward years. It contains sections to calculate the Iowa NOL, apply the NOL when it is not fully absorbed in a year, and apply the NOL when it is fully absorbed in a year. Key steps include adding back capital losses and deductions to the loss year, and recalculating itemized deductions and taxable income in the carryback/carryforward year after applying the NOL.

gov revenue formsandresources forms ESW-FID_fill-in

This document provides instructions for a 2009 Montana Fiduciary Estimated Income Tax Worksheet. It explains how to estimate income tax due for 2009 using tax due from 2008. It also provides guidance on recalculating estimated tax payments if income changes during the year, determining estimated withholding, nonresident tax payment requirements, and penalties for underpayment of estimated taxes.

Special Depreciation

- This document provides instructions for Illinois Form IL-2210, which is used to calculate penalties for failing to make timely estimated tax payments, failing to pay taxes owed by the due date, or failing to file a processable tax return by the extended due date.

- The instructions explain how to complete the six steps of Form IL-2210, including calculating required estimated tax installments, unpaid tax amounts, late payment penalties, and penalties for underpayment of estimated tax or late filing.

- Key details include penalty rates, rules for applying payments and credits, and options for using an annualized income method to potentially reduce penalty amounts for taxpayers with fluctuating incomes throughout the year.

revenue.ne.gov tax current f_1120n_inst

This document provides instructions for completing Nebraska's 2008 Corporation Income Tax return. It outlines who must file, when and where to file, income subject to Nebraska taxation, payment options including electronic funds transfer and credit cards, penalties, accounting methods, and other tax credits and deductions. Key reminders include no longer having to add back bonus depreciation and enhanced Section 179 deductions to Nebraska income and being able to reclaim portions of previous add-backs.

Instructions

This 3 sentence summary provides the essential information from the document:

The document provides instructions for completing Schedule OS to claim a credit for net income tax paid to another state. It explains who is eligible for the credit and how to calculate the credit amount based on income and taxes paid to the other state. The instructions include details on reporting income and tax amounts for different filing situations, such as composite returns filed by partnerships.

2009 Estimated Individual Income Tax Vouchers

This document provides instructions for filing estimated individual income tax payments in Mississippi for 2009. It outlines who must file estimated payments, when payments are due (in four equal installments on April 15, June 15, September 15, and January 15), and exceptions. It also lists personal exemptions, optional standard deductions, and tax rates that can be used to calculate estimated taxes. The mailing checklist provides details on how to submit estimate payments by mail.

2008 Application for Automatic Extension of Time to File

This document is Indiana's Form IT-9, which allows taxpayers to request a 60-day extension to file their state income tax return. It explains who should file, how to calculate the minimum extension payment, and where to send the completed form and payment. Key details include that the extension maintains an April 15 payment deadline to avoid penalties and interest, and the extension payment should be claimed as a credit on the eventual tax return.

Fill In

This document provides instructions for filing estimated tax declaration vouchers and making estimated tax payments for the 2008 tax year in Arkansas. Key details include:

- Taxpayers expecting to owe more than $1,000 in taxes must file a Declaration of Estimated Tax (Voucher 1) by April 15th for calendar year filers or by the 15th day of the 4th month of the fiscal year.

- The declaration estimates the taxpayer's income, deductions, credits and total tax for the year. Quarterly payments equaling at least 90% of the total tax must be made to avoid penalties for underestimating.

- Instructions are provided for completing the estimated tax worksheet to calculate the amount due, filling out

Estimated Partnership Business Tax Quarterly Payment Forms

This document provides instructions and forms for making estimated tax payments for New Hampshire partnership business taxes. It explains that partnerships must make estimated tax payments each quarter unless their annual tax is less than $200. The form is used to calculate the estimated tax amounts due for each quarter based on the partnership's taxable income. It must be submitted along with the estimated tax payment to meet the filing deadlines of April 15, June 15, September 15, and December 15. Penalties may apply for underpayment or late payment of estimated taxes.

2012 Income Tax Update

This document summarizes key 2011 individual income tax changes and tips. It discusses expanded IRS Form 1099 reporting requirements, the loss of some tax credits, a 2% payroll tax cut, and Illinois increasing its income tax rate from 3% to 5%. It provides details on new Forms 1099-K and 8949 for reporting stock basis and sales. The document also outlines various tax credits, deductions, and rates that were extended through 2012, including the alternative minimum tax exemption amounts.

Annual%20Insurance%20Return%20(Not%20for%20reporting%20Industrial%20Insurance...

This document is an annual insurance premium tax return for 2008 from an insurance company doing business in Nevada. It provides instructions for calculating various premium tax amounts owed to Nevada based on total premiums from the year. Key figures to report include total premiums, premium tax owed, potential credits for maintaining a home office or paying property taxes, and any penalties or interest owed for late filing.

schedule M wv.us taxrev forms

This document is a 2008 West Virginia tax form for reporting modifications to adjusted gross income. It lists various additions and subtractions that can modify a taxpayer's federal adjusted gross income for state tax purposes. Some key additions include tax-exempt interest from other states/localities and withdrawals from college savings plans not used for education. Key subtractions include certain retirement benefits, railroad retirement income, and senior/disability deductions. The taxpayer calculates total additions and subtractions and reports the amounts on the state tax return.

Instructions

This document provides instructions for Form 1-ES, which is used to pay estimated income tax for individuals, estates, and trusts in Wisconsin. It discusses who must pay estimated tax, when payments are due, and how to calculate the amount due. The key points are:

- You must pay estimated tax if you expect to owe at least $200 in tax and your withholding will be less than 90% of the current year's tax or 100% of the prior year's tax.

- Estimated tax payments are generally due on April 15, June 16, September 15, and January 16 of the following year. Special rules apply to farmers, fishers, and fiscal year filers.

- To calculate your

Amended Individual Income Tax Return

- The document provides instructions for filing an amended Illinois individual income tax return using Form IL-1040-X.

- It explains when an amended return should be filed, such as due to a change made on the federal return or an adjustment by the IRS.

- Detailed guidance is given on determining the filing deadline based on whether the change was state-only or resulted from federal adjustments. Supporting documentation that must be attached is also outlined.

Utility Property Tax Information Update

This document is a payment form for the New Hampshire Department of Revenue Administration's private car tax for 2007. It provides instructions for taxpayers to report their annual private car tax amount from their tax bill, make payments on any balance due including estimated tax payments, and claim overpayment credits or refunds. Taxpayers are directed to sign and submit the form along with any payment due by December 30, 2007.

azdor.gov Forms .. ADOR Forms 140ESi

1. This document provides instructions for making Arizona estimated income tax payments for 2002. It explains who must make estimated payments, how to calculate payment amounts, and payment due dates.

2. Taxpayers who had Arizona gross income over $150,000 ($75,000 for individuals) in 2001 must make estimated payments in 2002 unless their 2002 income will be lower. Payments are due in four equal installments by April 15, June 17, September 16, and January 15 of the following year.

3. Farmers, fishermen, and nonresident aliens have alternative estimated payment schedules with fewer required installments. Voluntary payments can also be made by those not otherwise required to pay estimated taxes.

What's hot (18)

740-ES Instructions for Filing Estimated Tax Vouchers - Form 42A740-S4

740-ES Instructions for Filing Estimated Tax Vouchers - Form 42A740-S4

gov revenue formsandresources forms ESW-FID_fill-in

gov revenue formsandresources forms ESW-FID_fill-in

2008 Application for Automatic Extension of Time to File

2008 Application for Automatic Extension of Time to File

Estimated Partnership Business Tax Quarterly Payment Forms

Estimated Partnership Business Tax Quarterly Payment Forms

Annual%20Insurance%20Return%20(Not%20for%20reporting%20Industrial%20Insurance...

Annual%20Insurance%20Return%20(Not%20for%20reporting%20Industrial%20Insurance...

Viewers also liked

4972-K - Kentucky Tax on Lump Sum Distribution - Form 42A740-S21

1) This document is a Kentucky tax form for reporting lump sum distributions from qualified retirement plans for individuals born before January 2, 1936.

2) It provides instructions for calculating the taxable and excludable portions of lump sum distributions based on information provided in federal tax forms.

3) The form walks through a multi-step process to determine the tax amount owed on lump sum distributions that must be included on the individual's state tax return.

4534_260841_7 michigan.gov documents taxes

This document is Michigan's 2008 Venture Capital Deduction Schedule. It provides instructions for taxpayers to claim a deduction for reinvesting gains from the sale of an initial equity investment in a qualified Michigan business into another qualified business within one year. Key details include requiring a minimum initial investment of $100,000, entering information about the initial and reinvestment businesses, and calculating the allowable deduction amount.

Nonrefundable Credits

This document is a Michigan Homestead Property Tax Credit Claim form for 2008. It requests information to determine eligibility for a tax credit, including the filer's home address, age, disability status, household income, property taxes paid, rent paid, and other financial information. The form provides instructions on how to calculate the potential tax credit amount and includes sections for homeowners, renters, occupants of housing where service fees are paid, and occupants of nursing homes.

Sch_NR_michigan.gov documents taxes

This document provides instructions for completing the Michigan Schedule NR form for nonresident and part-year resident taxpayers. It explains how to allocate and apportion different types of income to Michigan and other states. Key items include allocating wages, business income, capital gains, and retirement income based on residency. It also provides details on prorating exemptions and deductions for part-year residents.

Ohio Manufacturing Machinery and Equipment Investment Grant Program/Ohio Manu...

This document provides instructions for completing West Virginia estimated tax vouchers and worksheets. It defines estimated tax as expected income tax for the year less tax credits. Taxpayers must make estimated payments if their estimated tax is at least $600, unless the liability is less than 10% of estimated tax. Payments are due quarterly. The worksheet calculates estimated tax liability and the minimum amount to be paid through withholding and estimated payments as 90% of the estimated tax. Penalties apply if not enough is prepaid unless an exception applies such as having no tax liability the prior year.

an9725r wv.us taxrev forms 2008/

This administrative notice clarifies how to calculate the income percentage for West Virginia nonresident or part-year resident tax returns. The income percentage is the fraction of a taxpayer's West Virginia source income over their total federal adjusted gross income. This fraction is used to determine what portion of the tentative full-year tax liability is owed. The notice specifies that in no case will the income percentage exceed 100%, even if the fraction calculates to be over 100%, as the percentage is capped at 100%. An example is provided to illustrate where the calculated fraction is over 100% but the income percentage used is capped at 100%.

De Thi Vao 10ly Ams 2001 Dain

The document discusses five electrical circuit problems:

1. Calculating the power consumed by a circuit operating at 120V.

2. Determining the current in a circuit with a 120V-300W heater.

3. Calculating the resistance in a circuit with a 2.5W lamp.

4. Identifying components in a circuit diagram, including resistors, capacitors, inductors.

5. Analyzing a series circuit with a 50W bulb and variable resistor to determine how resistance affects bulb brightness.

Schedule A - Real Estate

This document is an inheritance tax return schedule for real estate owned by an estate. It includes sections to list the description and value of each real estate property owned by the decedent at the time of death. There is also a worksheet to calculate a special use value for any qualified real property used for farming or other special purposes, to potentially lower the taxable value from fair market value.

Combined Return for Household Employers

This document provides instructions for filling out an Illinois Form IL-4852, which is used to substitute for an unobtainable Form W-2 from an employer. The summary is:

1) Form IL-4852 should be filed if a taxpayer did not receive or cannot obtain a Form W-2 showing Illinois income tax withholding from their wages.

2) Proof of wages and withholding such as pay stubs or a letter from the employer must be attached, including the taxpayer's name, SSN, tax year, Illinois tax withheld, and total wages.

3) The form requires identifying information about the taxpayer and employer as well as stating the reason for not receiving a Form W-

Statement of Person Claiming Refund Due to Deceased Taxpayer

This document lists all of the designated enterprise zones in Illinois from 1983 to 2007. It provides the names of municipalities and counties that make up each zone as well as the dates they were designated. It also briefly describes what enterprise zones and foreign trade zones are and provides contact information for more details.

Venture capital

Venture capital is a form of private equity and refers to capital provided to early-stage, emerging firms that have high growth potential. This document discusses venture capital funding and its role in social entrepreneurship. It provides details on the venture capital process, types of funds, and what VCs look for in potential investments. Examples of social ventures like Grameen Bank that received VC funding are discussed, highlighting their success in alleviating poverty and empowering communities. While VC can motivate social initiatives requiring significant capital, the document notes that VCs primarily support experienced entrepreneurs and firms in high-tech sectors.

- Land Gains Foreclosure Basis Form & TB

This document is a Vermont Wholesale Cigarette Dealer Report form from the Vermont Department of Taxes. The form requires dealers to report their monthly inventory of cigarette stamps, the number of cigarette and little cigar packs stamped, as well as the amount of non-stamped little cigars and roll-your-own tobacco sold. The dealer must then calculate and report the total tax due for non-stamped little cigars and roll-your-own tobacco sold during the month.

schooldistrictcodes

The document provides information on school district codes and tax rates for Vermont. It lists the school district code, name, household income percentage for property taxes, homestead exemption value, and school tax on a $200,000 property for each district. It provides definitions for terms like household income percentage, homestead exemption value, and indicates which forms certain filers should use specific school district codes on.

taxCreditRecapScheduleAndScheduleT

This document is a summary form and schedule used by individuals in West Virginia to claim various state tax credits against their personal income tax. It lists 16 different tax credits that can be claimed, along with the schedule or form used to calculate each credit. The taxpayer must complete this summary form and attach the applicable calculation schedules or forms when filing their tax return in order to claim any of the credits.

schedule F wv.us taxrev forms

This document is a Schedule F form used to claim a tax refund due to a deceased taxpayer. It requests information such as the name and social security number of the deceased taxpayer and claimant. The claimant must check whether they are the surviving spouse filing a joint return, the administrator or executor of the estate, or another claimant. If another claimant, they must confirm whether the deceased left a will, if an administrator has been appointed, and if they will distribute the refund according to state law where the taxpayer was domiciled. The claimant signs to verify the claim and their authority to claim the refund.

schedules HE wv.us taxrev forms

This document contains information about West Virginia tax forms for disabled individuals and tax credits. It includes a certification of permanent and total disability form that must be completed by a physician. It also provides instructions on resident status and claiming a credit for income taxes paid to another state.

Homestead Property Tax Credit Claim for Veterans and Blind People

This document is a Michigan Homestead Property Tax Credit Claim form for veterans and blind people. It collects information such as the filer's name, address, dates of residency, veteran or disability status, income amounts from various sources, property taxes paid, and requests direct deposit information for a tax refund. The form has sections for homeowners to report their homestead address and dates of ownership, and calculations for property tax credits. It also has sections for renters, to report addresses and dates of rental properties and calculations to determine an equivalent property tax credit.

Inheritance Tax Release

This document is an inheritance tax release form from the Tennessee Department of Revenue. It provides instructions for completing the form to transfer ownership of real or personal property from a deceased person's estate without paying inheritance taxes. The form requires information like the decedent's name, county of residence, social security number, and a description of the specific property being transferred. It must be signed by an estate representative and returned to the Department of Revenue for approval.

Viewers also liked (20)

4972-K - Kentucky Tax on Lump Sum Distribution - Form 42A740-S21

4972-K - Kentucky Tax on Lump Sum Distribution - Form 42A740-S21

Ohio Manufacturing Machinery and Equipment Investment Grant Program/Ohio Manu...

Ohio Manufacturing Machinery and Equipment Investment Grant Program/Ohio Manu...

Statement of Person Claiming Refund Due to Deceased Taxpayer

Statement of Person Claiming Refund Due to Deceased Taxpayer

Homestead Property Tax Credit Claim for Veterans and Blind People

Homestead Property Tax Credit Claim for Veterans and Blind People

Similar to MI-1040H_2michigan.gov documents taxes

MBT Small Co

This document summarizes information from Samuel L. Hodges, a CPA with over 20 years of experience providing state and local tax advice. It discusses topics related to the Michigan Business Tax including nexus, apportionment, credits, and definitions. Base case examples are provided to illustrate tax calculations under different scenarios.

BI-473 - Partnership/Limited Liability Company Schedule

This document provides instructions for completing Vermont Form BA-402, which is used for apportioning and allocating income for entities that conduct business both within and outside of Vermont. It explains that a three-factor apportionment formula is used that considers sales, payroll, and property within Vermont as a percentage of the total amounts everywhere. The form has sections to directly allocate nonbusiness income and foreign dividends, calculate apportionment factors for sales, payroll, and property, and then average the percentages to determine Vermont apportioned income.

Michigan Business Tax Case Study

This document discusses several topics related to unitary taxation and the Michigan Business Tax (MBT), including:

- Defining what constitutes a unitary business group and the tests for determining unity

- The process of attributing ownership and control through constructive ownership rules

- Examples of factors that demonstrate a flow of value between business entities

- An overview of how the MBT applies to deferred tax accounting under FAS 109

Amended Individual Income Tax Return

This document is an Indiana amended individual income tax return form (IT-40X) for the year being amended. It provides instructions for taxpayers to correct errors or omissions on their original Indiana individual income tax return. The form collects identifying information about the taxpayer, income and exemption amounts, tax due, credits, payments, and refund or amount due. It directs taxpayers to provide explanations for amendments and attach supporting documentation.

gov revenue formsandresources forms FRM_fill-in

This document provides instructions for Montana's 2008 Farm and Ranch Risk Management Account annual reporting form. It explains that eligible agricultural businesses can establish an account to exclude deposits of up to $20,000 from adjusted gross income. Deposits must be made in the tax year or within 3.5 months after, and must be distributed within 5 years or will be considered taxable income. The form requires information on the account grantor and trustee, deposits made in the tax year, and any distributions from the account.

Country by country

Country by Country (CbC) reporting is covered by the UAE’s cabinet resolution No. 32 of 2019. It is part of action 13 of the Base Erosion and Profit Shifting (BEPS) initiative led by the Organization for Economic Co-operation and Development (OECD) and the Group of Twenty (G20) industrialized nation.

Kichen

This document provides instructions for completing Schedule E of Form 1040 to report supplemental income and loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. Key details include:

- Schedule E is used to report income or loss from various sources including rental real estate, royalties, partnerships, and S corporations.

- Forms that may also need to be filed depending on the type of income include Form 4562 for depreciation, Form 4797 for sales of business property, and Form 8582 for passive activity losses.

- Special rules apply for husband-wife qualified joint ventures treating a jointly owned and operated rental real estate business as

Planning to Avoid the New Medicare Tax & Other 2013 Tax Increases

Information on all of the new tax increases for 2013, including the new Medicare tax, and how it will affect you!

For more information, please visit us at www.givnerkaye.com

Solution Manual for South-Western Federal Taxation 2024 Corporations, Partner...

Solution Manual for South-Western Federal Taxation 2024 Corporations, Partner...Test Bank And Solution Manual Marketplace

South-Western Federal Taxation 2024 Corporations, Partnerships, Estates and Trusts, 47th Edition Solution Manual ISBN-13 9780357900673, full product at https://coursecost.com/product/solution-manual-for-south-western-federal-taxation-2024-corporations-partnerships-estates-and-trusts-47th-edition/state.ia.us tax forms 0841134

This document is an Iowa Department of Revenue form and instructions for calculating an S Corporation Apportionment Credit. It provides information for shareholders of S corporations operating in Iowa and other states to determine what portion of their S corporation income is taxable in Iowa. Key parts include:

- Calculating the shareholder's Iowa-source S corporation income by applying the business activity ratio reported by the S corporation to the shareholder's net S corporation income.

- Determining cash or property distributions from income not previously taxed by Iowa to calculate the credit amount.

- Instructions specify not to include certain itemized deductions or distributions already taxed by Iowa in previous years.

state.ia.us tax forms 0845007

This document provides instructions for calculating penalties for underpayment of estimated taxes on an Iowa individual income tax return form (IA 2210). Key details:

- Lines 1-10 calculate the amount of tax owed for the year. Line 10 is the smaller of the current year or prior year tax.

- Line 11 divides the amount on line 10 by the number of required installment payments, generally 4. This is the minimum payment due per period.

- Line 12 allows for calculating installments using an annualized income method if income varies greatly during the year.

- Lines 13-18 calculate any penalties owed for underpayment of estimated taxes by comparing actual payments to the required installments on line 11 or 12

Schedule EC

This document provides instructions for completing Wisconsin Schedule EC, which is used to claim the enterprise zone jobs credit. The credit is available for businesses certified by the Wisconsin Department of Commerce that operate within a designated enterprise zone. The schedule collects information to calculate a regular credit based on increased employment and wages, as well as a supplemental credit for training employees who work in an enterprise zone. Line-by-line instructions are provided for completing various parts of the schedule to determine the total available enterprise zone jobs credit.

ACC 291 GENIUS NEW Introduction Education--acc291genius.com

This document provides study materials and practice problems for ACC 291 exam preparation. It includes a 100-question practice exam guide, two case study assignments analyzing the financial statements of Columbia Sportswear Company and VF Corporation, and a Connect practice assignment recording journal entries for various retail business transactions involving purchases, sales, payments and returns. The document aims to help students learn accounting concepts related to receivables, payables, inventory, and financial statement analysis.

Sch_1_2michigan.gov documents taxes

This document is a 2008 Michigan Schedule 1 Additions and Subtractions form. It contains instructions for reporting additions to and subtractions from income on a Michigan tax return. Some key additions include interest and dividends from other states, the deduction for federal taxes, and gains/losses from other forms. Key subtractions include income from U.S. government bonds, military pay, retirement/pension benefits, and various tax credits. The purpose of this form is to reconcile a taxpayer's federal adjusted gross income with their income for Michigan state tax purposes.

Voluntary Contributions Schedule

This document is a 2008 Michigan Schedule 1 Additions and Subtractions form. It contains instructions for reporting additions to and subtractions from income on a Michigan tax return. Some key additions include interest and dividends from other states, the deduction for federal taxes, and gains/losses from other forms. Key subtractions include income from U.S. government bonds, military pay, retirement/pension benefits, and various tax credits. The purpose of this form is to reconcile a taxpayer's federal adjusted gross income with their income for Michigan state tax purposes.

2018 federal budget

The 2018 Federal Budget document summarizes key impacts on businesses, individuals, and trusts from the Canadian federal budget presented on February 27, 2018. For businesses, the budget reduces the small business tax rate over the next two years and proposes new measures around passive investment income that will reduce access to the small business tax rate for corporations with over $50,000 of investment income. For individuals, the budget increases the Canada Worker Benefit. For trusts, new reporting requirements will require most trusts to file a T3 tax return providing additional information on trustees, beneficiaries, and controllers starting in 2021.

2016.06.11_Minimum Alternate Tax (MAT).docx

The document discusses Minimum Alternate Tax (MAT) under Section 115JB of the Income Tax Act, 1961. It was introduced to tax "zero tax companies" that showed profits but paid no tax. MAT is calculated at 18.5% of book profits, which are adjusted net profits as per financial statements. Various additions and deductions are prescribed to calculate book profits for MAT. The document explains the objective, history, charging section, applicability, computation of book profits, and adjustments in detail over multiple pages.

2771f_2901_7 michigan.gov documents taxes

Michigan requires concessionaires operating at events to collect and remit sales, use, and income tax withholding. This document provides instructions for concessionaires to complete the Concessionaire's Sales Tax Return and Payment form to file the required taxes. It explains how to calculate the amounts due for sales tax on goods sold, use tax on items purchased for business use, and income tax withholding for wages paid to employees. Late fees are charged as a percentage of unpaid taxes and daily interest is applied if taxes are paid after the due date, which is 3 business days after the event.

FKA Tax Cuts and Jobs Act 12 21

The document summarizes key provisions of the Tax Cuts and Jobs Act that are of interest to real estate advisors. It outlines changes to individual and corporate tax rates, pass-through business rates, business interest deductions, like-kind exchanges, expensing and depreciation of equipment, international tax provisions, reduced FIRPTA withholding rates, and state and local tax deductions. It also notes other provisions and considerations for strategic planning.

Advanced Taxation to understand the taxation

The document provides an outline for an advanced taxation presentation for members of an internal audit department. It covers various topics related to income tax including sources of income, assessable income, business income, deductions, capital allowances, losses, calculation of taxable income, and imposition of income tax. The desired outcomes of the presentation are to refresh knowledge of taxation, develop auditing skills, maximize results with minimum efforts, create a learning culture, and contribute to career development and achieving annual audit plans.

Similar to MI-1040H_2michigan.gov documents taxes (20)

BI-473 - Partnership/Limited Liability Company Schedule

BI-473 - Partnership/Limited Liability Company Schedule

Planning to Avoid the New Medicare Tax & Other 2013 Tax Increases

Planning to Avoid the New Medicare Tax & Other 2013 Tax Increases

Solution Manual for South-Western Federal Taxation 2024 Corporations, Partner...

Solution Manual for South-Western Federal Taxation 2024 Corporations, Partner...

ACC 291 GENIUS NEW Introduction Education--acc291genius.com

ACC 291 GENIUS NEW Introduction Education--acc291genius.com

More from taxman taxman

ftb.ca.gov forms 09_3528a

This document is an application for a California homebuyer's tax credit. It contains sections for the seller to certify that the home has never been occupied, as well as sections for the escrow company to provide closing details. Finally, there are sections for up to three qualified buyers to provide their contact and ownership information and certify that they intend to use the home as their primary residence for at least two years. The buyers will receive a tax credit of up to 5% of the home's purchase price or $10,000, whichever is less.

ftb.ca.gov forms 09_593bk

This document contains Forms 593-C and 593-E and instructions for real estate withholding in California for 2009. It explains that real estate withholding is a prepayment of estimated income tax due from gains on real estate sales in California. The Real Estate Escrow Person is responsible for providing the forms to sellers and withholding the appropriate amount based on the forms submitted.

ftb.ca.gov forms 09_593v

This document provides instructions for completing Form 593-V Payment Voucher for Real Estate Withholding Electronic Submission. Key details include:

1) Form 593-V is used to remit real estate withholding payment to the Franchise Tax Board if Form 593 was filed electronically. It must include the withholding agent's identifying information and payment amount.

2) Payments can be made by check or money order payable to the Franchise Tax Board, or through electronic funds transfer for large payments. The payment must match the electronically filed Form 593.

3) Payments are due within 20 days of the end of the month in which the real estate transaction occurred. Interest and penalties

ftb.ca.gov forms 09_593i

This document provides instructions for California real estate withholding on installment sales. It explains that for tax years beginning on or after January 1, 2009, the buyer is required to withhold taxes on the principal portion of each installment payment for properties sold via an installment sale. The form guides the buyer through providing their contact information, the seller's information, acknowledging the withholding requirement, and signing to indicate they understand their obligation to withhold taxes and send payments to the state. Escrow agents are instructed to send the initial withholding amount to the state and provide copies of documents to help facilitate ongoing withholding as future installment payments are made.

ftb.ca.gov forms 09_593c

This document is a California Form 593-C, which is a Real Estate Withholding Certificate. It allows a seller of California real estate to certify exemptions from real estate withholding requirements. The form has four parts: seller information, certifications that fully exempt from withholding, certifications that may partially or fully exempt, and the seller's signature. Checking boxes in Part II or III can allow full or partial exemption from the default 3 1/3% withholding on the sales price of California real estate.

ftb.ca.gov forms 09_593

This document is a California Form 593 for real estate withholding tax. It contains information about the withholding agent, seller or transferor, escrow or exchange details, and transaction details. The form requires the seller to sign a perjury statement if electing an optional gain on sale calculation method rather than the default 3 1/3% of total sales price withholding amount.

ftb.ca.gov forms 09_592v

This document provides instructions for completing Form 592-V, the payment voucher for electronically filed Form 592 (Quarterly Resident and Nonresident Withholding Statement) and Form 592-F (Foreign Partner or Member Annual Return). Key details include verifying complete information is provided on the voucher, rounding cents to dollars, mailing the payment and voucher to the Franchise Tax Board by the payment due date, and interest and penalties for late payments.

ftb.ca.gov forms 09_592b

This document is a California Form 592-B for the tax year 2009. It provides instructions for withholding agents and recipients regarding nonresident and resident withholding. Key details include:

- Form 592-B is used to report income subject to withholding and the amount of California tax withheld.

- It must be provided to recipients by January 31 and to foreign partners by the 15th day of the 4th month following the close of the taxable year.

- The recipient should attach Copy B to their California tax return to claim the withholding amount.

ftb.ca.gov forms 09_592a

This document is a Foreign Partner or Member Quarterly Withholding Remittance Statement form for tax year 2009 from the California Franchise Tax Board. It contains instructions for three installment payments due by the 15th day of the 4th, 6th, and 9th months of the tax year. The form collects identifying information about the Withholding Agent such as name, address, ID number, and payment amounts to be remitted to the Franchise Tax Board.

ftb.ca.gov forms 09_592

This document is a Quarterly Resident and Nonresident Withholding Statement form for tax year 2009. It is used to report tax amounts withheld from payments made to independent contractors, recipients of rents/royalties, distributions to shareholders/partners/beneficiaries, and other types of income. The form includes sections to enter information about the withholding agent, types of income, amounts of tax withheld and due, and a schedule of payees listing details of payments made and tax withheld for each recipient. Instructions are provided on filing deadlines, common errors to avoid, electronic filing requirements, interest and penalties.

ftb.ca.gov forms 09_590p

This document is a Nonresident Withholding Exemption Certificate form used to certify an exemption from withholding on distributions of previously reported income from an S corporation, partnership, or LLC. It allows a nonresident shareholder, partner, or member to claim exemption if the income represented by the distribution was already reported on their California tax return. The form requires information about the entity and individual, and certification that the income has been reported. It is to be kept by the entity and presented to claim exemption from withholding requirements on distributions of prior year income.

ftb.ca.gov forms 09_590

This document is a Withholding Exemption Certificate form from the California Franchise Tax Board. It allows individuals and entities to certify an exemption from California nonresident income tax withholding. The form contains checkboxes for different types of taxpayers, including individuals, corporations, partnerships, LLCs, tax-exempt entities, and trusts, to claim an exemption based on their status. It requires the taxpayer's name, address, and signature to certify that the information provided is true and correct.

ftb.ca.gov forms 09_588

This document is a request form for a waiver of nonresident withholding in California. It requests information about the requester, withholding agent, and payees. The requester provides their name and address and selects the type of income payment for which a waiver is requested. The withholding agent's name and address are also provided. In the vendor/payee section, names, addresses, and tax identification numbers are listed along with the reason for waiver request. Reasons include having current tax returns on file, making estimated payments, being a member of a combined reporting entity, or other special circumstances. The form is signed under penalty of perjury.

ftb.ca.gov forms 09_587

This document is a Nonresident Withholding Allocation Worksheet (Form 587) used to determine if withholding of income tax is required for payments made by a withholding agent to a nonresident vendor/payee. The vendor/payee provides information about the types of payments received and allocation of income between California and other states. The withholding agent uses this information to determine if withholding of 7% is required based on the amount of California-source income payments exceeding $1,500.

ftb.ca.gov forms 09_570

This document is a tax return form for California's nonadmitted insurance tax. It provides instructions for calculating taxes owed on insurance premiums paid to insurers not authorized to conduct business in California. The form includes sections to enter the taxpayer's information, identify the tax period and insurance contracts, compute the tax amount, and make payments or claim refunds. It also provides directions on filing amended returns, payment due dates, and authorizing a third party to discuss the filing with the tax agency.

ftb.ca.gov forms 09_541es

The document provides instructions for Form 541-ES, which is used to calculate and pay estimated tax for estates and trusts. Key details include:

- Estimated tax payments for 2009 are now required to be 30% of the estimated tax liability for the 1st and 2nd installments and 20% for the 3rd and 4th installments.

- Estates and trusts with a 2009 adjusted gross income of $1,000,000 or more must base estimated tax payments on their 2009 tax liability rather than the prior year's tax.

- The form and instructions provide guidance on calculating estimated tax, payment due dates, and how to complete and submit Form 541-ES.

ftb.ca.gov forms 09_540esins

This document provides instructions for California taxpayers to estimate their tax liability and make estimated tax payments for tax year 2009. Key details include:

- Taxpayers must make estimated payments if they expect to owe $500 or more in tax for 2009 after subtracting withholding and credits.

- Payments are due April 15, June 15, September 15 of 2009, and January 15 of 2010.

- A worksheet is provided to help calculate estimated tax liability based on 2008 tax return or expected 2009 income.

- Failure to make required estimated payments may result in penalties. Electronic payment is required for payments over $20,000.

ftb.ca.gov forms 09_540es

This document provides instructions for making estimated tax payments for individuals in California. It includes:

1) Directions for making online payments through the Franchise Tax Board website for ease and to schedule payments up to a year in advance.

2) A form for making estimated tax payments by mail on April 15, June 15, September 15, and January 15 that includes fields for name, address, amounts owed, and payment instructions.

3) Reminders not to combine estimated tax payments with tax payments from the previous year and to write your name and identification number on the check.

ftb.ca.gov forms 1240

This document contains contact information for the California Franchise Tax Board. It lists phone numbers and addresses for various tax-related services, including automated phone services, taxpayer assistance, tax practitioner services, and departments within the FTB that handle issues like collections, bankruptcy, and deductions. The board members and executive officer are also named.

ftb.ca.gov forms 1015B

This document provides answers to frequently asked questions about tax audits conducted by the Franchise Tax Board of California. It explains that the purpose of an audit is to fairly verify the correct amount of taxes owed. It addresses questions about obtaining representation, responding to information requests, payment plans if additional taxes are owed, and appeal rights. The document directs taxpayers to contact their auditor or the Franchise Tax Board directly for additional assistance.

More from taxman taxman (20)

Recently uploaded

Structural Design Process: Step-by-Step Guide for Buildings

The structural design process is explained: Follow our step-by-step guide to understand building design intricacies and ensure structural integrity. Learn how to build wonderful buildings with the help of our detailed information. Learn how to create structures with durability and reliability and also gain insights on ways of managing structures.

Creative Web Design Company in Singapore

At Techbox Square, in Singapore, we're not just creative web designers and developers, we're the driving force behind your brand identity. Contact us today.

一比一原版新西兰奥塔哥大学毕业证(otago毕业证)如何办理

一模一样【微信:A575476】【新西兰奥塔哥大学毕业证(otago毕业证)成绩单Offer】【微信:A575476】(留信学历认证永久存档查询)采用学校原版纸张、特殊工艺完全按照原版一比一制作(包括:隐形水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠,文字图案浮雕,激光镭射,紫外荧光,温感,复印防伪)行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备,十五年致力于帮助留学生解决难题,业务范围有加拿大、英国、澳洲、韩国、美国、新加坡,新西兰等学历材料,包您满意。

【业务选择办理准则】

一、工作未确定,回国需先给父母、亲戚朋友看下文凭的情况,办理一份就读学校的毕业证【微信:A575476】文凭即可

二、回国进私企、外企、自己做生意的情况,这些单位是不查询毕业证真伪的,而且国内没有渠道去查询国外文凭的真假,也不需要提供真实教育部认证。鉴于此,办理一份毕业证【微信:A575476】即可

三、进国企,银行,事业单位,考公务员等等,这些单位是必需要提供真实教育部认证的,办理教育部认证所需资料众多且烦琐,所有材料您都必须提供原件,我们凭借丰富的经验,快捷的绿色通道帮您快速整合材料,让您少走弯路。

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

→ 【关于价格问题(保证一手价格)

我们所定的价格是非常合理的,而且我们现在做得单子大多数都是代理和回头客户介绍的所以一般现在有新的单子 我给客户的都是第一手的代理价格,因为我想坦诚对待大家 不想跟大家在价格方面浪费时间

对于老客户或者被老客户介绍过来的朋友,我们都会适当给一些优惠。

选择实体注册公司办理,更放心,更安全!我们的承诺:可来公司面谈,可签订合同,会陪同客户一起到教育部认证窗口递交认证材料,客户在教育部官方认证查询网站查询到认证通过结果后付款,不成功不收费!

Event Report - SAP Sapphire 2024 Orlando - lots of innovation and old challenges

Holger Mueller of Constellation Research shares his key takeaways from SAP's Sapphire confernece, held in Orlando, June 3rd till 5th 2024, in the Orange Convention Center.

Zodiac Signs and Food Preferences_ What Your Sign Says About Your Taste

Know what your zodiac sign says about your taste in food! Explore how the 12 zodiac signs influence your culinary preferences with insights from MyPandit. Dive into astrology and flavors!

Brian Fitzsimmons on the Business Strategy and Content Flywheel of Barstool S...

On episode 272 of the Digital and Social Media Sports Podcast, Neil chatted with Brian Fitzsimmons, Director of Licensing and Business Development for Barstool Sports.

What follows is a collection of snippets from the podcast. To hear the full interview and more, check out the podcast on all podcast platforms and at www.dsmsports.net

-- June 2024 is National Volunteer Month --

Check out our June display of books on voluntary organisations

Organizational Change Leadership Agile Tour Geneve 2024

Organizational Change Leadership at Agile Tour Geneve 2024

Best practices for project execution and delivery

A select set of project management best practices to keep your project on-track, on-cost and aligned to scope. Many firms have don't have the necessary skills, diligence, methods and oversight of their projects; this leads to slippage, higher costs and longer timeframes. Often firms have a history of projects that simply failed to move the needle. These best practices will help your firm avoid these pitfalls but they require fortitude to apply.

The APCO Geopolitical Radar - Q3 2024 The Global Operating Environment for Bu...

The Radar reflects input from APCO’s teams located around the world. It distils a host of interconnected events and trends into insights to inform operational and strategic decisions. Issues covered in this edition include:

Satta Matka Dpboss Matka Guessing Kalyan Chart Indian Matka Kalyan panel Chart

Satta Matka Dpboss Matka Guessing Kalyan Chart Indian Matka Kalyan panel Chart➒➌➎➏➑➐➋➑➐➐Dpboss Matka Guessing Satta Matka Kalyan Chart Indian Matka

SATTA MATKA SATTA FAST RESULT KALYAN TOP MATKA RESULT KALYAN SATTA MATKA FAST RESULT MILAN RATAN RAJDHANI MAIN BAZAR MATKA FAST TIPS RESULT MATKA CHART JODI CHART PANEL CHART FREE FIX GAME SATTAMATKA ! MATKA MOBI SATTA 143 spboss.in TOP NO1 RESULT FULL RATE MATKA ONLINE GAME PLAY BY APP SPBOSSHow are Lilac French Bulldogs Beauty Charming the World and Capturing Hearts....

“After being the most listed dog breed in the United States for 31

years in a row, the Labrador Retriever has dropped to second place

in the American Kennel Club's annual survey of the country's most

popular canines. The French Bulldog is the new top dog in the

United States as of 2022. The stylish puppy has ascended the

rankings in rapid time despite having health concerns and limited

color choices.”

Mastering B2B Payments Webinar from BlueSnap

B2B payments are rapidly changing. Find out the 5 key questions you need to be asking yourself to be sure you are mastering B2B payments today. Learn more at www.BlueSnap.com.

Top mailing list providers in the USA.pptx

Discover the top mailing list providers in the USA, offering targeted lists, segmentation, and analytics to optimize your marketing campaigns and drive engagement.

Dpboss Matka Guessing Satta Matta Matka Kalyan Chart Satta Matka

Dpboss Matka Guessing Satta Matta Matka Kalyan Chart Satta Matka➒➌➎➏➑➐➋➑➐➐Dpboss Matka Guessing Satta Matka Kalyan Chart Indian Matka

Dpboss Matka Guessing Satta Matta Matka Kalyan Chart Indian Matka Indian satta Matka Dpboss Matka Kalyan Chart Matka Boss otg matka Guessing Satta Anny Serafina Love - Letter of Recommendation by Kellen Harkins, MS.

This letter, written by Kellen Harkins, Course Director at Full Sail University, commends Anny Love's exemplary performance in the Video Sharing Platforms class. It highlights her dedication, willingness to challenge herself, and exceptional skills in production, editing, and marketing across various video platforms like YouTube, TikTok, and Instagram.

❼❷⓿❺❻❷❽❷❼❽ Dpboss Matka Result Satta Matka Guessing Satta Fix jodi Kalyan Fin...

❼❷⓿❺❻❷❽❷❼❽ Dpboss Matka Result Satta Matka Guessing Satta Fix jodi Kalyan Fin...❼❷⓿❺❻❷❽❷❼❽ Dpboss Kalyan Satta Matka Guessing Matka Result Main Bazar chart

❼❷⓿❺❻❷❽❷❼❽ Dpboss Matka Result Satta Matka Guessing Satta Fix jodi Kalyan Final ank Satta Matka Dpbos Final ank Satta Matta Matka 143 Kalyan Matka Guessing Final Matka Final ank Today Matka 420 Satta Batta Satta 143 Kalyan Chart Main Bazar Chart vip Matka Guessing Dpboss 143 Guessing Kalyan night Recently uploaded (20)

Structural Design Process: Step-by-Step Guide for Buildings

Structural Design Process: Step-by-Step Guide for Buildings

Event Report - SAP Sapphire 2024 Orlando - lots of innovation and old challenges

Event Report - SAP Sapphire 2024 Orlando - lots of innovation and old challenges

Zodiac Signs and Food Preferences_ What Your Sign Says About Your Taste

Zodiac Signs and Food Preferences_ What Your Sign Says About Your Taste

Brian Fitzsimmons on the Business Strategy and Content Flywheel of Barstool S...

Brian Fitzsimmons on the Business Strategy and Content Flywheel of Barstool S...

Organizational Change Leadership Agile Tour Geneve 2024

Organizational Change Leadership Agile Tour Geneve 2024

The APCO Geopolitical Radar - Q3 2024 The Global Operating Environment for Bu...

The APCO Geopolitical Radar - Q3 2024 The Global Operating Environment for Bu...

Satta Matka Dpboss Matka Guessing Kalyan Chart Indian Matka Kalyan panel Chart

Satta Matka Dpboss Matka Guessing Kalyan Chart Indian Matka Kalyan panel Chart

How are Lilac French Bulldogs Beauty Charming the World and Capturing Hearts....

How are Lilac French Bulldogs Beauty Charming the World and Capturing Hearts....

Dpboss Matka Guessing Satta Matta Matka Kalyan Chart Satta Matka

Dpboss Matka Guessing Satta Matta Matka Kalyan Chart Satta Matka

Anny Serafina Love - Letter of Recommendation by Kellen Harkins, MS.

Anny Serafina Love - Letter of Recommendation by Kellen Harkins, MS.

❼❷⓿❺❻❷❽❷❼❽ Dpboss Matka Result Satta Matka Guessing Satta Fix jodi Kalyan Fin...

❼❷⓿❺❻❷❽❷❼❽ Dpboss Matka Result Satta Matka Guessing Satta Fix jodi Kalyan Fin...

MI-1040H_2michigan.gov documents taxes