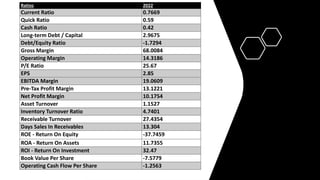

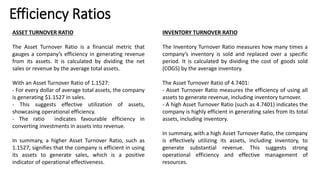

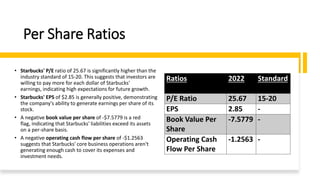

Starbucks' financial ratios reveal some areas of strength as well as opportunities for improvement. Positives include healthy profit margins, efficient inventory and receivables management, and high returns on assets and investments. However, ratios also point to potential liquidity issues, weak returns on equity, and negative cash flows and book value per share that suggest underperformance. Addressing high debt levels and improving cash generation could help optimize Starbucks' financial profile.