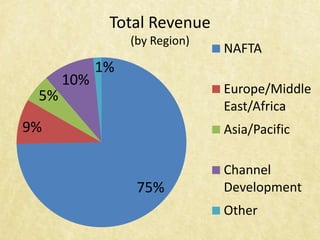

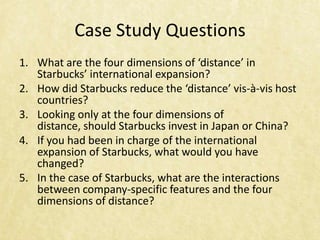

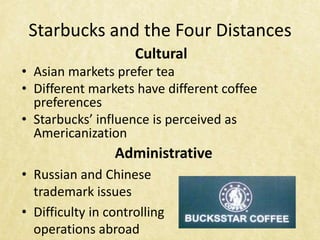

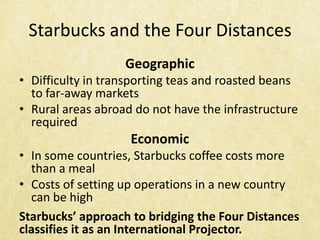

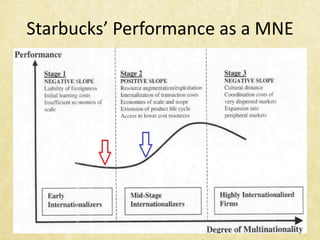

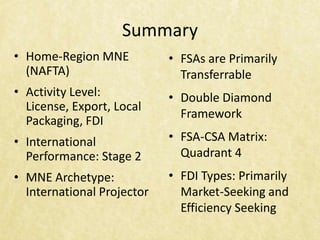

Starbucks is a prominent global specialty coffee retailer with over 18,000 stores across 60 countries, known for its innovative corporate practices and extensive product portfolio. The company employs various strategies to mitigate cultural, administrative, geographic, and economic distances in international expansion, primarily through licensing, exporting, and foreign direct investment. Starbucks plans to significantly increase its store presence in North America and Asia, highlighting its focus on market-seeking and efficiency-seeking expansion.