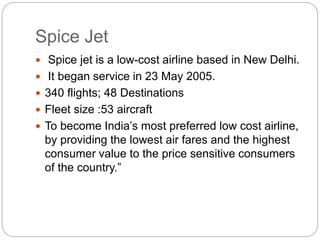

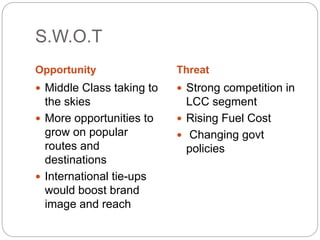

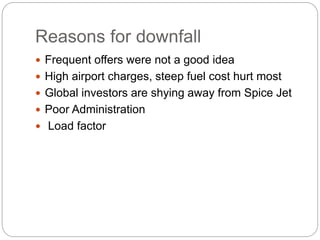

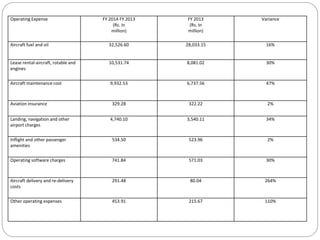

SpiceJet, a low-cost airline based in New Delhi, began operations in 2005 and has grown to operate 340 flights across 48 destinations. Despite its strong market presence and backing, the airline faces challenges such as high operating costs, significant competition, and financial distress, which led to substantial losses in past years. Suggestions for recovery include selling assets, restructuring debt, and exploring strategic alliances to improve financial stability.