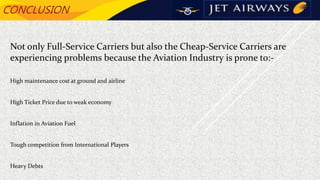

Jet Airways began operations in 1992 and over several decades grew to become India's largest private airline, at one point operating over 70 destinations worldwide. However, rising costs, increased competition from low-cost carriers, fluctuating oil prices, and poor management decisions contributed to significant financial losses. By 2019, Jet Airways had accumulated massive debts and was only operating a handful of aircraft with a 1% market share before ceasing all operations. The collapse affected over 20,000 employees and had ripple effects on other airlines, investors, and the broader Indian aviation industry.