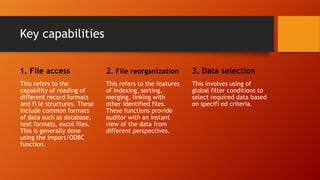

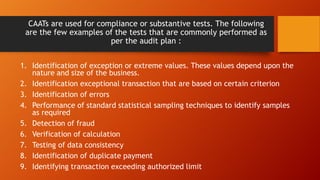

Computer aided audit techniques (CAATs) use computer tools to automate the audit process and help auditors handle large volumes of data more efficiently. CAATs refer to techniques and programs designed to audit electronic or manually unauditable data. Key benefits of CAATs include making audits more rational, improving quality and effectiveness, providing audit trails, and enabling statistical analysis and identification of outliers. Common CAAT capabilities include file access, reorganization, data selection, and arithmetic/statistical functions. Auditors must take precautions like understanding the CAAT software, identifying correct data, and ensuring data completeness when using CAATs. Excel is a commonly used CAAT tool due to its data import features, flexibility, and