Embed presentation

Downloaded 175 times

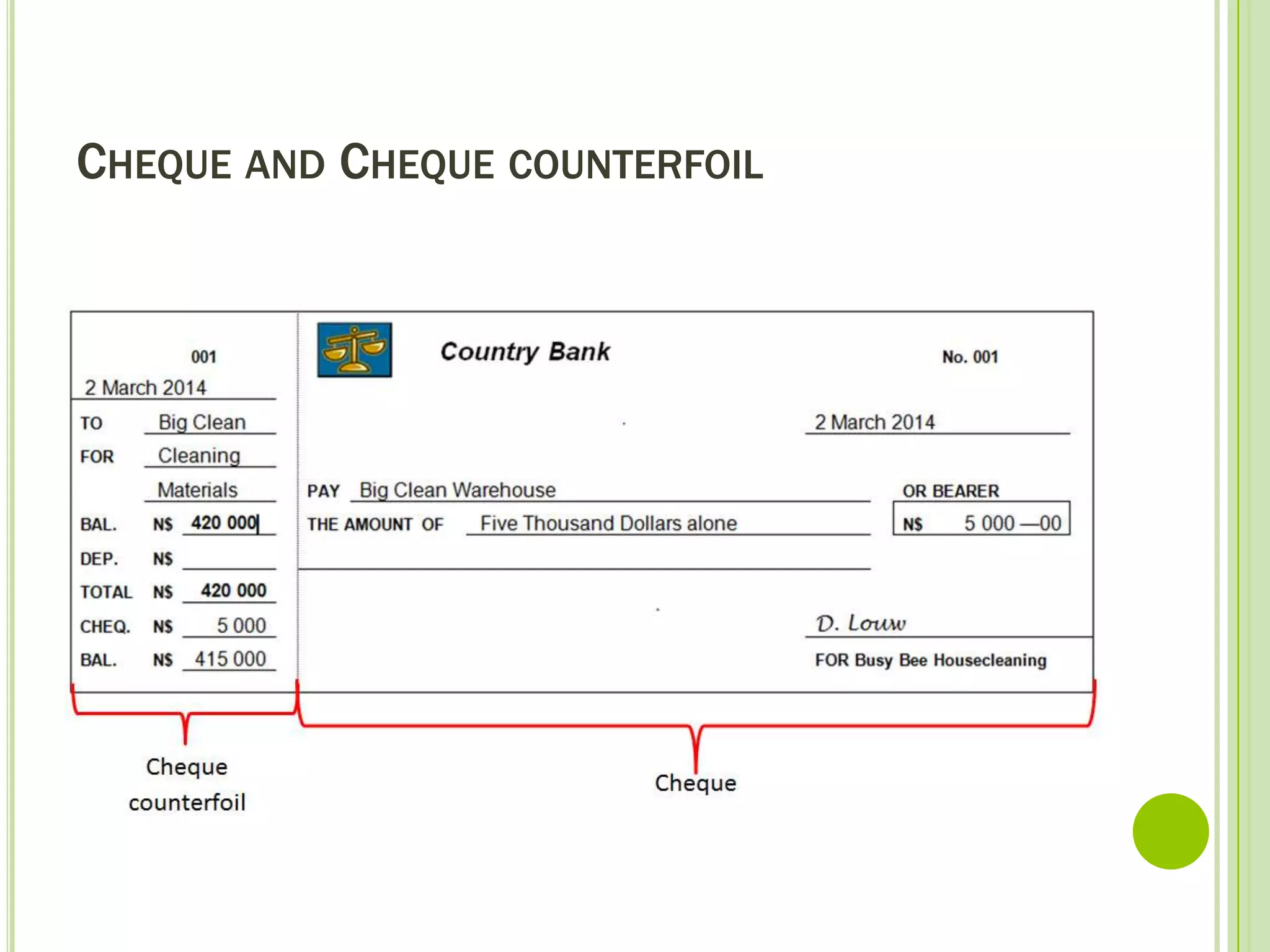

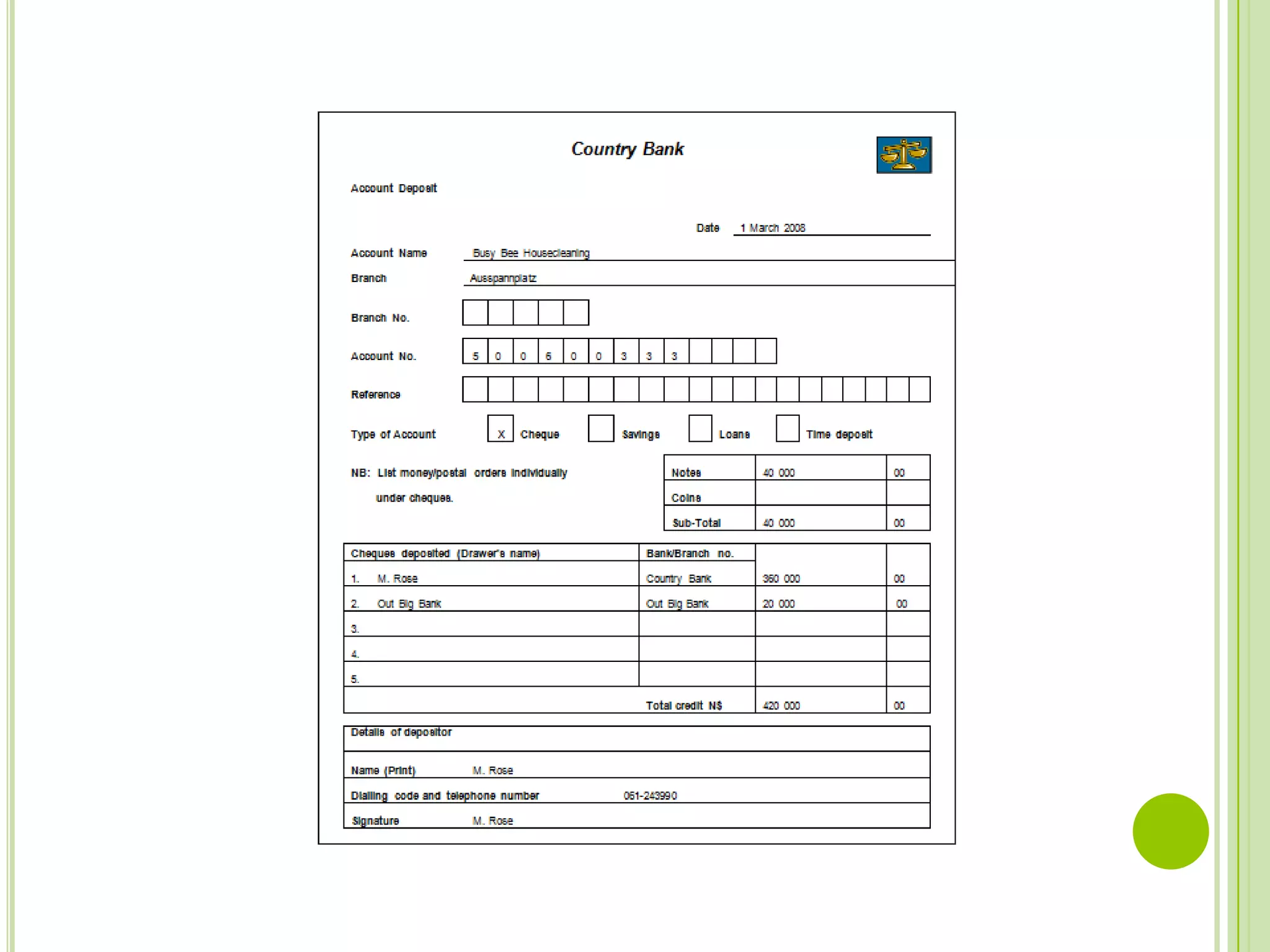

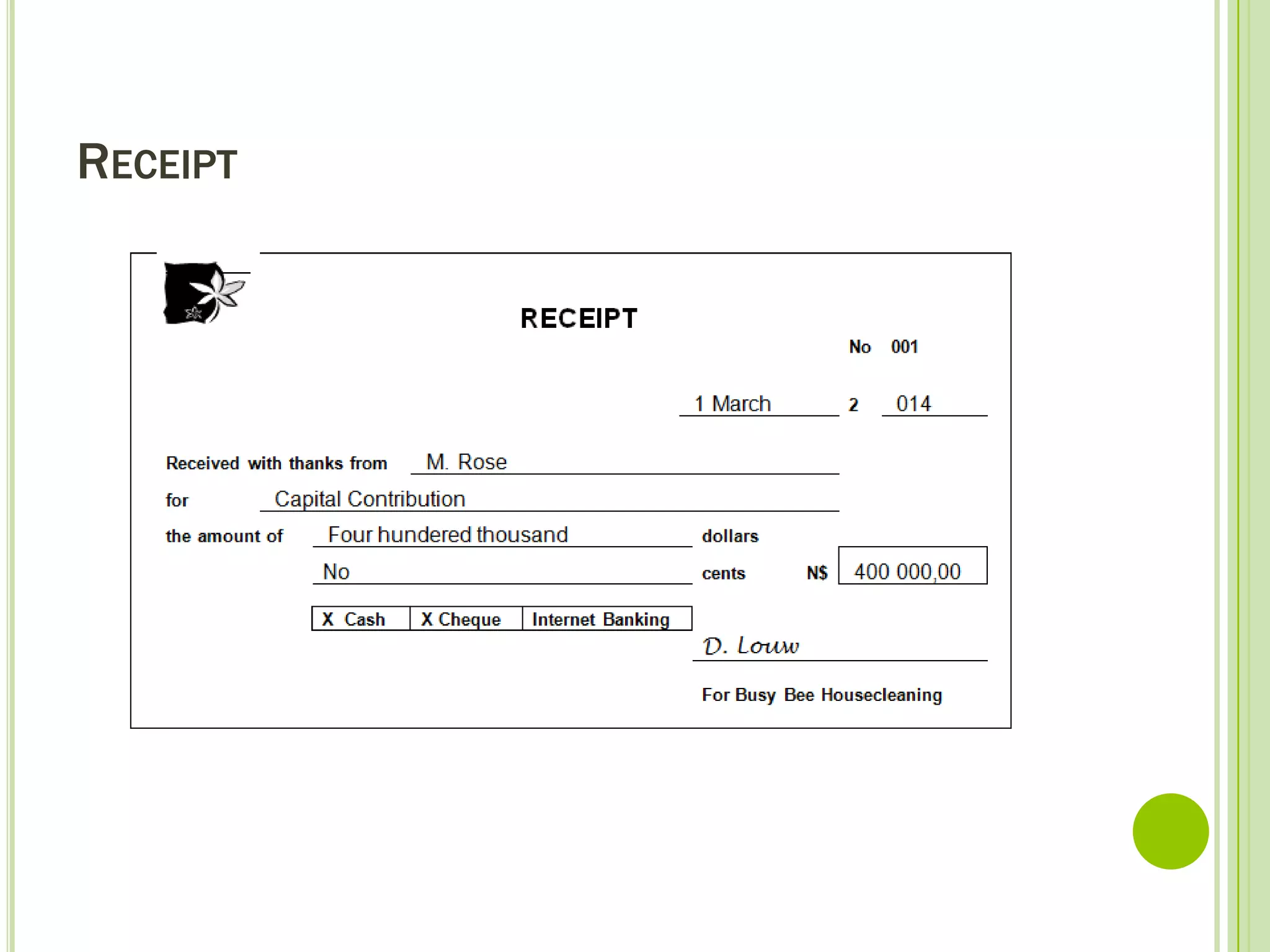

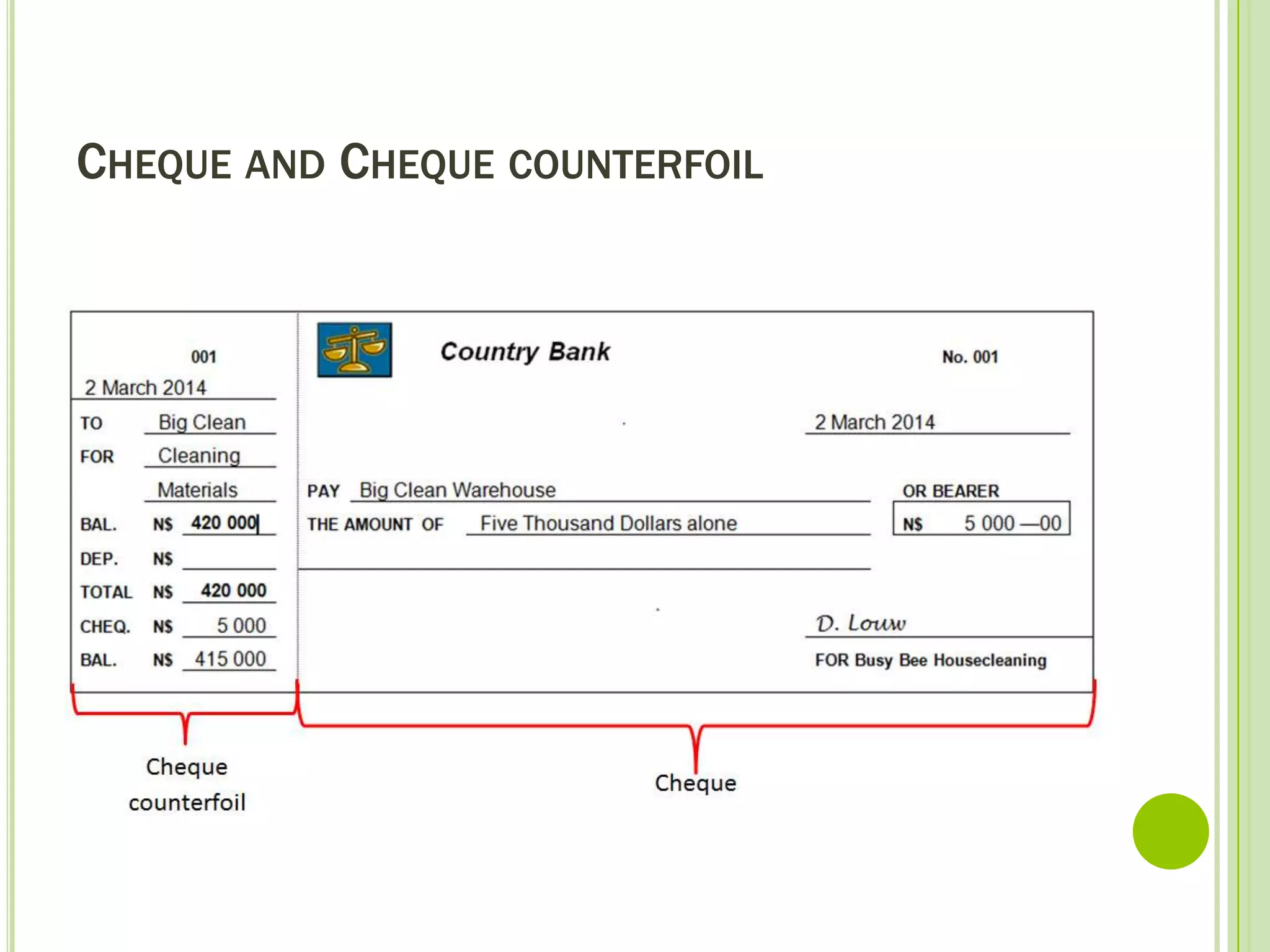

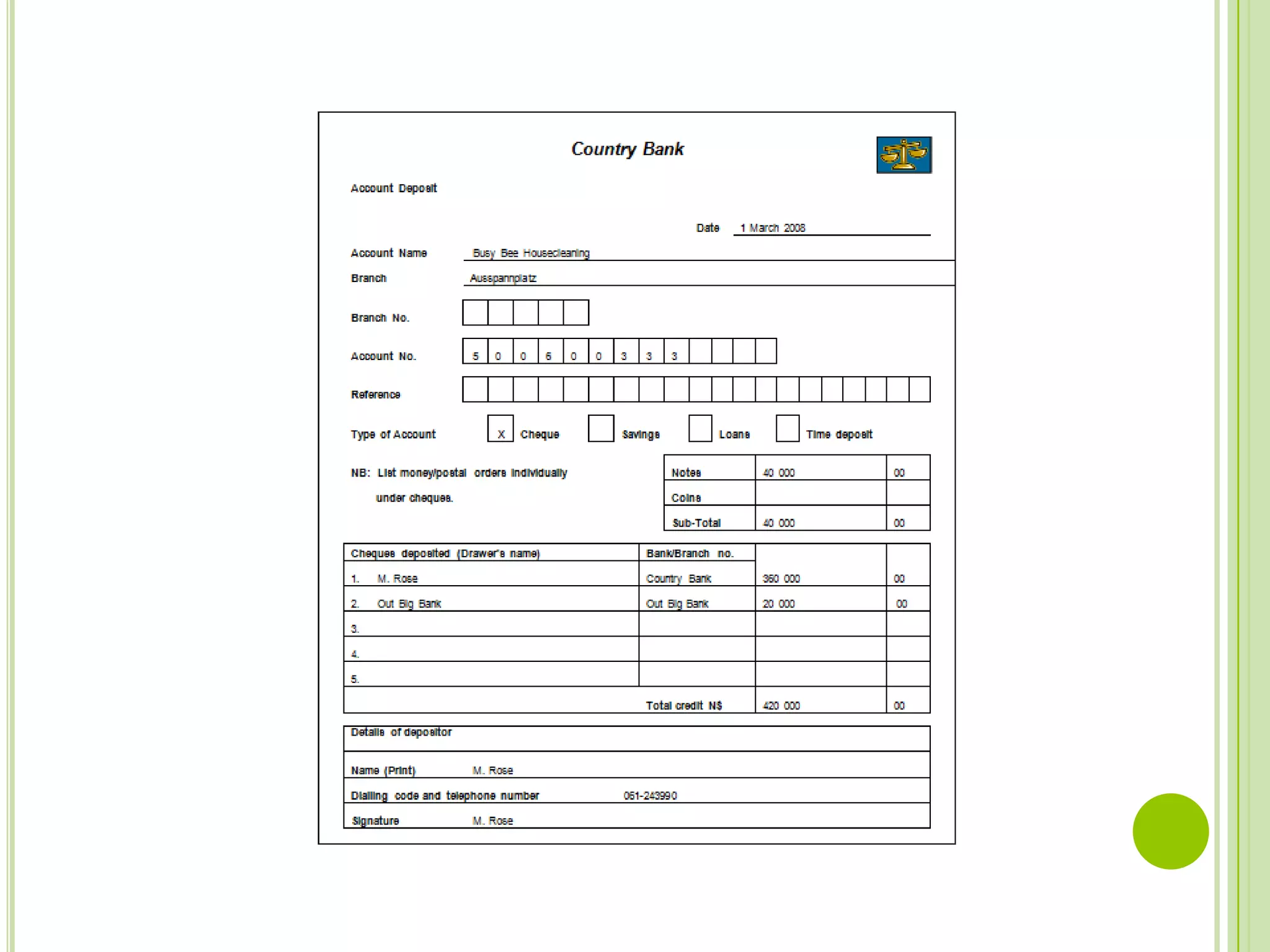

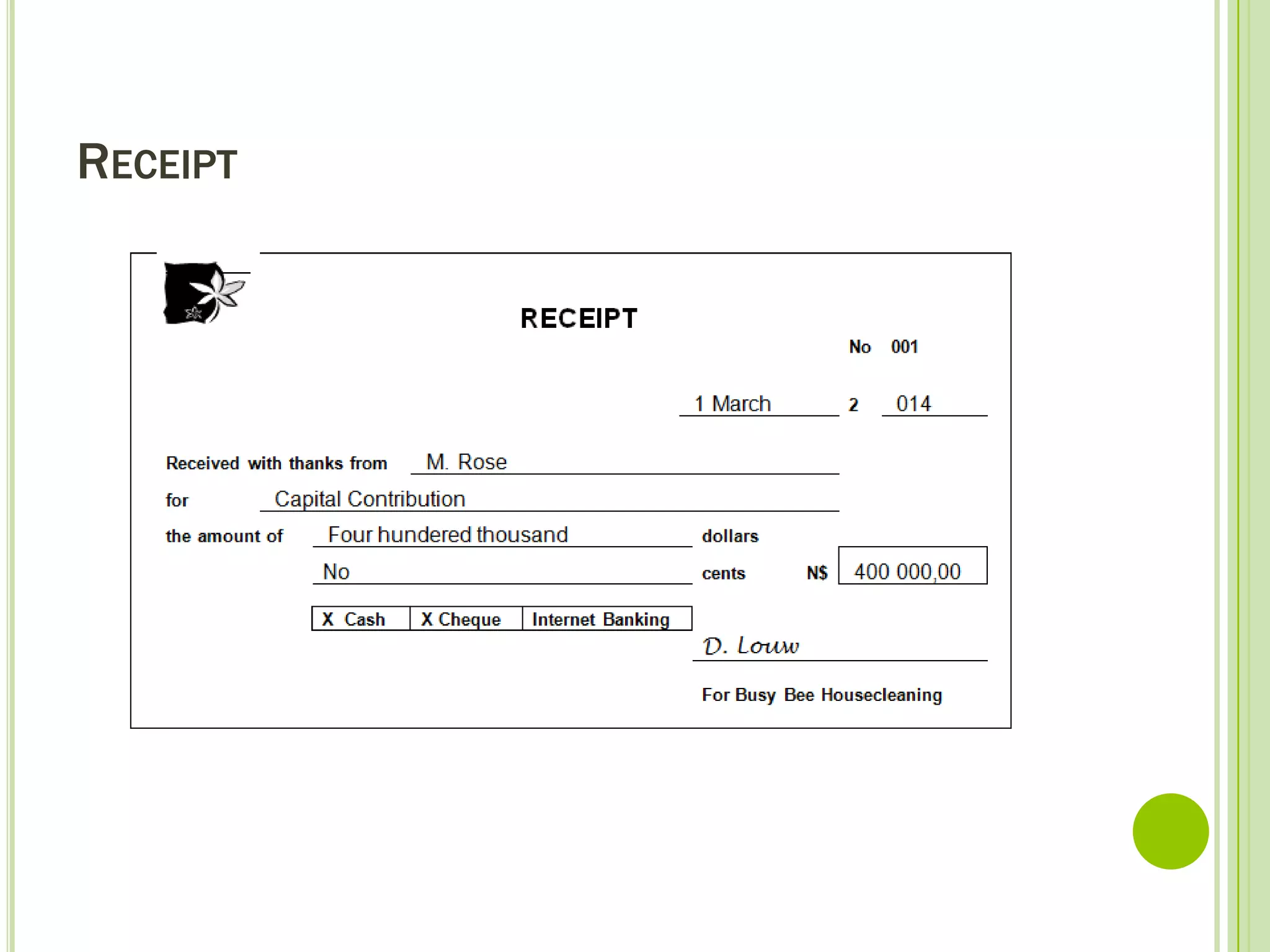

A business usually pays other parties by cheque, with information written on both the cheque itself and a corresponding cheque counterfoil. A deposit slip is filled out when depositing money including cash, cheques, and money orders into a bank account, with the depositor keeping a duplicate and the bank keeping the original. When a customer pays a business through various methods like cash, cheque, or credit/debit card, the business can provide a receipt, cash register receipt, or credit card slip to acknowledge receiving payment.

Introduces different types of source documents used in business transactions.

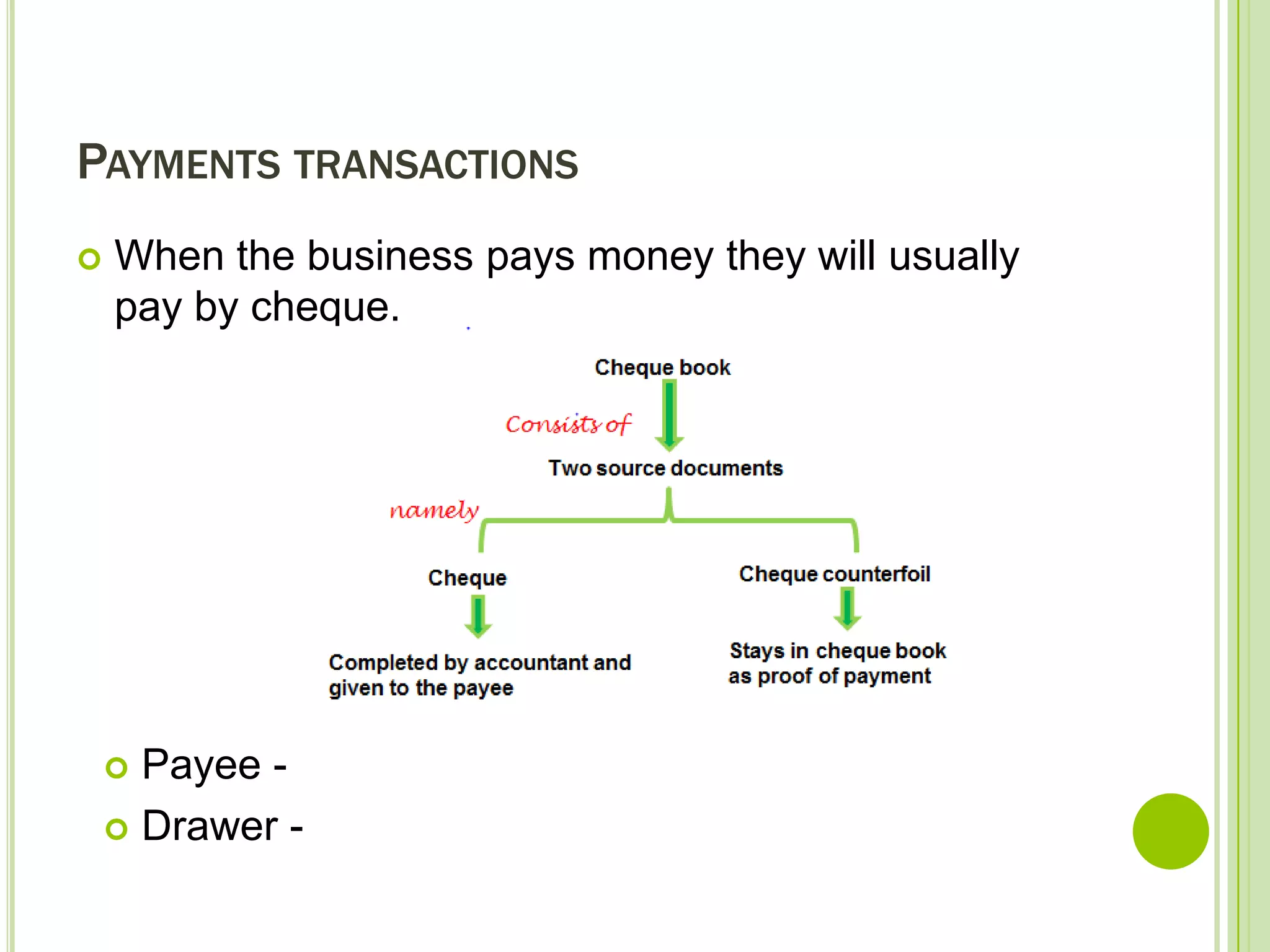

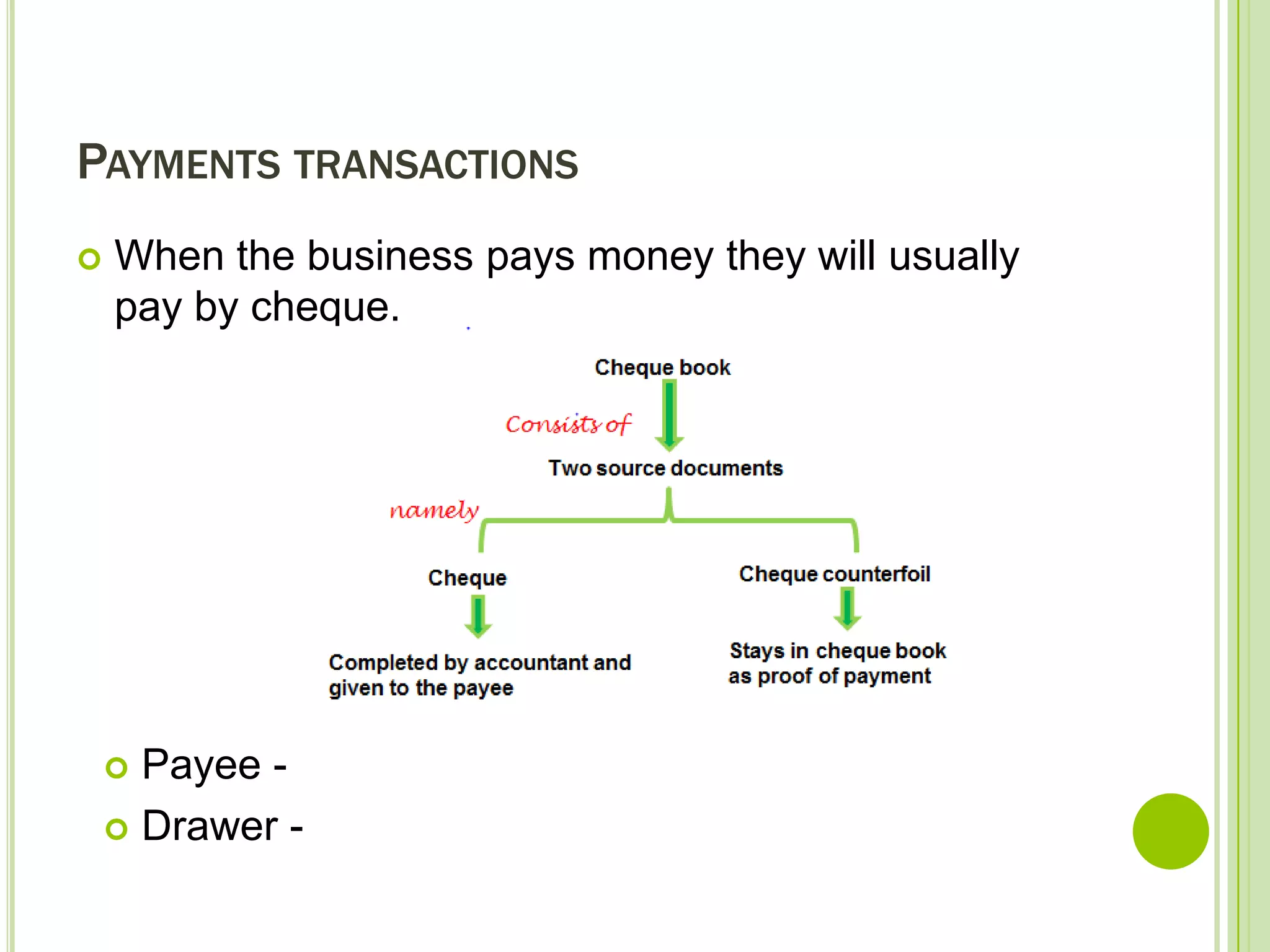

Discusses cheque payments and the roles of payee and drawer in business money transactions.

Mentions cheques and their counterfoils as key financial documents.

Explains the purpose of a deposit slip in bank transactions, detailing information required for deposits.

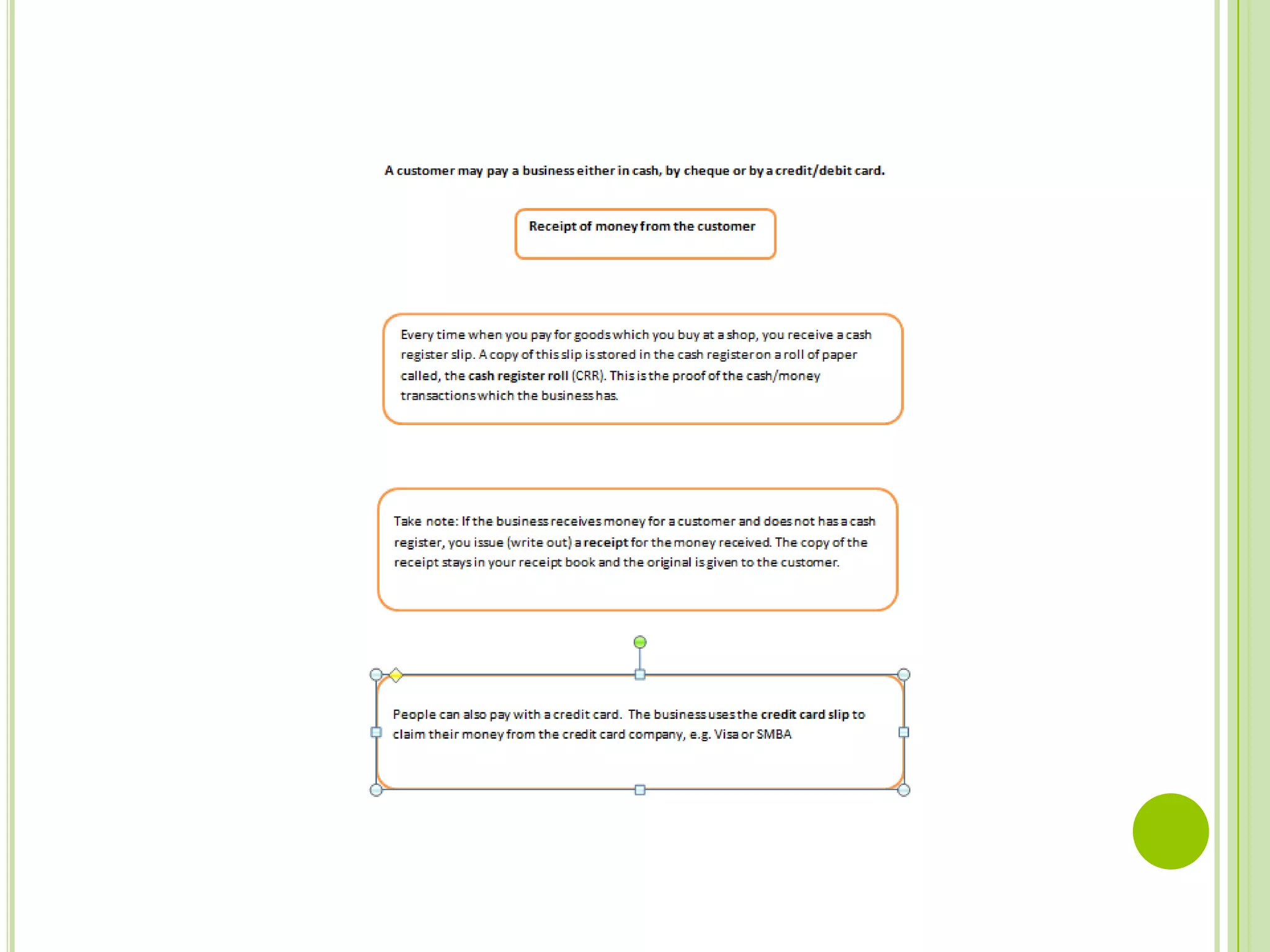

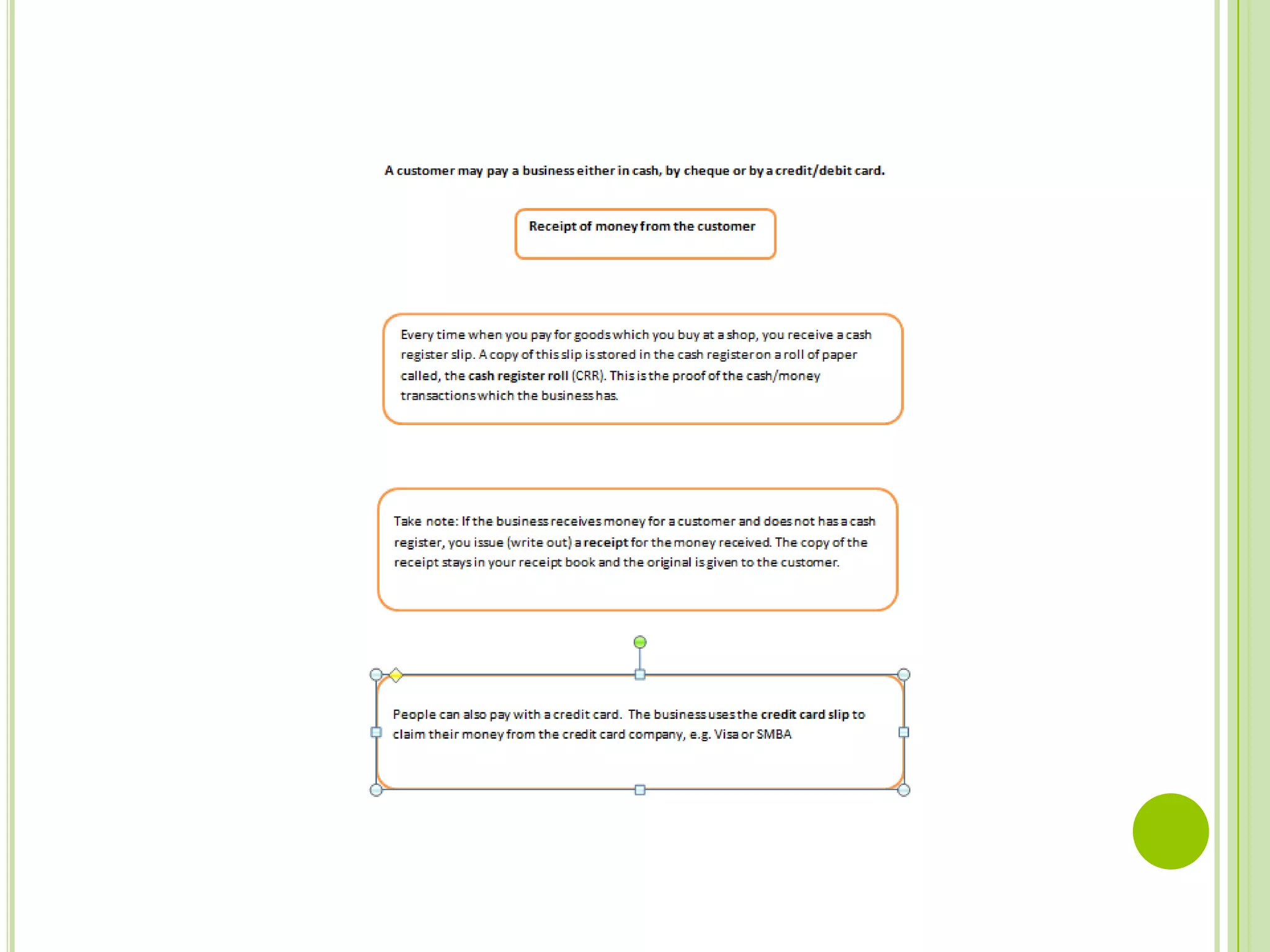

Describes various payment methods and the issuance of receipts, slips depending on payment type.

Refers to the receipt document, emphasizing its importance in confirming transactions.