Embed presentation

Download to read offline

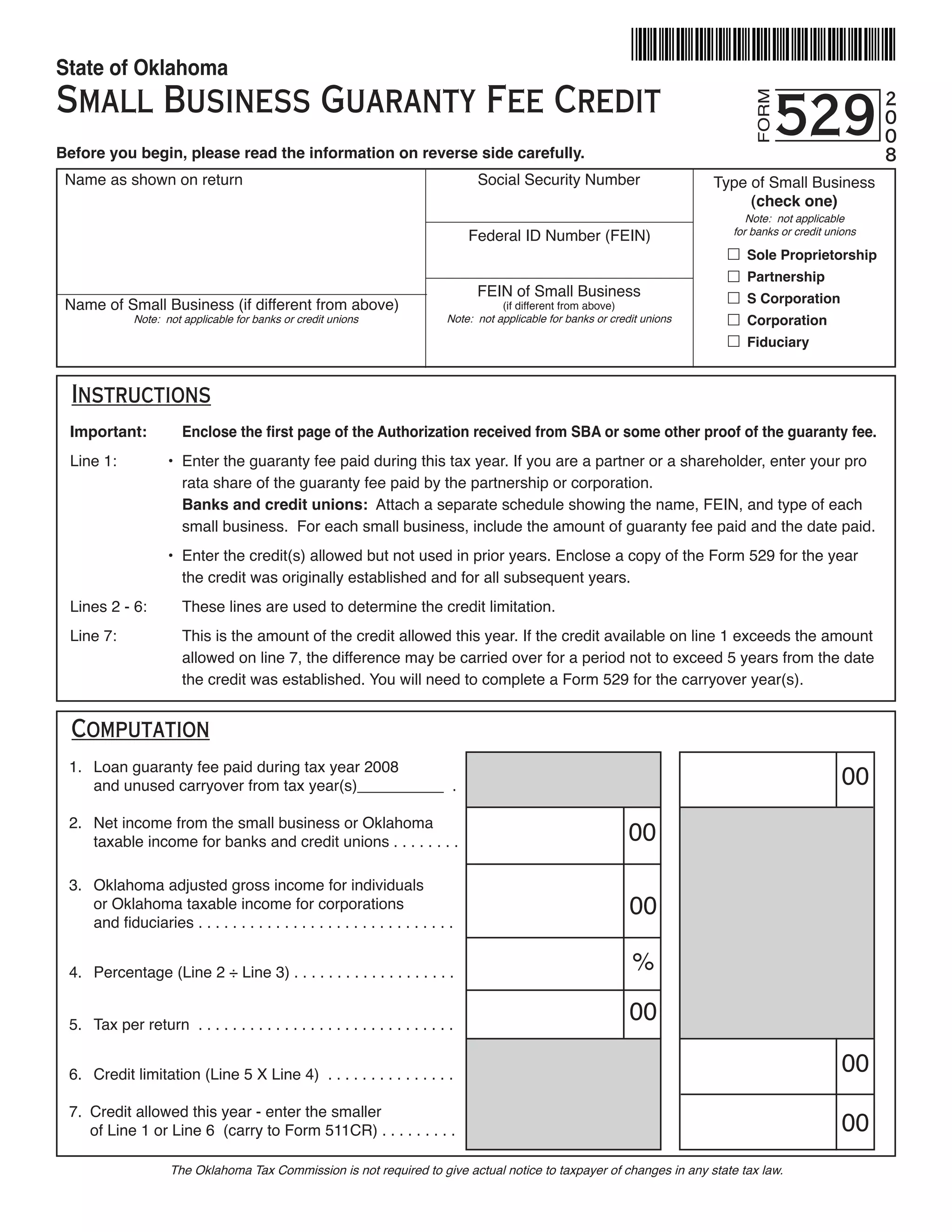

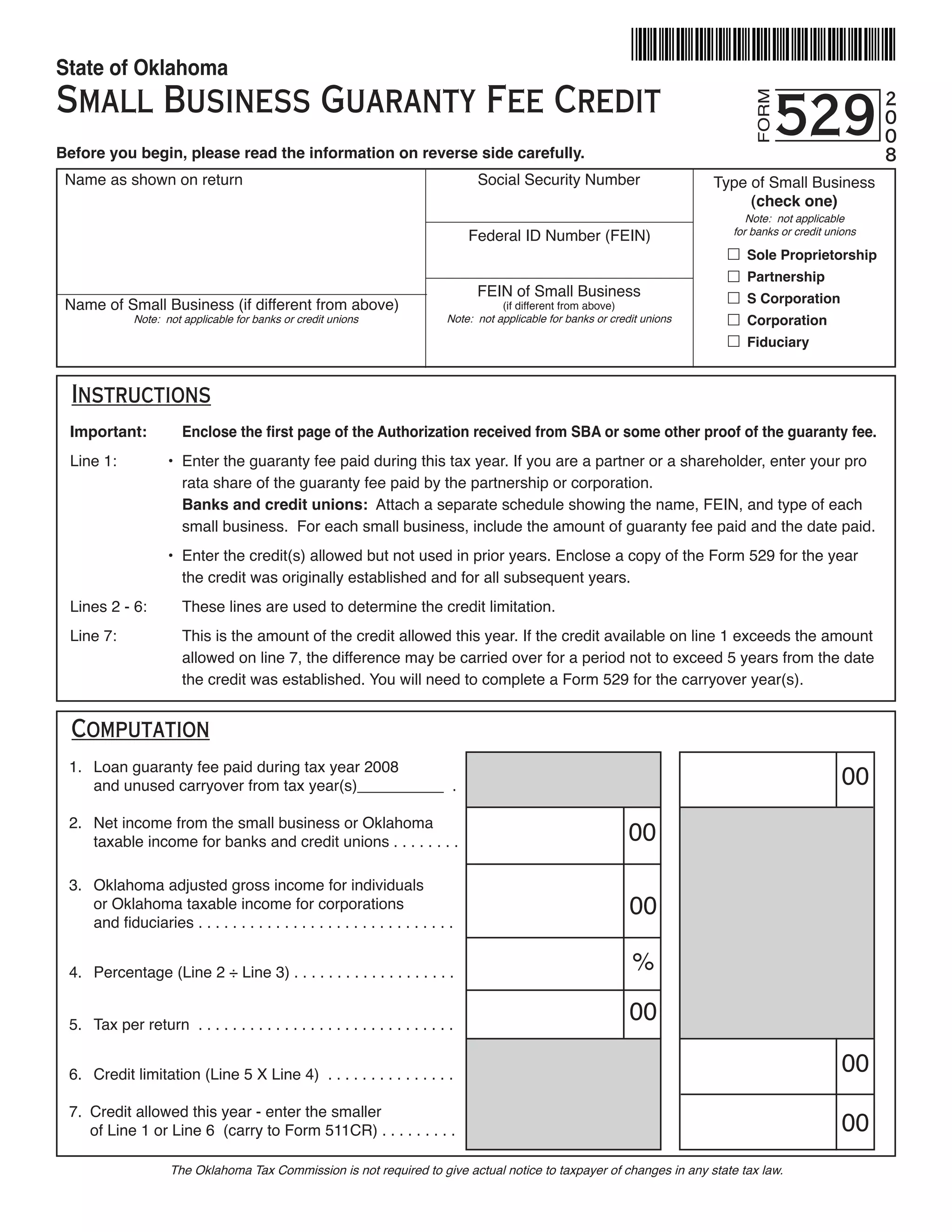

This document provides information about an Oklahoma state tax credit for small businesses that pay fees to the U.S. Small Business Administration (SBA) to obtain loan guarantees. It allows small businesses to claim a credit for the SBA guaranty fee paid against their Oklahoma income tax liability. The credit is limited to the percentage of income generated by the small business. Any unused credit can be carried forward for up to 5 years. It also provides a similar credit for banks and credit unions that pay SBA guaranty fees through the SBA's 7(a) loan program.