Embed presentation

Download to read offline

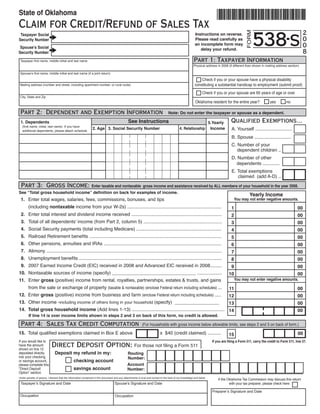

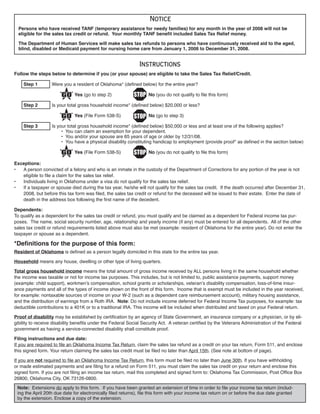

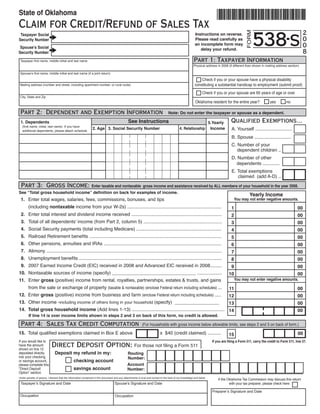

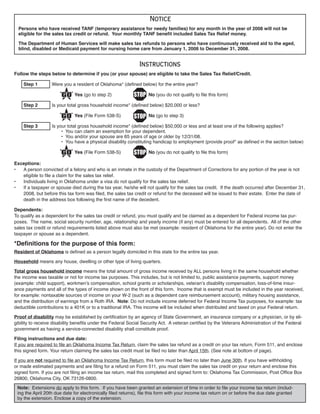

This document is a claim form for a sales tax credit/refund from the state of Oklahoma. It requests information such as the taxpayer's name, address, social security number, dependents, and total household income for 2008. The form provides instructions on determining eligibility for the credit/refund based on being an Oklahoma resident for the full year, total household income being $20,000 or less, or $50,000 or less with qualifying exemptions. It explains what constitutes a household and total gross household income. The completed form can be filed with an Oklahoma tax return or by June 30th if no tax return is required.