Embed presentation

Download to read offline

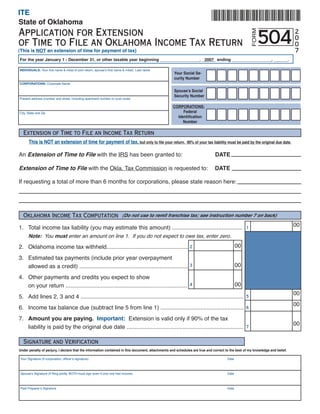

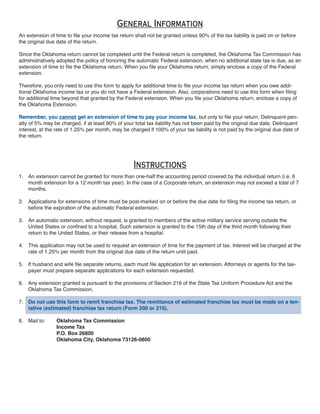

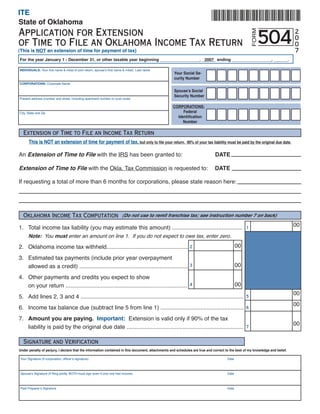

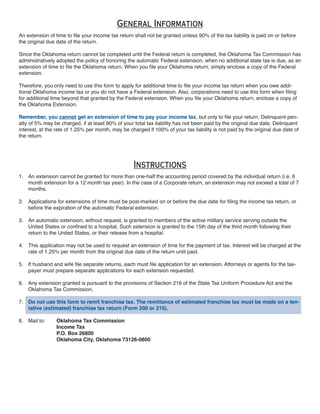

This document is an application for an extension of time to file an Oklahoma income tax return. It provides important information about the extension: 1) The extension is not for an extension of time to pay tax, only to file the return. Applicants must pay 90% of their total tax liability by the original due date. 2) Corporations may request a total extension of no more than 7 months beyond the original due date. 3) The application requires applicants to estimate their total tax liability and payments/credits to calculate any balance due. They must pay the balance due or 90% of the total liability, whichever is lower, to qualify for the extension.