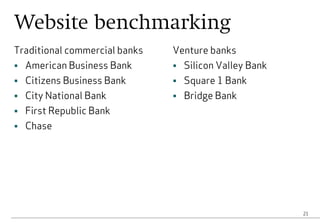

This document discusses the importance of competitor research for corporate branding and design. It recommends assessing no more than five competitors to avoid information overload. The document provides a case study of a regional bank that conducted competitor positioning audits and website benchmarking as part of refreshing its brand and website following significant growth through acquisitions. The case study includes samples from the bank's competitor positioning audit and website benchmarking analysis. Conducting ongoing competitor research is important for understanding relative strengths, weaknesses and staying aware of changing competitive dynamics.