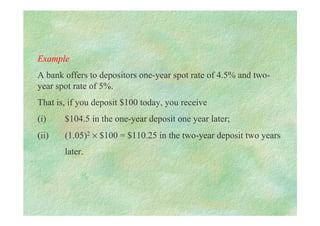

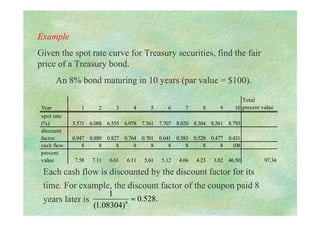

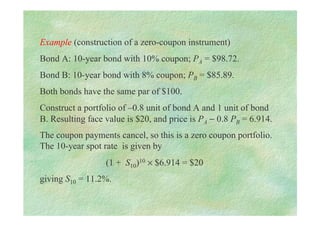

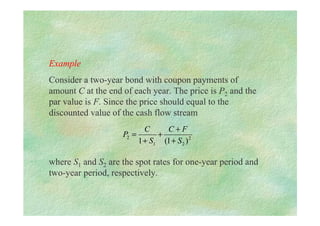

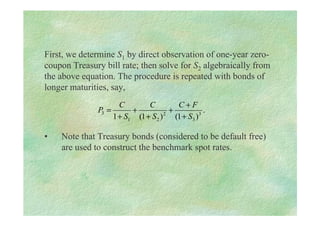

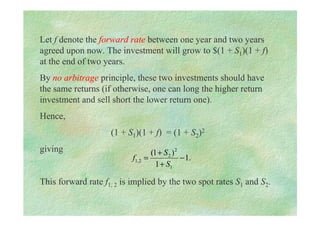

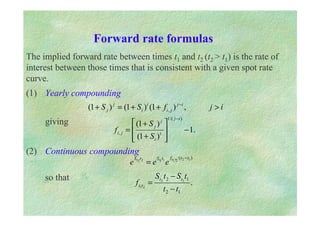

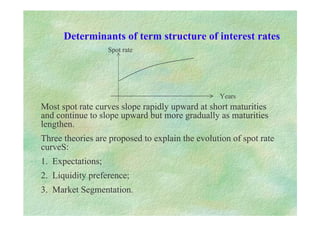

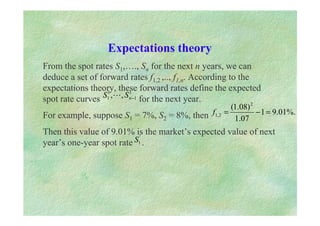

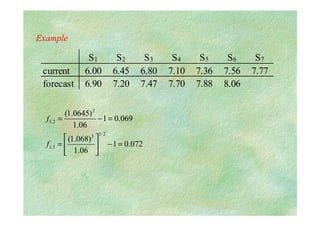

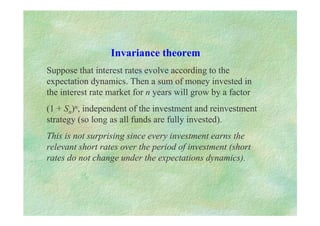

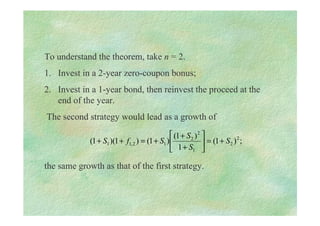

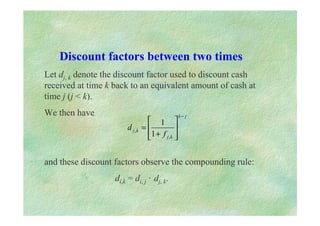

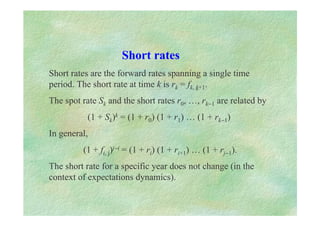

This document discusses yield curves and term structure theory. It defines key terms like yield curve, spot rates, and forward rates. The yield curve plots bond yields against maturity and typically slopes upward. Spot rates are zero-coupon bond yields, while forward rates are implied by the yield curve for rates in the future. The document also summarizes three theories that attempt to explain the shape of the yield curve: expectations theory, liquidity preference theory, and market segmentation theory.