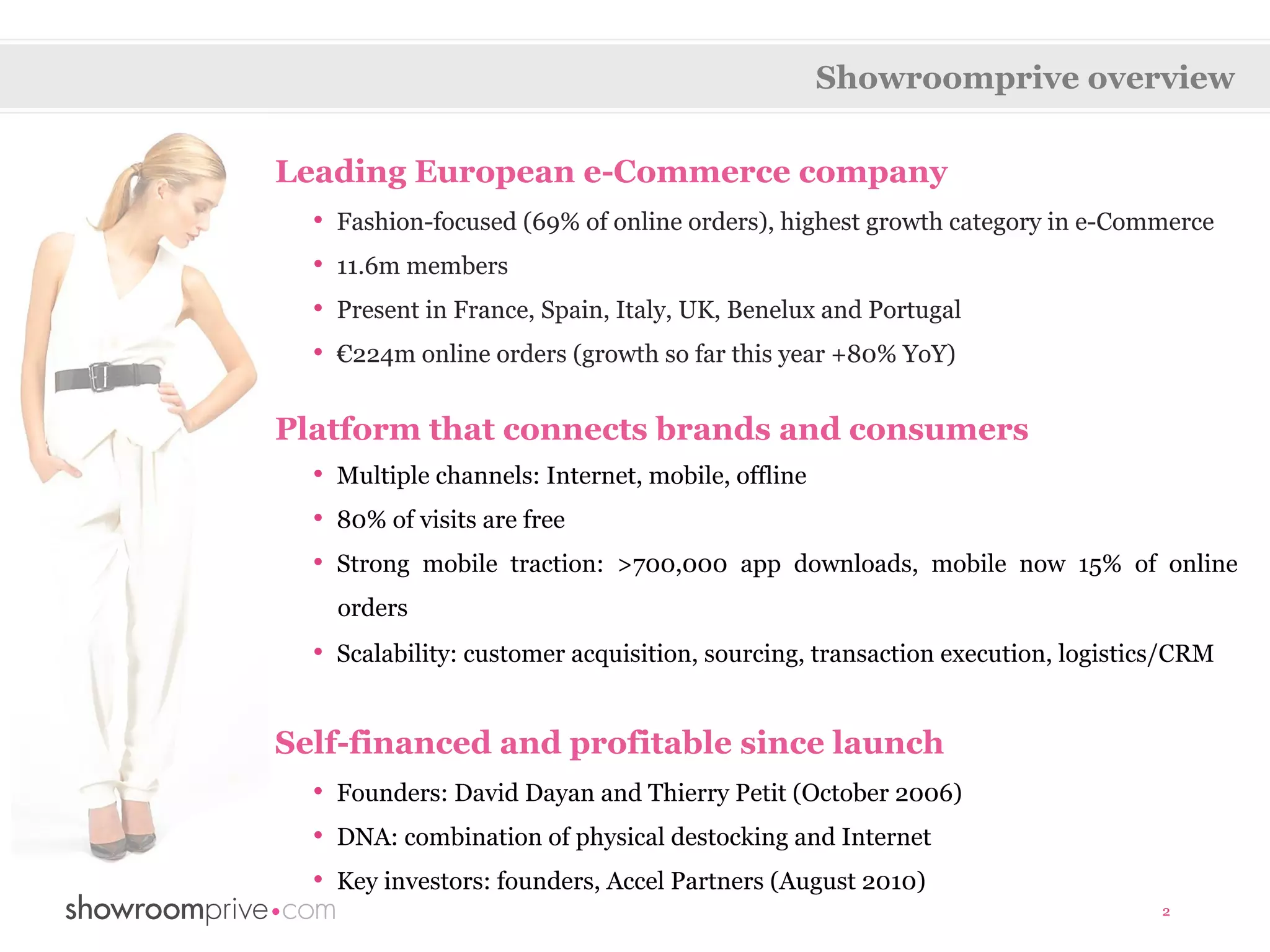

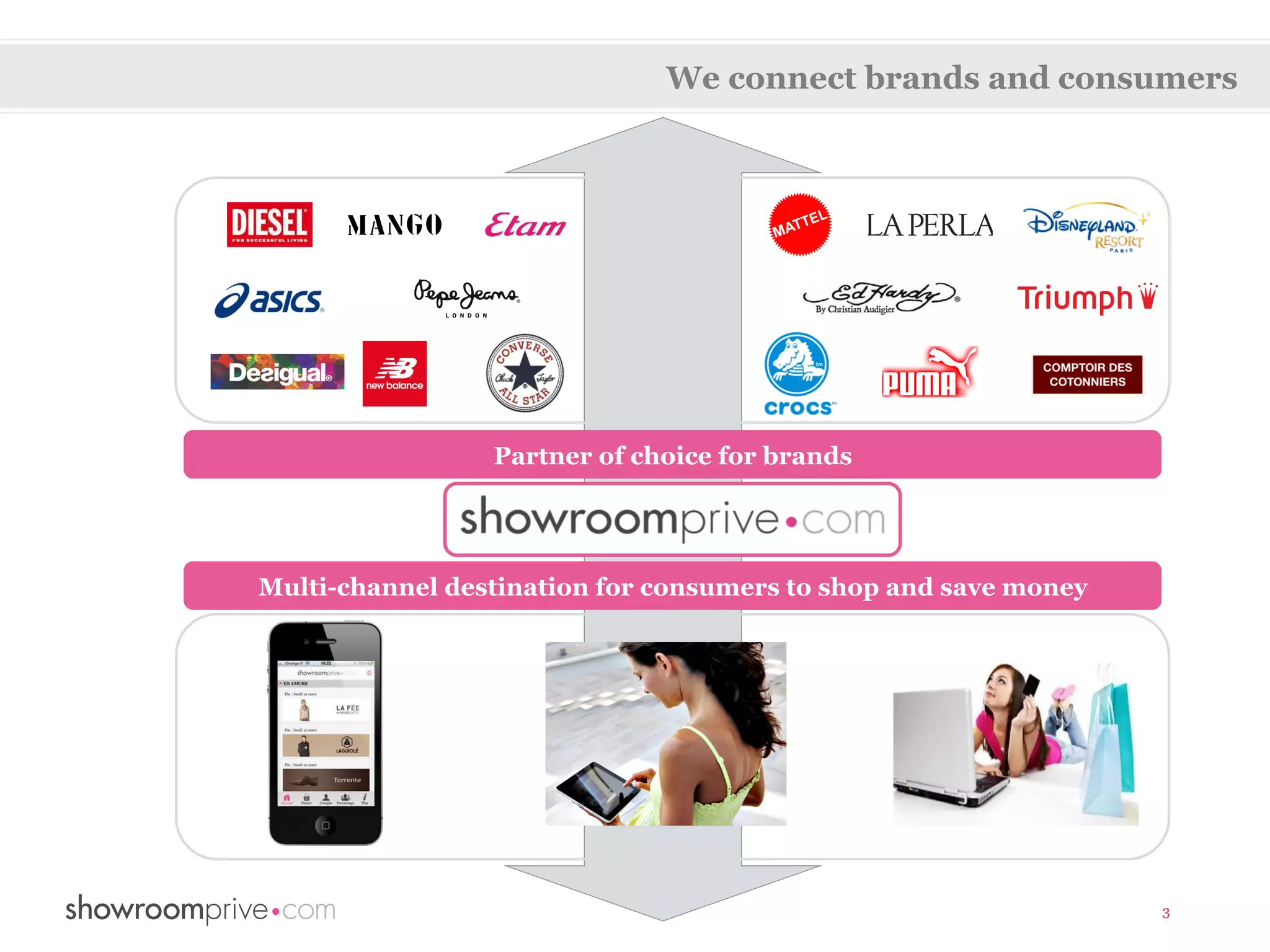

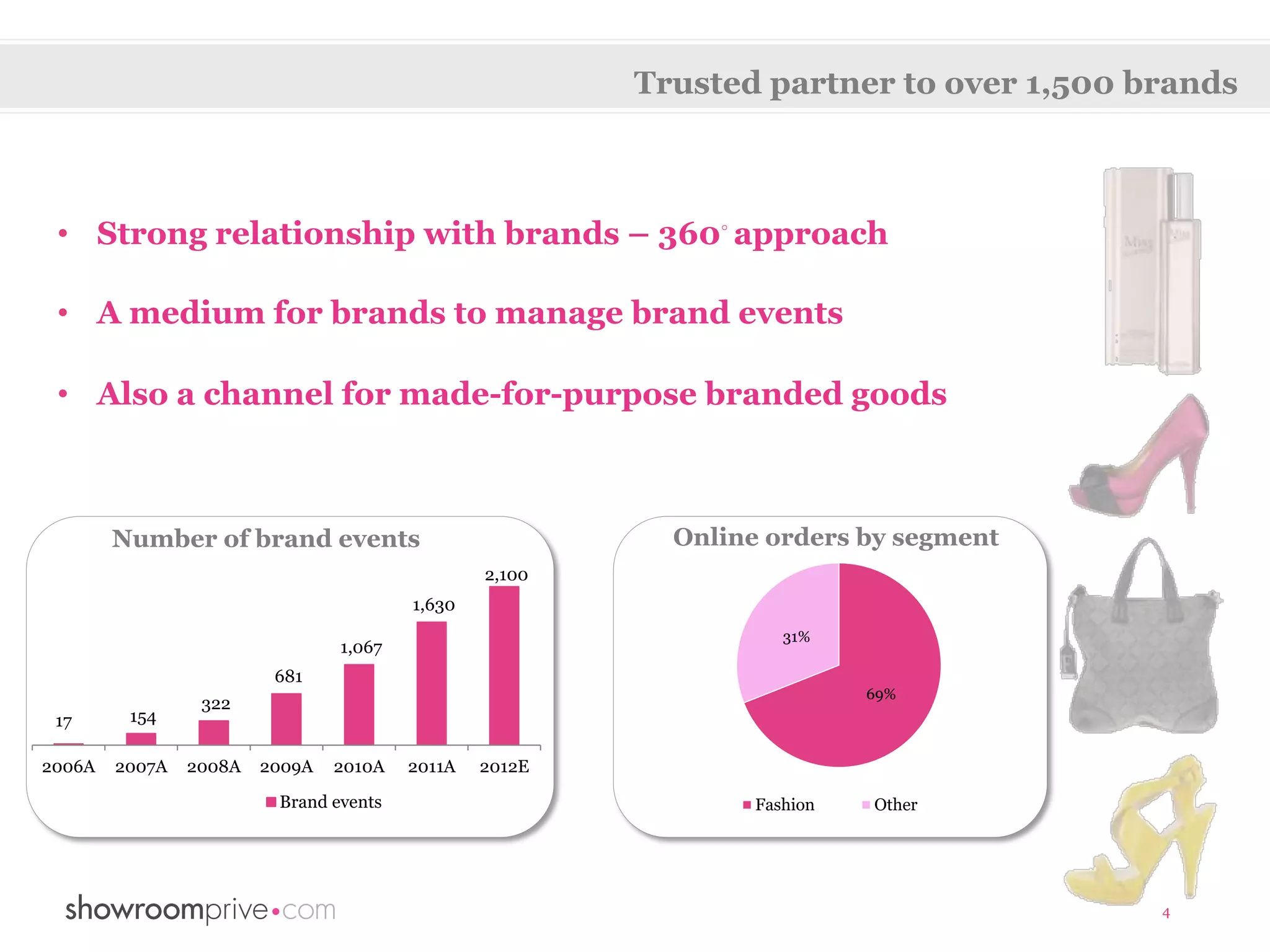

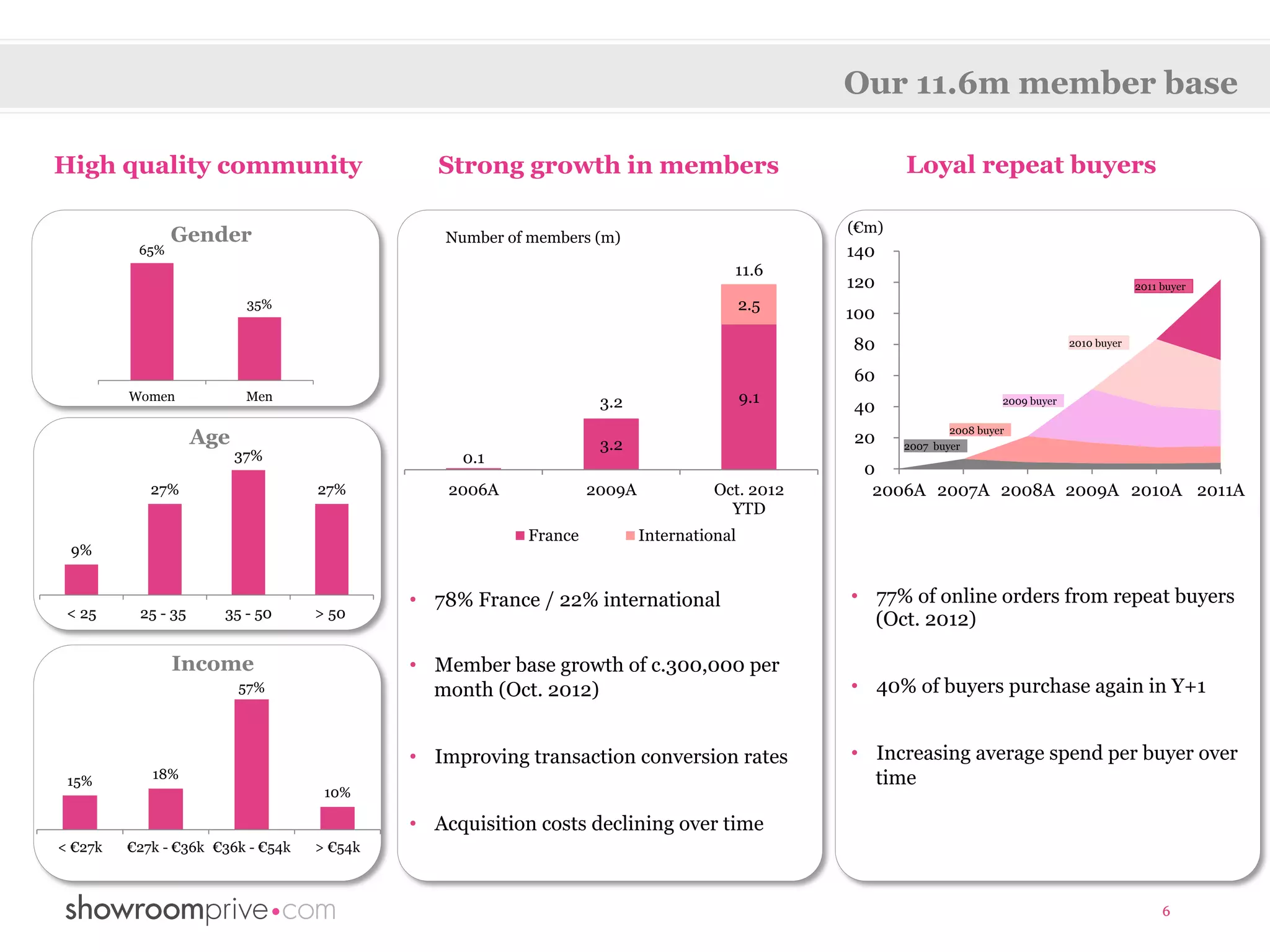

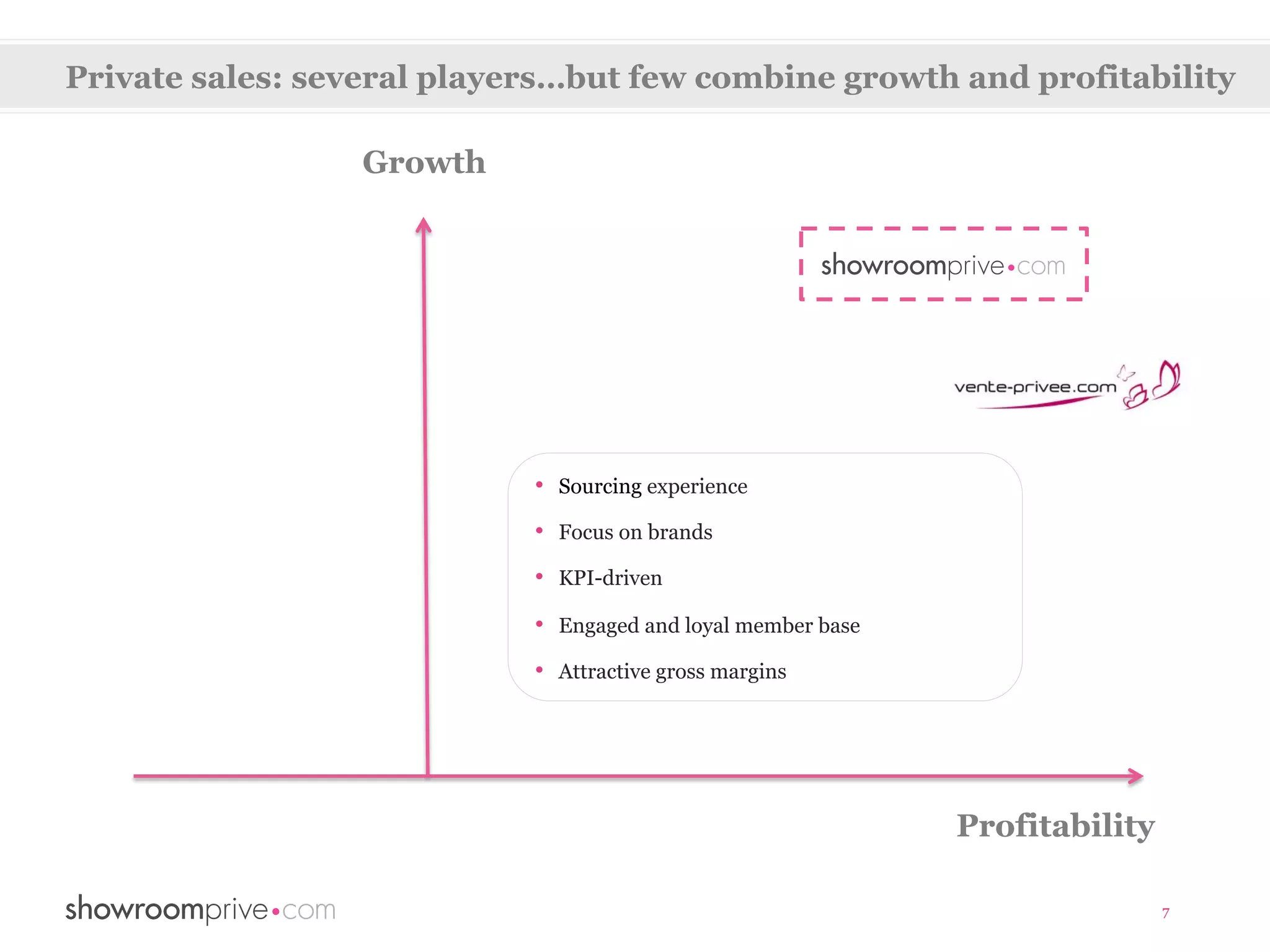

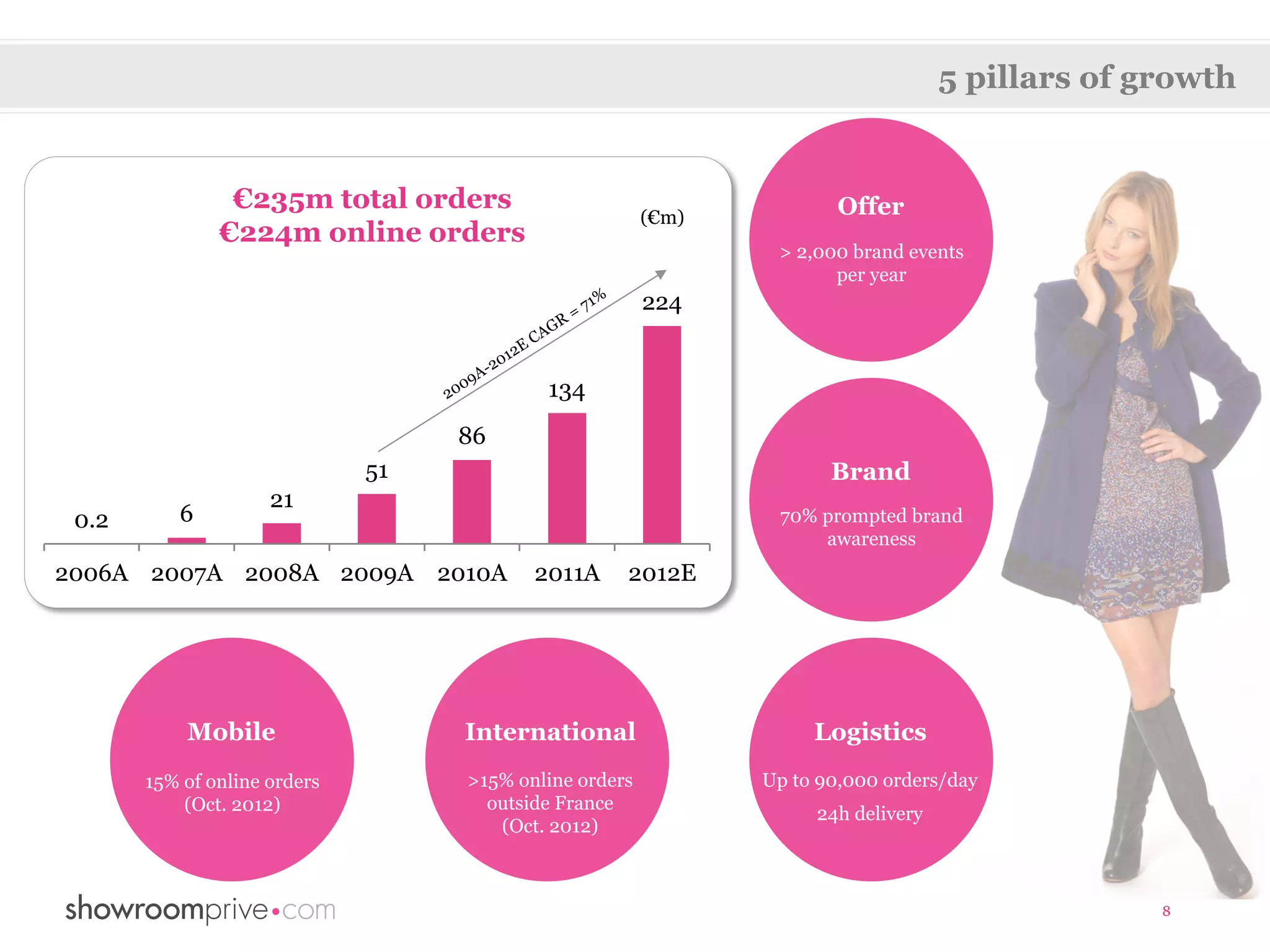

Showroomprive is a leading European e-commerce company with a focus on fashion, boasting 11.6 million members and €224 million in online orders for the year, marking an 80% year-over-year growth. The platform connects brands and consumers through multiple channels and maintains strong relationships with over 1,500 brands. With a profitable and scalable business model, the company showcases a high-quality user experience and attracts a loyal member base, particularly in France.