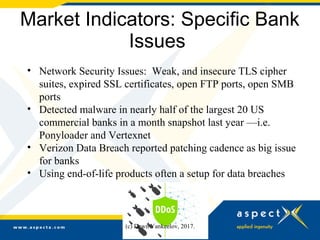

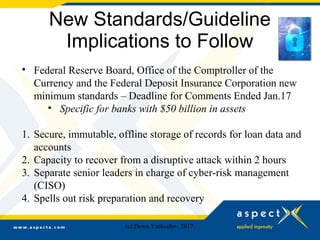

Cybercrime is now the most reported economic crime, with the financial sector responding by increasing cybersecurity spending, which is projected to grow to $68 billion by 2020. New regulations and standards for financial institutions are being introduced to enhance cybersecurity measures, requiring comprehensive risk management strategies and incident response plans. Additionally, there is a significant workforce gap in cybersecurity, with a growing demand for skilled professionals to address these challenges.

![Mobile Banking Issues

"There is a massive transformation in flight [in our industry]…

nearly half of our customers only go to a physical branch once

a year and we expect that number to be closer to 70% very

soon."

- Kim Hammonds, Group Chief Operating Officer at Deutsche

Bank (CEO panel at Dreamforce 2016)

Identity Theft Resource Center's database (1/17/17) shows that mobile devices pose the

smallest data breach threat. Companies should focus on securing laptops, external

hard drives and cloud services using encryption to lower their risk of a breach.

(c) Dawn Yankeelov, 2017.](https://image.slidesharecdn.com/aspectxbankcyberfinal-170505181947/85/Shaping-Your-Future-in-Banking-Cybersecurity-27-320.jpg)