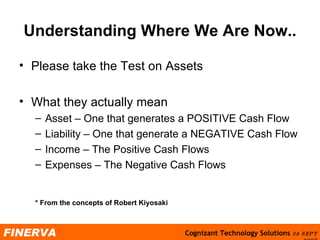

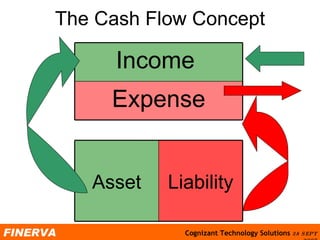

The document outlines three steps to financial success: 1) Save money by setting goals and creating a budget to control spending; 2) Invest saved money to generate positive cash flow; 3) Protect assets and income by managing taxes and paying down debt. It provides information on concepts like assets, liabilities, income and expenses to understand personal finances and develop a net worth chart and cash flow plan.