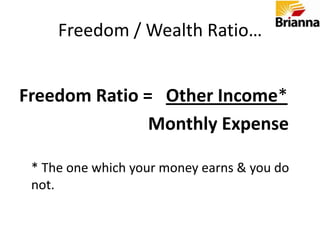

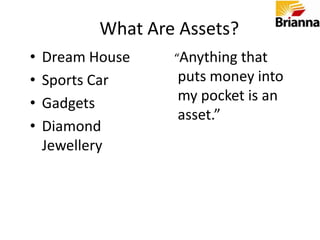

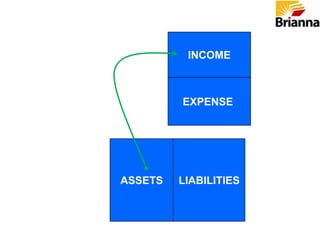

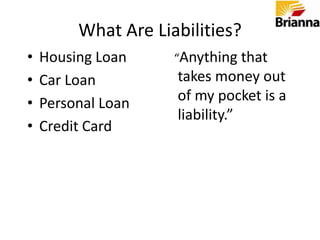

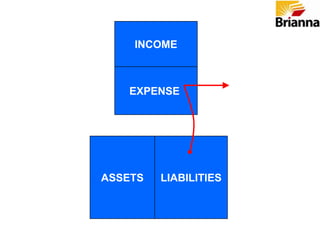

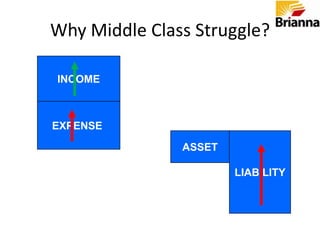

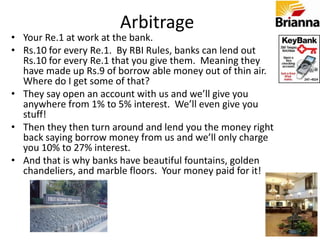

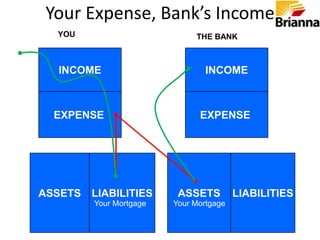

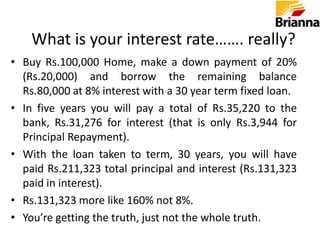

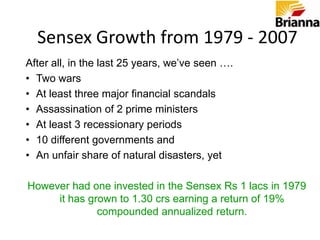

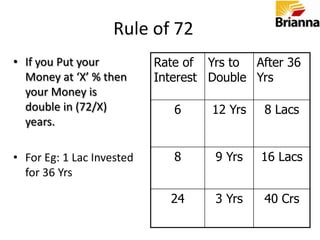

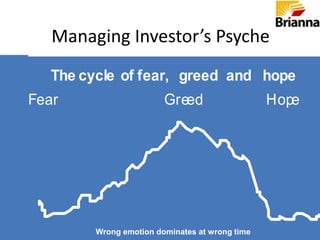

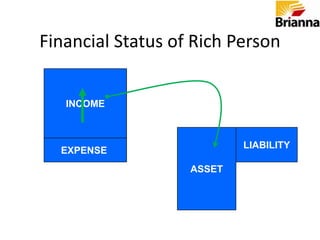

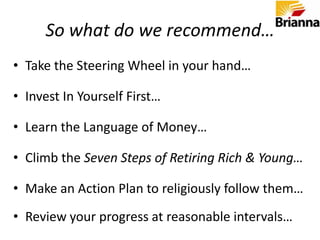

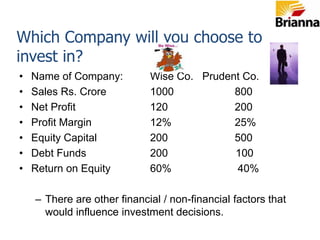

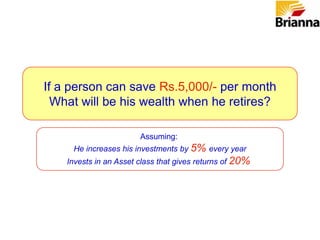

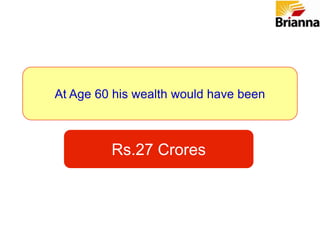

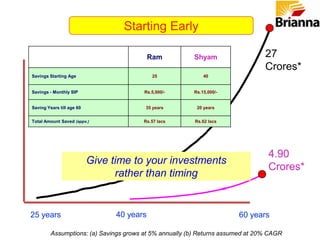

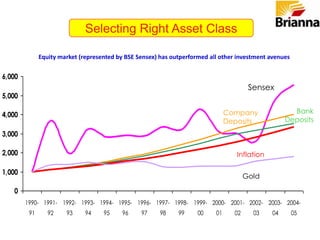

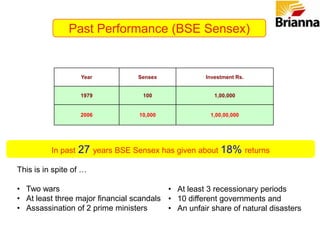

The document provides an overview of strategies for retiring rich and young presented by Vishal Thakkar. It discusses the importance of making one's money work harder through investment rather than just working hard. It outlines seven steps for retiring rich and young including deciding one's retirement age, buying liabilities based on needs not desires, linking liability and asset targets, planning liabilities in advance, increasing cash through knowledge and habits, making money work harder, and having job earnings and freedom ratio targets. Key investment avenues discussed include real estate, commodities, stocks, bonds, mutual funds, and more.