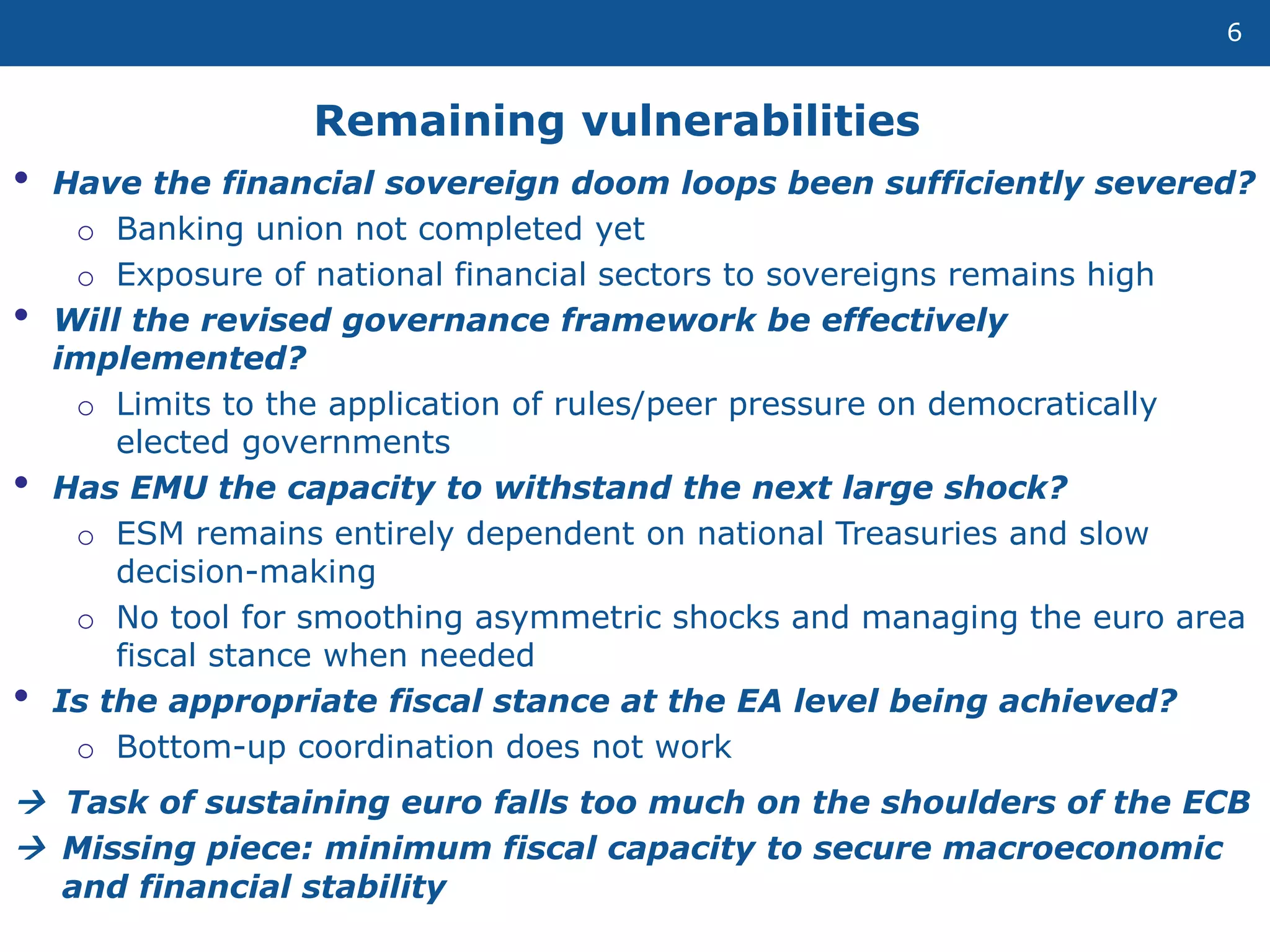

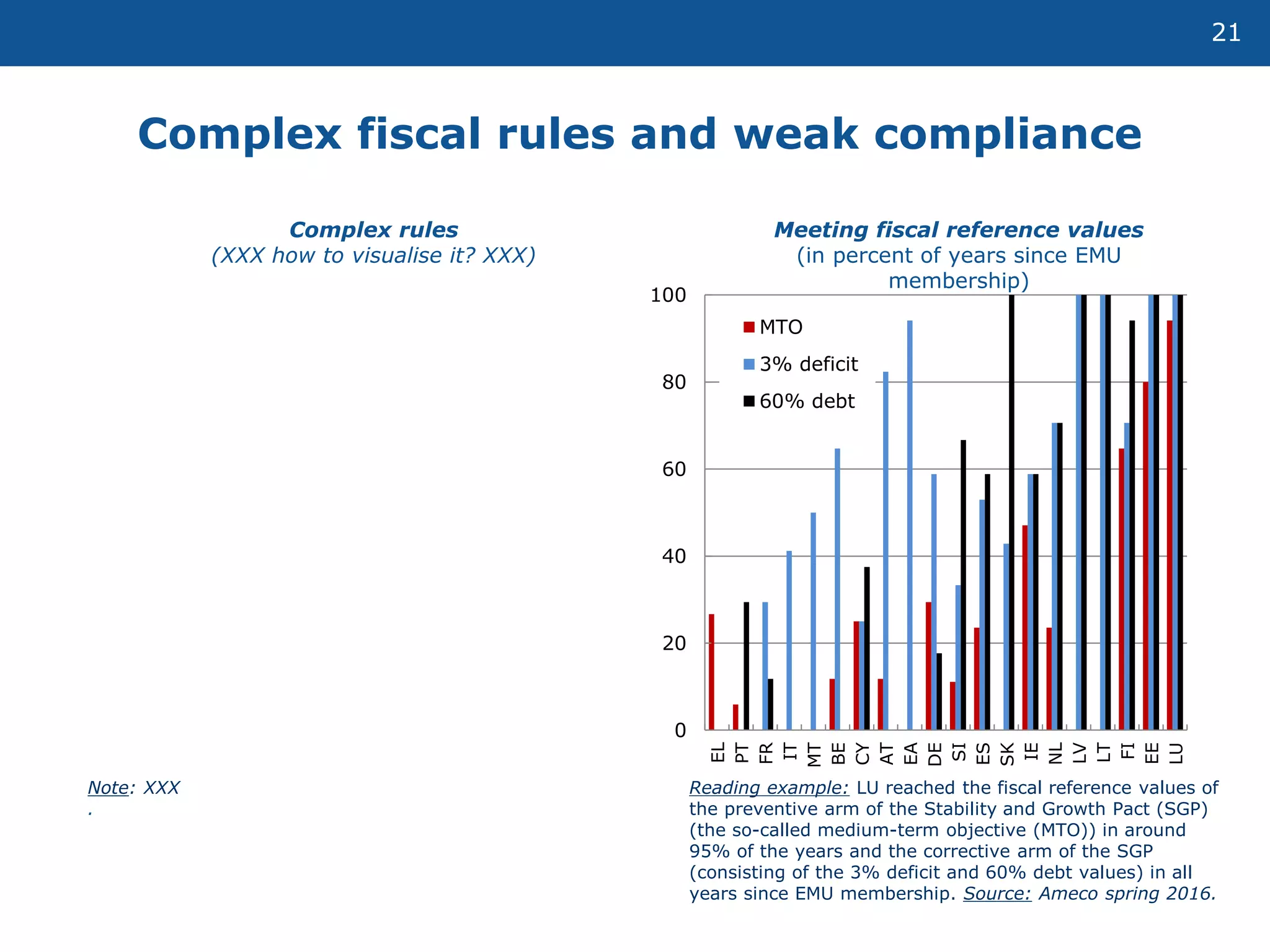

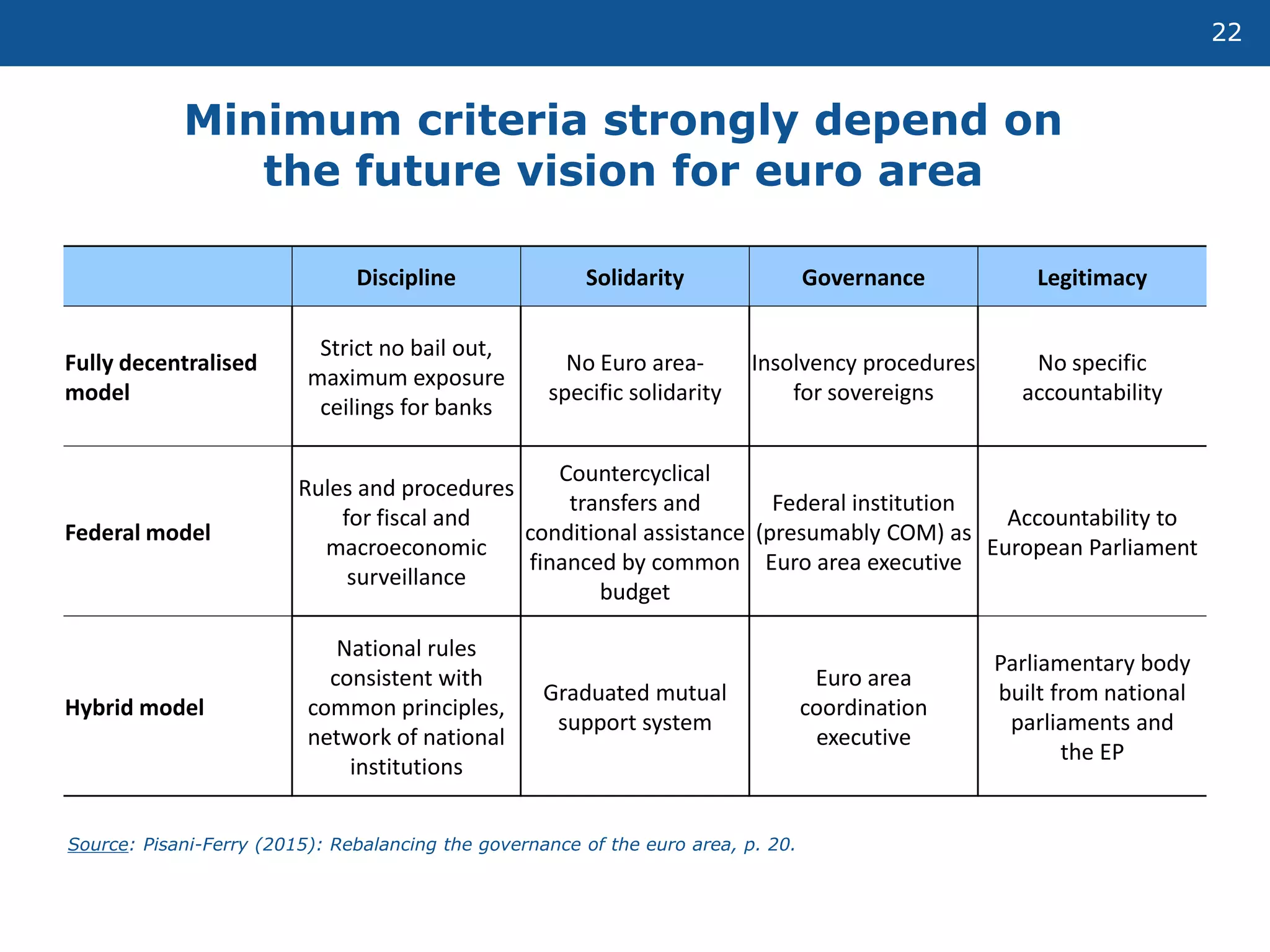

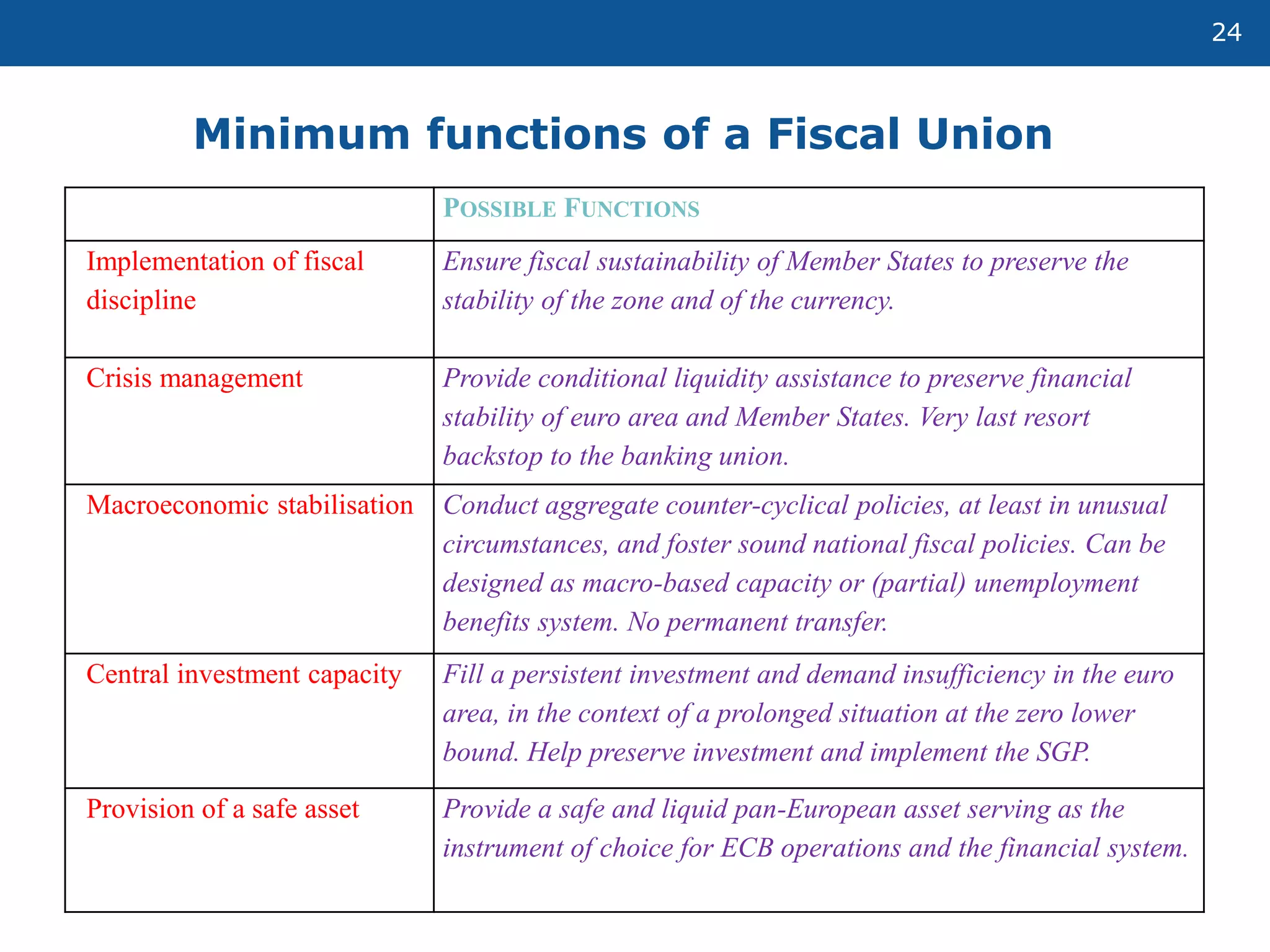

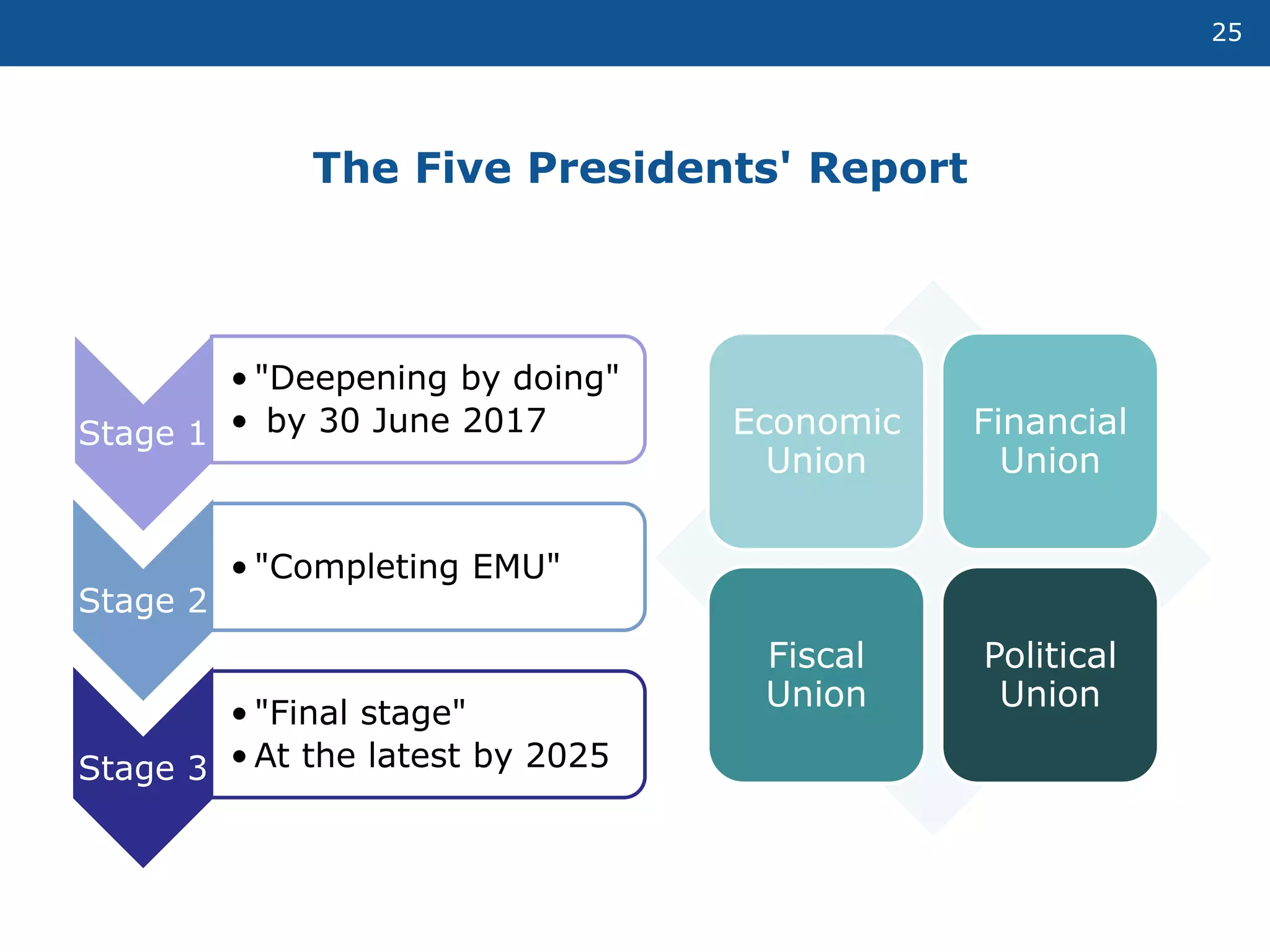

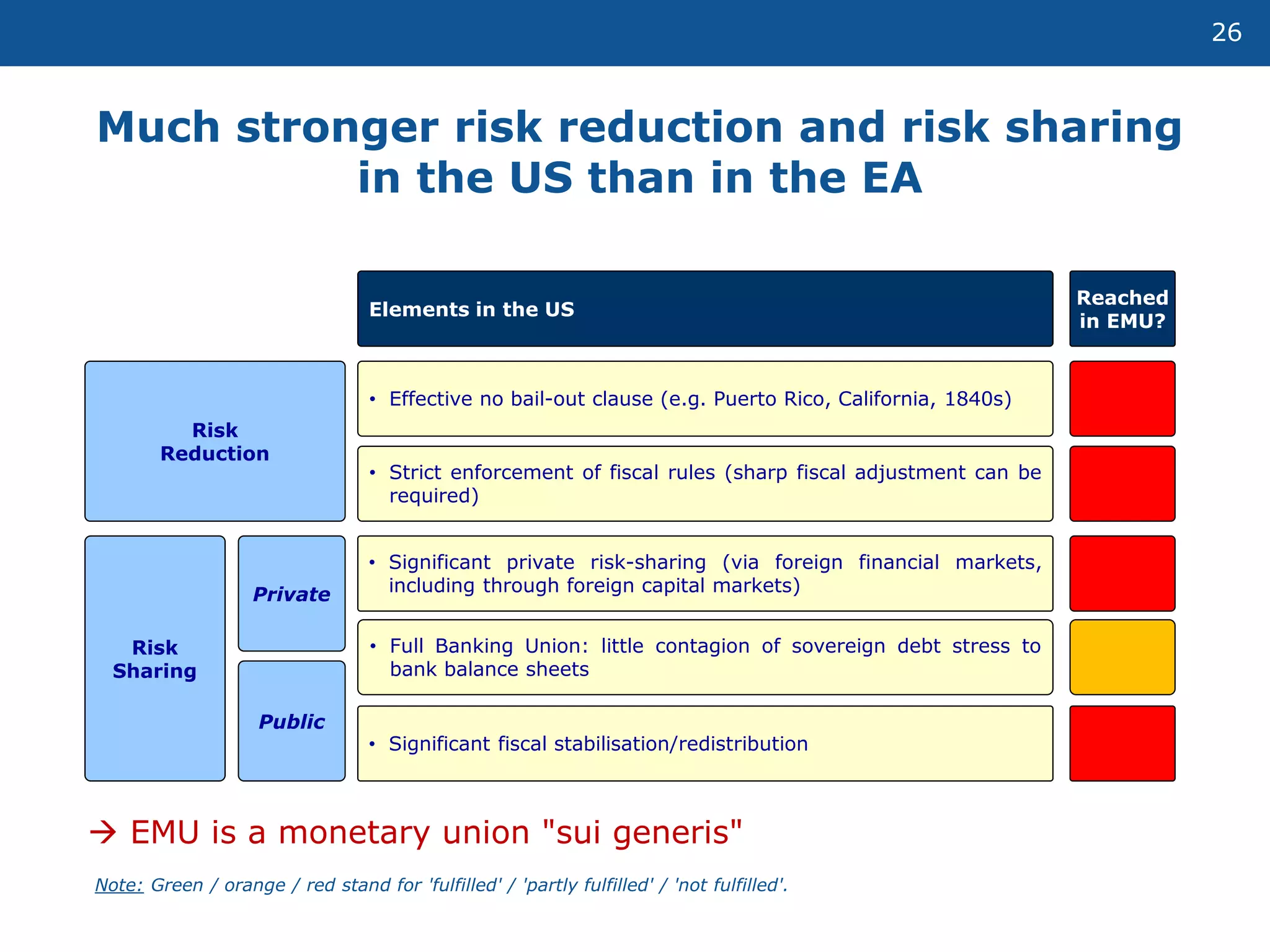

The document discusses the evolution of fiscal policy within the Economic and Monetary Union (EMU) since the financial crisis, highlighting the need for a sustainable fiscal union to manage economic shocks and improve stability. It outlines the changes made to fiscal rules and governance since 2011, emphasizing the remaining vulnerabilities and the necessity for a minimum fiscal capacity to ensure macroeconomic and financial stability. The document concludes that while significant improvements have been observed, the current setup still risks leaving heavy responsibilities on the European Central Bank and lacks adequate mechanisms for effective crisis management.