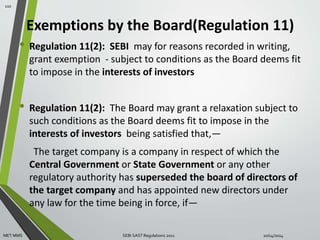

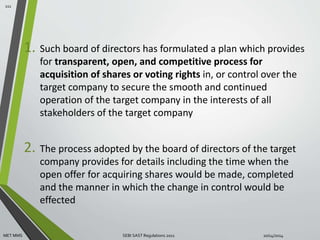

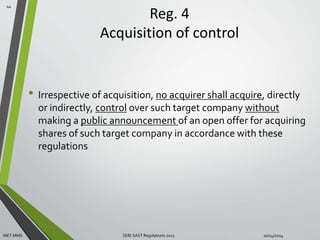

This document outlines the contents of the SEBI (Substantial Acquisition of Shares and Takeovers) Regulations 2011, which provides the legal framework for takeover bids and acquisitions of Indian public companies. It discusses the objectives of the regulations, key definitions, triggers for mandatory open offers, offer size and pricing requirements, escrow accounts, the open offer process, obligations of acquirers and target companies, exemptions, and penalties for non-compliance. The regulations aim to protect investors and ensure fair acquisition processes along with timely disclosure of information.

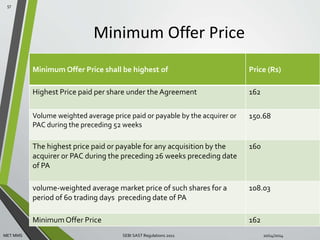

![The minimum offer price should be highest of the following, computed with reference

to the cut-off date:

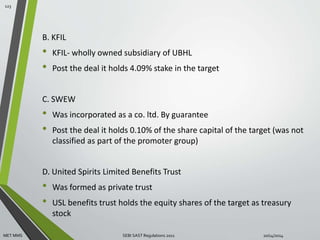

Direct Acquisition[Regulation 8(2)] Indirect Acquisition[Regulation 8(3)]

1) The highest negotiated price per share

of the target company for any acquisition

under the agreement attracting the

obligation to make a public

announcement of an open offer

1)The highest negotiated price per share

of the target company for any acquisition

under the agreement attracting the

obligation to make a public

announcement of an open offer

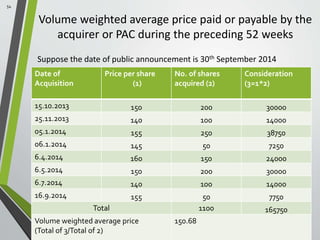

2) Volume weighted average price paid or

payable by the acquirer or PAC during the

preceding 52 weeks#

2)Volume weighted average price paid or

payable by the acquirer or PAC during the

preceding 52 weeks*

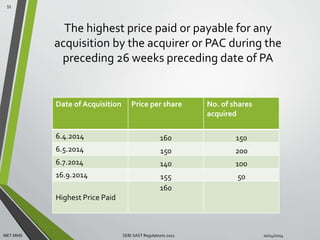

3)The highest price paid or payable for

any acquisition by the acquirer or PAC

during the preceding 26 weeks#

3)The highest price paid or payable for

any acquisition by the acquirer or PAC

during the preceding 26 weeks*

52

MET MMS SEBI SAST Regulations 2011 10/14/2014](https://image.slidesharecdn.com/finalsast13thsep-141013225008-conversion-gate01/85/SAST-REGULATIONS-52-320.jpg)

![Direct Acquisition[Regulation 8(2)] Indirect Acquisition[Regulation 8(3)]

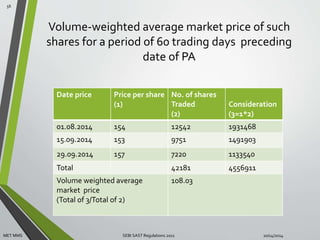

4)For frequently traded shares: volume-weighted

average market price of such shares

for a period of 60 trading days#

For infrequently traded shares: the price

determined by the acquirer and the manager

to the open offer taking into account

valuation parameters

4)Volume weighted average market price of

such shares for a period of 60 trading days*,

for frequently traded shares

5) The per share value of the target company

computed (In case of Deemed Direct

Acquisition where net assets value or sales

turnover or market capitalization of the target

company is more than 15% of consolidated

net asset or sales turnover or the enterprise

value of the entity or business being acquired

as per latest audited annual financial

statements, the per share value of the target

company computed by the acquirer )

5)The per share value of the target company

computed (Where net assets value or sales

turnover or market capitalization of the target

company is more than 15% of consolidated

net asset or sales turnover or the enterprise

value of the entity or business being acquired

as per latest audited annual financial

statements, the per share value of the target

company computed by the acquirer

# Cut-off date: Date on which PA is made *Cut-off date: Earlier of, the date on which

the primary acquisition is contracted and

the date on which intention or decision to

make primary acquisition is announced

53](https://image.slidesharecdn.com/finalsast13thsep-141013225008-conversion-gate01/85/SAST-REGULATIONS-53-320.jpg)