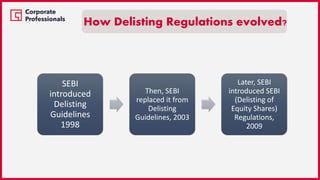

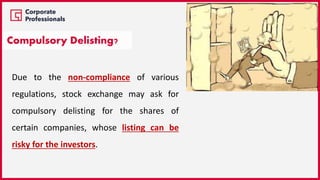

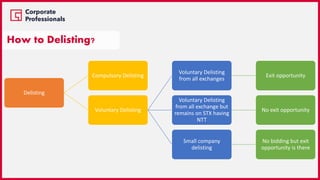

This document discusses corporate restructuring tools like takeovers, buybacks, and delisting. It defines takeovers as the acquisition of substantial shares and control over a target company. Buybacks allow companies to buy back their own shares from existing shareholders. Delisting is the removal of a company's stock from a stock exchange. The key regulations governing these tools in India are the SEBI Takeover Code, Companies Act provisions on buybacks, and SEBI Delisting Regulations. The document outlines the processes, requirements, and methods involved in takeovers, buybacks and delisting.

![Initial Threshold – 25% of the voting rights in Target Company

Creeping Acquisition or Consolidation of holdings – [if already holds 25% or more but less than 75%] in

excess of 5% of voting rights in any financial year

Acquisition of Control – irrespective of any shares or voting

Direct Acquisition](https://image.slidesharecdn.com/corporaterestructuringtakeoverbuybackdelisting-170301062552/85/Corporate-Restructuring-Takeover-Buy-Back-Delisting-16-320.jpg)

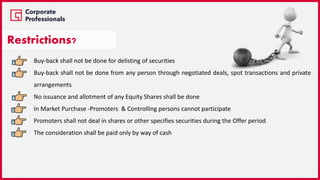

![Company shall not withdraw the offer of buy back after the public announcement is made

The company shall not buy back the locked in shares or other specified securities and non-transferable

shares or other specified securities

No fresh issue of Equity Shares or other specified securities from the date of closure of Buy Back upto

six months [except by way of bonus issue or in the discharge of subsisting obligations such as

conversions of warrants, stock options schemes, sweat equity or conversion of preference shares or

debentures into equity shares]

Restrictions?](https://image.slidesharecdn.com/corporaterestructuringtakeoverbuybackdelisting-170301062552/85/Corporate-Restructuring-Takeover-Buy-Back-Delisting-32-320.jpg)