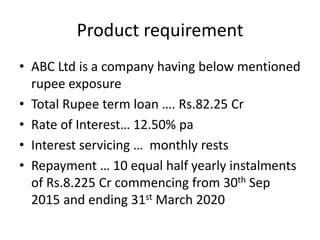

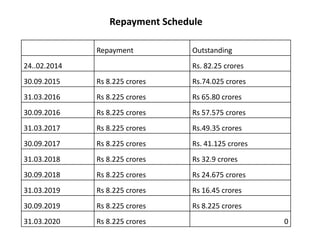

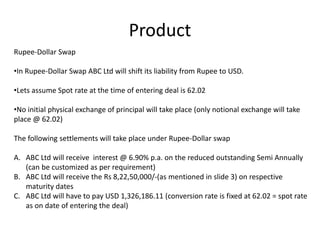

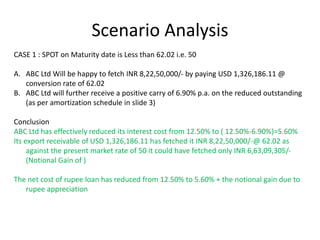

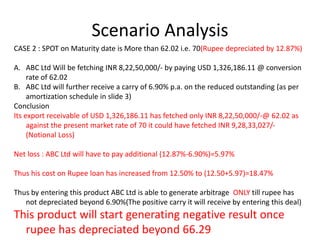

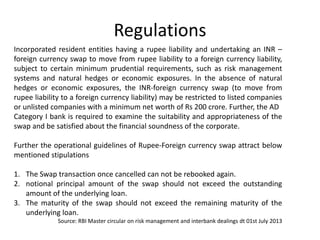

ABC Ltd, an Indian exporter, has a Rs. 82.25 crore term loan at 12.5% interest that it wants to reduce costs on. It receives USD and wants to leverage its net USD receivables. Through a rupee-dollar swap, ABC Ltd can shift its rupee liability to USD at a fixed rate of 62.02. This would reduce ABC Ltd's interest rate to 6.9% while receiving principal repayments in rupees on maturity dates. The swap provides benefits if the rupee depreciates versus the dollar but risks if the rupee appreciates beyond 6.9%. RBI regulations allow such swaps for companies meeting certain criteria to hedge foreign currency exposures.