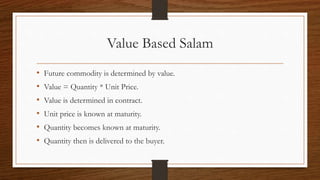

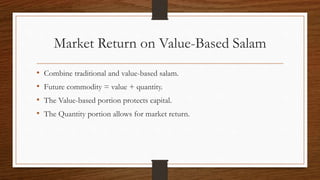

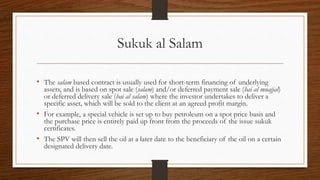

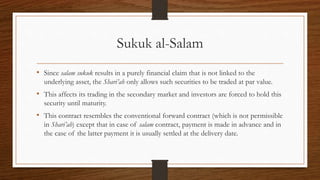

This document discusses various techniques for mitigating risk in Islamic banking. It begins by explaining how Islamic finance prohibits separating ownership from risk like conventional interest-based loans. It then discusses several key risks like credit risk and how Islamic banks estimate expected losses. It provides details on techniques for mitigating different types of risk, including using loan loss reserves, collateral, contracts, partnerships, murabahah structures, salam, parallel salam and sukuk structures. The goal is to encourage risk sharing over risk transferring in accordance with Islamic principles.