This document contains information about three different sukuk structures:

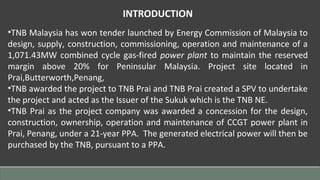

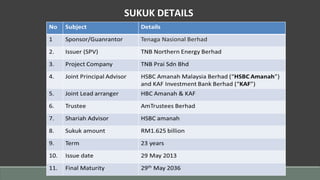

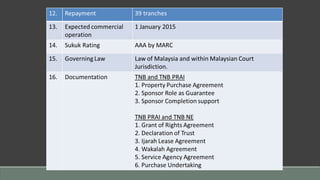

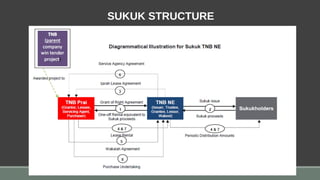

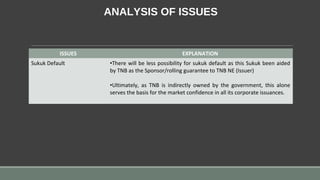

1. TNB Malaysia sukuk involved TNB issuing sukuk to fund a power plant project, with guarantees from TNB and implicit backing from the Malaysian government reducing default risk.

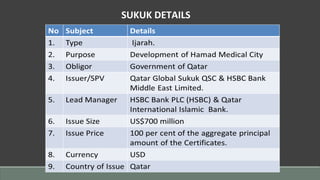

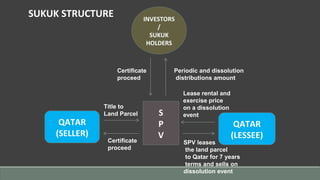

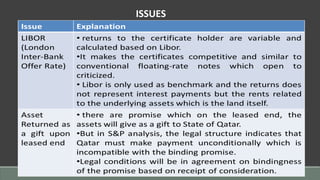

2. Qatar Global Sukuk was used to fund construction of a medical city, with the sukuk structure involving the SPV leasing land from Qatar and selling it upon maturity.

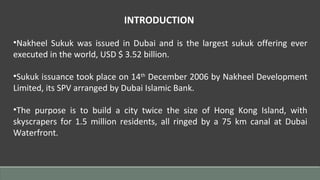

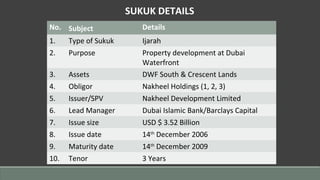

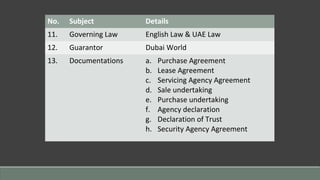

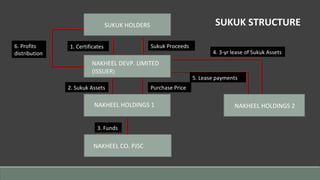

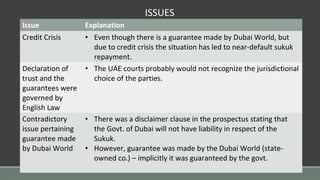

3. Nakheel sukuk was the largest ever at $3.52 billion to develop Dubai Waterfront, but faced issues during the financial crisis despite guarantees, and questions around applicable law for the guarantees.