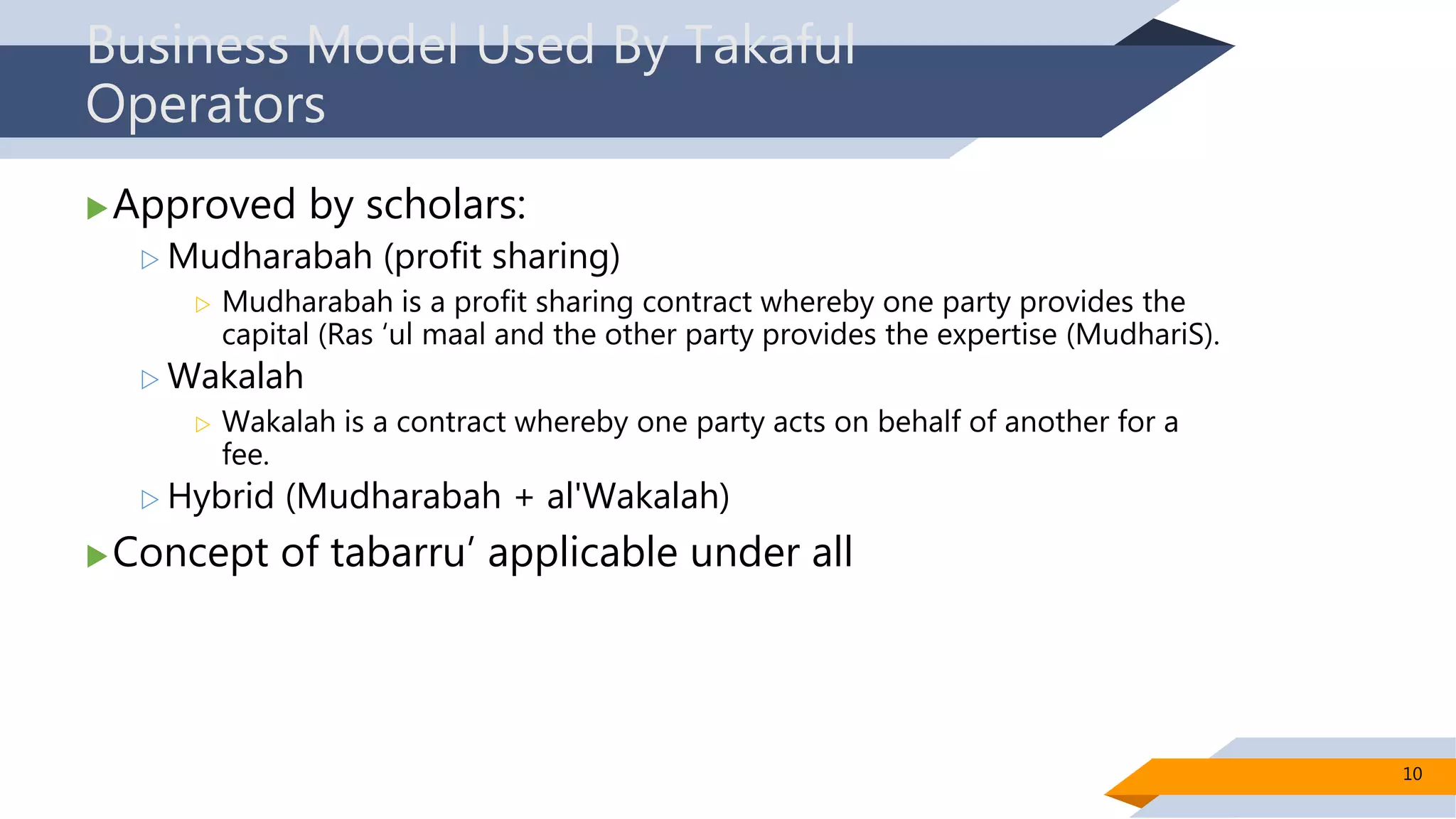

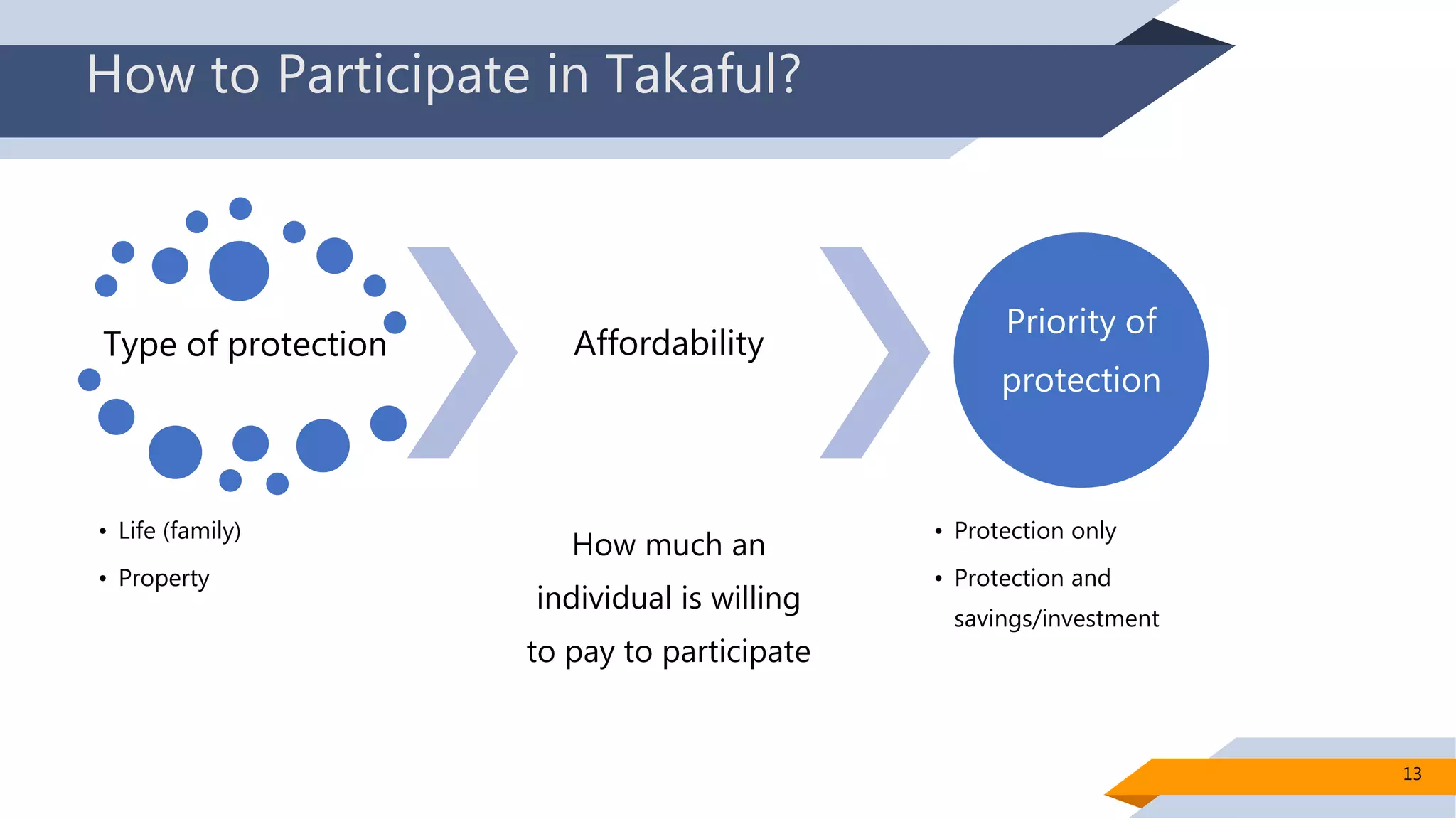

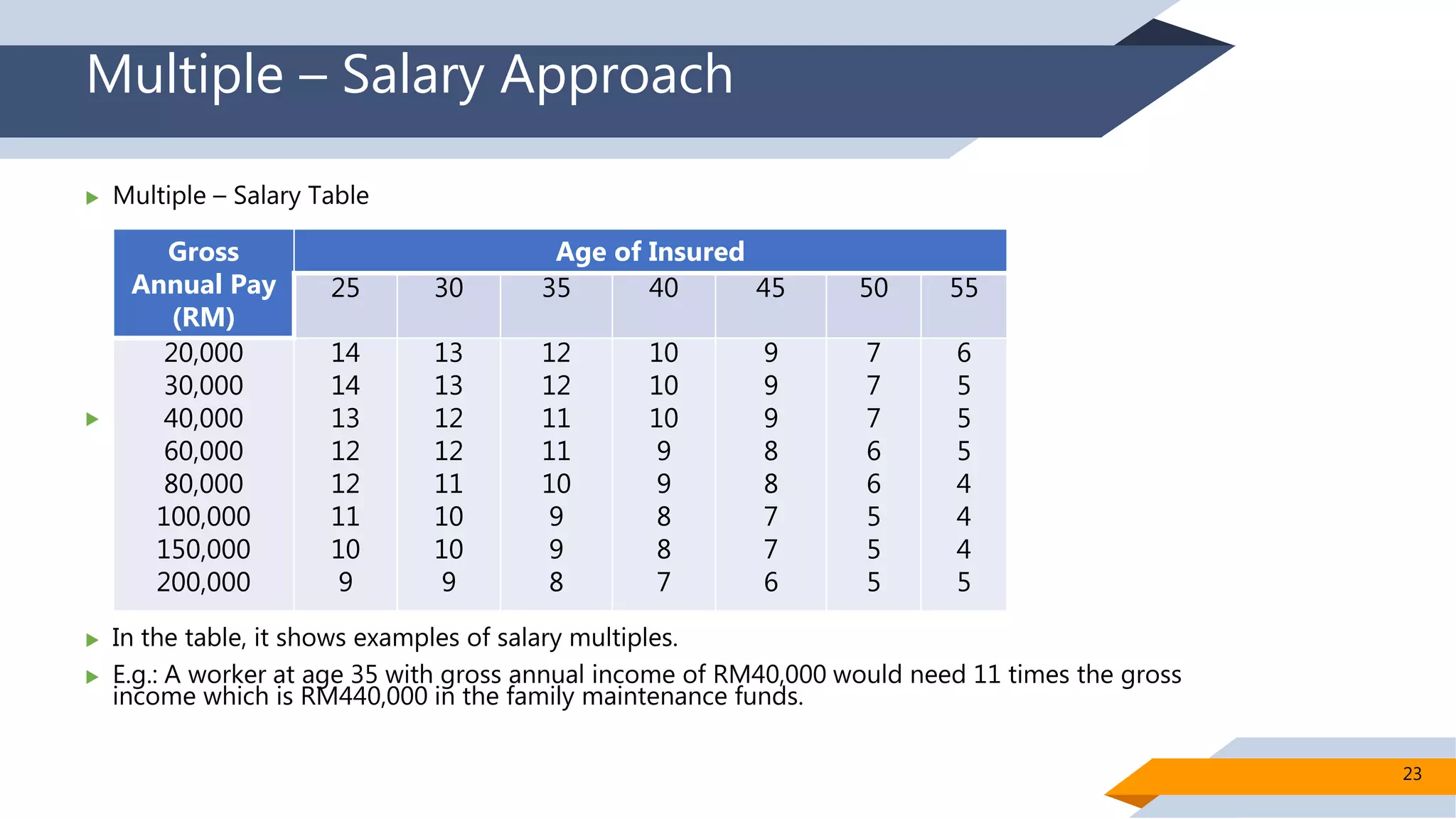

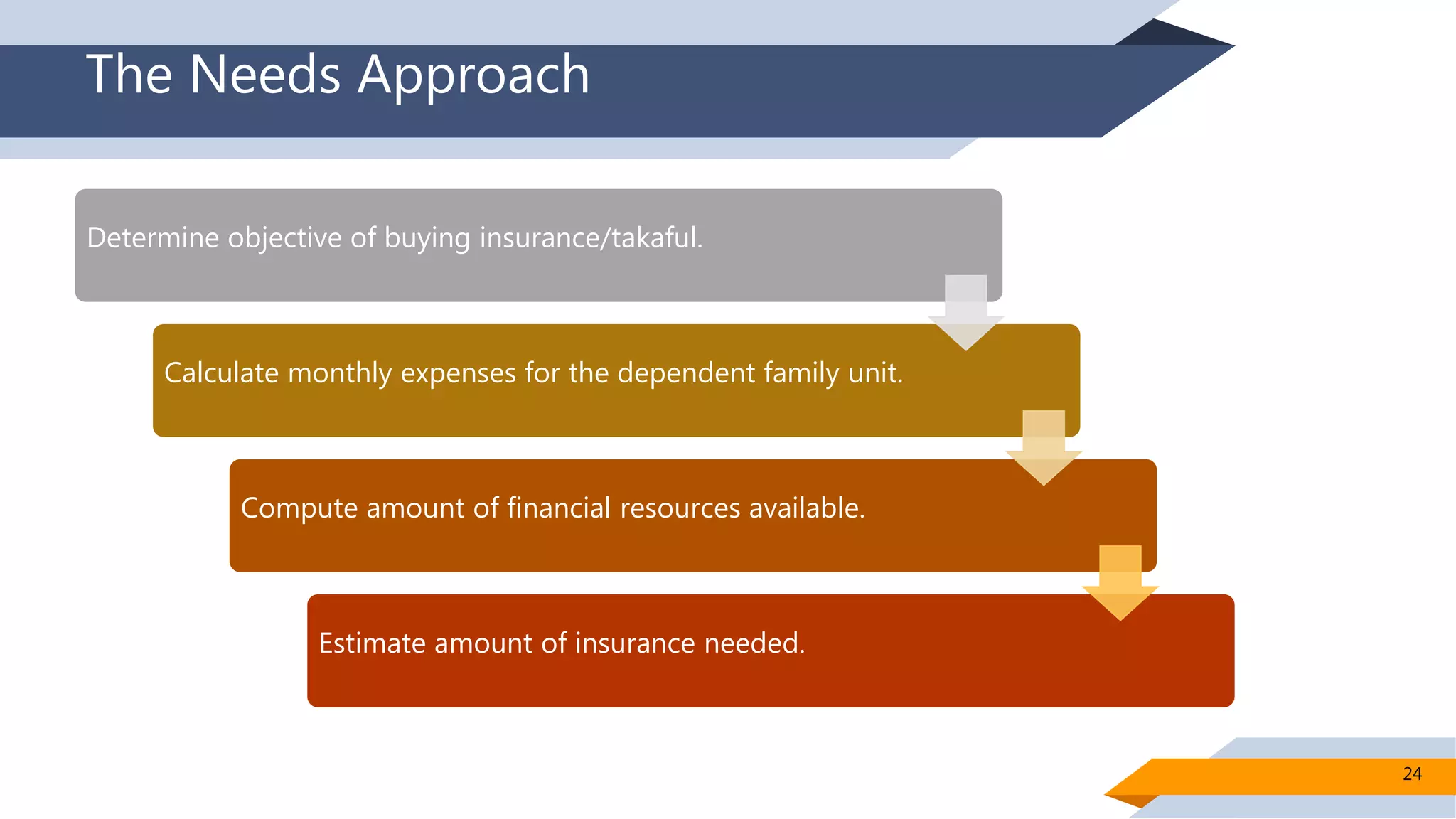

This document discusses Islamic financial planning and takaful (Islamic insurance). It begins by defining takaful and explaining how it differs from conventional insurance by being based on mutual assistance and contribution to a common fund. The document outlines the key concepts of tabarru' (donation) and mudharabah (profit-sharing) business models used by takaful operators. It then discusses how to determine the appropriate amount of takaful coverage needed based on a family's monthly expenses and existing financial resources. The document provides approaches like using a multiple of one's salary or assessing actual needs to estimate a maintenance fund size. It emphasizes the importance of choosing a takaful policy that matches one's specific needs and objectives