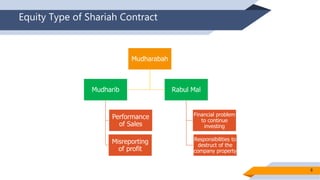

This document discusses risk management in Islamic finance, specifically equity investment risk. It defines equity investment risk according to the Islamic Financial Service Board as the risk of participating in a business partnership where the provider of finance shares in business risks. Equity investments in Islamic finance are typically done through mudarabah and musharakah contracts which are profit/loss sharing in nature and can result in total loss of capital. The document outlines some of the key risks of equity investment including partner risk, lack of reliable partner information, credit risk, industry risk, and risks specific to mudarabah and musharakah contracts. It concludes by suggesting some ways to mitigate equity investment risk such as diversification, long-term investing, expert advice,