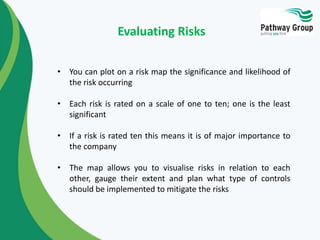

The document outlines the concept of risk in business, defining it as the probability of an event and its consequences, with categories including strategic, financial, and operational risks. It discusses risk management processes, which involve identifying, assessing, and responding to risks, as well as the benefits of effective risk management, such as improved decision-making and resource allocation. The evaluation of risks is emphasized as essential for ranking their significance and determining appropriate actions to minimize potential negative impacts.