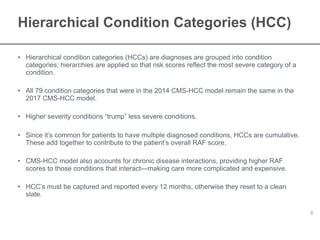

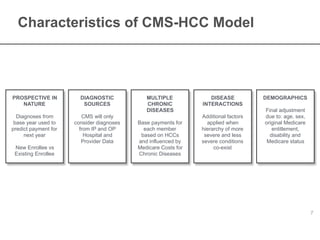

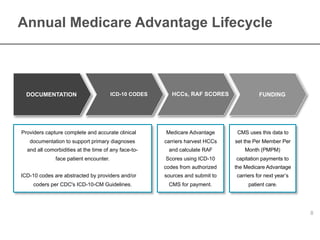

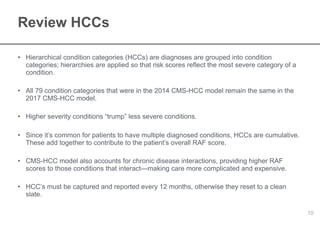

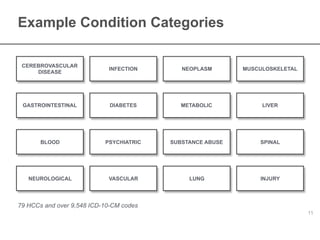

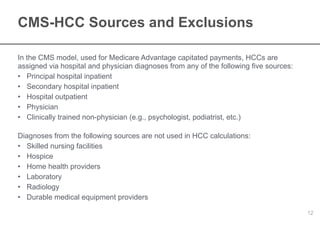

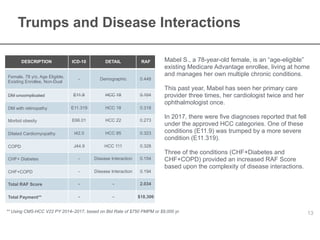

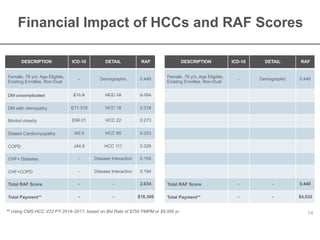

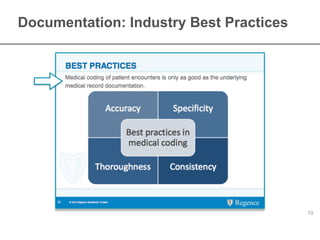

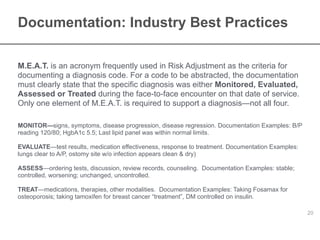

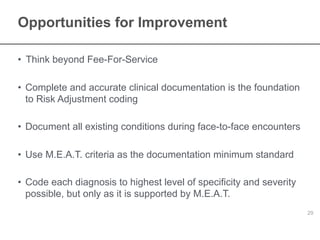

The document provides an overview of risk adjustment in Medicare Advantage, focusing on the importance of hierarchical condition categories (HCCs) and their impact on capitation payments. It explains how risk adjustment factors are calculated based on demographic and diagnosed conditions, emphasizing the necessity for accurate documentation and coding by healthcare providers. Additionally, it outlines the legal requirements and best practices for medical coding and documentation necessary for compliance and effective patient care.