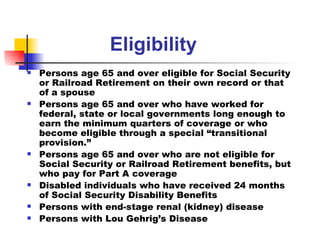

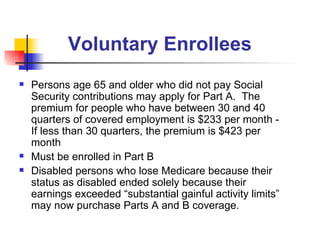

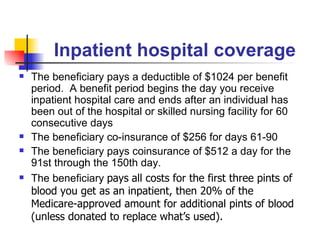

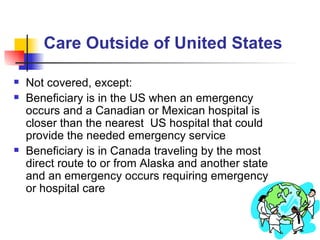

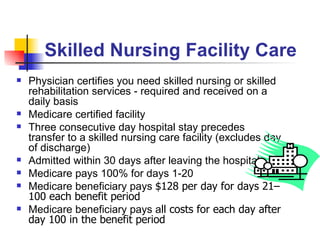

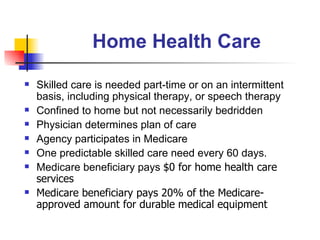

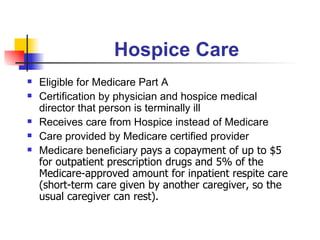

Medicare Part A provides coverage for inpatient hospital stays, skilled nursing facilities, home health care, and hospice care. It is funded through the payroll tax and people aged 65+ who are eligible for Social Security are automatically enrolled. Those not receiving Social Security benefits must apply. Part A covers hospital costs, nursing facilities for up to 100 days, home health care with a skilled need, and hospice care for terminally ill patients. Beneficiaries may have copays for certain services covered by Part A.