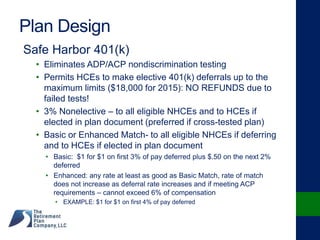

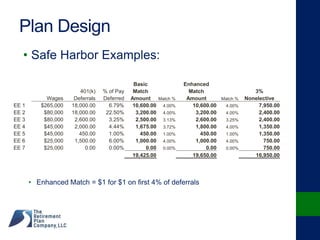

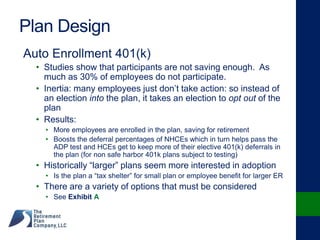

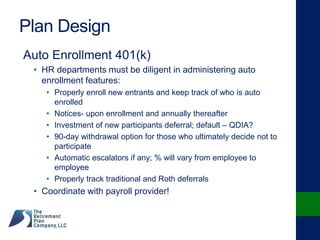

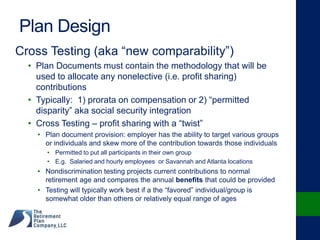

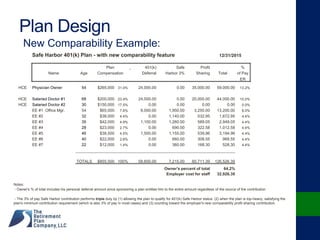

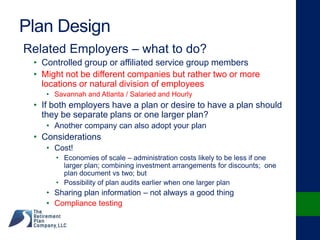

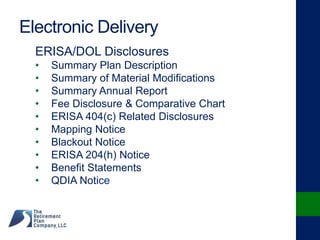

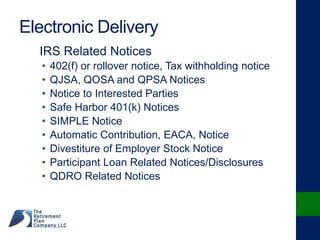

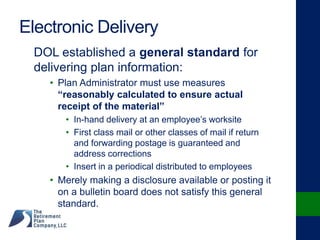

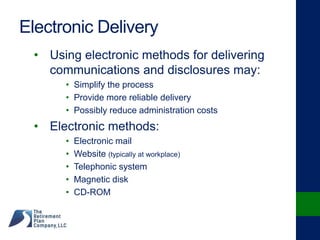

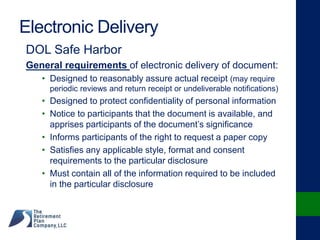

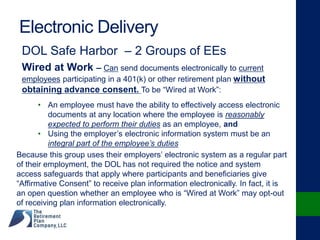

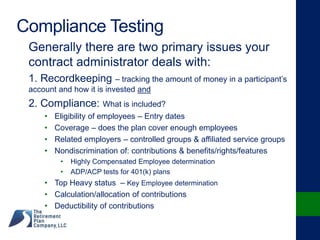

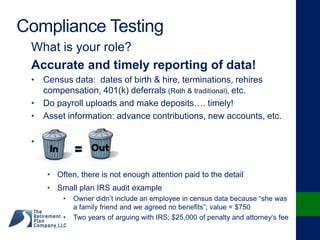

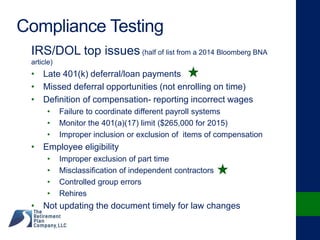

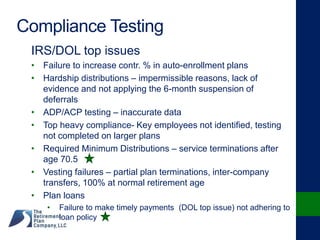

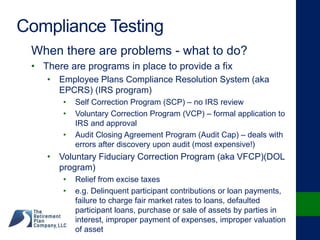

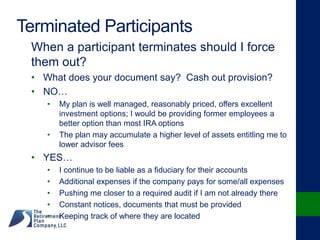

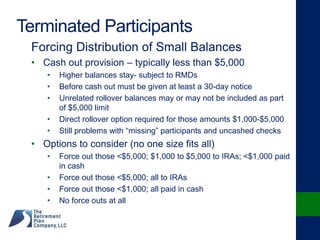

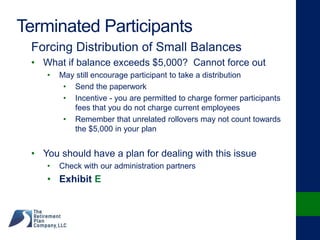

The document outlines effective plan design and administration for retirement plans, covering topics such as safe harbor 401(k) options, electronic delivery of participant disclosures, and compliance testing. It emphasizes the importance of auto enrollment strategies to increase participation and savings among employees and discusses the intricacies of cross-testing contributions among different employee groups. Additionally, it highlights various compliance issues that need to be addressed to avoid penalties and ensures plans are effectively managed for participants' benefit.