The document discusses the impact of the Uniform Guidance on performing single audits. Some key points include:

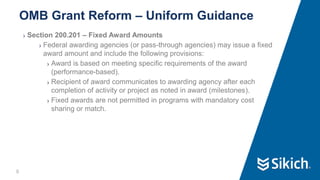

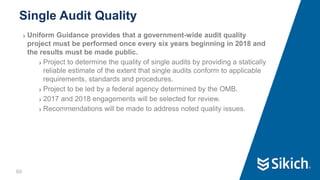

- The Uniform Guidance consolidated and streamlined eight OMB circulars into one set of guidance. It aims to reduce administrative burden while strengthening accountability.

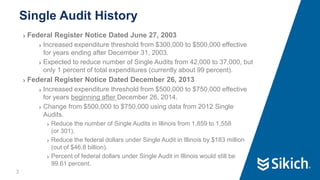

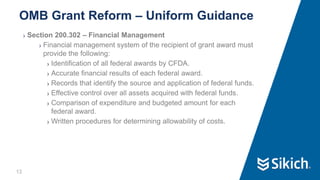

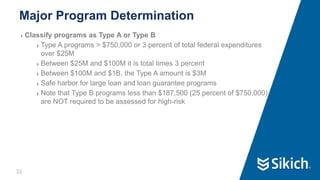

- Major changes under the Uniform Guidance include increasing the threshold for single audits to $750,000, revising internal control and documentation standards for compensation costs, and requiring consideration of an auditor's most recent peer review in the selection process.

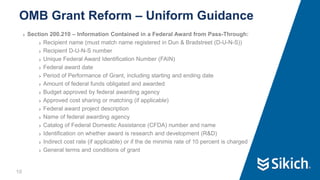

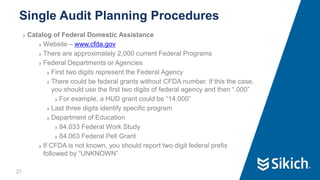

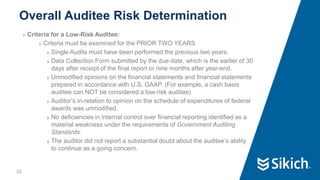

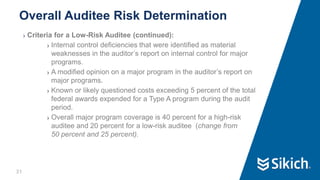

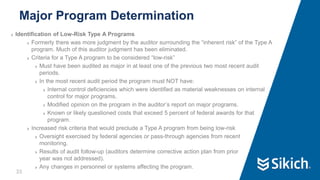

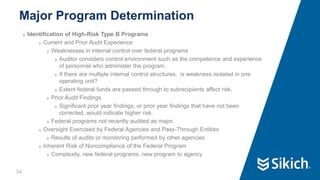

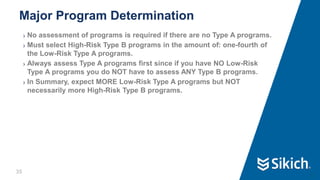

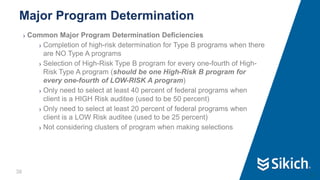

- Planning procedures for single audits involve determining federal awards expended, distinguishing between subrecipients and vendors, identifying program clusters using the Catalog of Federal Domestic Assistance, and assessing overall auditee risk