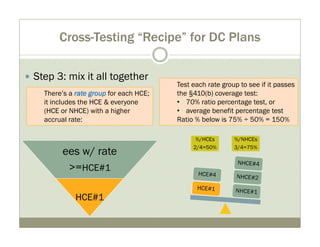

Cross-tested plans allow employers to demonstrate nondiscrimination by converting contributions into benefits and testing the benefits rather than contributions. Common cross-tested plan designs include age-weighted, service-weighted, and class allocation profit sharing plans as well as cash balance and defined benefit/defined contribution combinations. Cross-testing works best when using a profit sharing/cash balance or 401(k) safe harbor combination and can be applied to groups of related employers. Flexible plan designs and avoiding unfavorable demographics are keys to successful implementation of cross-tested plans.