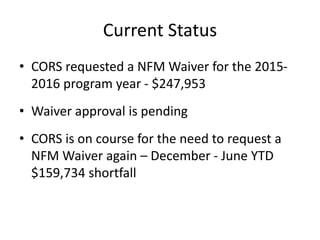

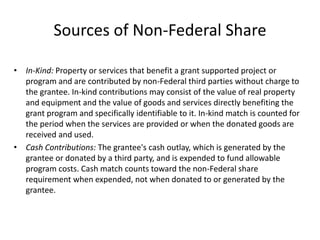

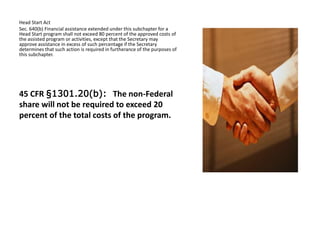

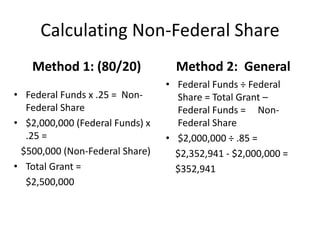

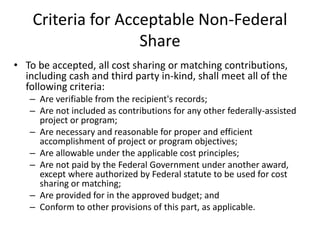

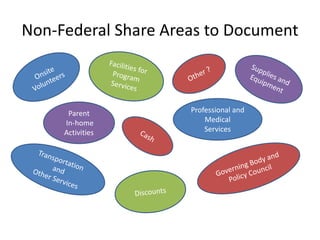

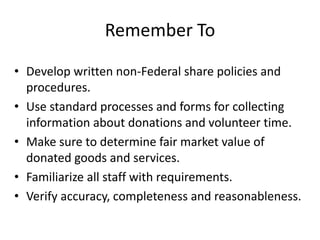

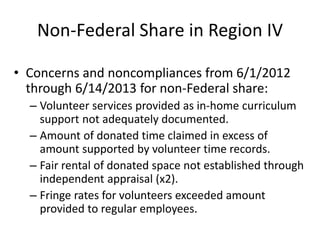

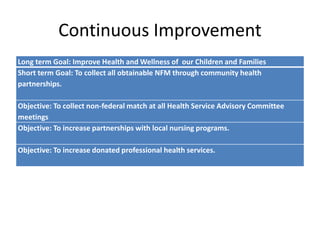

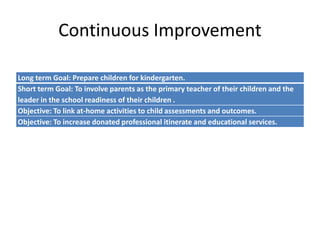

The document summarizes a meeting agenda discussing the Council on Rural Services' (CORS) non-federal match (NFM) status and continuous improvement efforts. It notes that CORS has requested an NFM waiver for the past two years and is on track to need another waiver. Presenters will provide an overview of NFM requirements, the current NFM shortfall, and opportunities for maximizing NFM sources going forward in compliance with federal regulations.