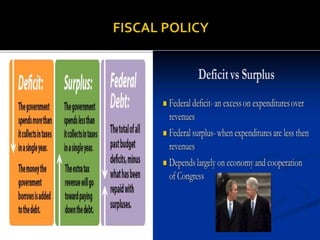

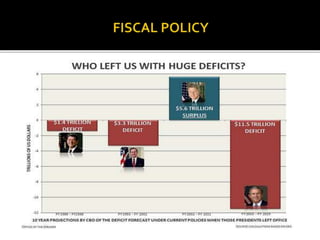

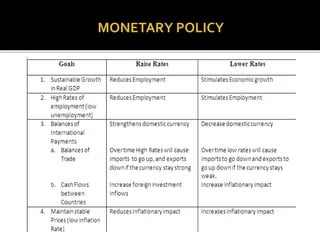

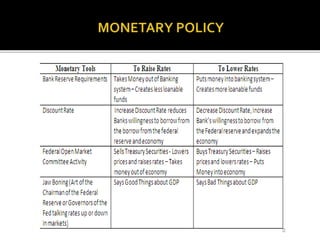

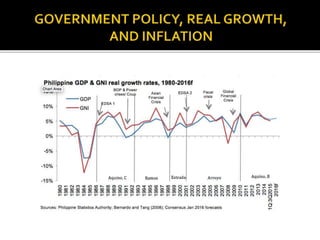

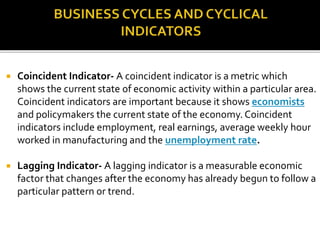

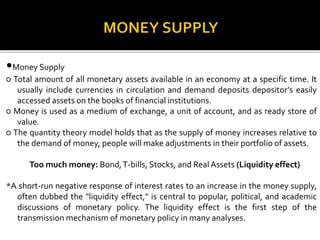

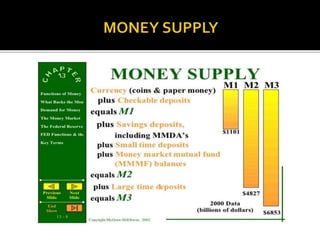

The document discusses key topics related to economic activity and business cycles including fiscal policy, monetary policy, and government policy. It provides historical context on economic policies and conditions in the United States from the 1940s through 2000s. Key economic indicators such as GDP, money supply, and industrial production are also examined in relation to business cycles.