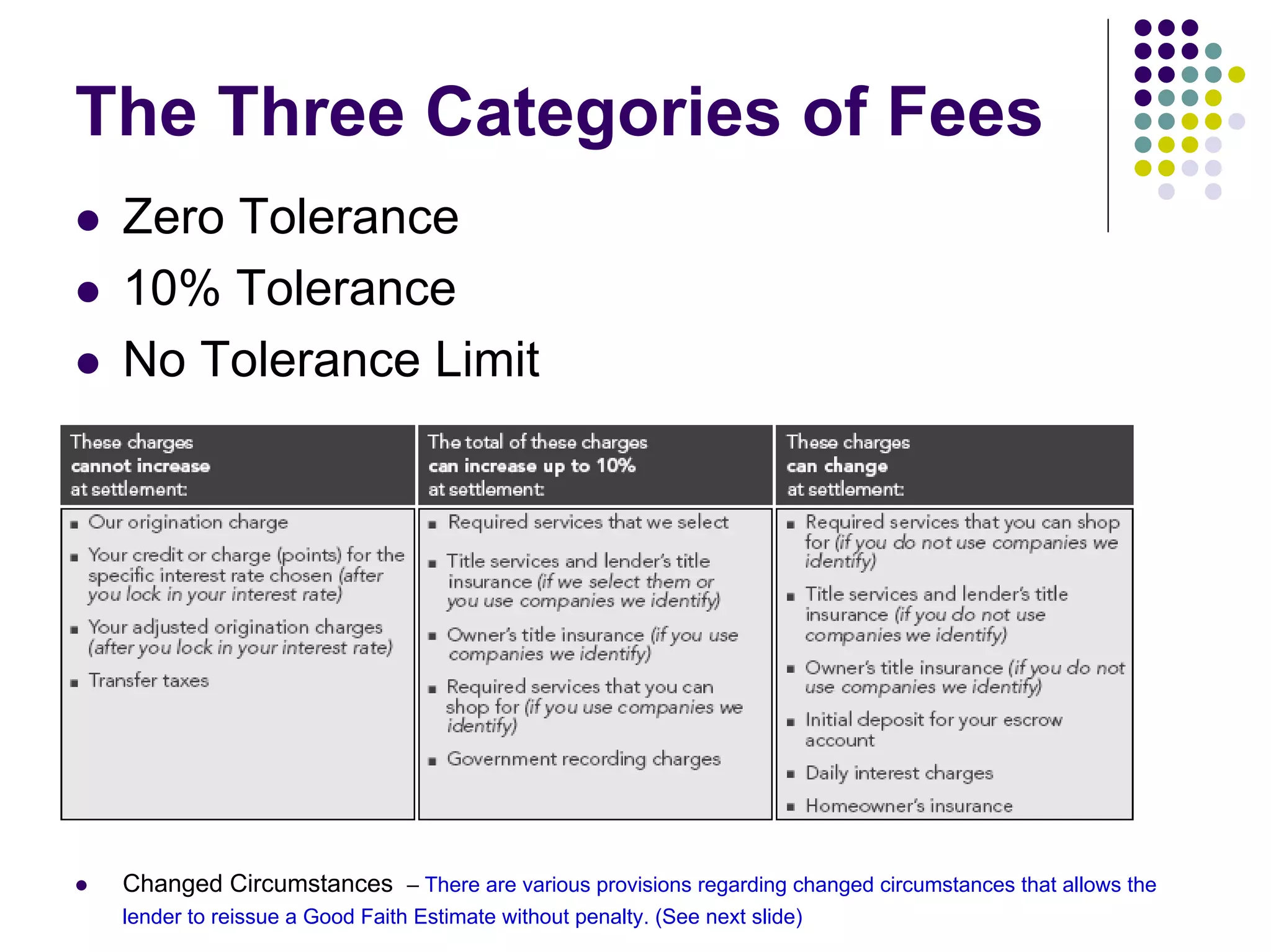

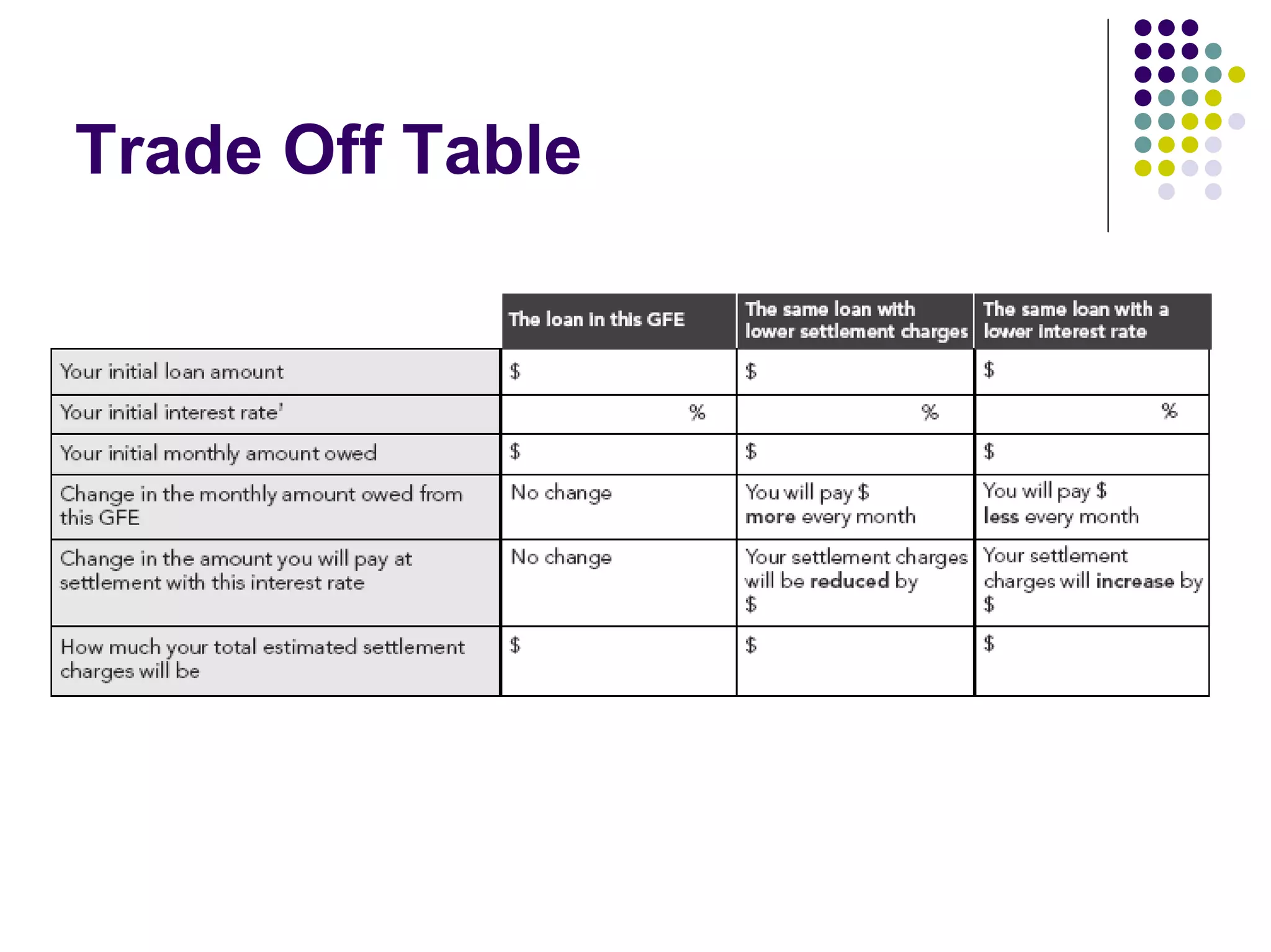

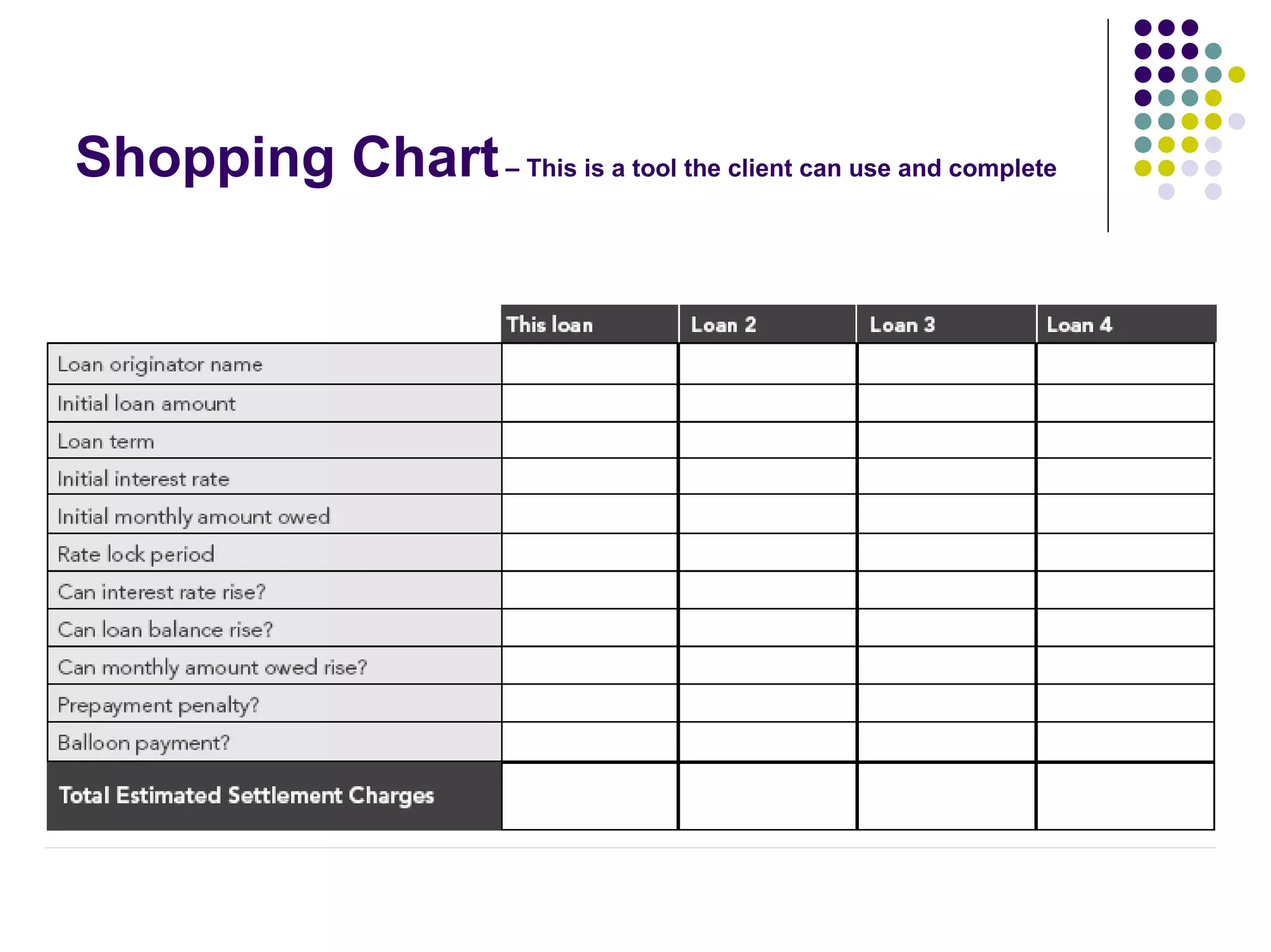

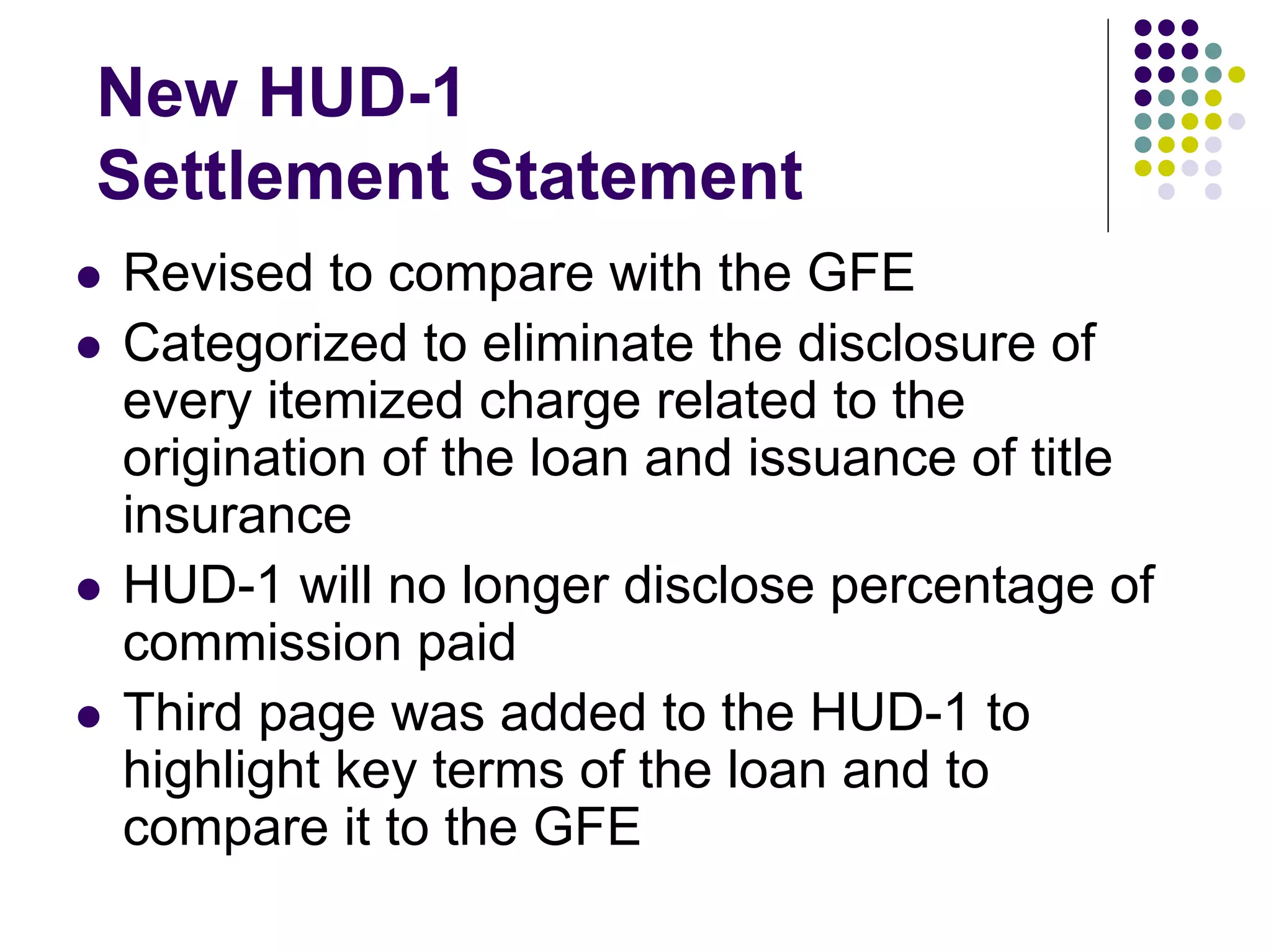

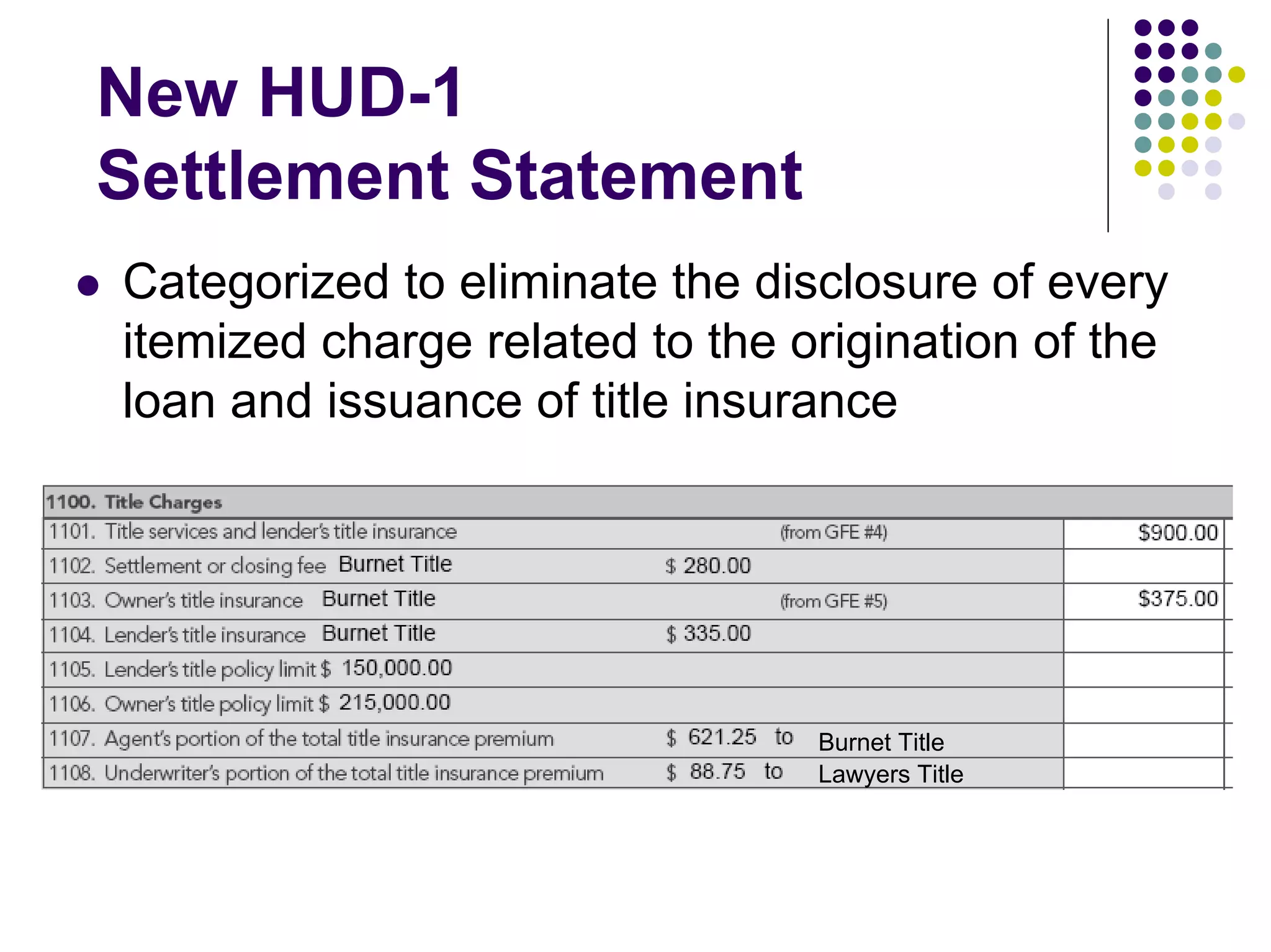

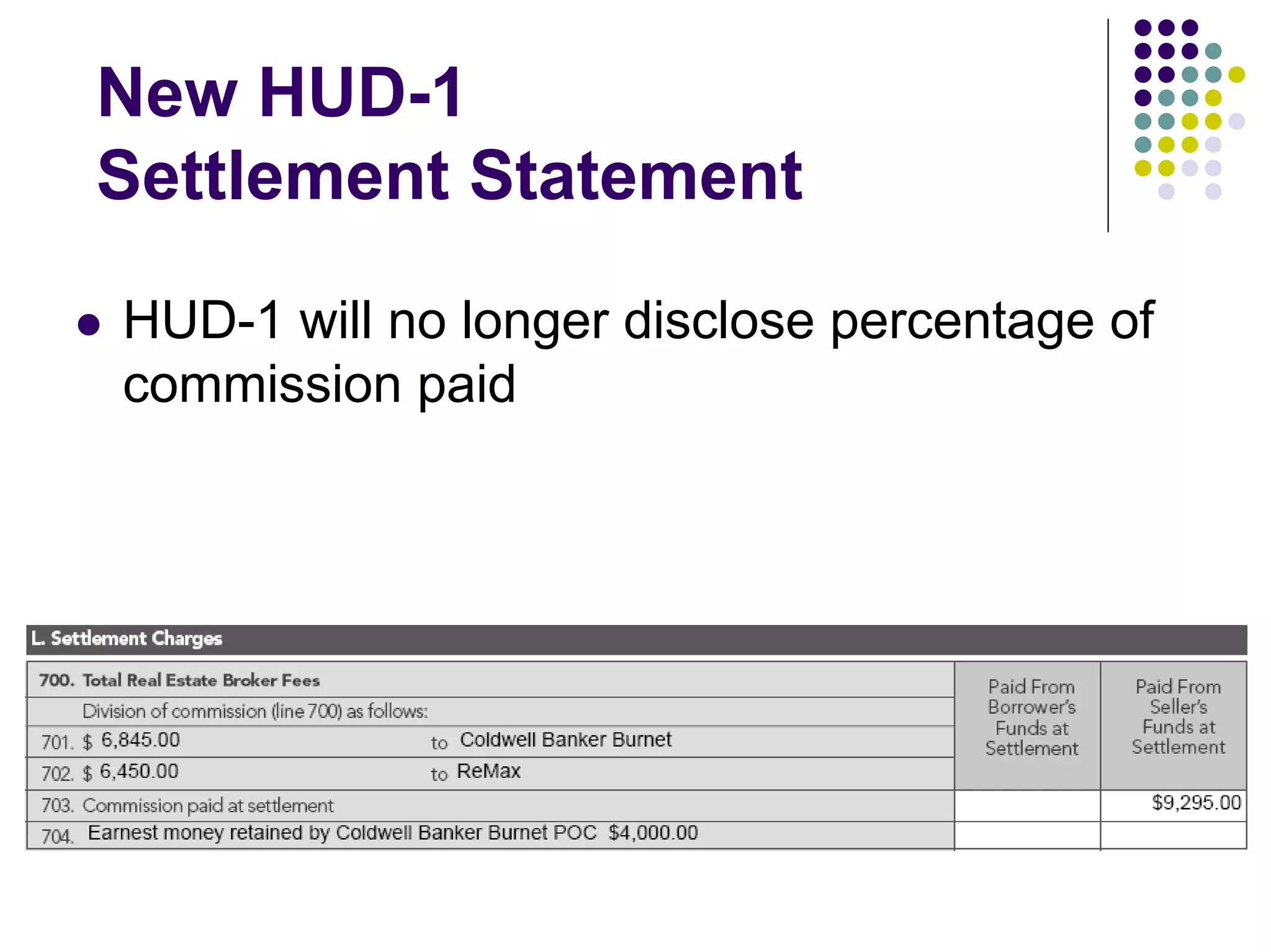

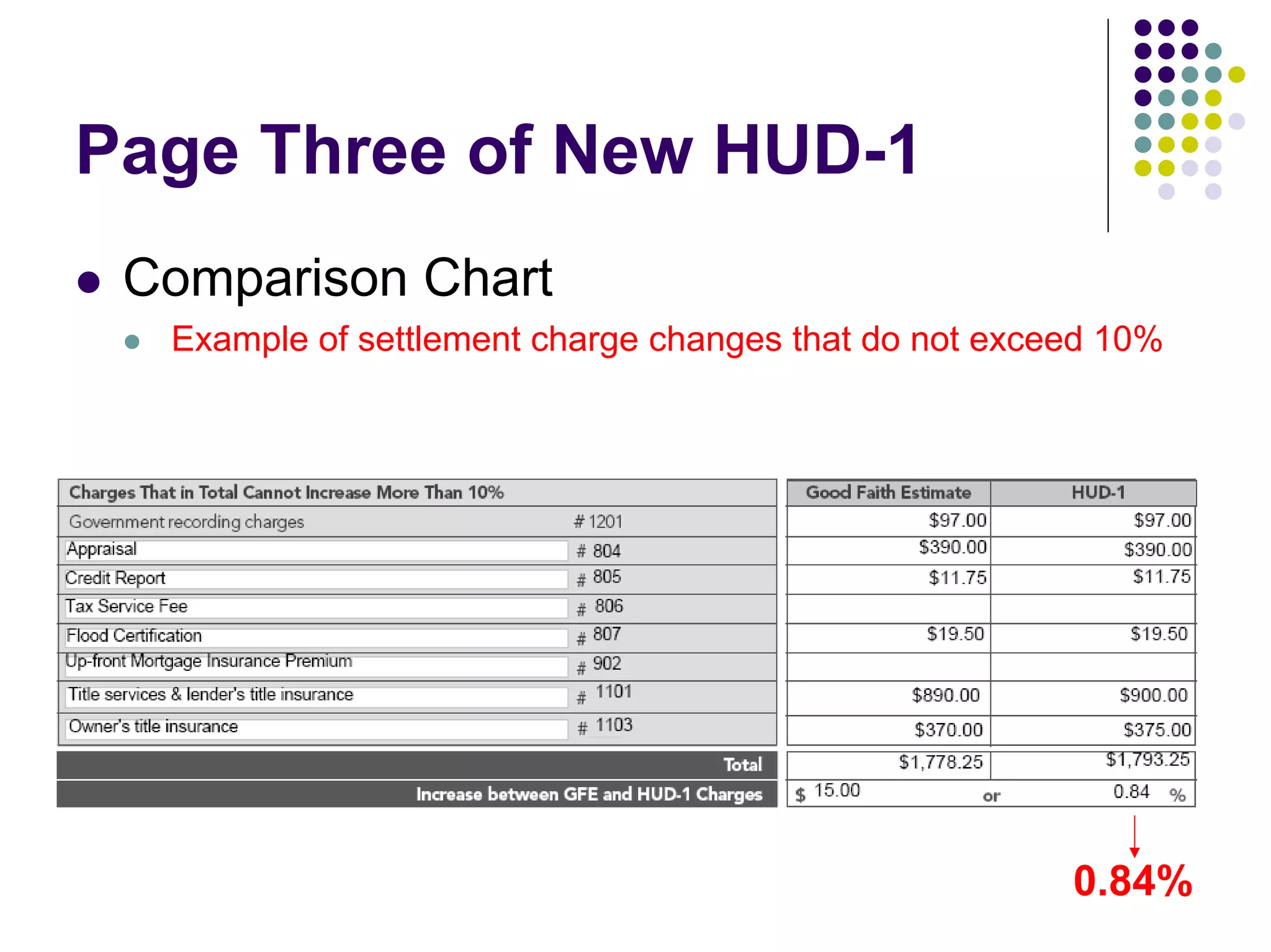

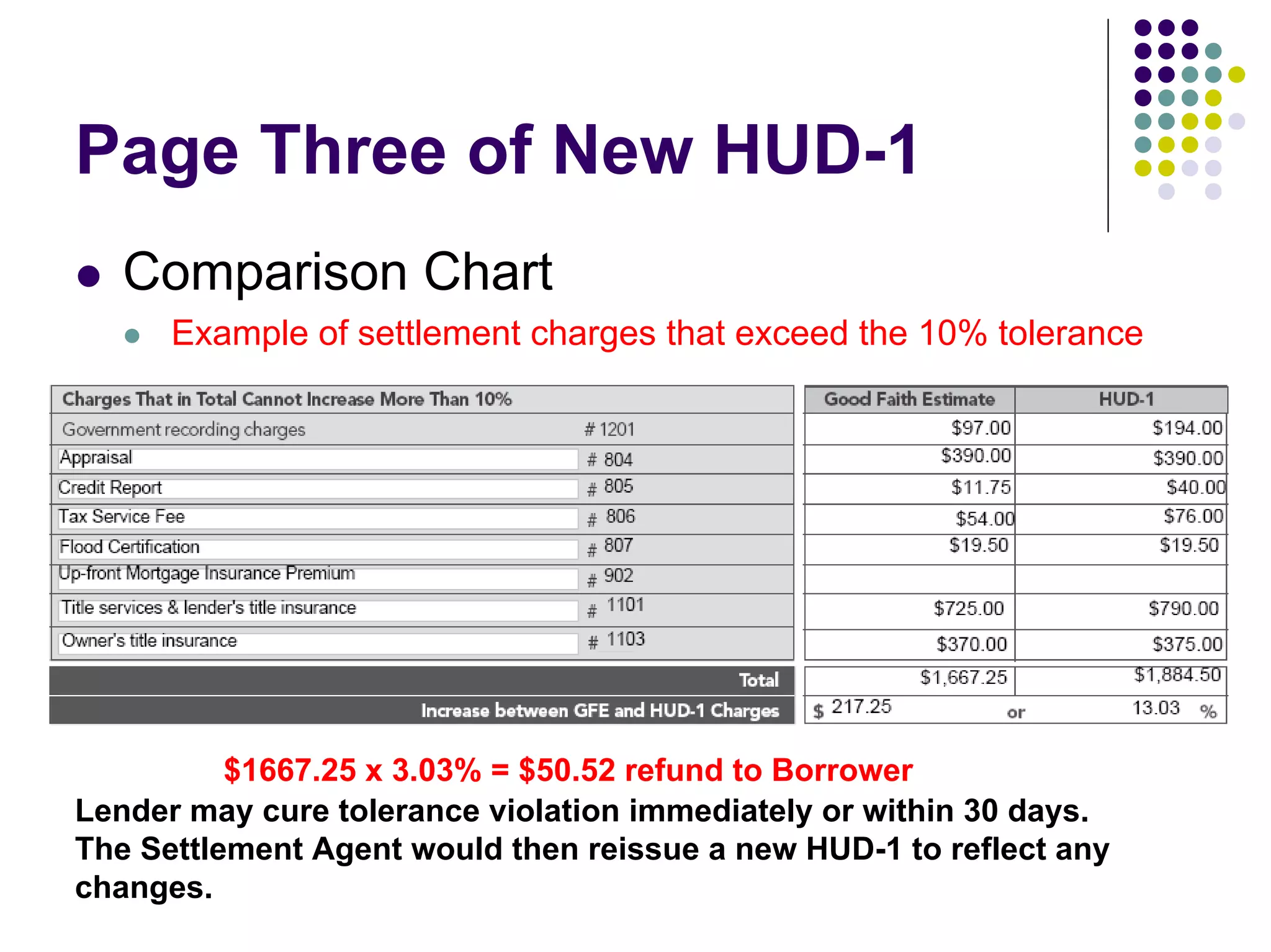

The document discusses reforms to the Real Estate Settlement Procedures Act (RESPA) that aim to provide more transparency to home buyers. The Good Faith Estimate (GFE) and HUD-1 settlement statement were revised to better inform borrowers about loan terms and prevent unexpected fee increases. Key changes include making GFEs binding documents, adding fee tolerance limits, and requiring refunds if certain fees exceed tolerances. A third page was also added to the HUD-1 to compare final fees to those in the GFE. The reforms take effect for applications starting January 1st and are designed to increase competition and lower costs through an improved disclosure process.