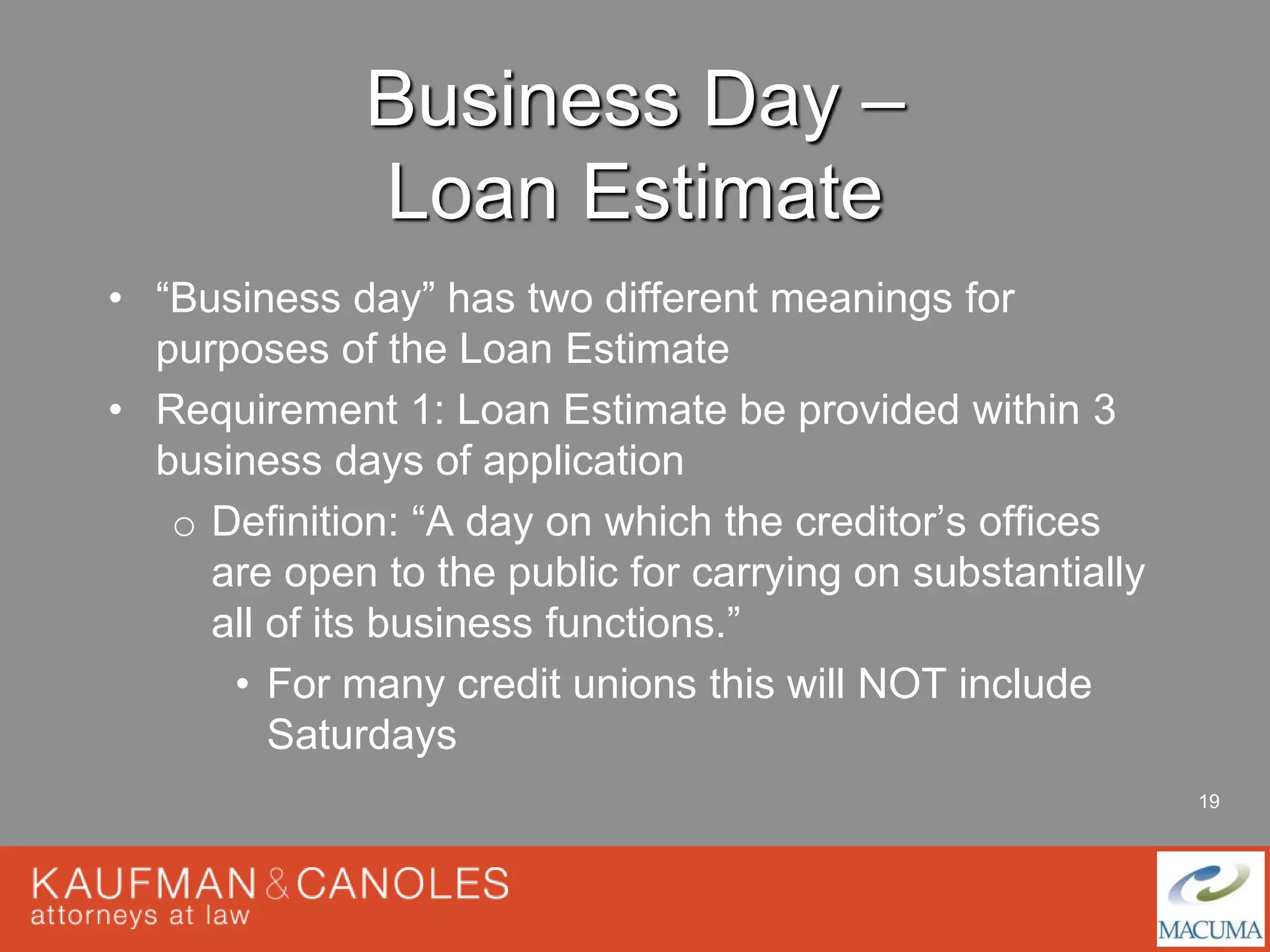

The document outlines the new integrated mortgage disclosure rules from the CFPB effective August 1, 2015, which combine TILA and RESPA requirements to improve consumer understanding of loan terms. It details the loan estimate and closing disclosure processes, including timing requirements and the definition of business days. It also emphasizes the need for credit unions to prepare for these changes through technology upgrades and staff training.

![18

Advertisements

All advertisements require a disclaimer warning that

there is no substitute for Loan Estimate Form –

[“This is not an official Loan Estimate”]

BUT – Stay tuned, CFPB might modify](https://image.slidesharecdn.com/truthin-lending-respathenewrulesbye-141215091314-conversion-gate02/75/Truth-in-Lending-RESPA-The-New-Rules-18-2048.jpg)

![20

Business Day – L.E. (cont.)

• Requirement 2: Loan Estimate provided 7 business

days prior to consummation

o Definition: means all calendar days except

Sundays and the legal public holidays. Business

days includes Saturdays for the waiting period

[It is all about Saturdays]](https://image.slidesharecdn.com/truthin-lending-respathenewrulesbye-141215091314-conversion-gate02/75/Truth-in-Lending-RESPA-The-New-Rules-20-2048.jpg)