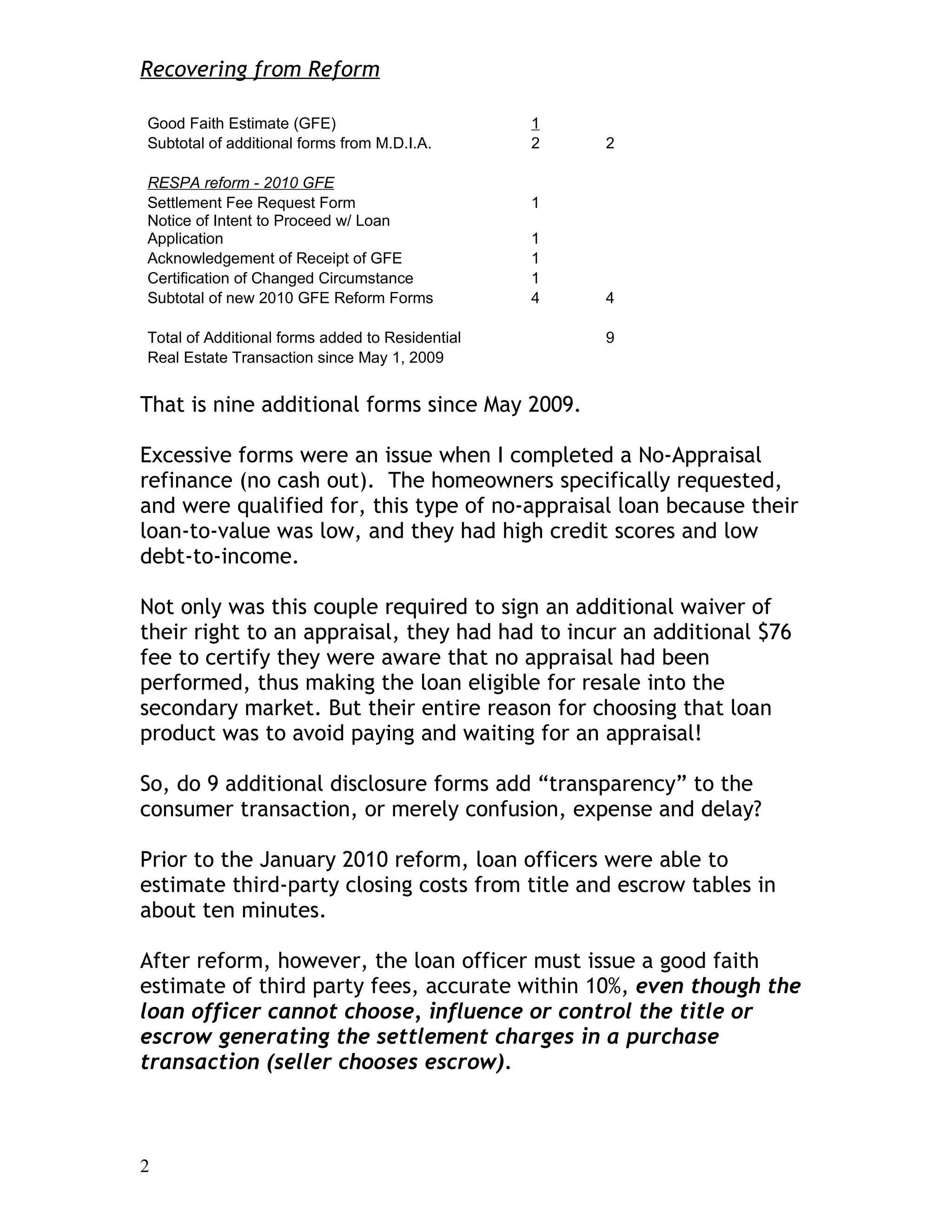

The document discusses the impacts of recent mortgage lending reforms on loan officers and borrowers. It summarizes that since 2009, three phases of reform - including changes to appraisal practices, disclosure requirements, and the Good Faith Estimate - have added 9 new forms to the loan process. This has increased compliance complexity, costs, and processing times. Borrowers are confused by the excessive information and often uninterested in details like fees paid by sellers. The reforms have unintentionally grown an industry around compliance at the expense of transparency and efficiency in lending.

![Recovering from Reform

Recently, a first time homebuyer walked out in anger, refusing to

proceed with the initial loan application package for his $189,000

purchase. Closing costs figure disproportionately higher for

$189,000 loans, than for $300,000 or $417,000 loans, since all loans

require a minimum of underwriter, escrow, title and county

recording cost, or no loan will result.

He was disgruntled because the loan officer refused to “bargain”

over closing costs, notwithstanding that we don’t choose or control

for purchase transactions [seller chooses escrow/title].

And this first time homebuyer was singularly unimpressed with the 9

new forms, or that our bank had hired, trained and staffed an

entirely new department called the “GFE Analyst” to comply with

the new regulatory environment. He was uninterested that, if the

loan officer failed to properly disclose the 3rd-party fees (escrow,

title, county recording) adequately, the loan officer could pay more

in penalties than the loan officer could earn on this $189,000 loan.

Nor did he entirely grasp that, if the loan officer failed to fill out all

these forms or comply with all these regulations, his loan would be

ineligible for resale in the secondary market. As a result, he would

lose the historically low rates on the historically low property value

that made the transaction available to him.

All possible fees to the transaction were fully-disclosed to this

borrower. And this borrower is free to shop for lower fees. But he

isn’t going to find them.

The same costs and compliance burden exist for $189,000

transactions as for a $729,000 transaction. This borrower will need

to find a shop which is willing, as the joke goes, “lose money on

every transaction, but make it up in volume.”

This buyer failed to find new consumer protection in the reforms.

Nor did the reforms appear to give him greater insight into the

process.

Isn’t this the issue reform was supposed to address?

6](https://image.slidesharecdn.com/recoveringreform4-12699647855665-phpapp02/75/Recovering-from-Reform4-6-2048.jpg)