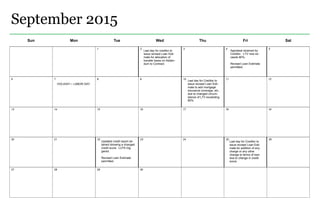

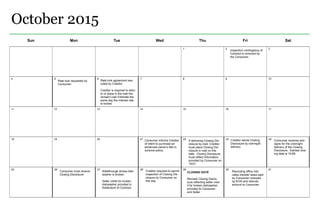

This document provides a calendar example of the TILA RESPA Integrated Disclosure timeline and process for a real estate purchase transaction that will close on October 29, 2015. Key events in the timeline include the consumer receiving the initial Loan Estimate on August 3rd after applying, revised Loan Estimates being issued on August 28th, September 4th and 22nd due to changes in transfer taxes, loan-to-value ratio, and credit score, and the consumer receiving the initial Closing Disclosure by October 21st. The transaction then closes on October 29th. The calendar illustrates the disclosure requirements and timing under the TILA RESPA Integrated Disclosure rule.