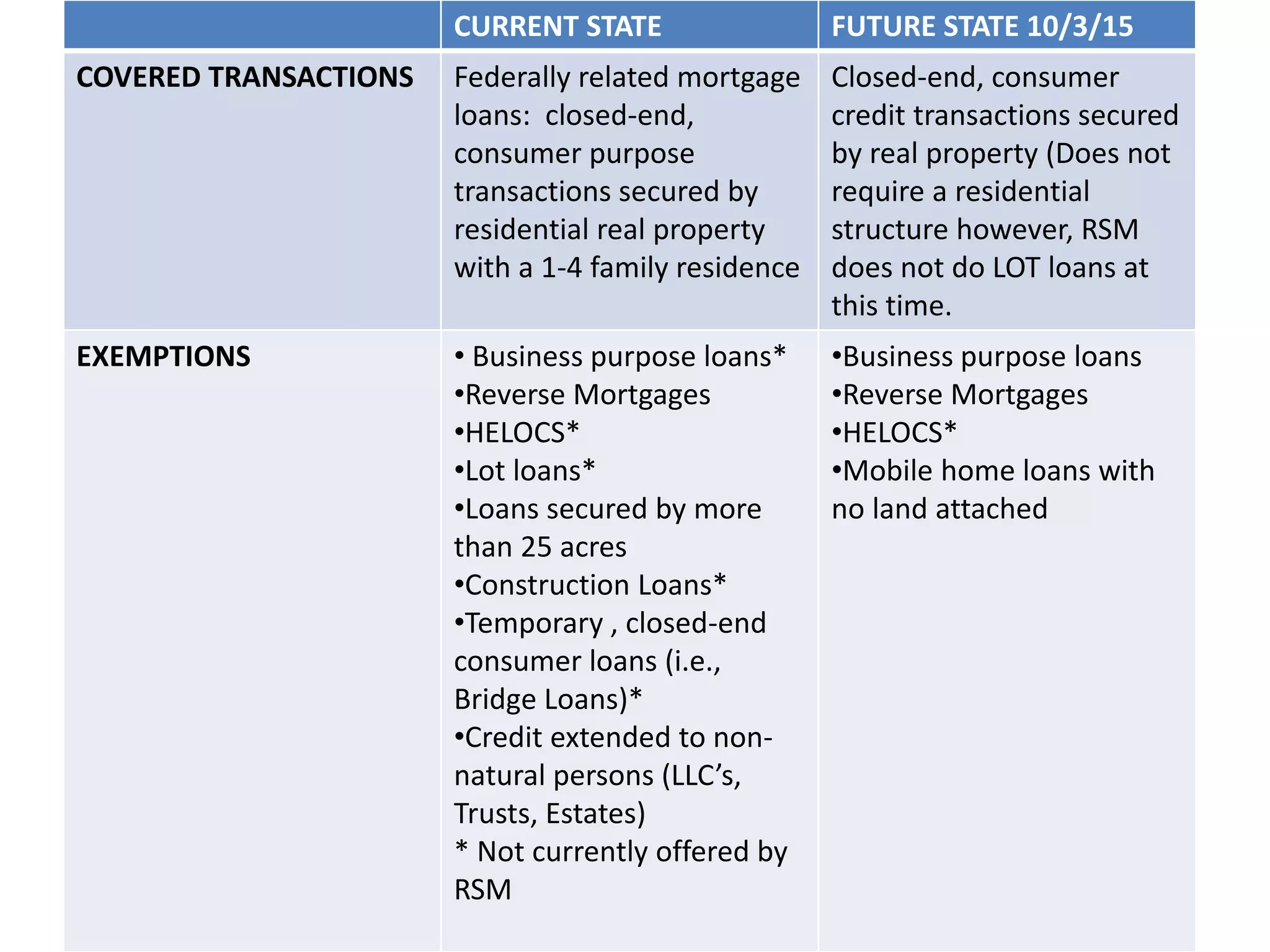

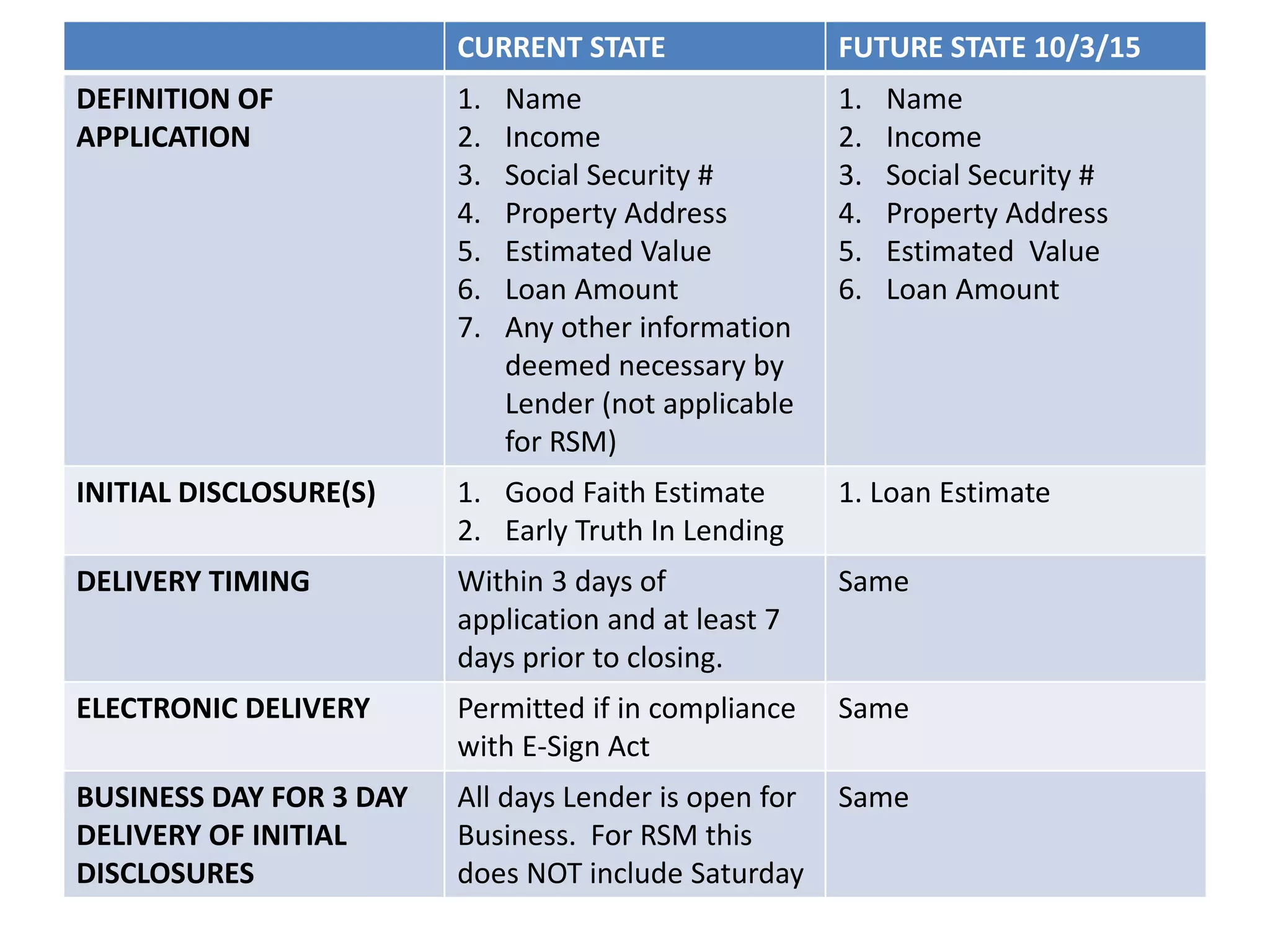

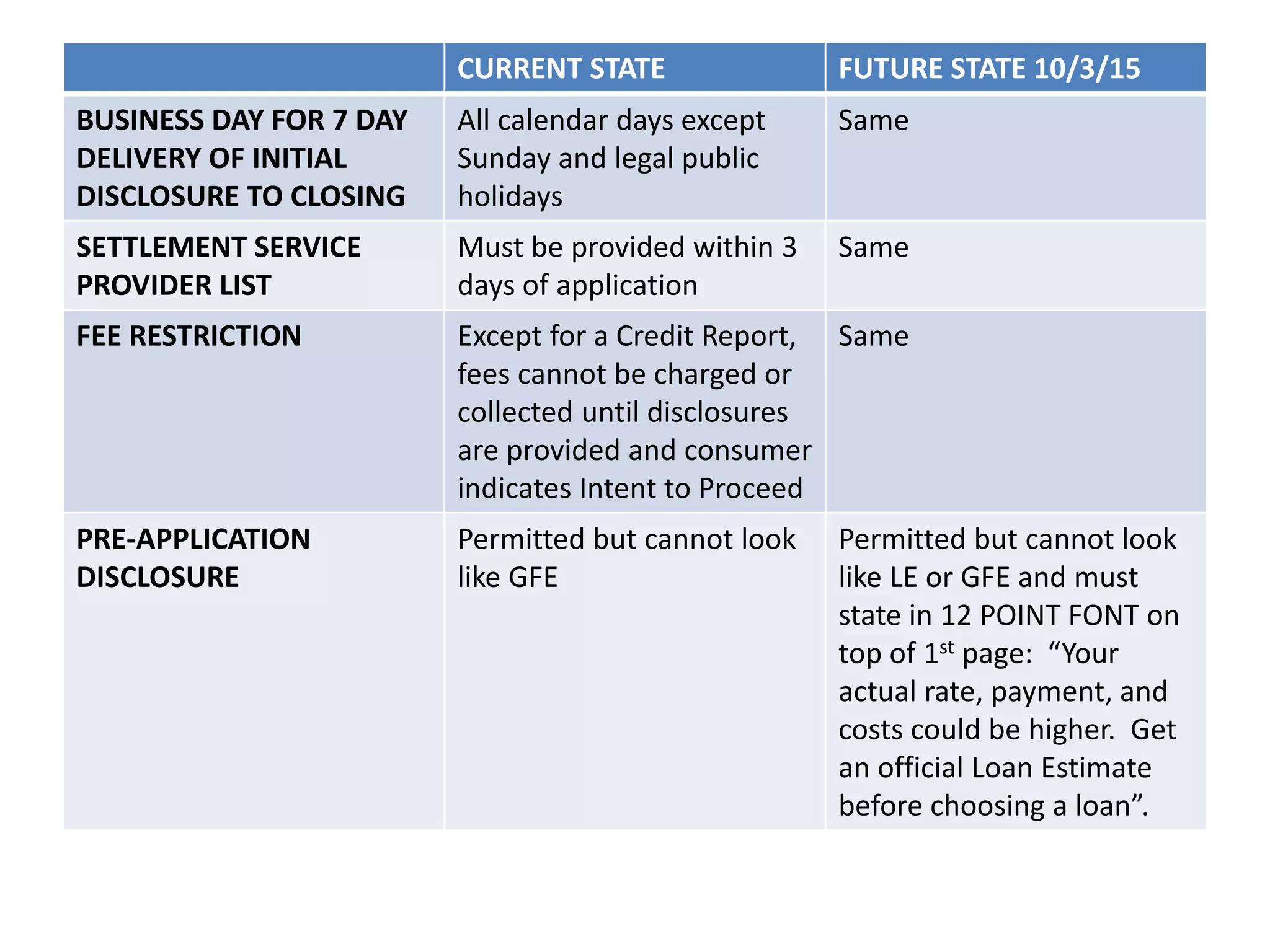

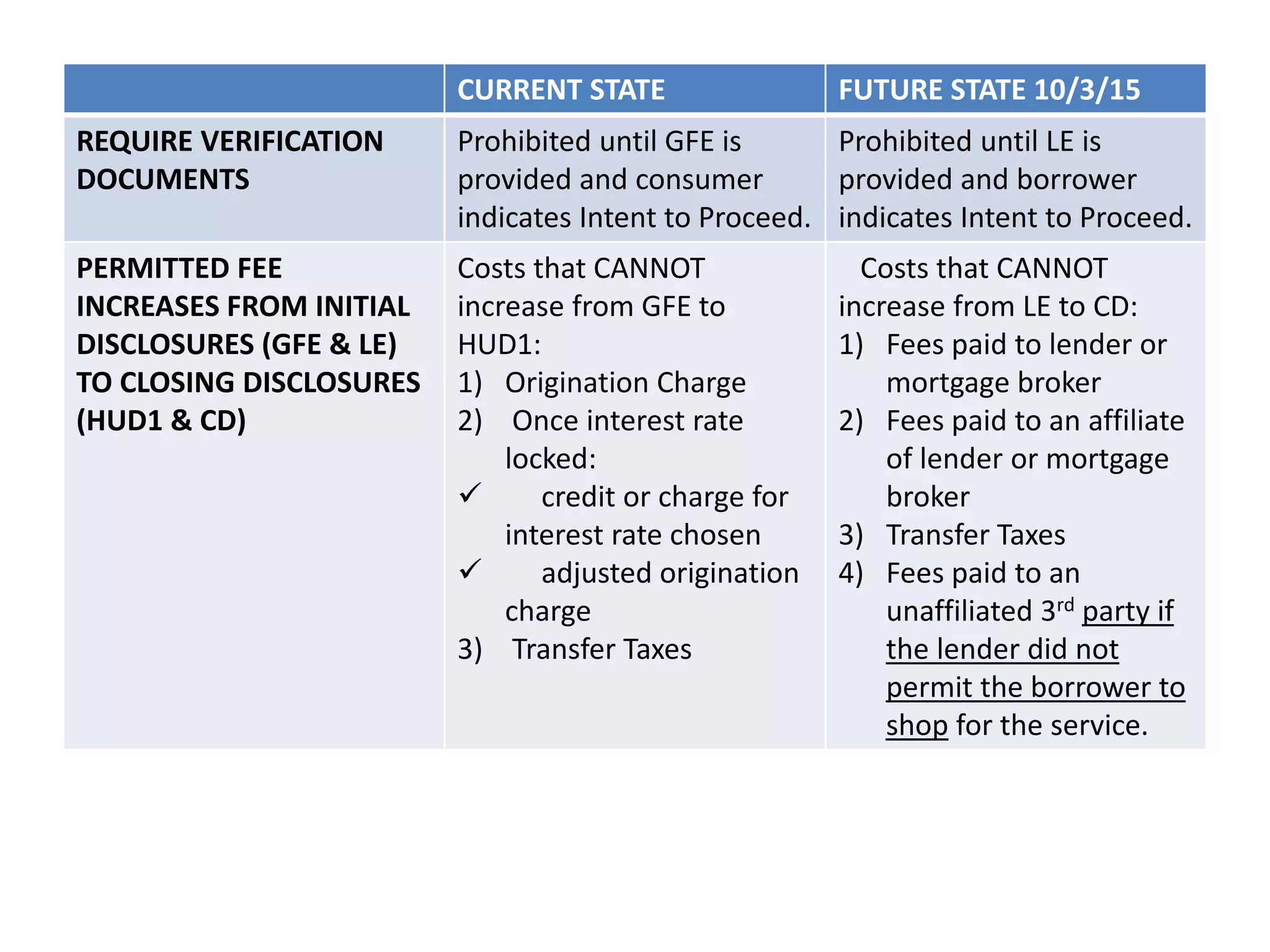

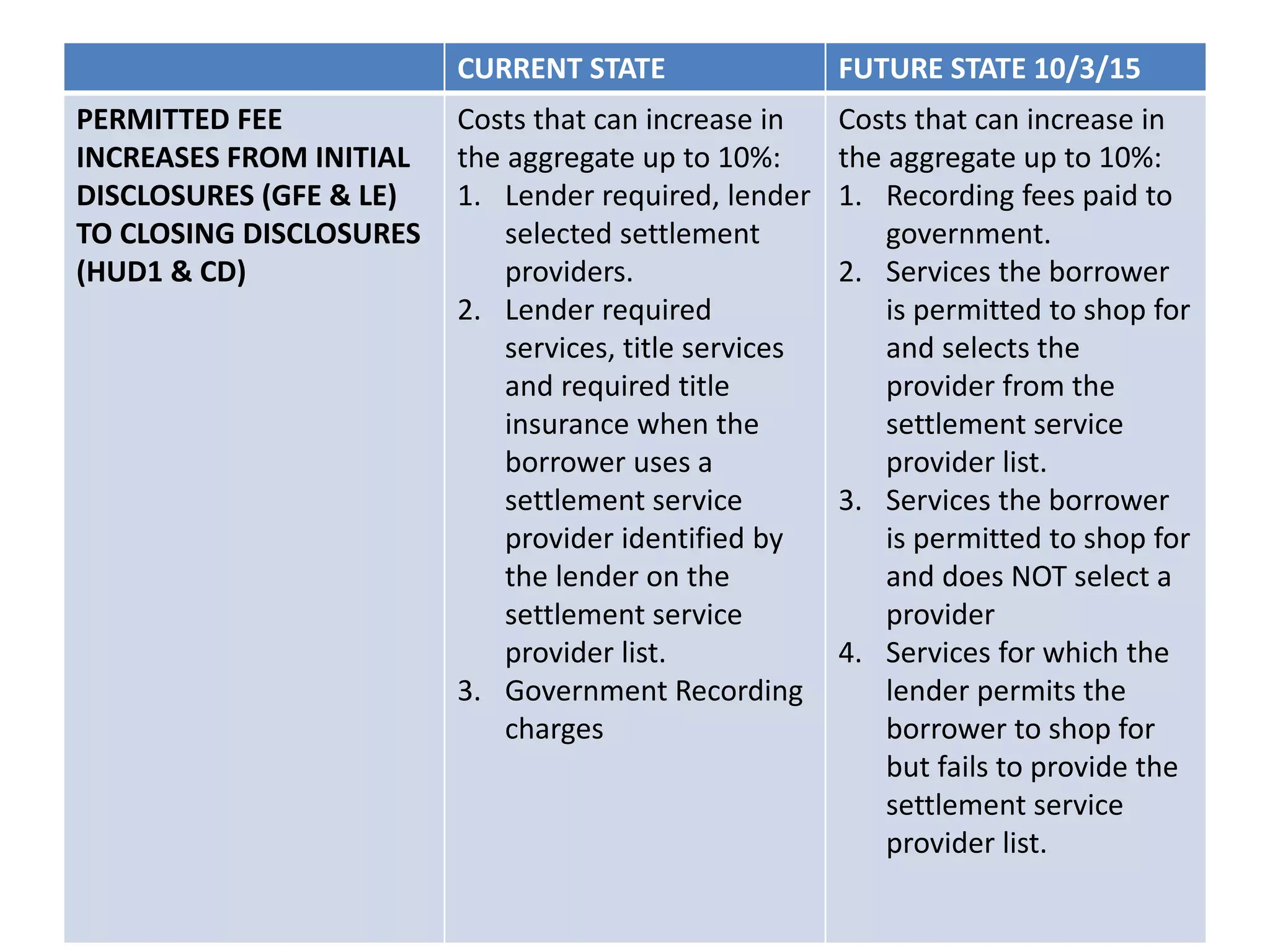

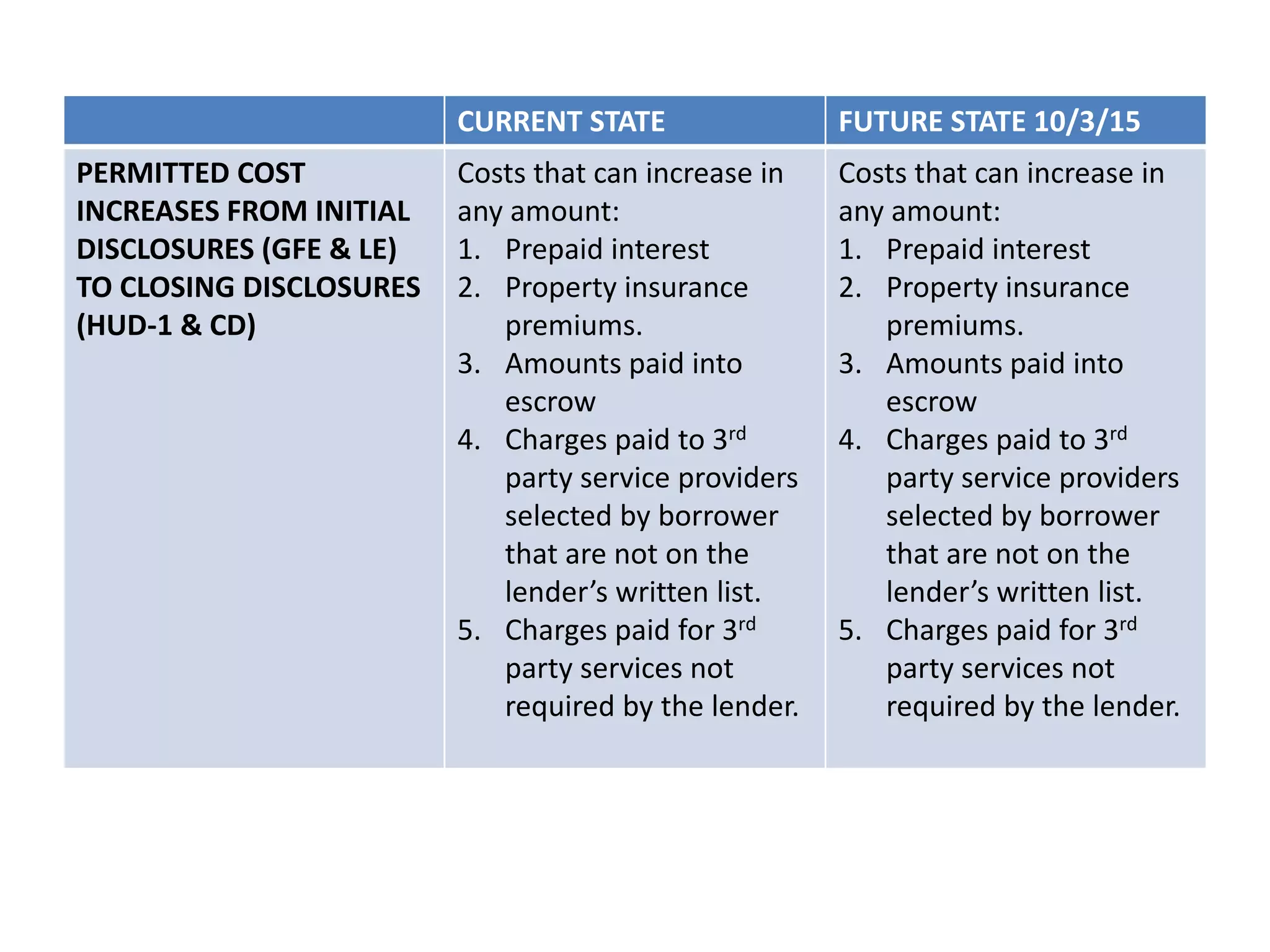

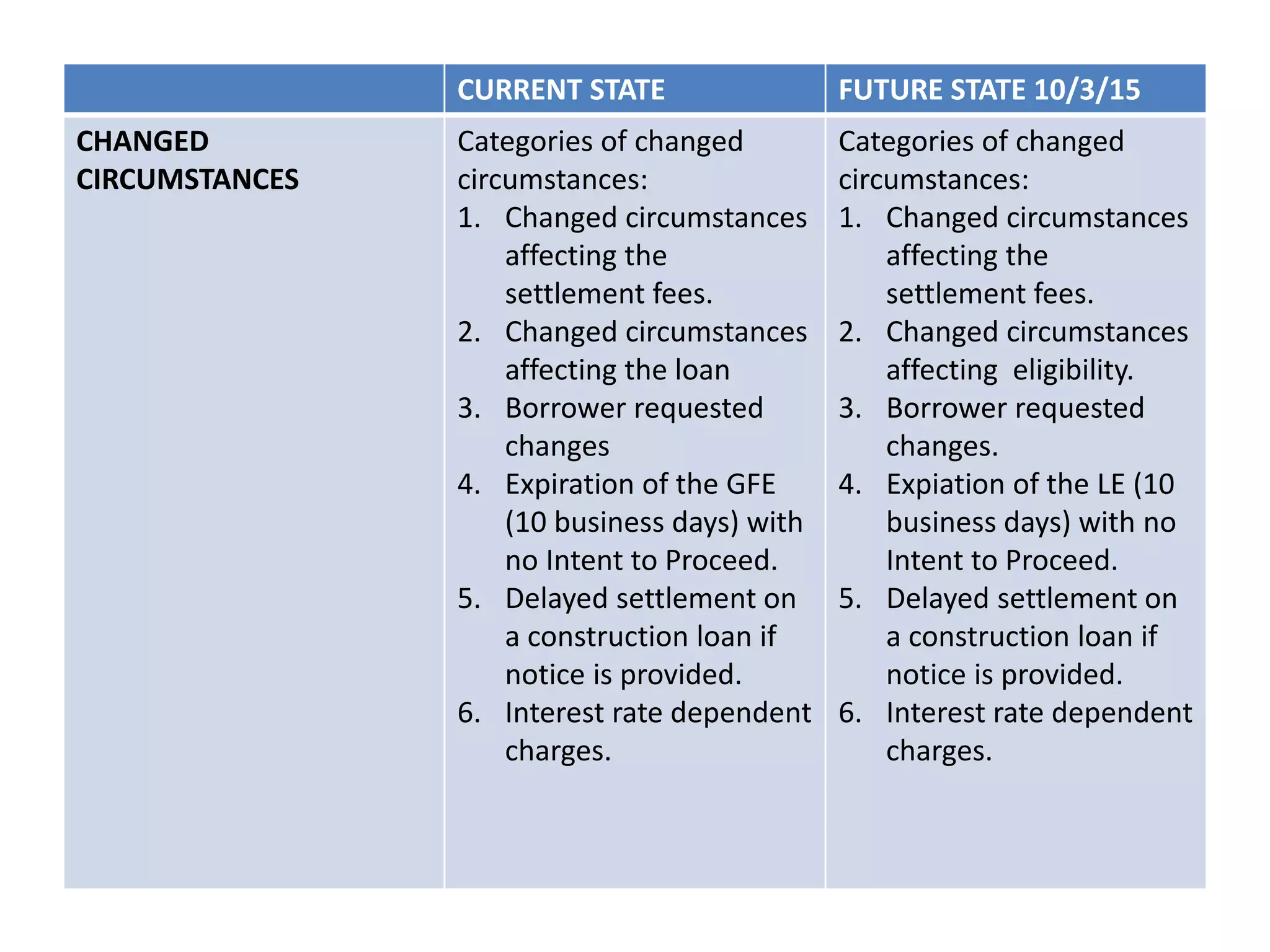

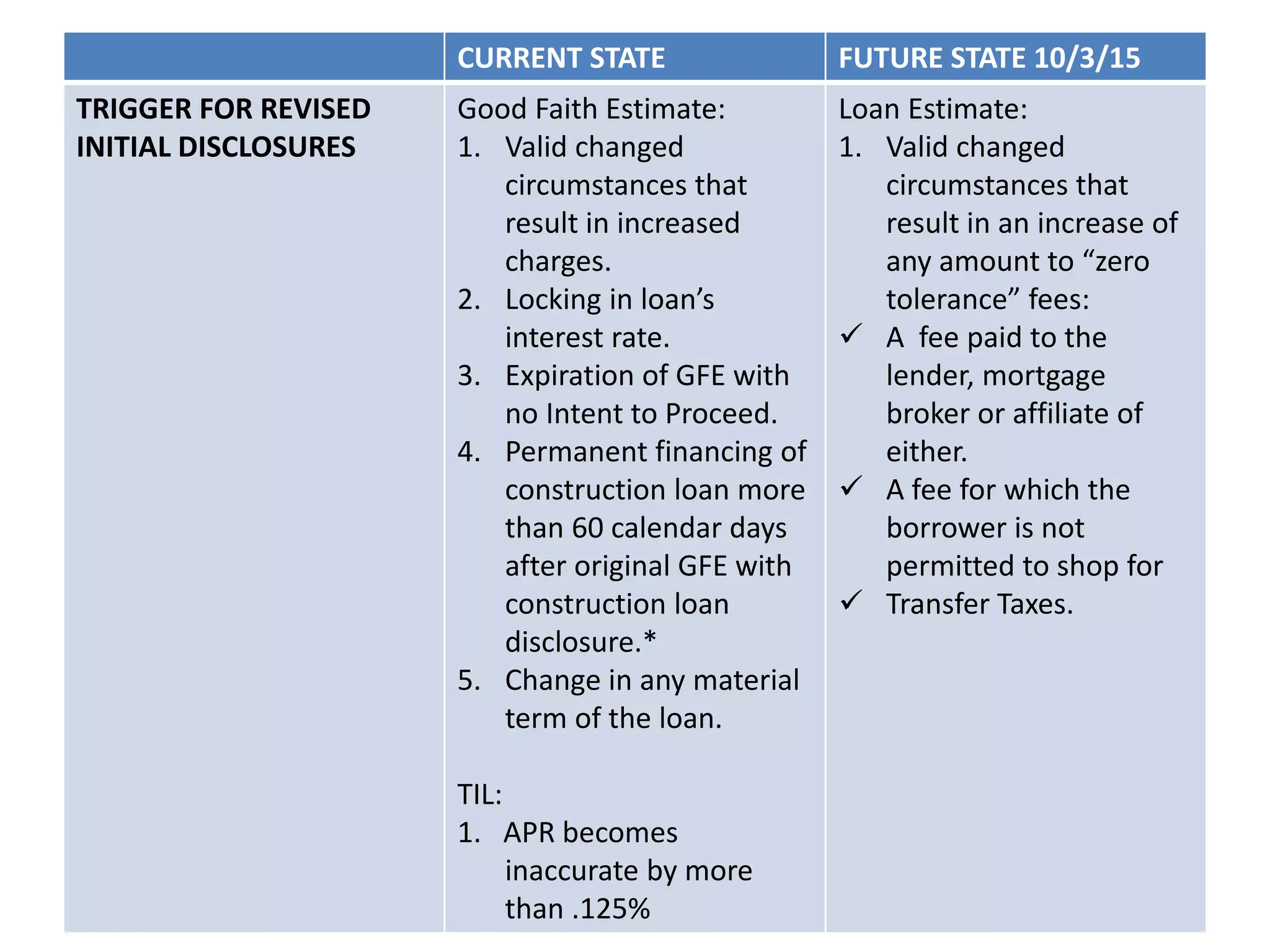

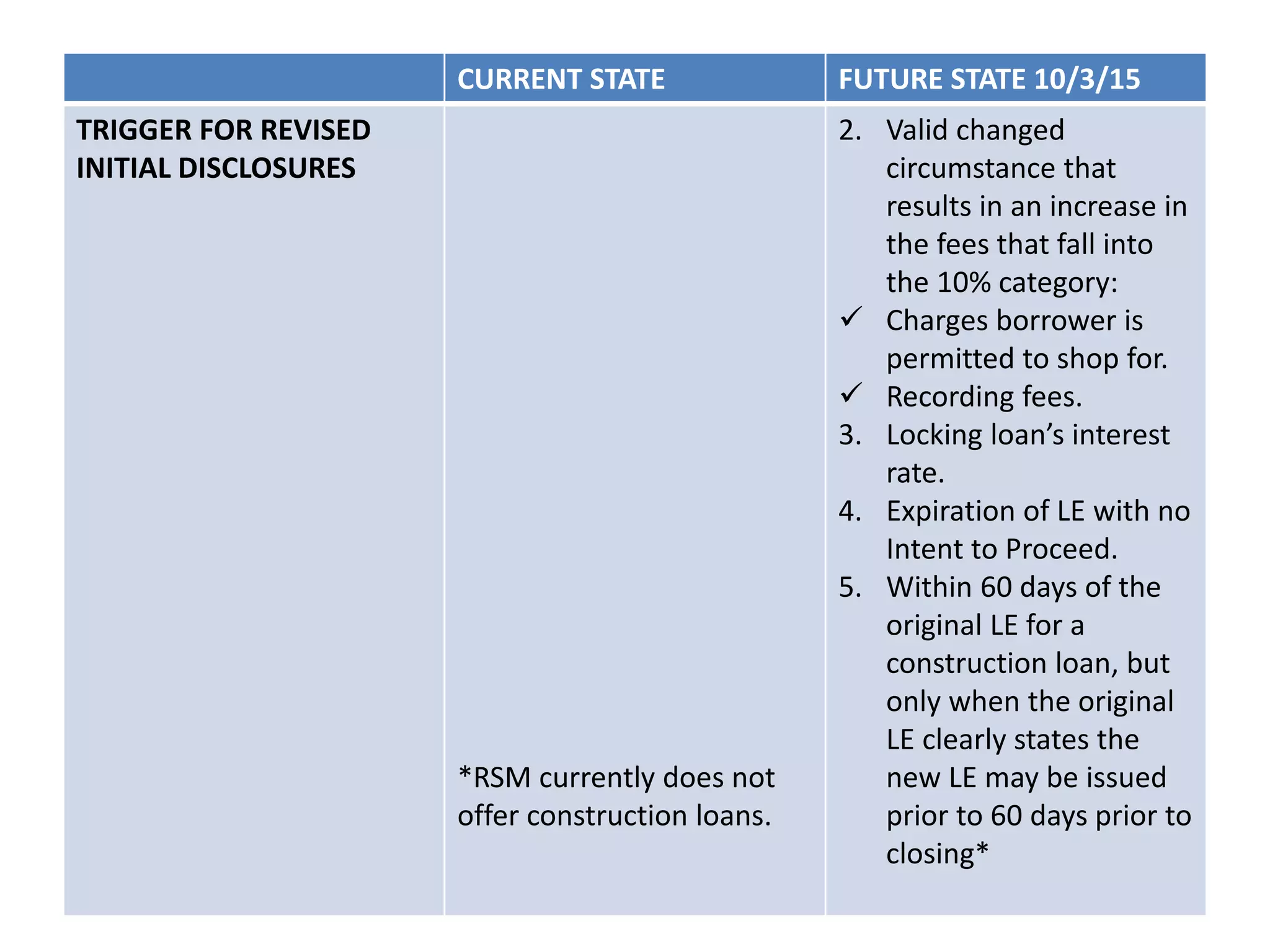

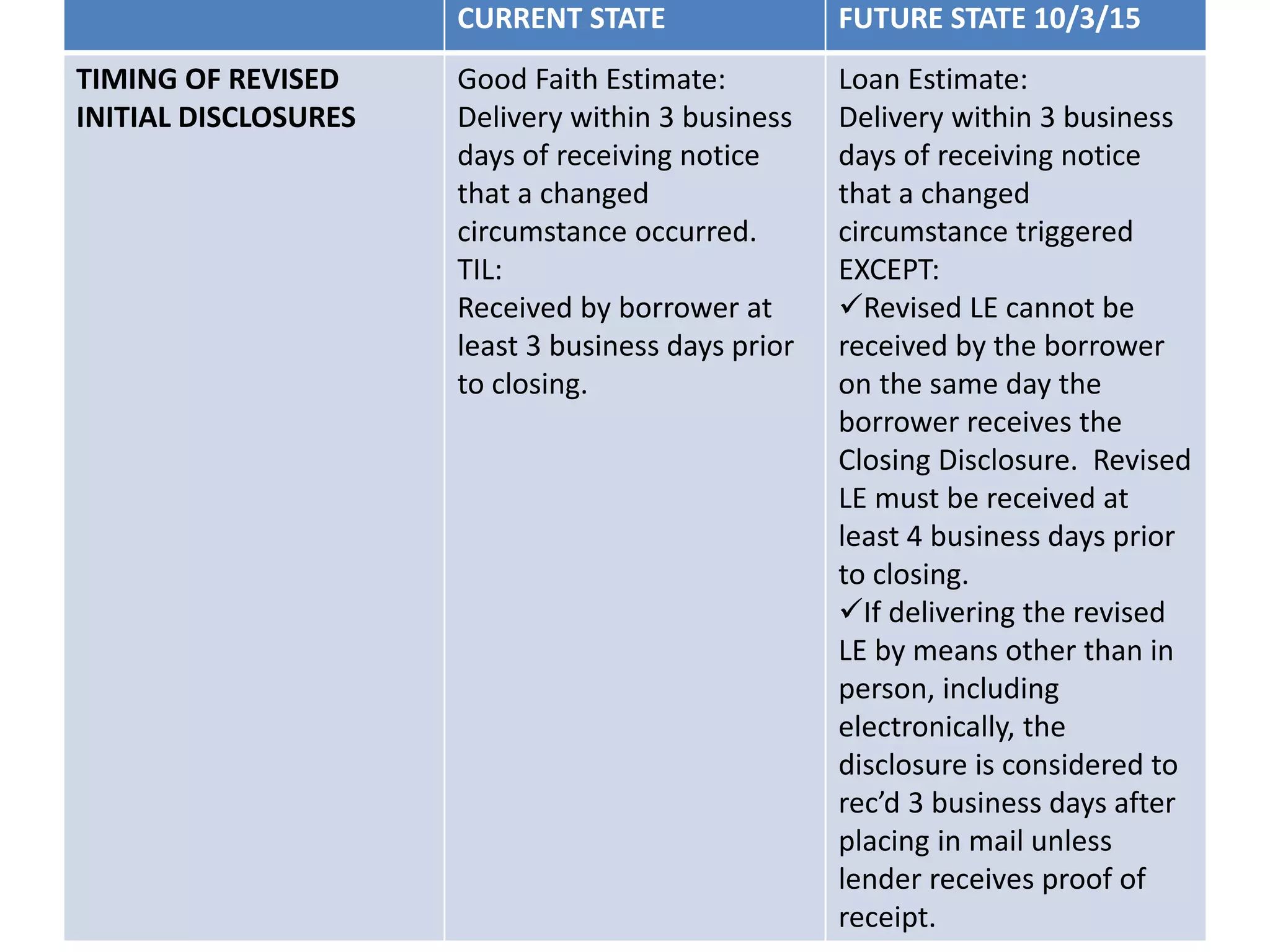

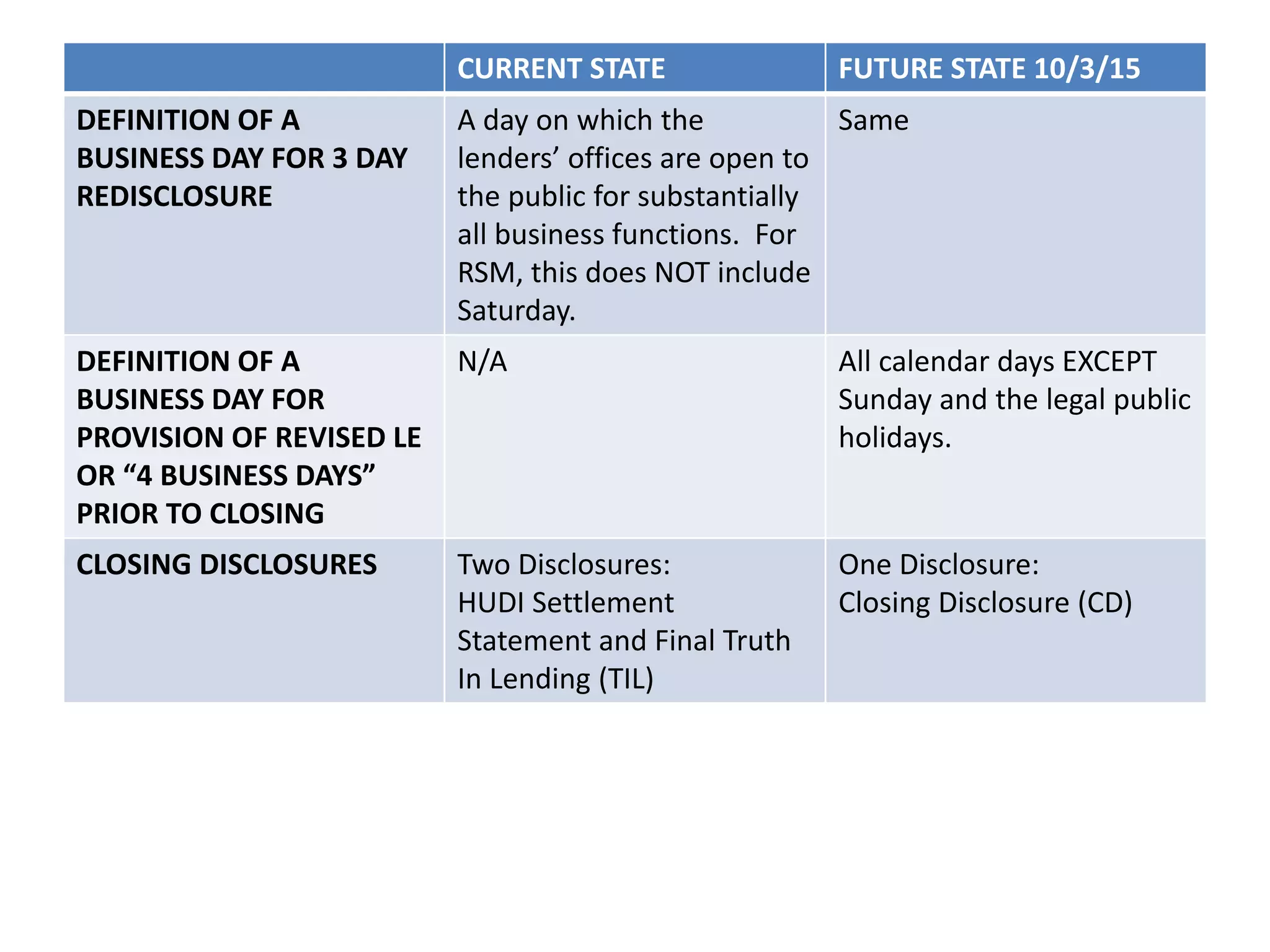

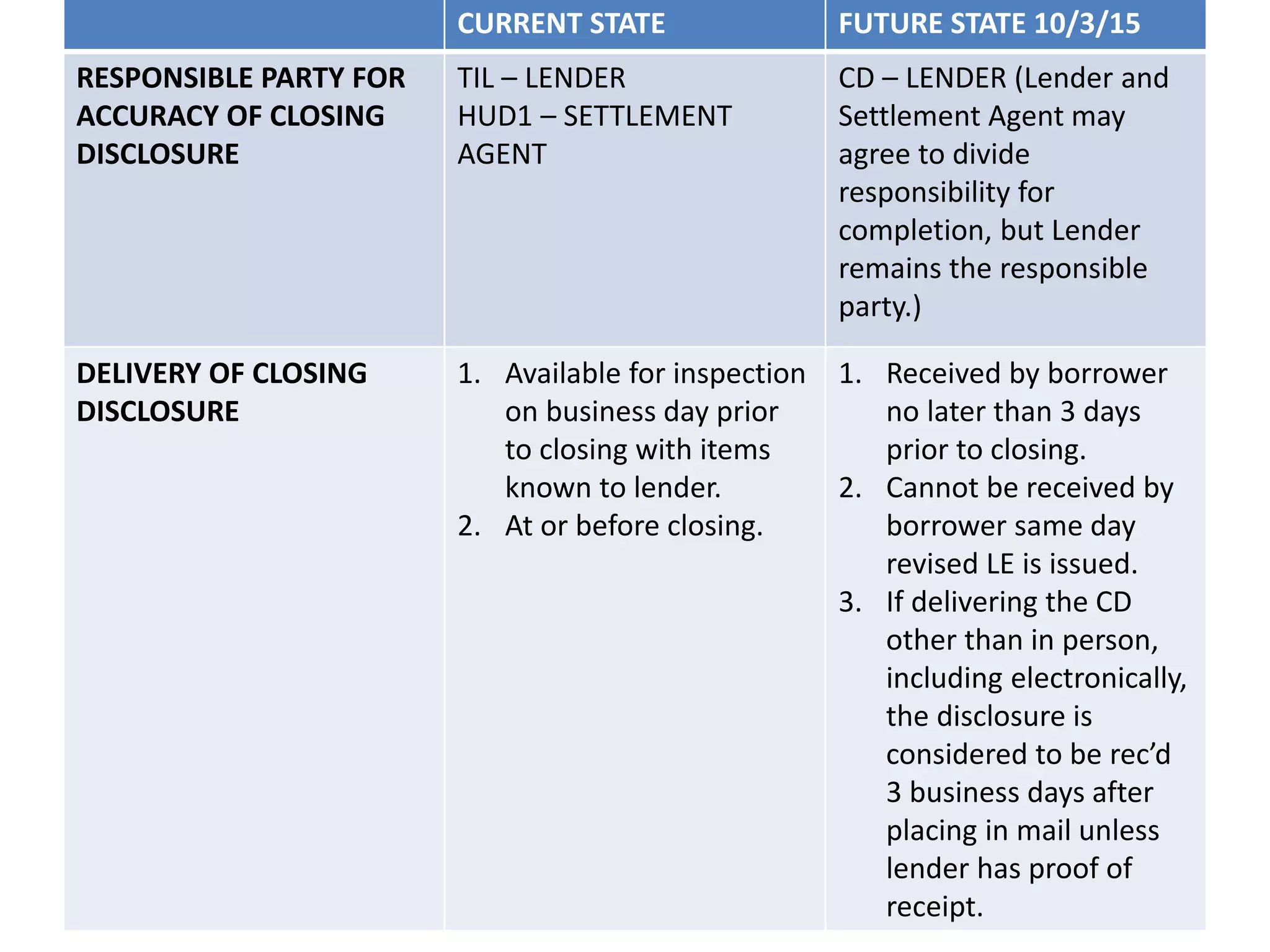

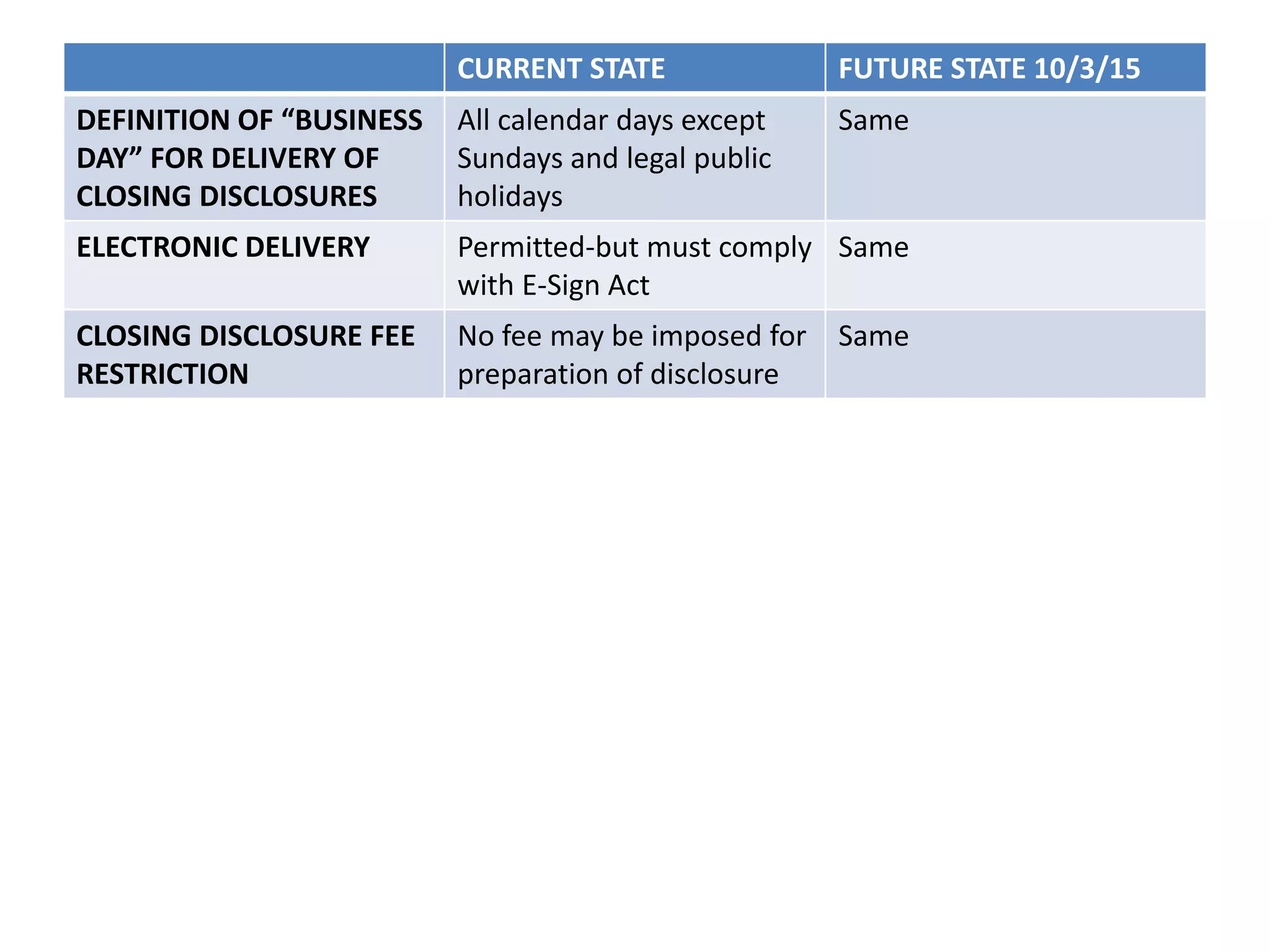

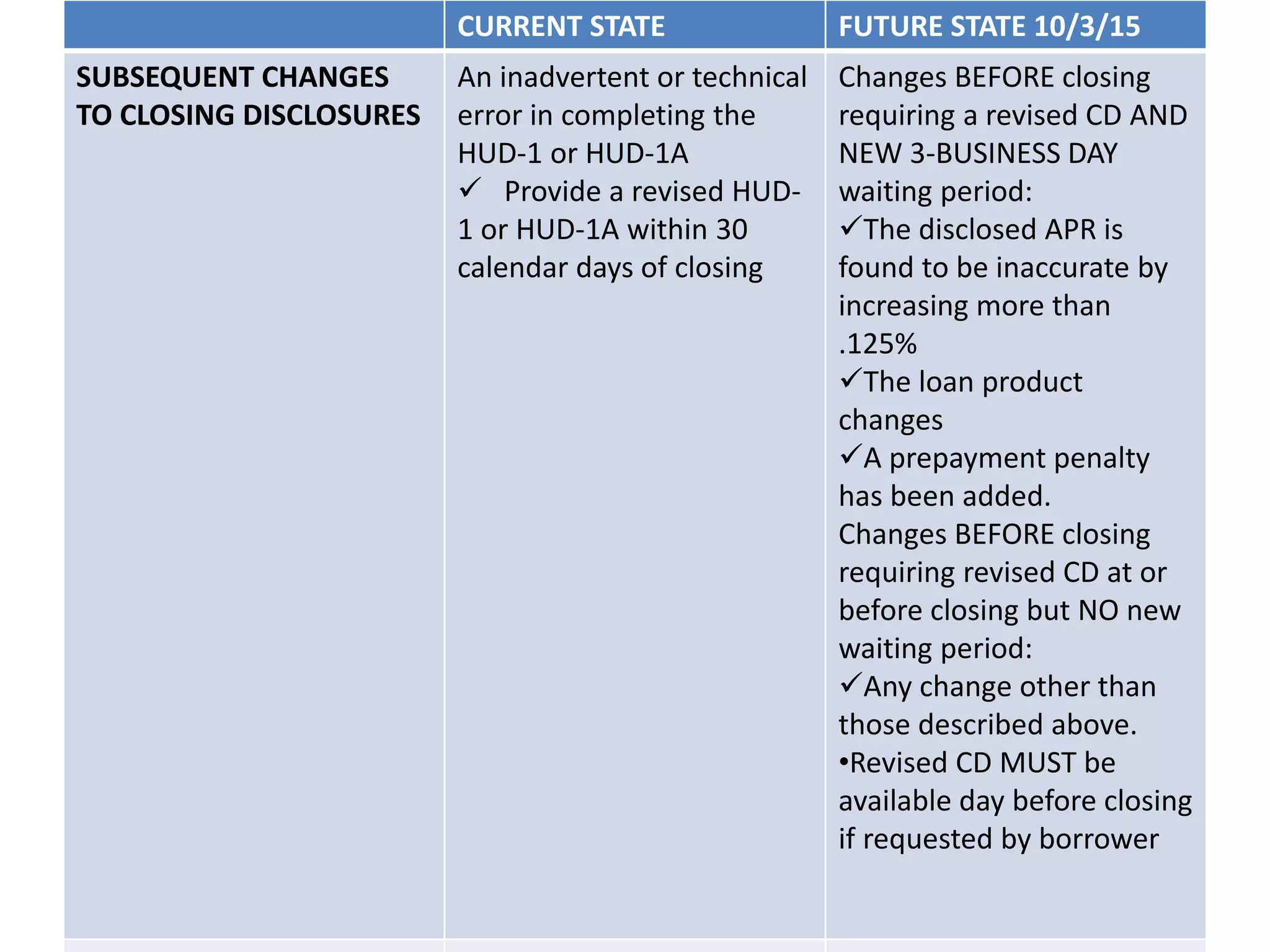

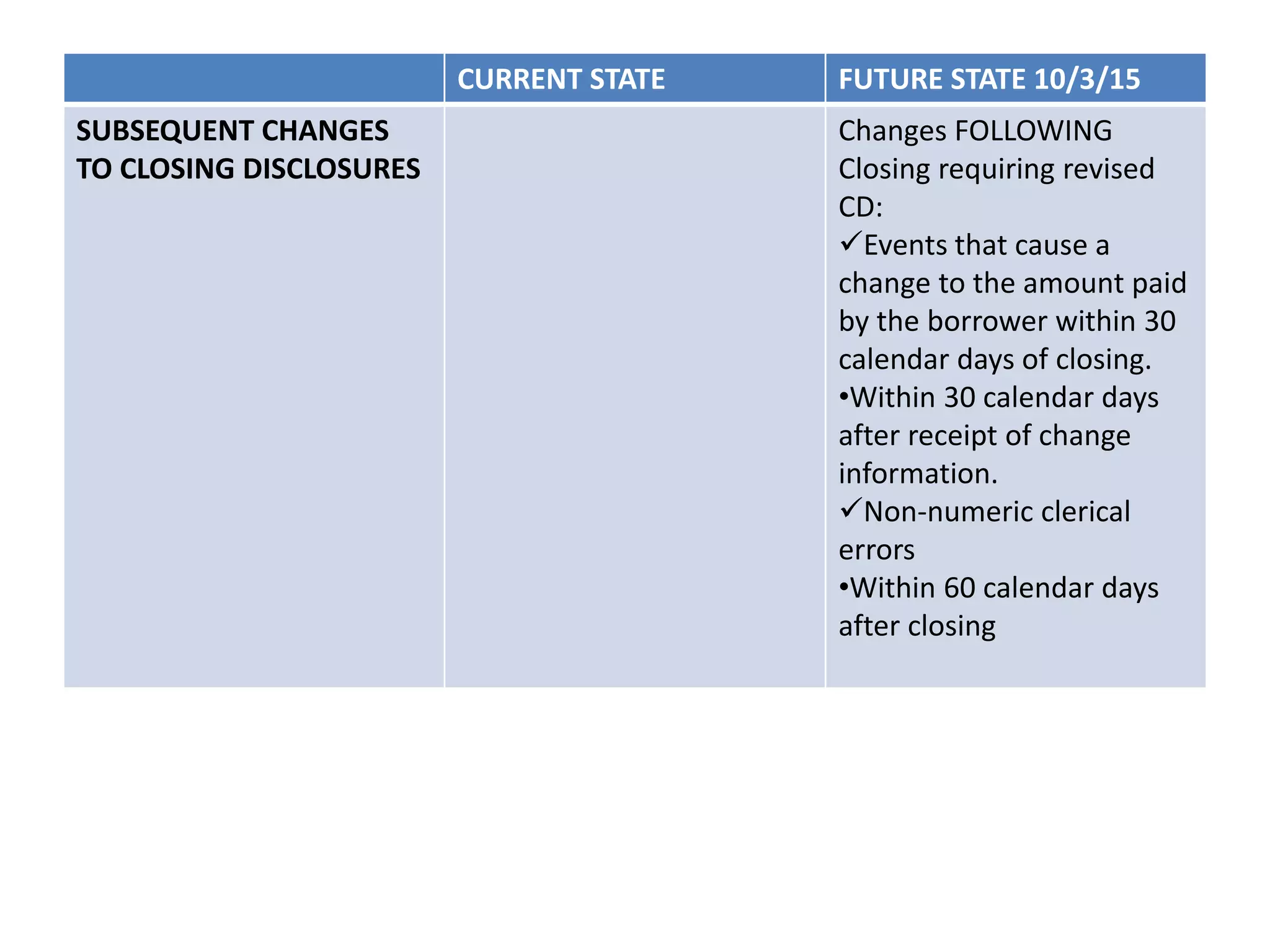

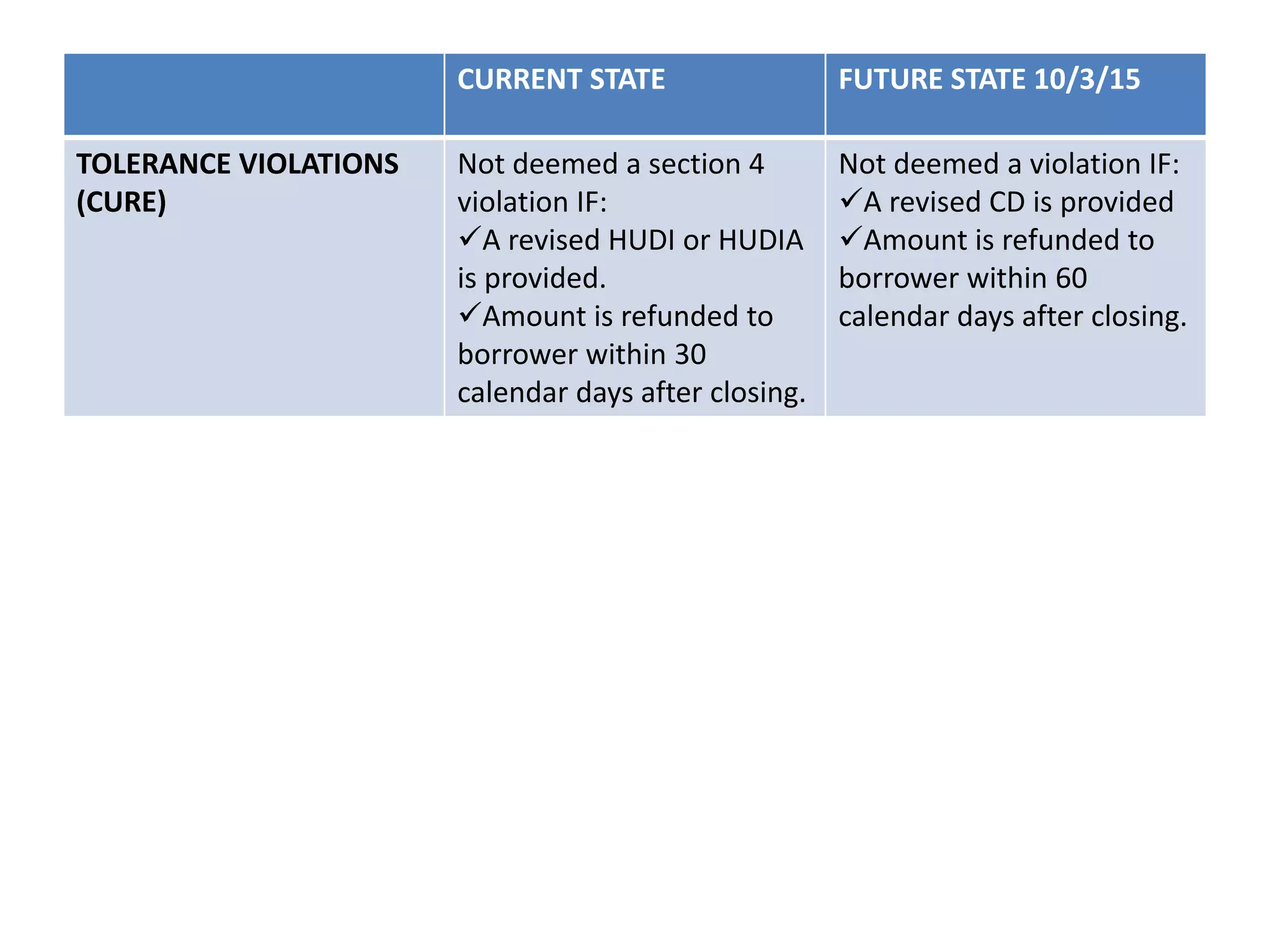

The document compares the current and future state of regulations regarding mortgage loan disclosures and closing processes. Some key changes in the future state include expanding the scope of covered transactions, requiring a single Closing Disclosure form to replace the HUD-1 and TILA forms, more restrictions on fee increases at closing, additional triggers requiring revised initial disclosures, and changes to timing requirements for delivery of disclosures to the borrower. The future state aims to increase consumer protections and align regulations with the new TILA-RESPA integrated disclosures.