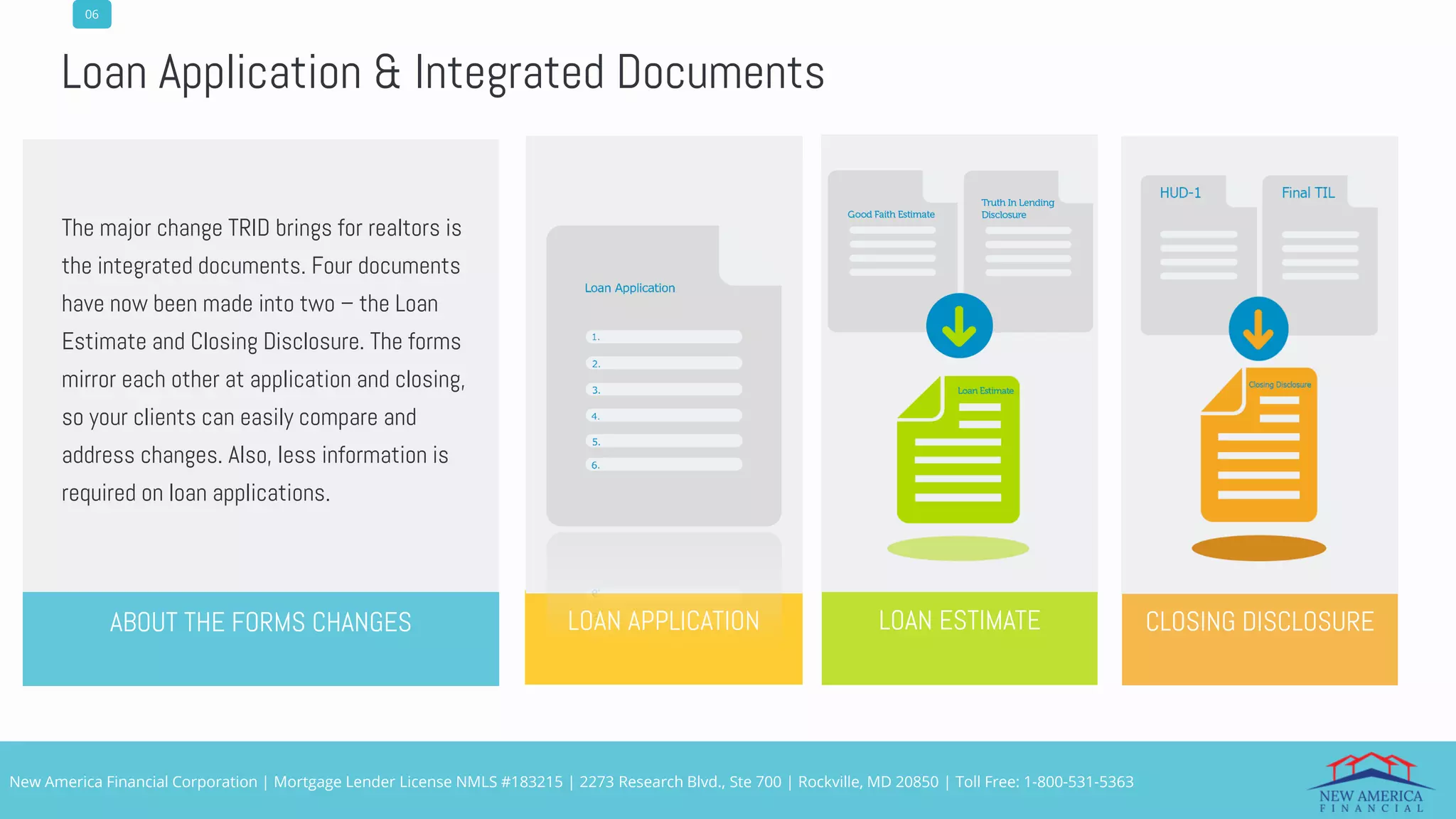

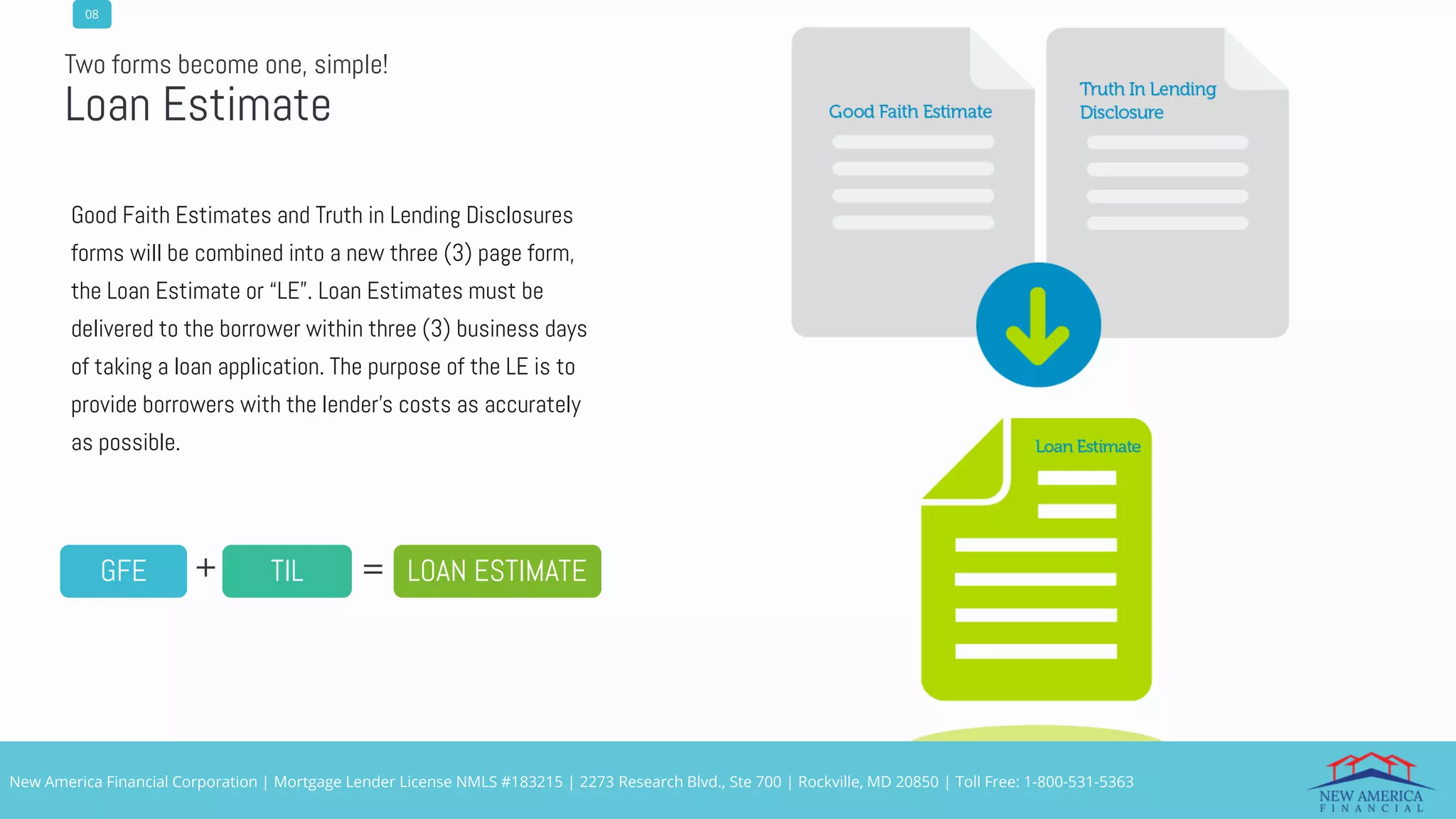

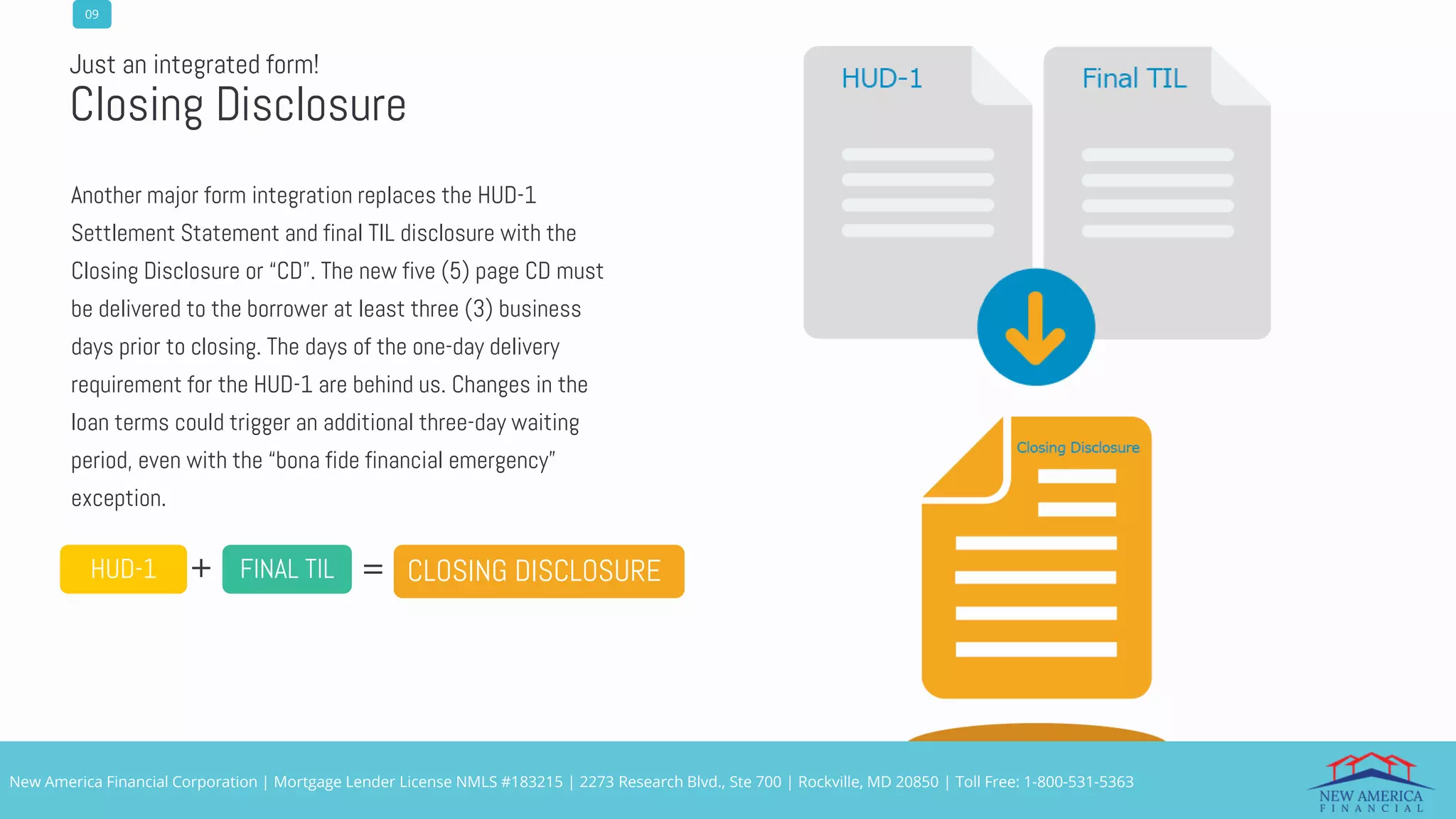

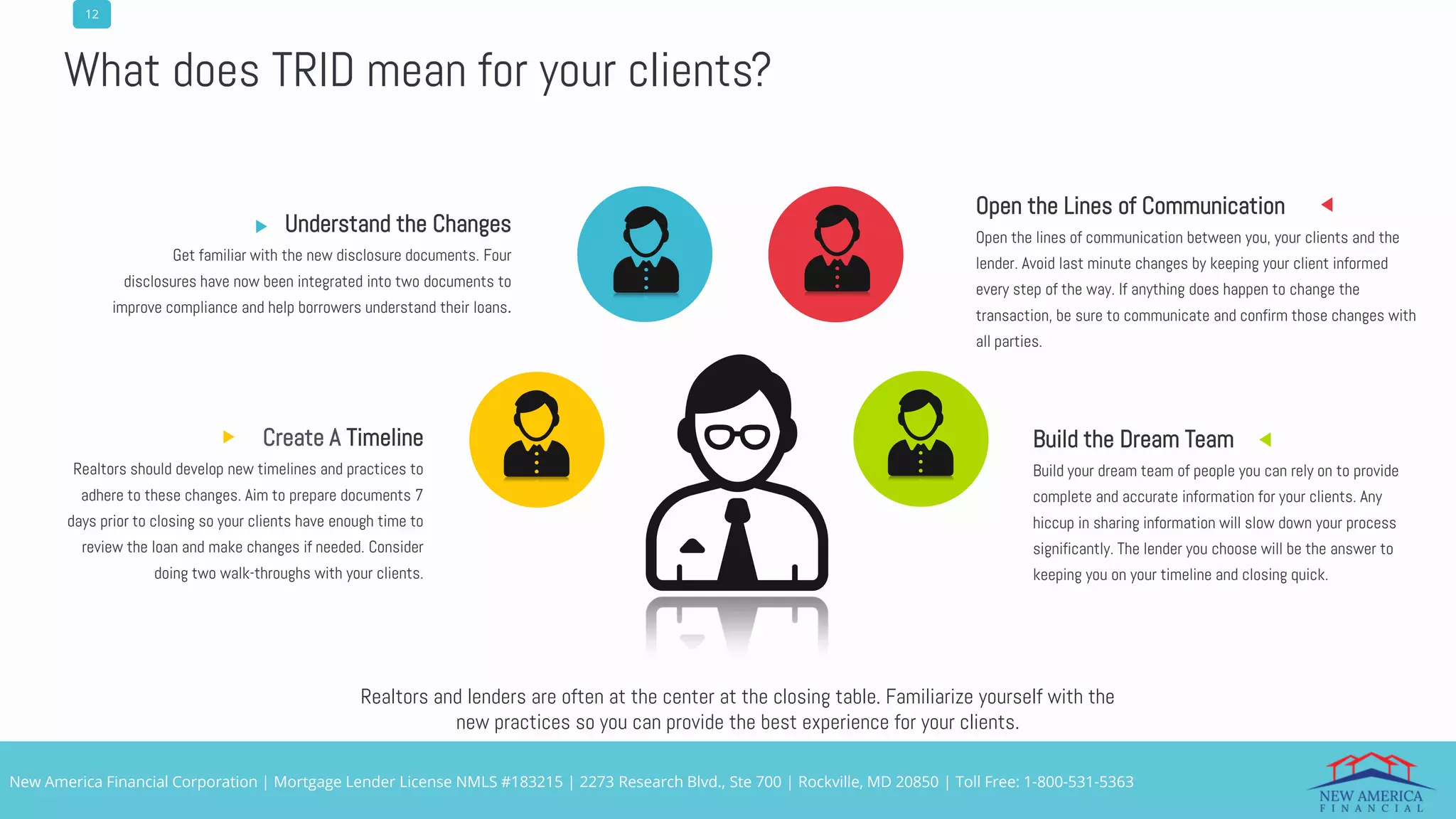

TRID is a new regulation that combines mortgage disclosures to improve compliance and help borrowers understand loan terms. It impacts realtors, lenders, and clients. Key changes include integrating Good Faith Estimates, Truth-in-Lending disclosures and HUD-1 Settlement Statements into new Loan Estimate and Closing Disclosure forms. Lenders must provide these documents within specific timelines, including delivering the Closing Disclosure 3 business days before closing. Realtors must familiarize themselves with the new requirements and ensure timely communication between all parties to avoid delays.