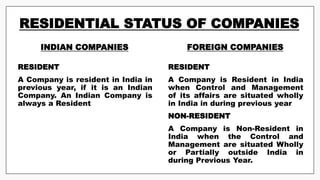

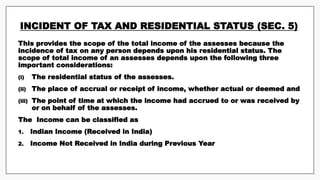

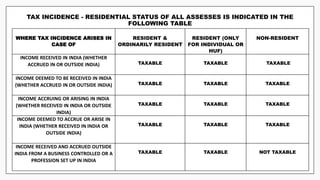

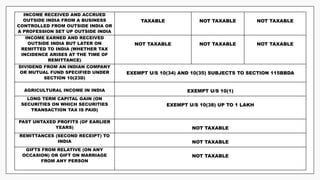

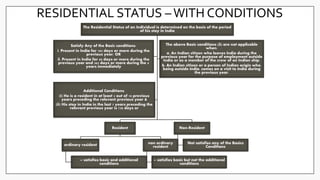

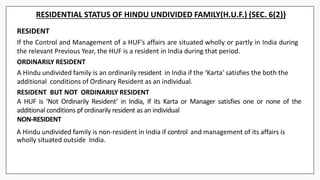

The document discusses the residential status of various persons under the Income Tax Act, including individuals, HUFs, companies, firms, AOPs and other entities. It explains the basic and additional conditions to determine whether a person is a resident, ordinarily resident or non-resident. It also summarizes the tax incidence on different types of incomes based on the residential status and source of income. Key points include that an individual is considered resident if present in India for 182 days or more, or 60 days and 182 days in last 4 years. For HUFs and firms, control and management needs to be wholly/partly in India. Companies are resident if incorporated in India or controlled from India.

![IMPORTANT CONCEPTS

PERSON [SECTION 2(31)] : Income-tax is charged in respect of the total income of the previous year of every

person. Hence, it is important to know the definition of the word person. As per section 2(31), Person

includes : Individual : An individual is a natural human being i.e. male, female, minor or a person of sound

or unsound mind, Hindu Undivided Family (HUF), Company, AOP & BOI Firm & LLP, Local Authority Every

other Artificial and Judicial Person & partnership firm.](https://image.slidesharecdn.com/residentialstatus-201203064257/85/Residential-status-2-320.jpg)

![RESIDENTIAL STATUS OF FIRM, ASSOCIATION OF PERSONS [SEC.6(2)] AND

EVERY OTHER PERSON (LOCAL AUTHORITY, ARTIFICIAL JUDICIARY PERSON

LIKE IDOLS ETC.) OTHER THAN A COMPANY [(SEC. 6(4))]

RESIDENT

A Partnership Firm, AOP or Every Other Person is resident in India if the

‘Control and Management of its affairs’ is situated Wholly or Partly in India

during the relevant Previous Year.

NON-RESIDENT

All the Three type of Assesses i.e.., firm, AOP and any other person are non-

resident when the Control and Management of their affairs is situated

outside India. The Control and management of affairs must be ‘Wholly’

outside India to make the assesses ‘Non-Resident’](https://image.slidesharecdn.com/residentialstatus-201203064257/85/Residential-status-5-320.jpg)