Embed presentation

Downloaded 10 times

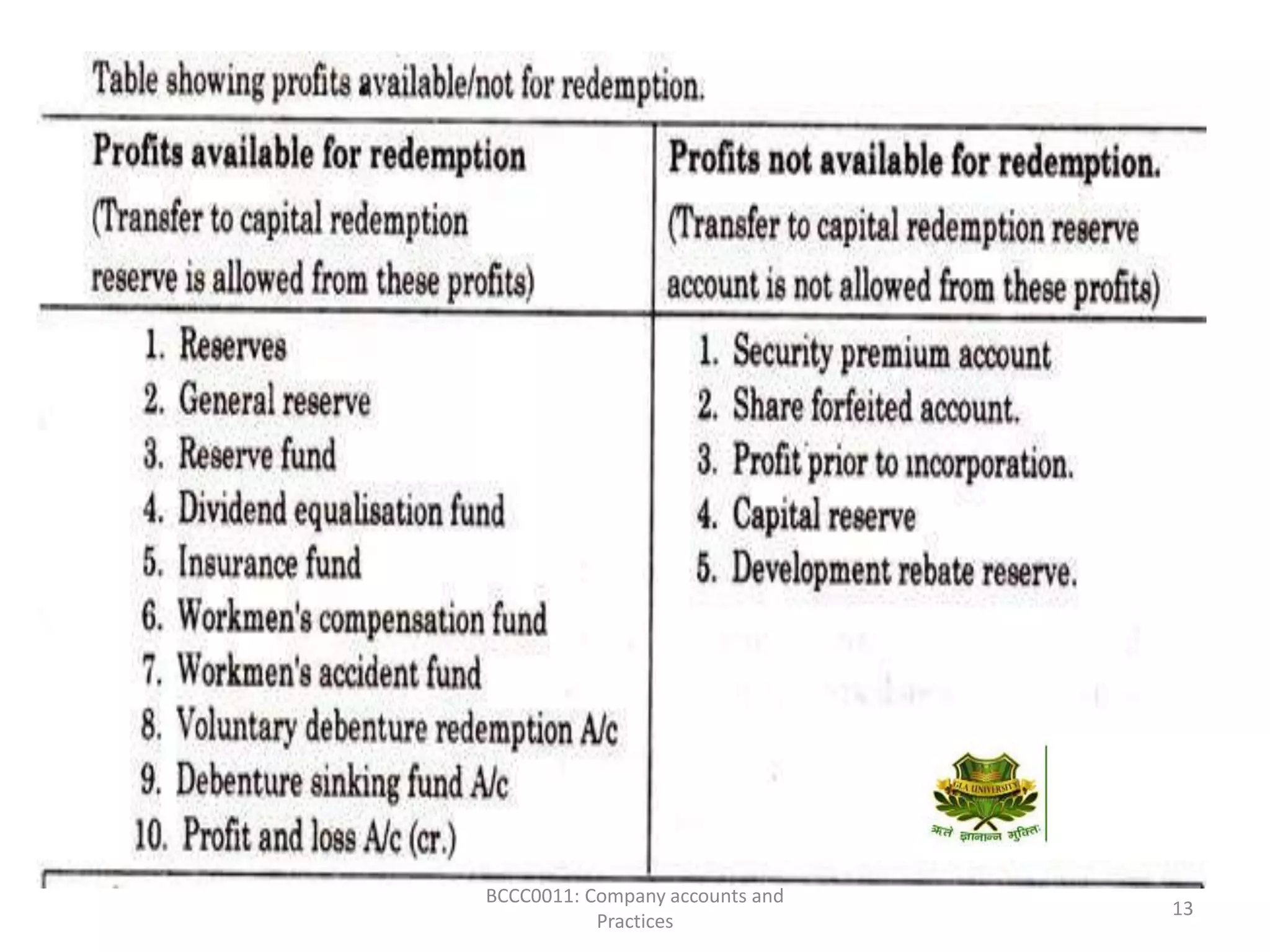

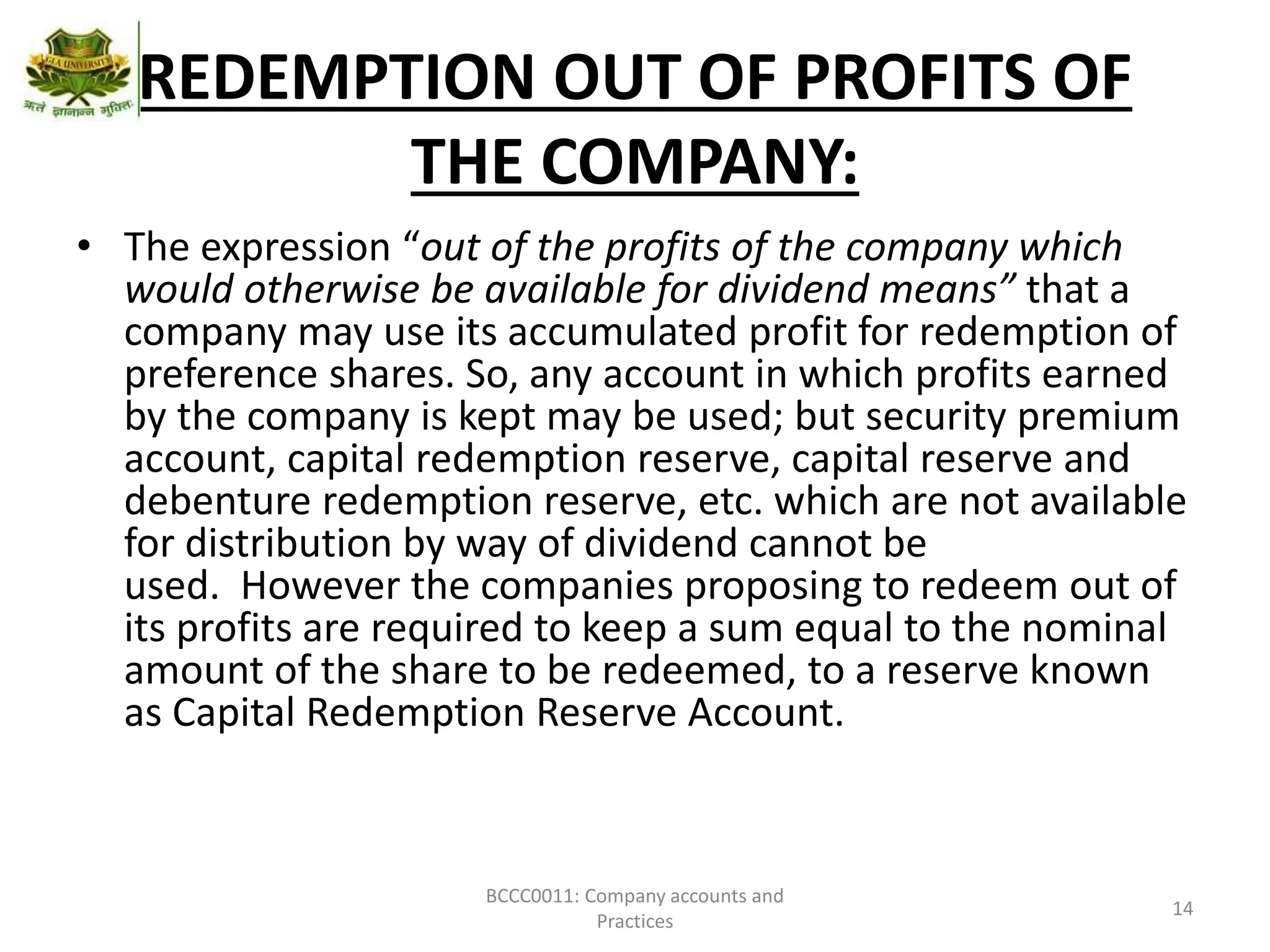

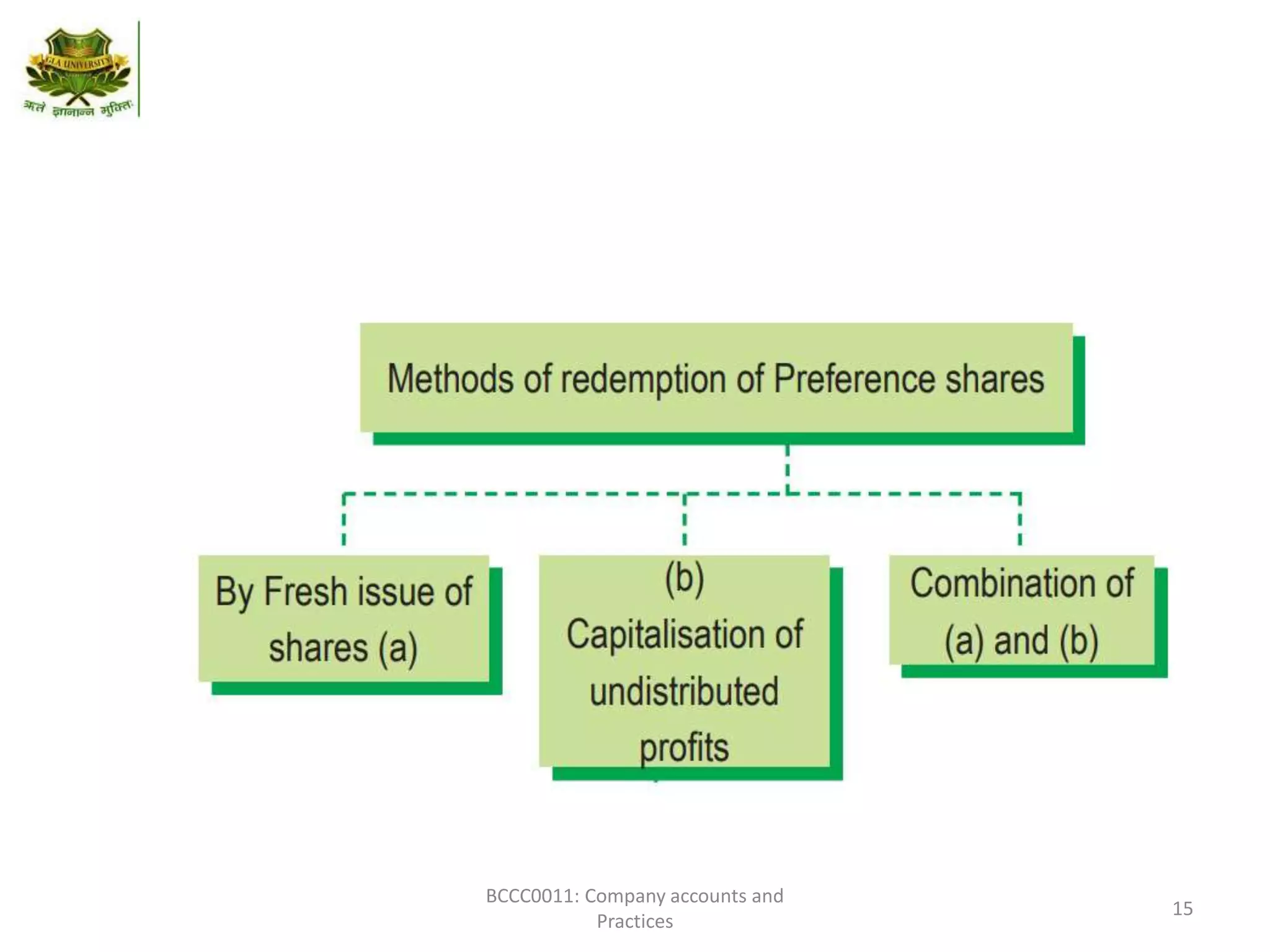

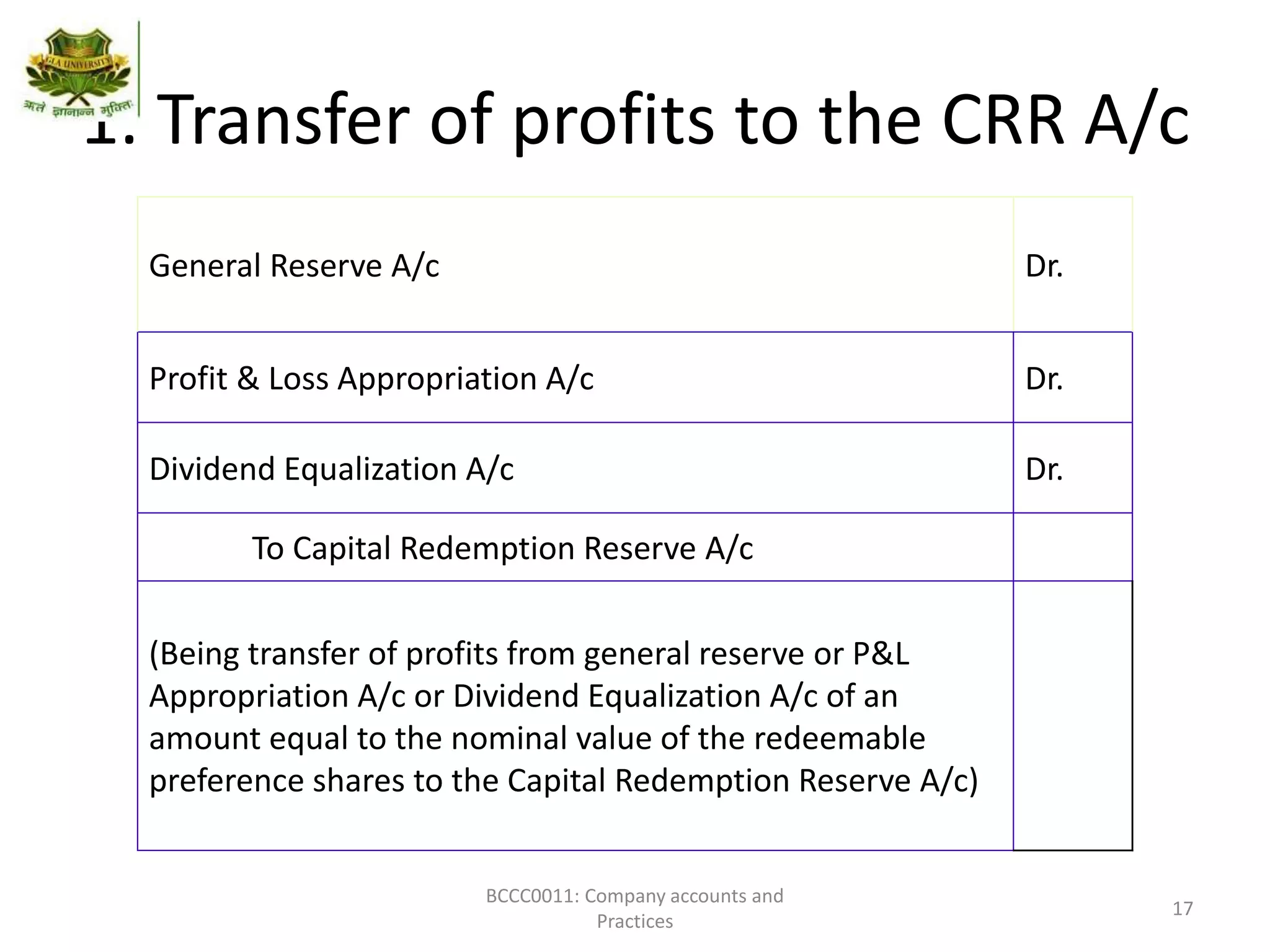

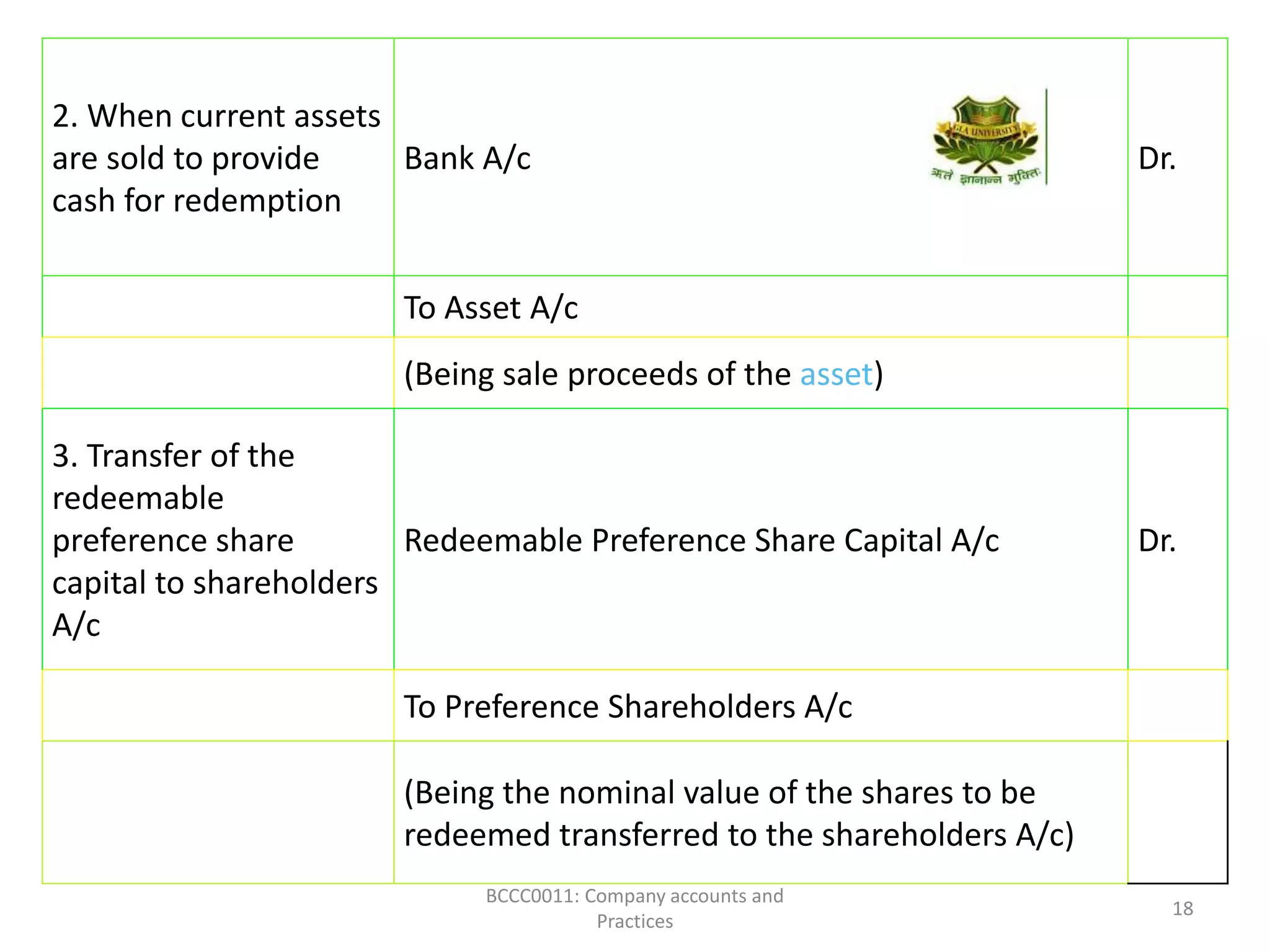

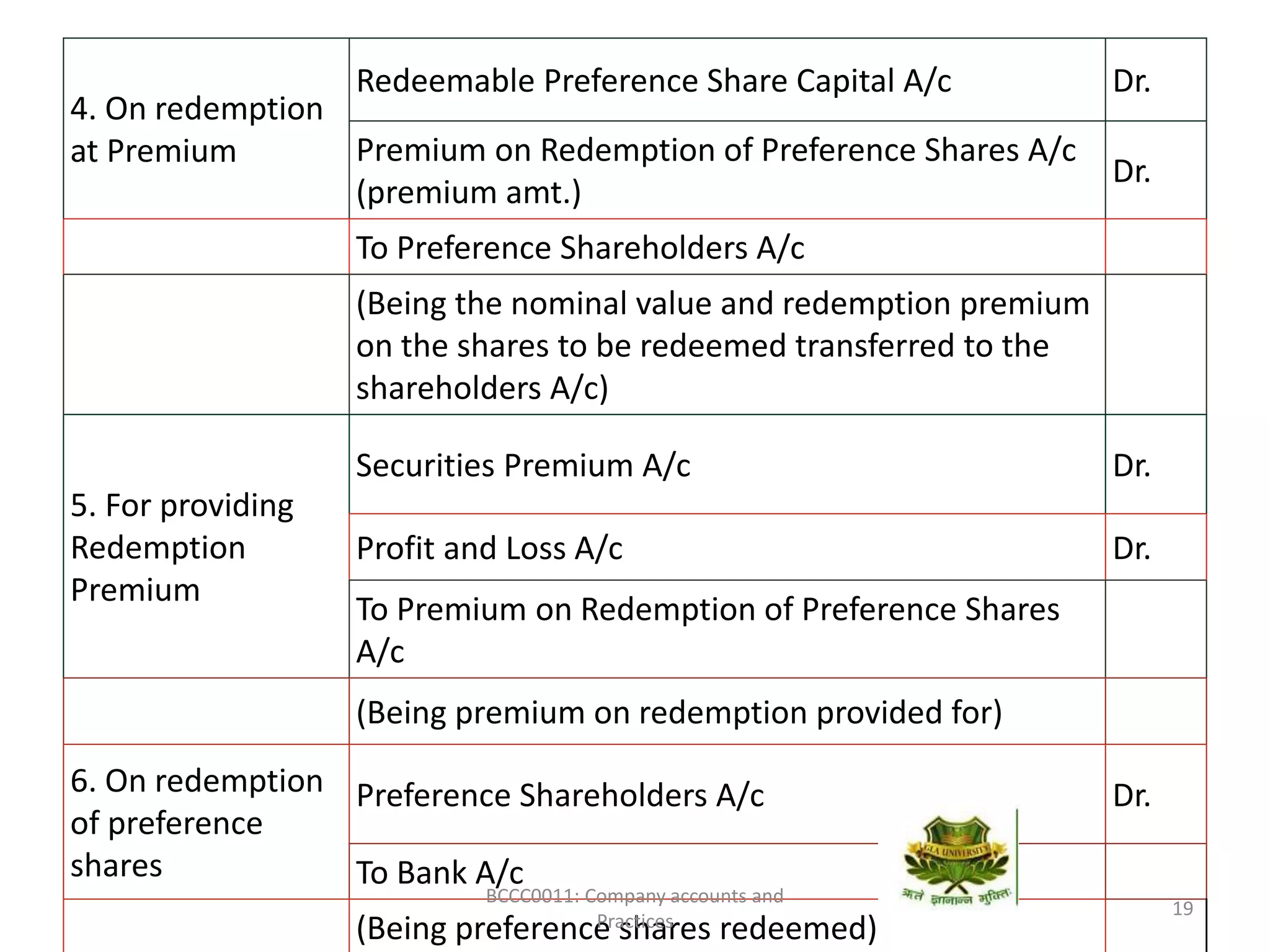

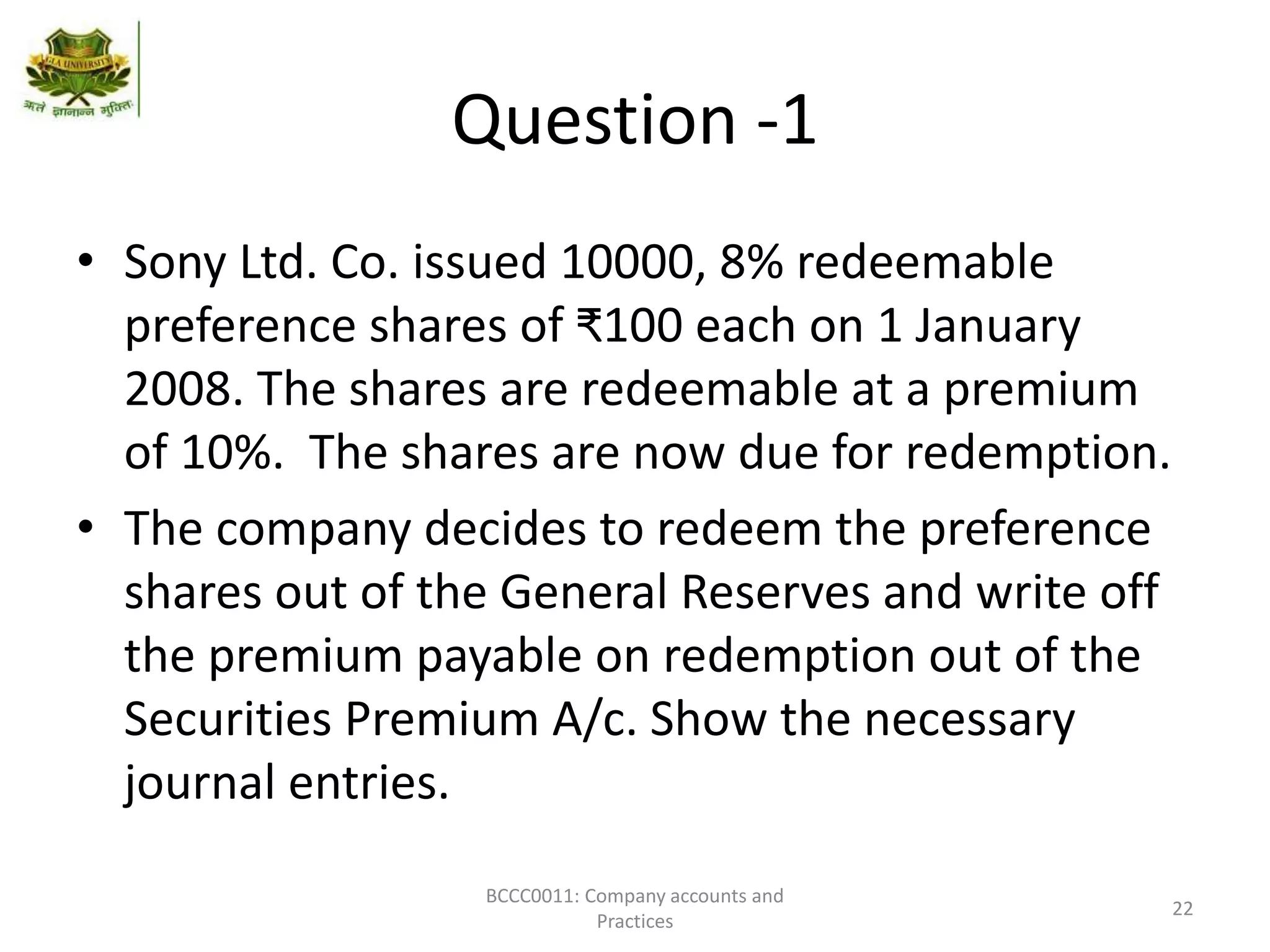

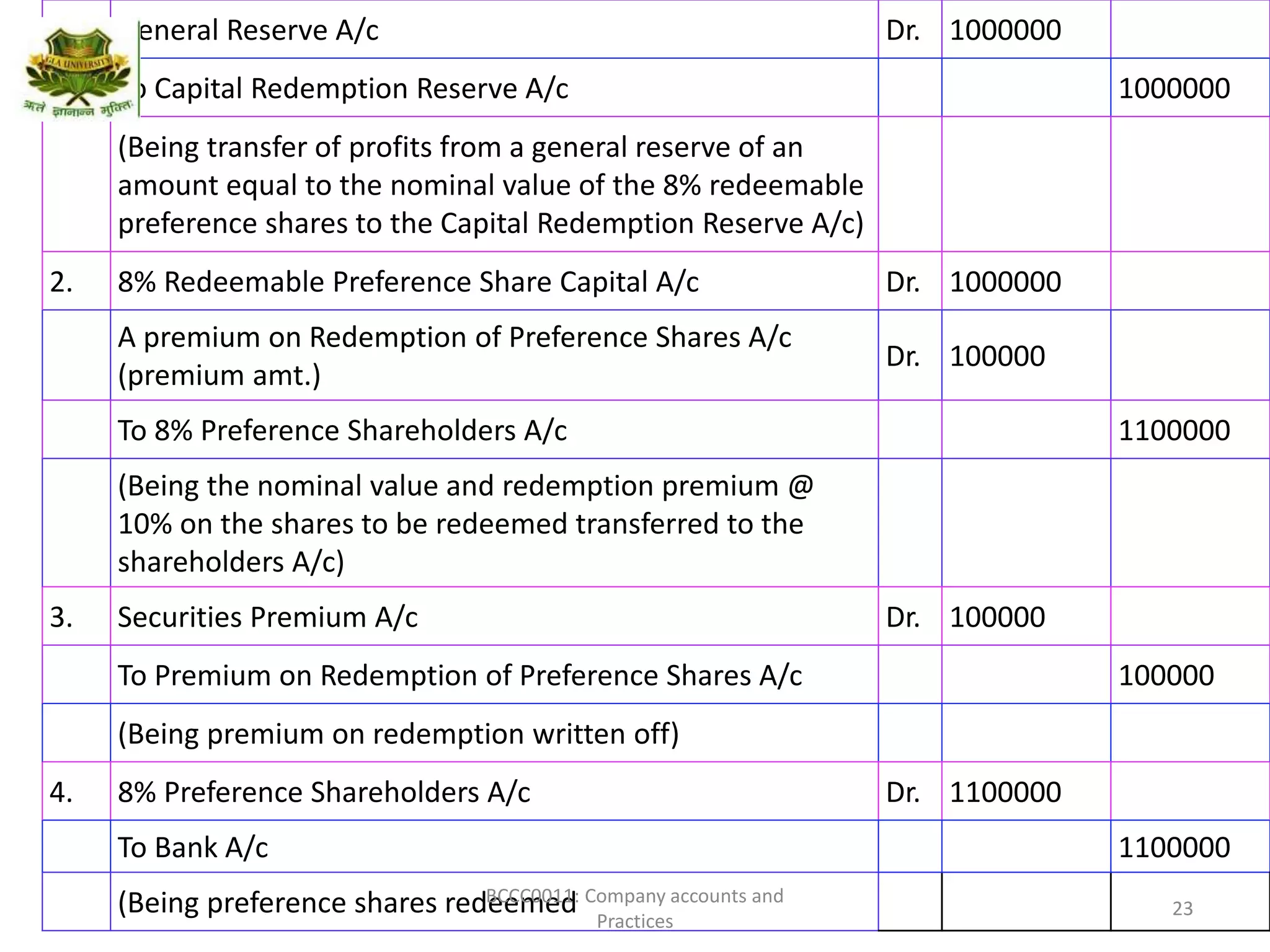

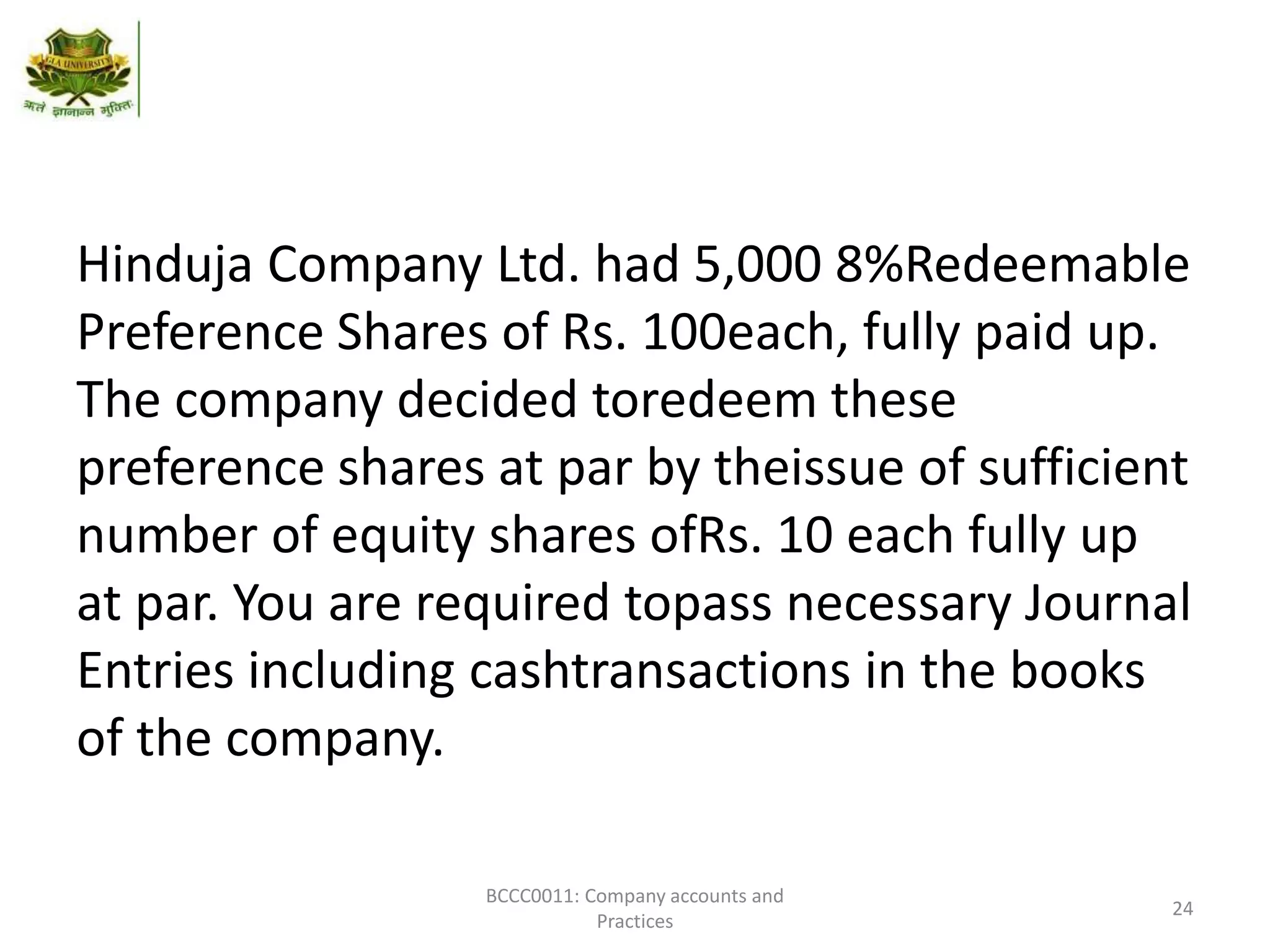

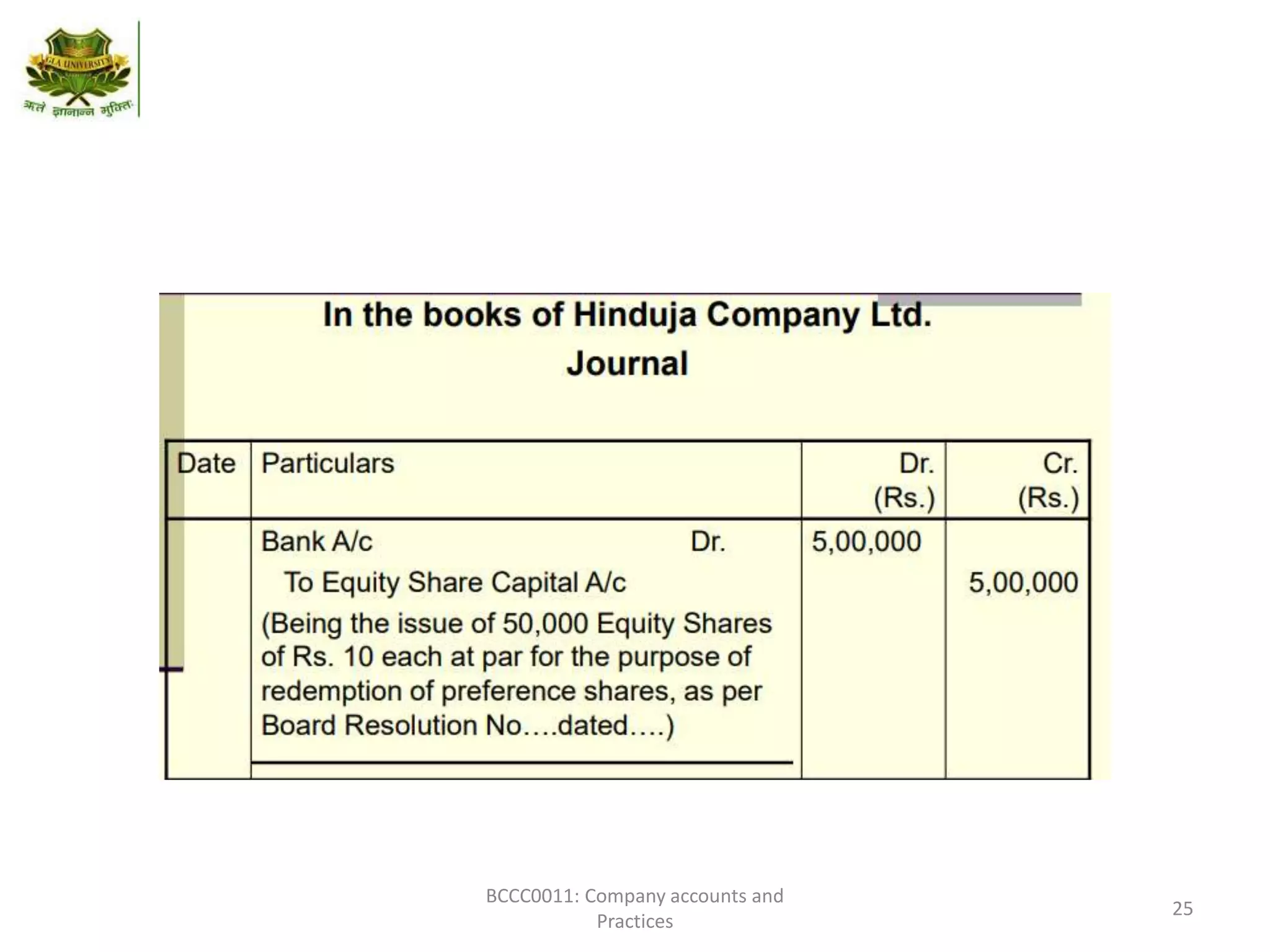

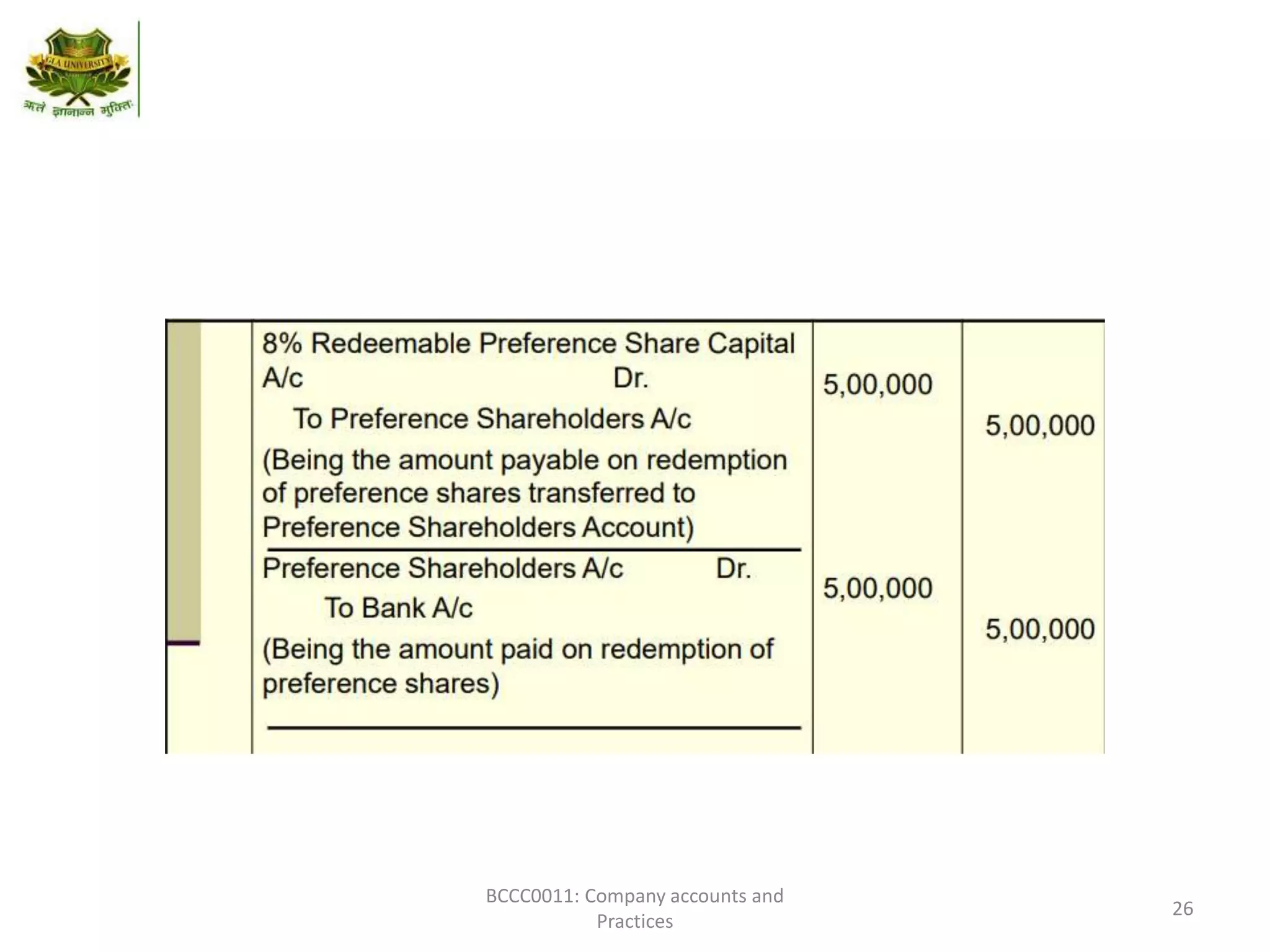

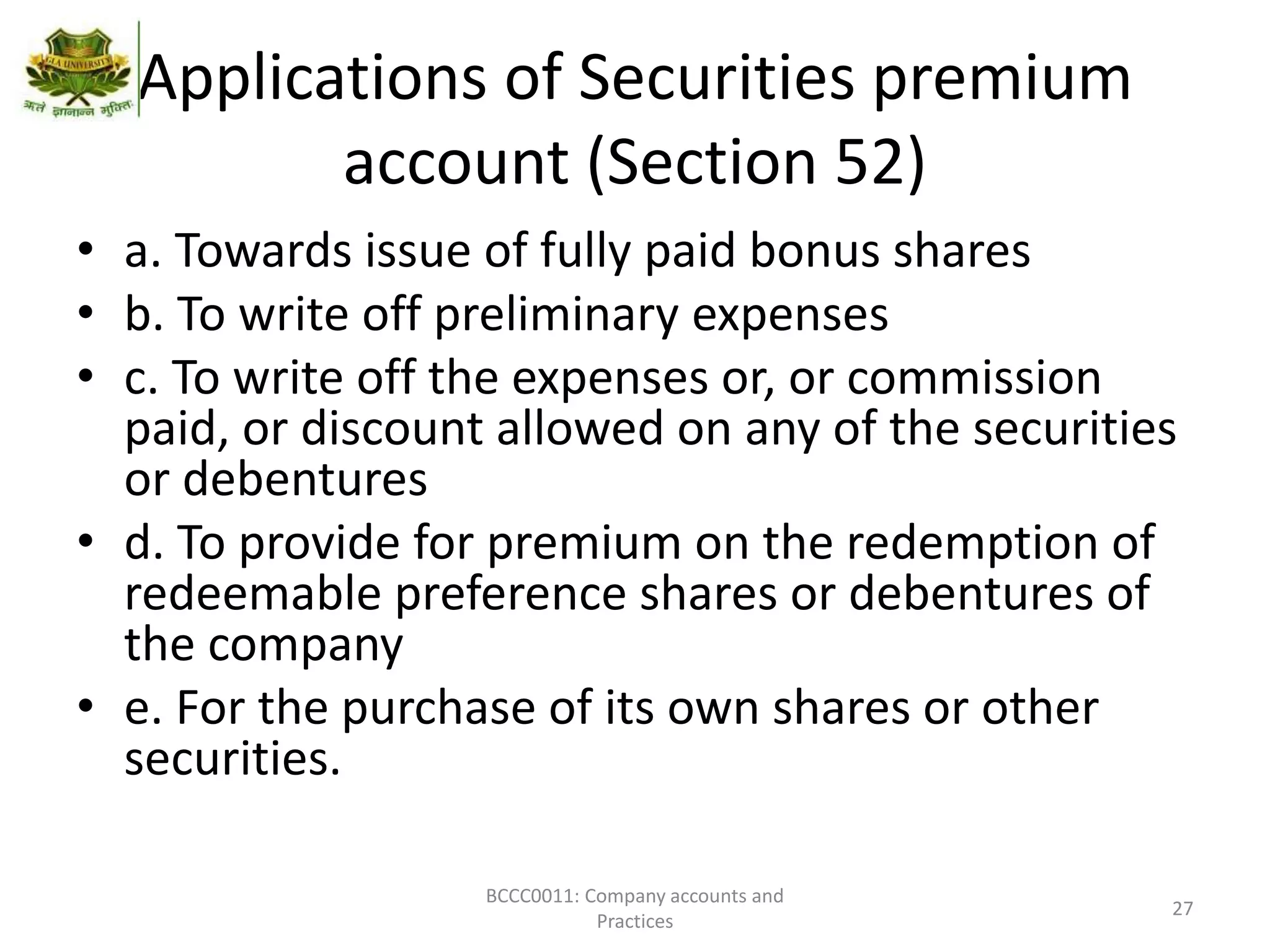

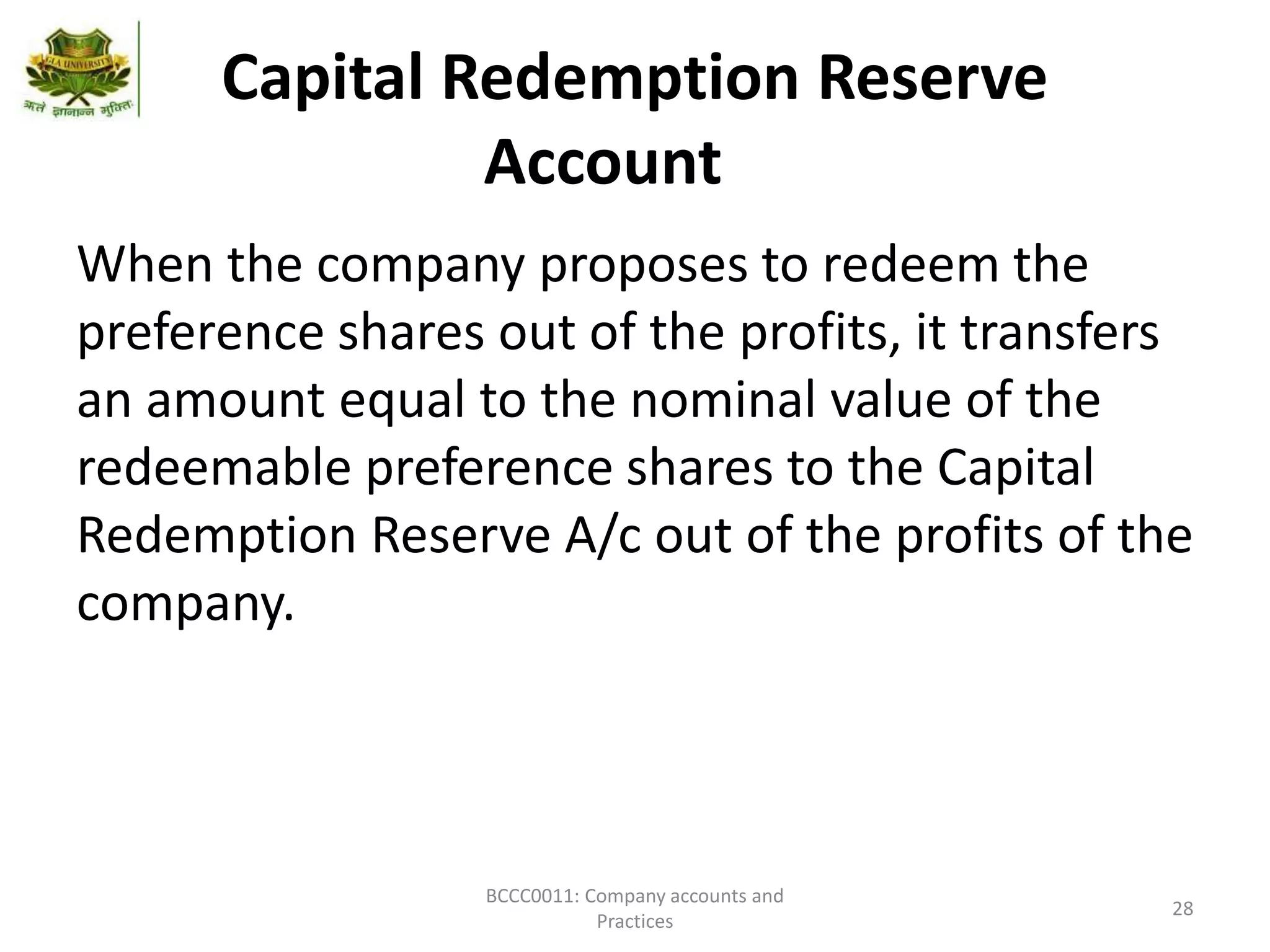

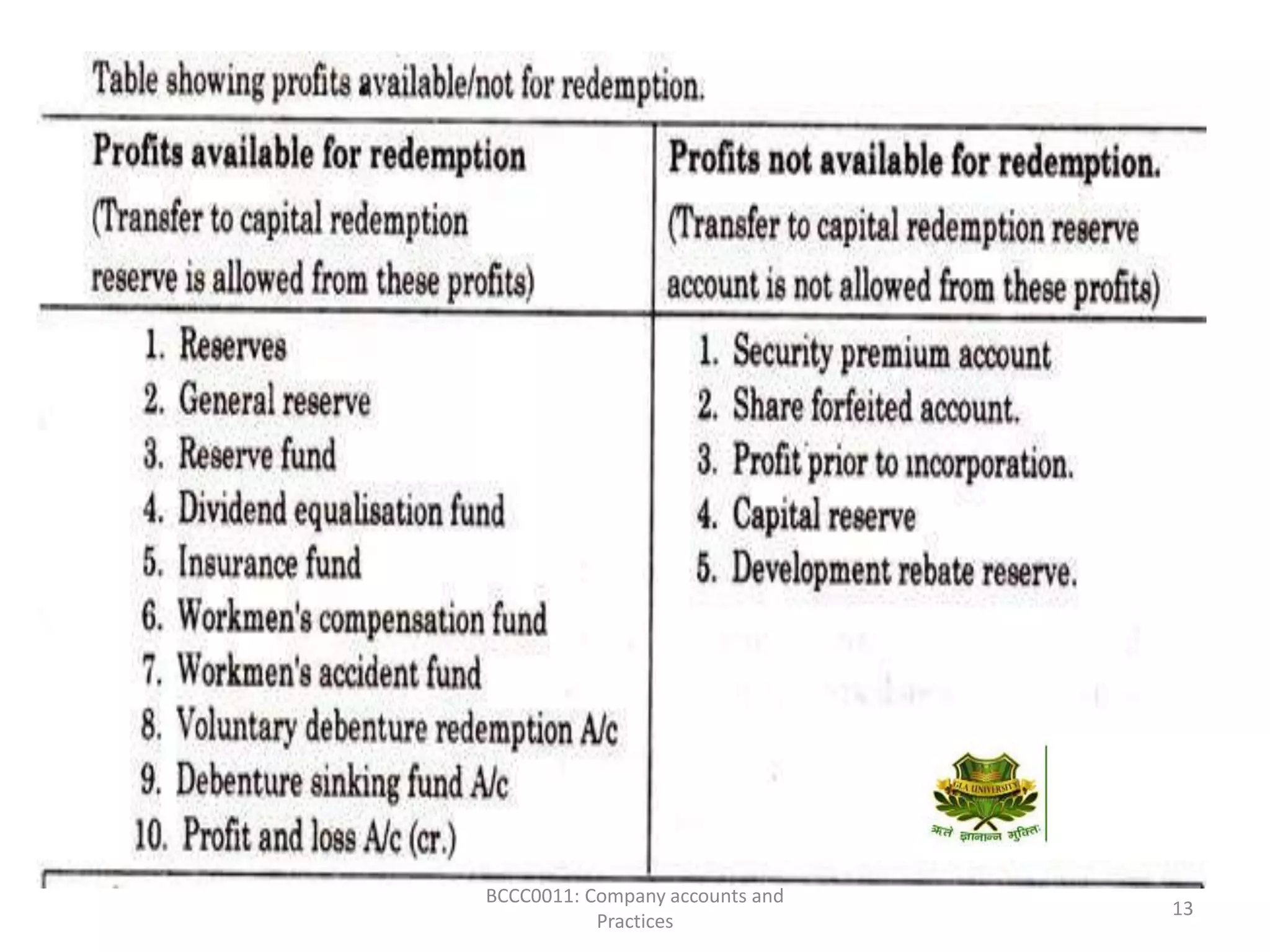

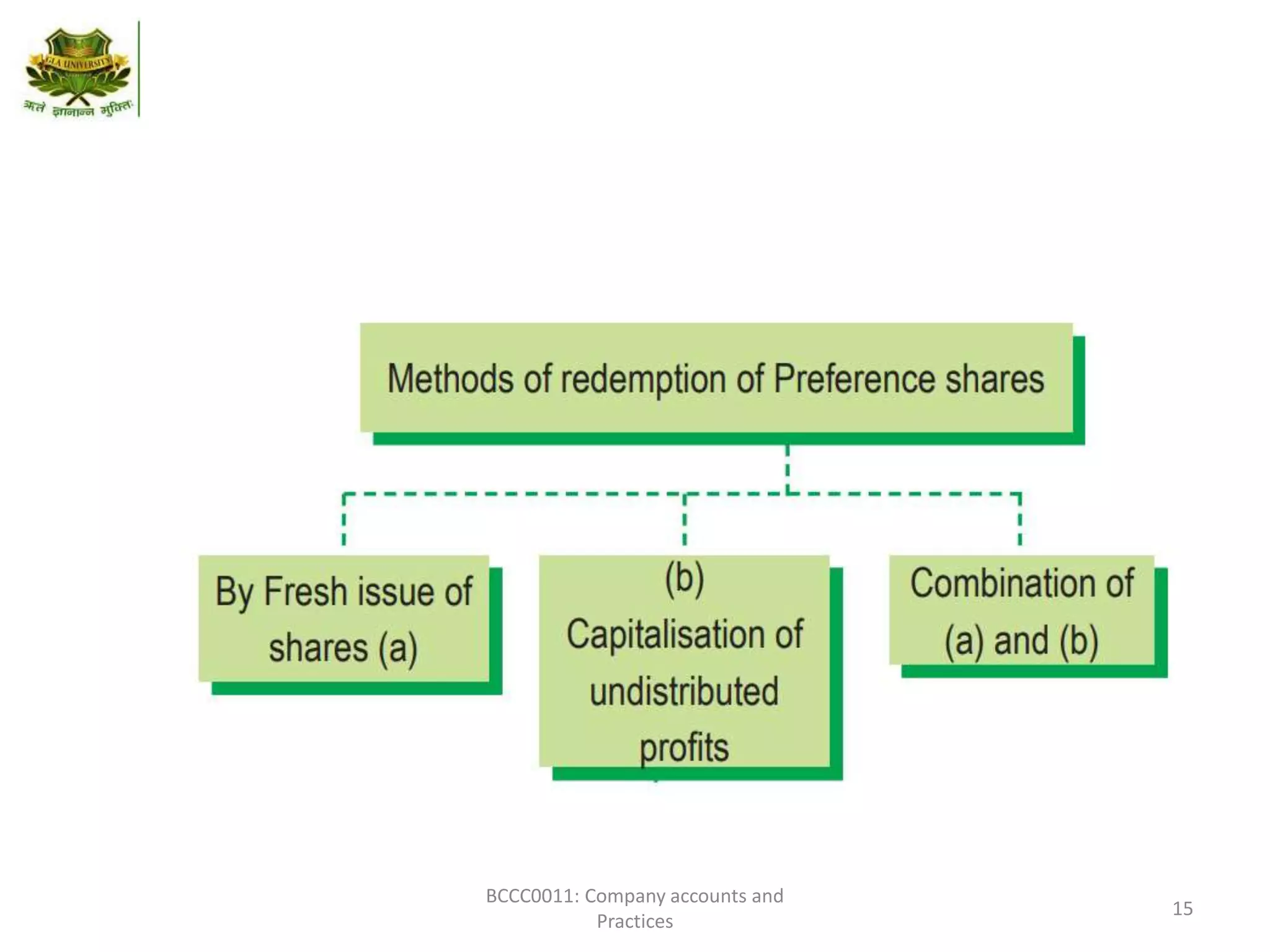

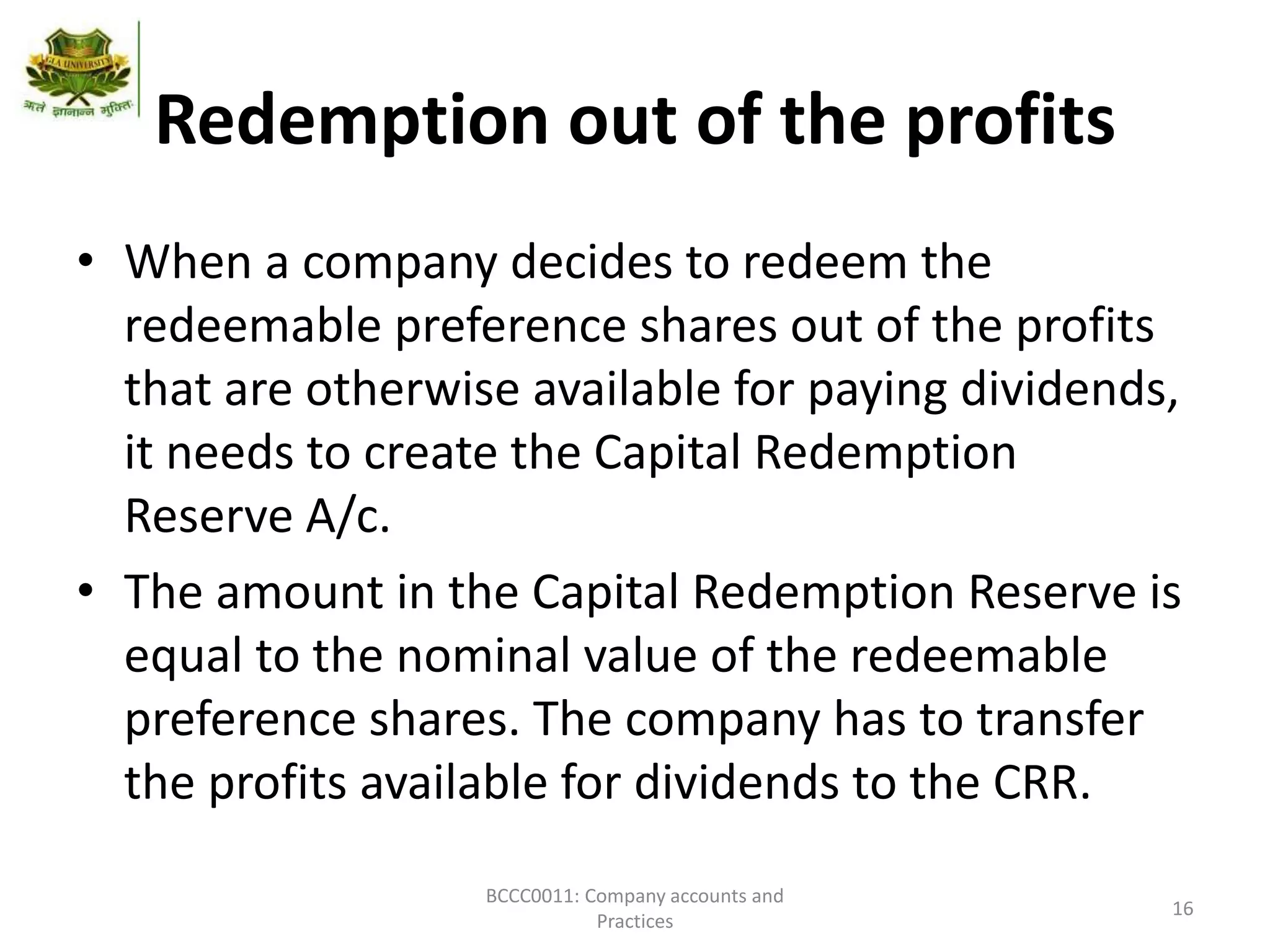

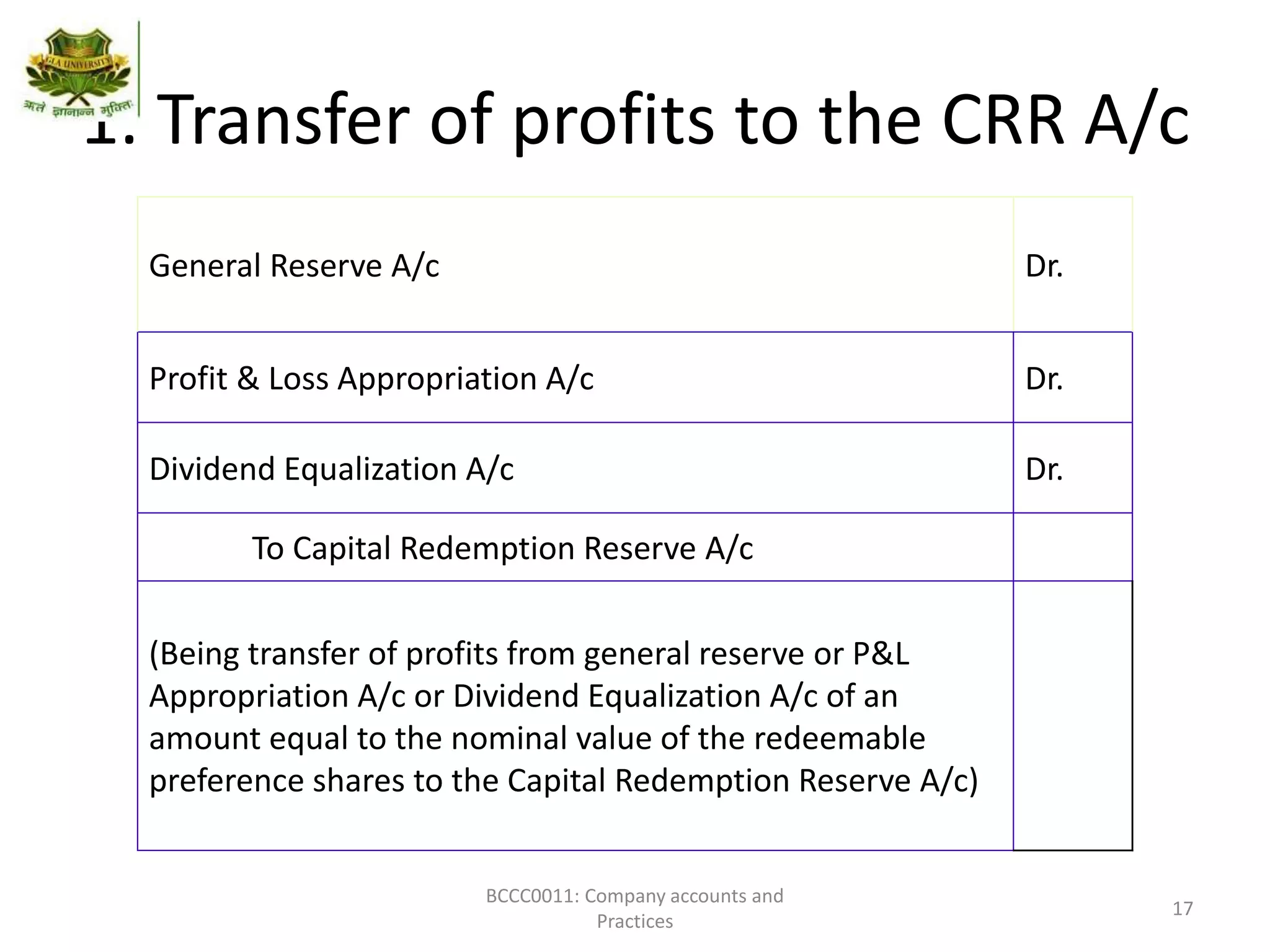

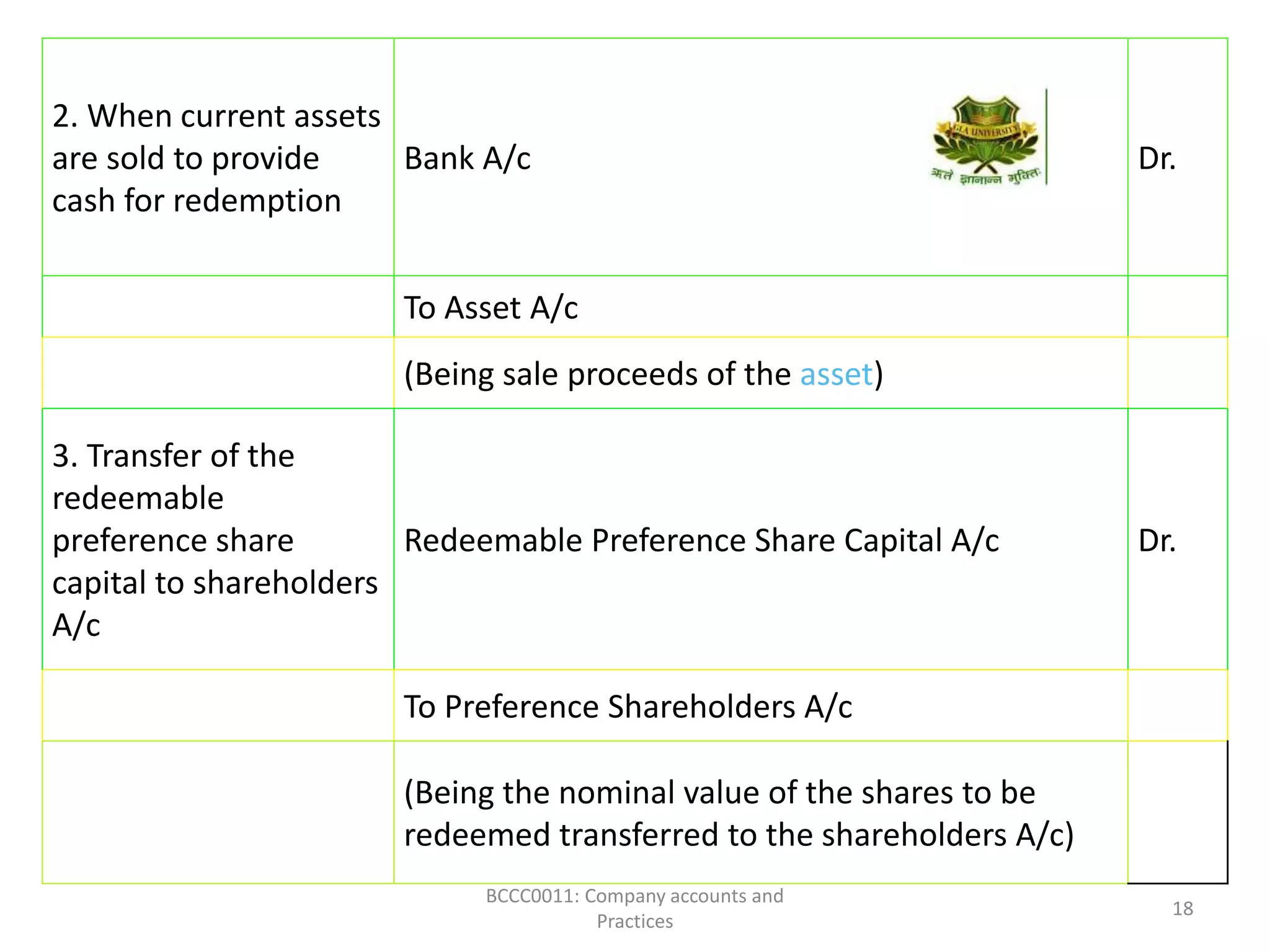

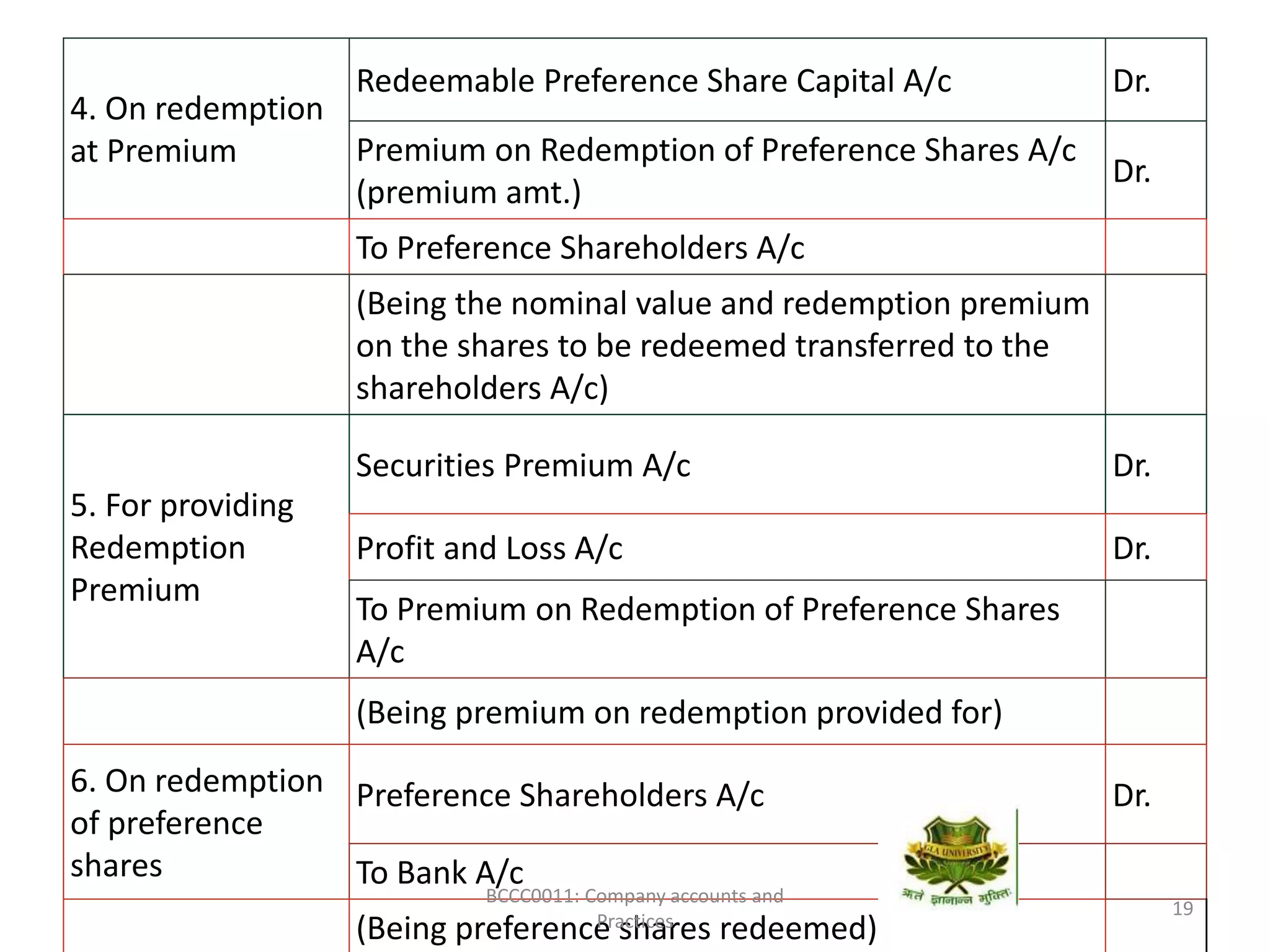

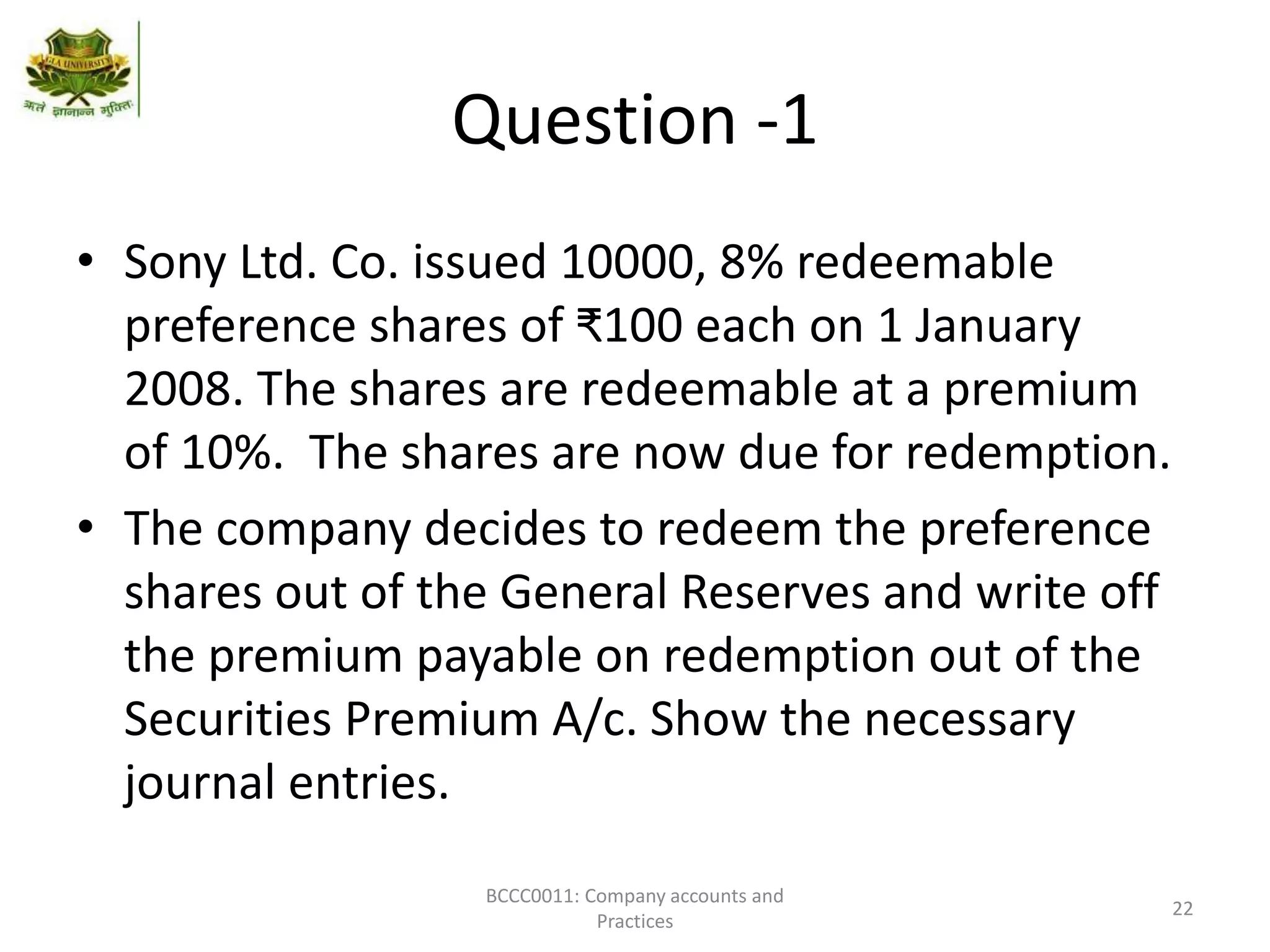

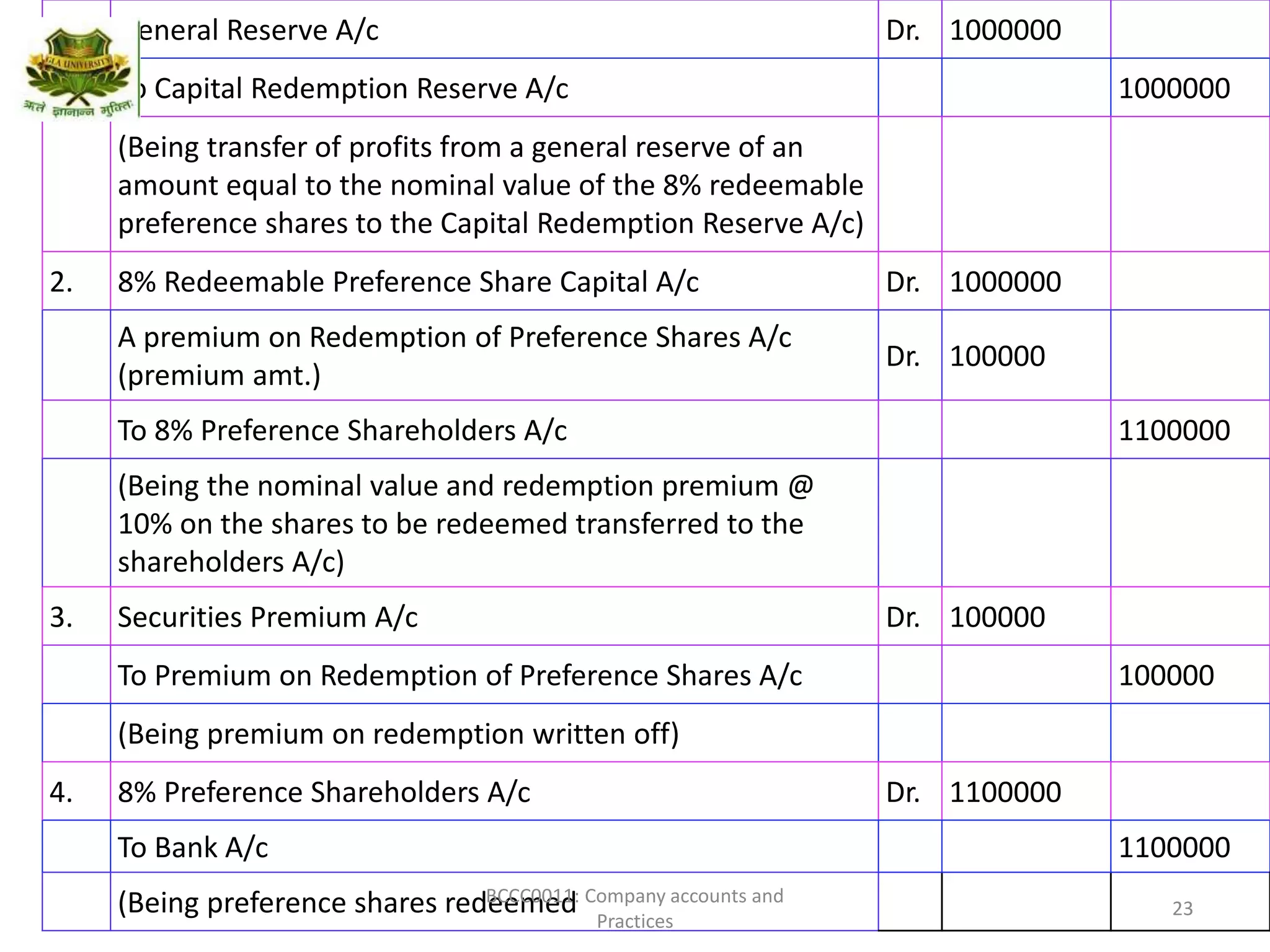

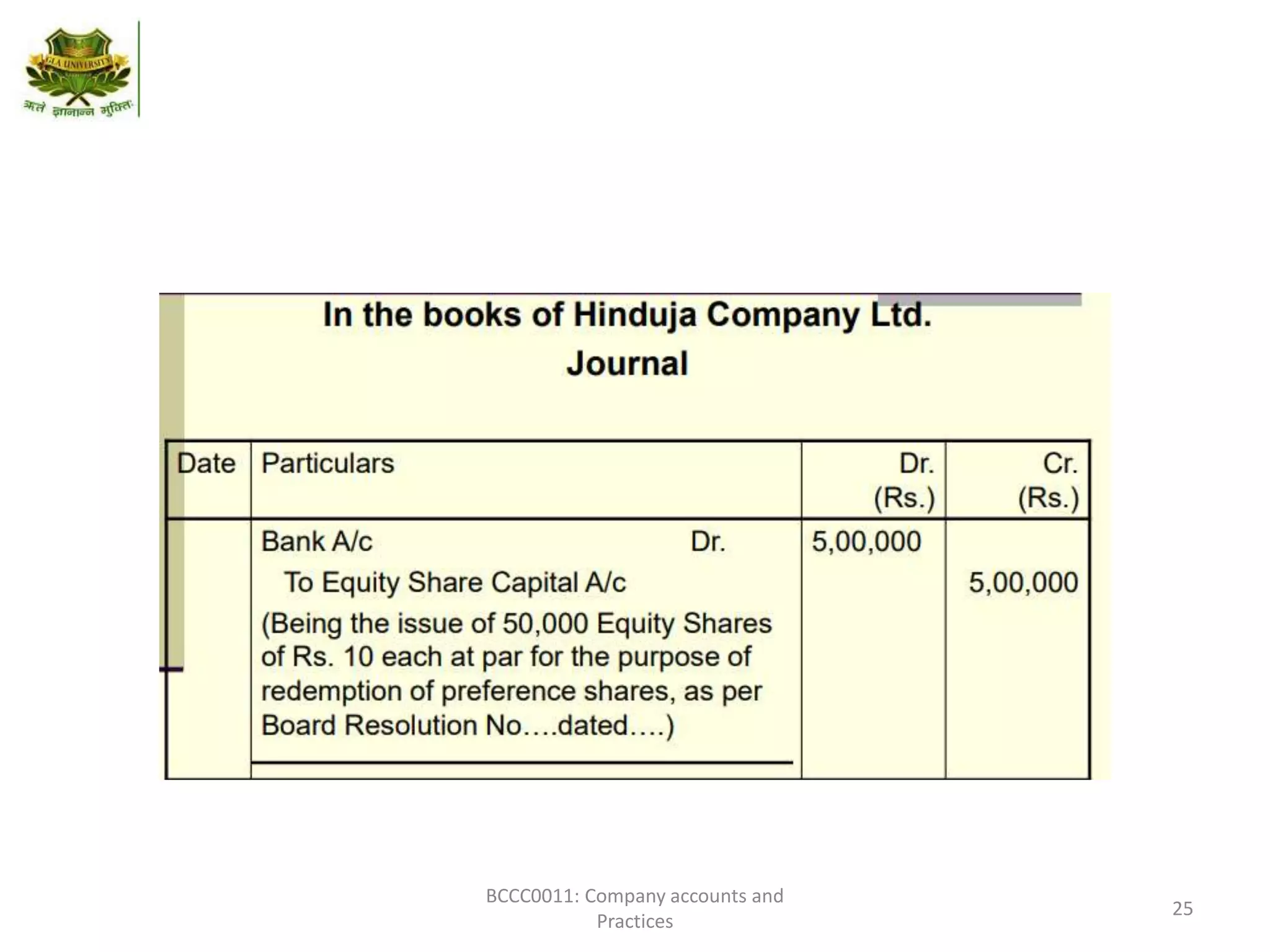

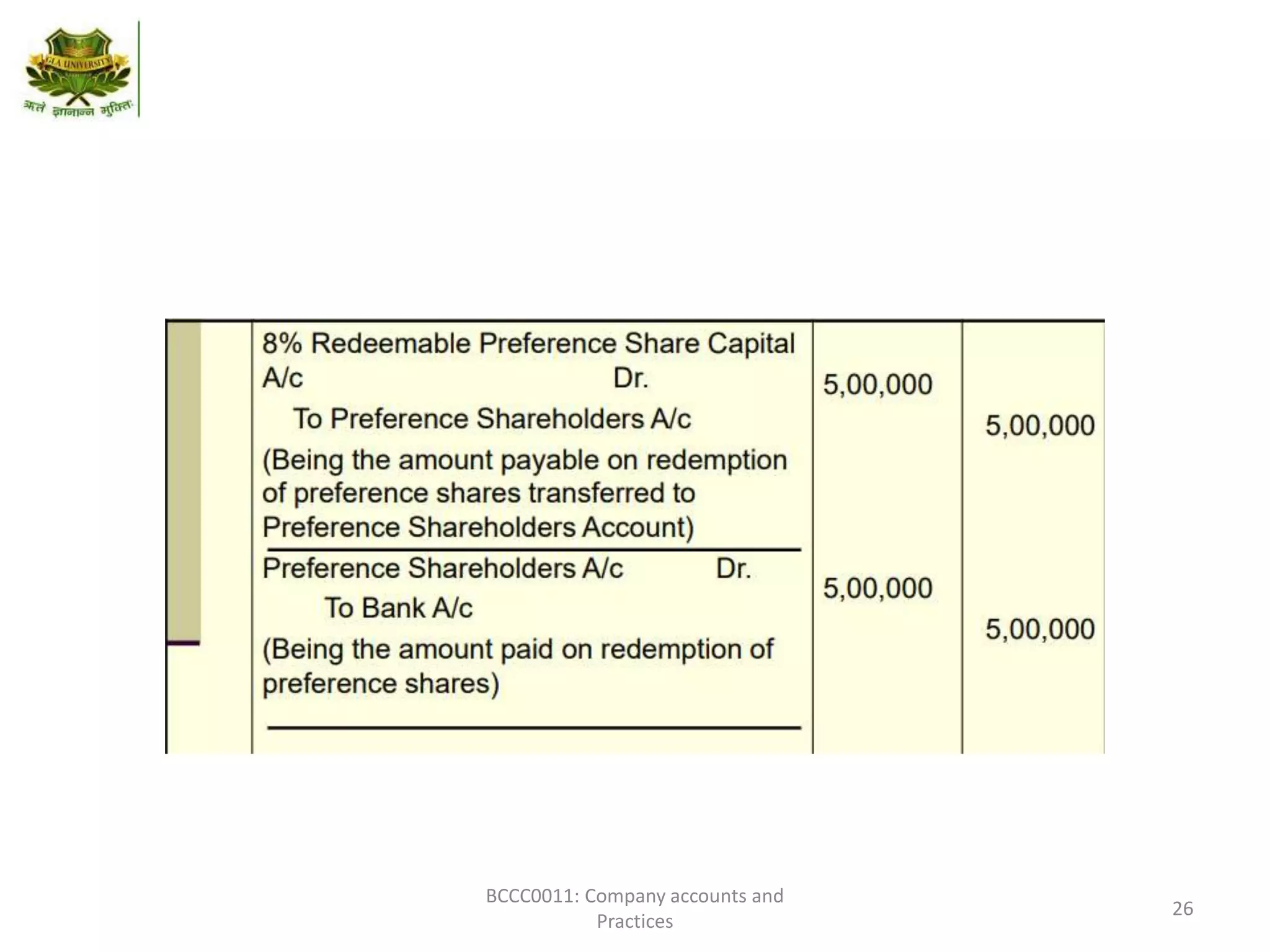

The document discusses various types of preference shares such as cumulative, non-cumulative, redeemable, non-redeemable, convertible, and participating shares. It also covers the accounting treatment for redeeming preference shares, including transferring profits to a capital redemption reserve equal to the nominal value of shares redeemed. The capital redemption reserve can be used to issue bonus shares. Securities premium may be used to write off any premium paid to redeem preference shares.