Embed presentation

Download to read offline

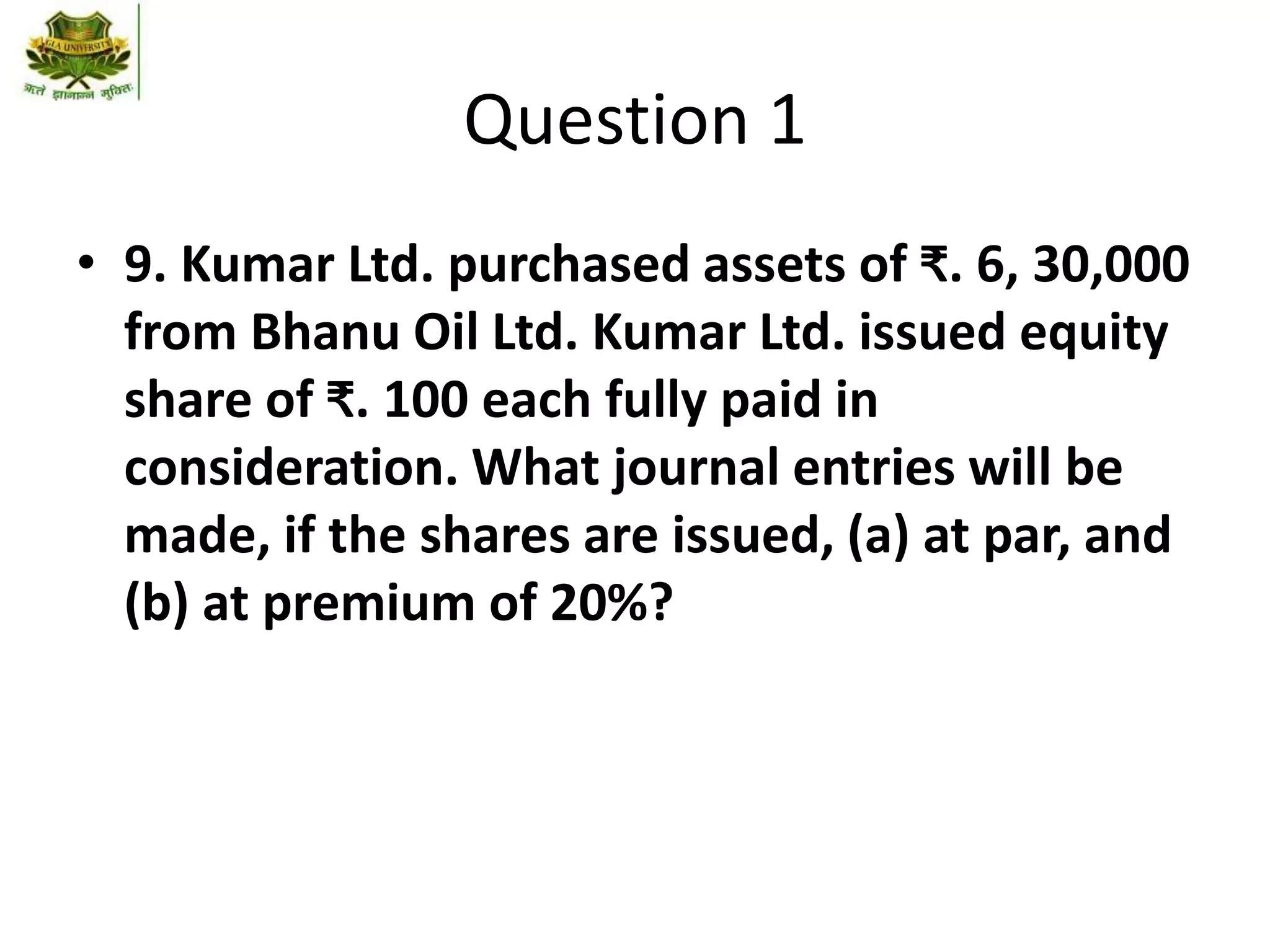

1. XYZ Limited issued 50,000 equity shares of Rs. 10 each at a premium of Rs. 6 per share and 20,000 10% preference shares of Rs. 10 each. 2. The amounts were payable in stages - equity shares had application money of Rs. 4 per share, allotment including premium of Rs. 8 per share, and first call of Rs. 4 per share. Preference shares had application of Rs. 5 per share and allotment of Rs. 5 per share. 3. Journal entries were passed to record the share application, allotment, and call amounts. The transactions were also recorded in the cash book.