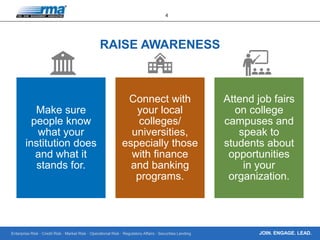

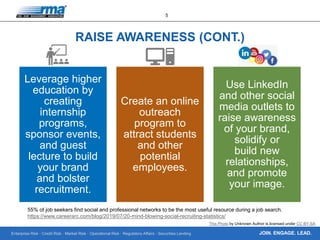

The document discusses strategies for attracting and retaining talent in risk management within the financial services industry, especially in light of the negative perceptions following the 2008 financial crisis. Key recommendations include raising awareness through outreach, leveraging technology for recruitment, and establishing a positive work culture that focuses on work-life balance and career development. The aim is to enhance the reputation of the sector and develop a skilled, resilient workforce aligned with evolving industry needs.