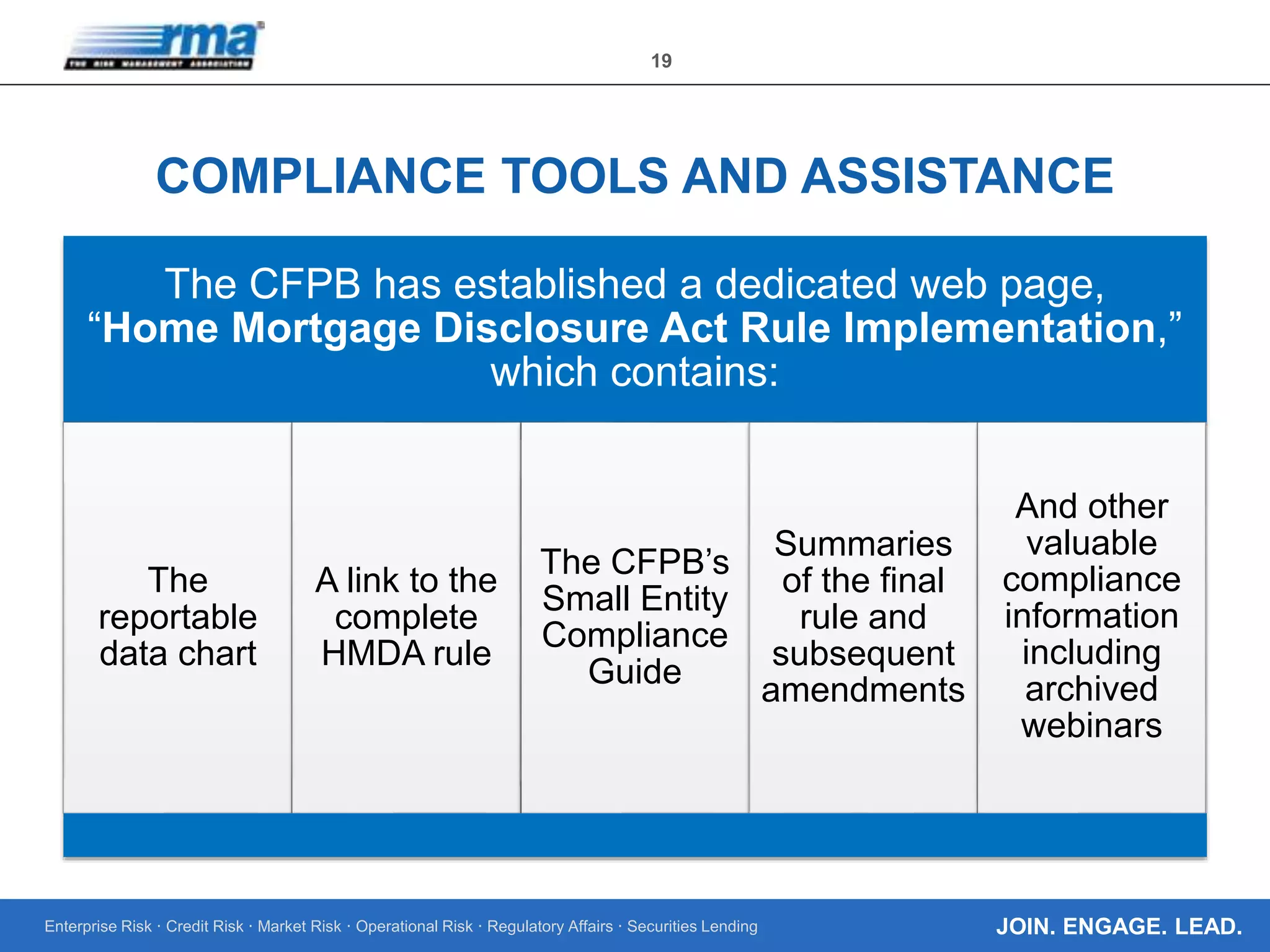

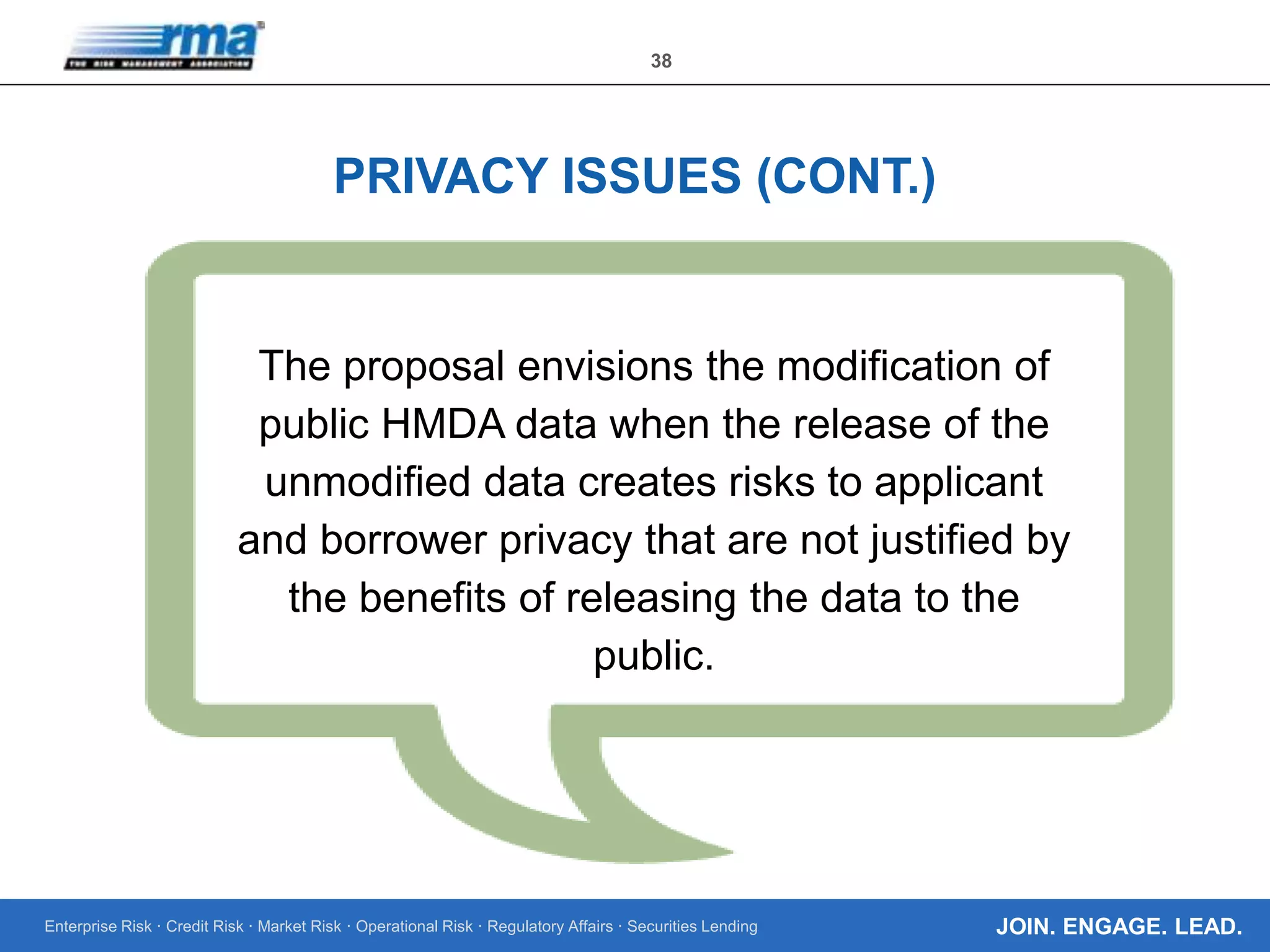

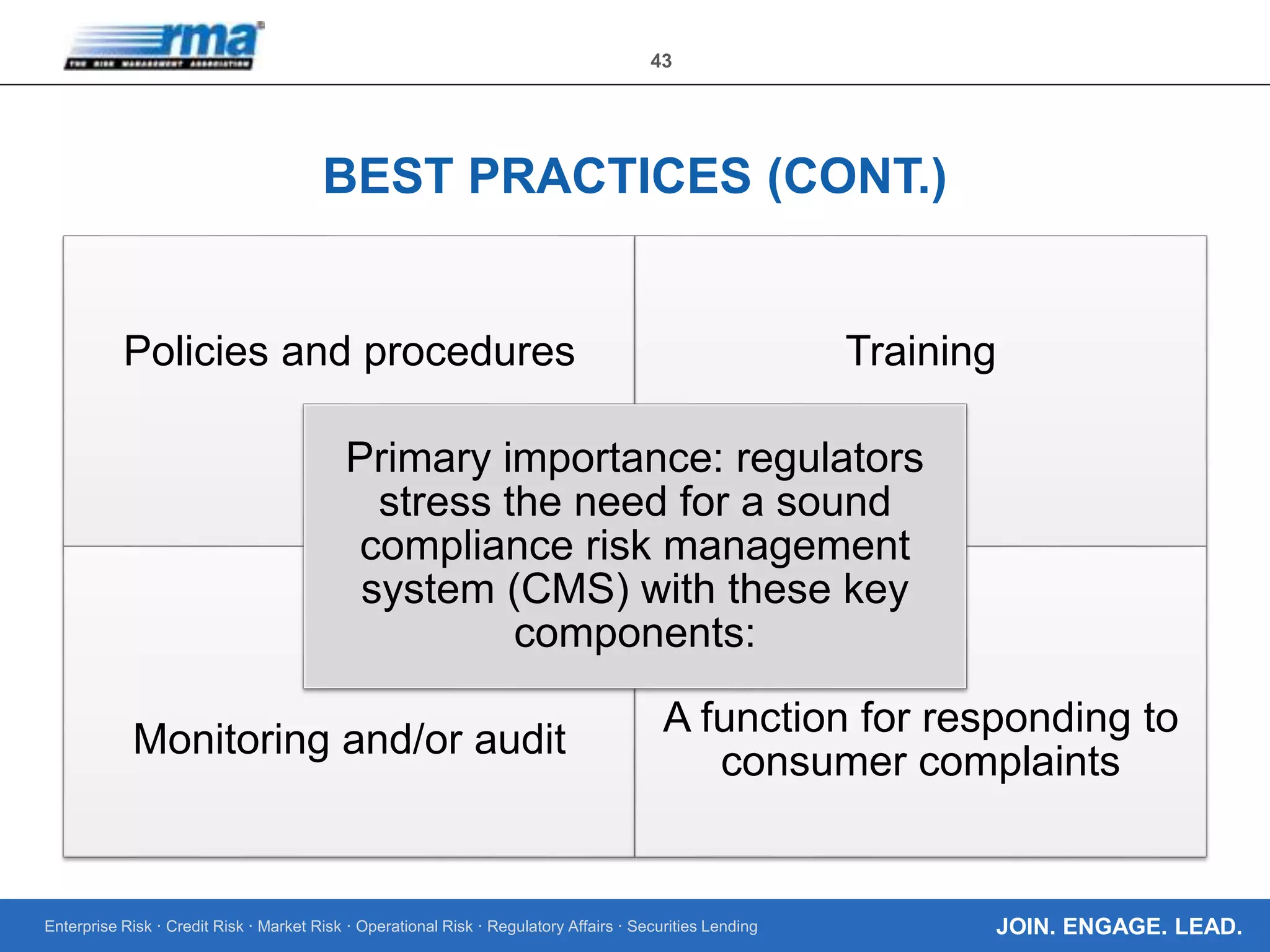

The document discusses the Home Mortgage Disclosure Act (HMDA) compliance updates that took effect on January 1, 2018, requiring lenders to report additional data points to enhance transparency in lending practices. It outlines the goals of the amendments, which include improving the understanding of market conditions and identifying potential discriminatory practices, as well as compliance assistance provided by the CFPB. The document also emphasizes the importance of sound compliance management systems within financial institutions to meet the new requirements.