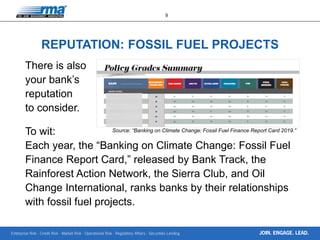

The document discusses the impact of climate change on financial institutions, highlighting the need for banks to address climate risks amidst increasing regulatory scrutiny and changing market dynamics. It emphasizes the importance of evaluating exposure to climate-related risks and adapting lending practices to align with emerging regulations and consumer preferences. The text also covers the reputational risks associated with fossil fuel financing and encourages a balanced risk appetite to seize opportunities in projects responding to climate change.