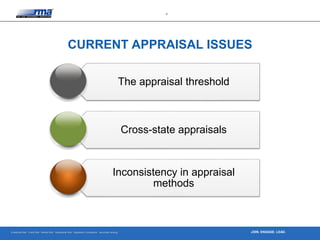

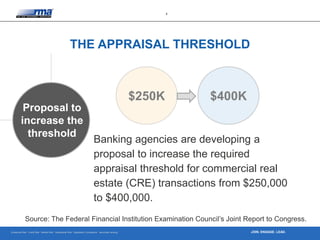

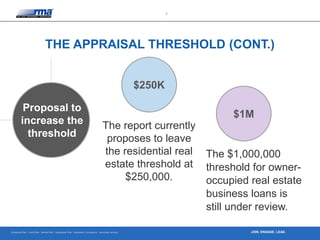

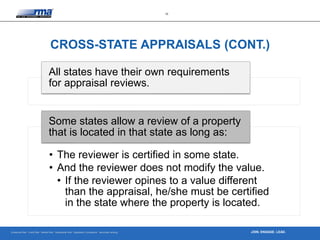

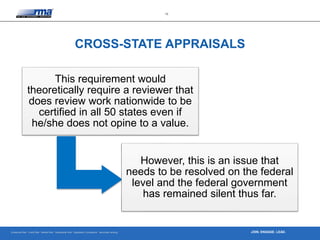

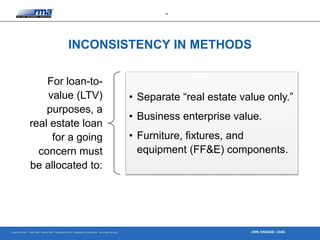

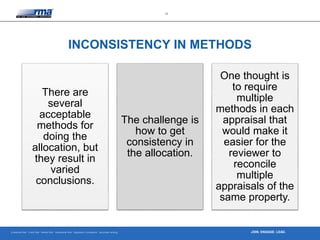

The document discusses contemporary appraisal issues in real estate transactions, highlighting the critical need for independent ordering and review processes. Key topics include the proposal to raise the appraisal threshold for commercial real estate transactions, legal challenges with cross-state appraisals, and inconsistencies in appraisal methods for going concerns. The Credit Risk Council aims to support best practices in credit risk management, emphasizing the importance of consistent valuation methods.