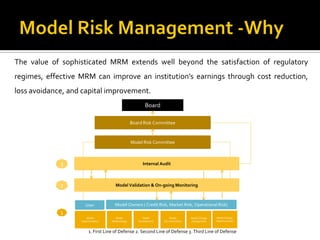

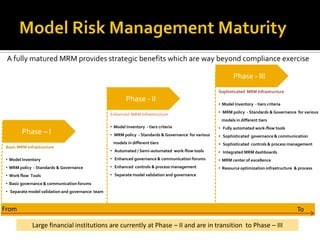

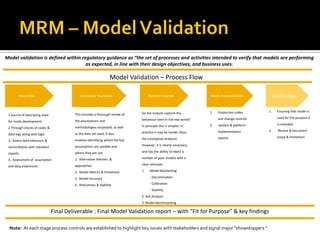

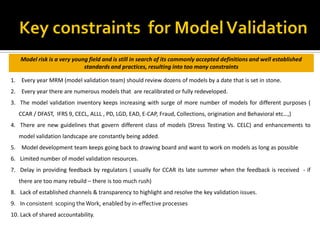

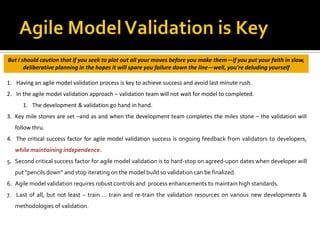

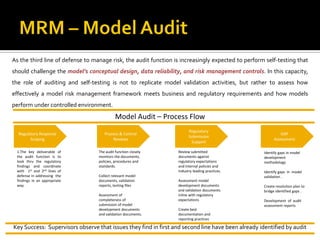

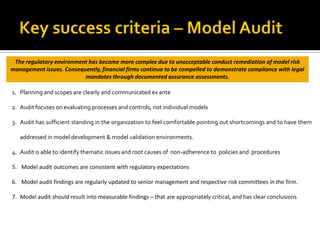

Model risk management aims to identify and address risks from model failures. It evaluates models across their lifecycle from development to usage. A three lines of defense approach is used with model owners, a validation team, and internal audit each providing oversight. Regular model validation is important to assess performance, assumptions, and risk. Agile validation processes that provide ongoing feedback can help address increasing model volumes and changing regulatory needs.