The document discusses prudent valuation in the context of global derivatives trading and risk management, focusing on its regulatory background and theoretical foundations. It highlights the need for financial institutions to apply prudent valuation in accordance with capital requirements, bridging the gap between fair value assessment and risk management practices. Key topics include valuation uncertainty, market incompleteness, and various valuation adjustments that impact core equity capital.

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 2

Summary [1]

1. Introduction

o Overview

o Prudent valuation history

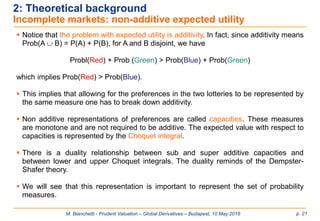

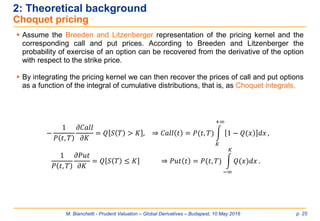

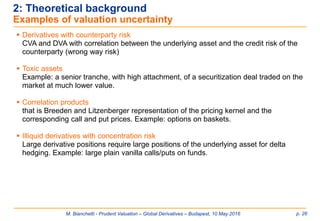

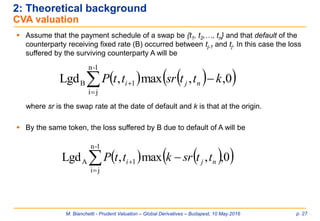

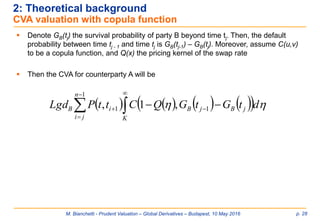

2. Theoretical Background

o Price opacity & financial crisis

o Pricing beyond Black-Scholes

o Market incompleteness & illiquidity

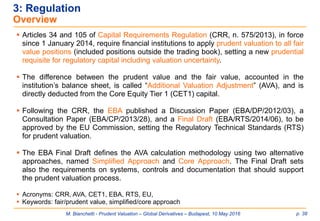

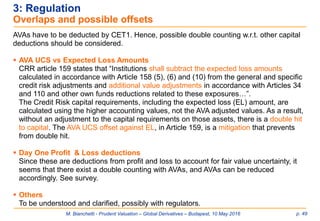

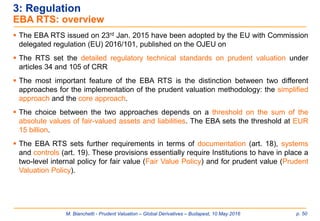

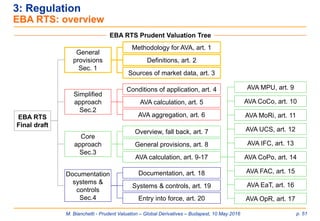

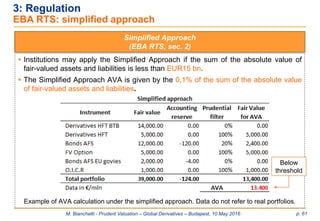

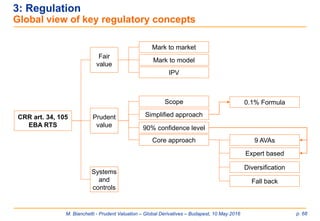

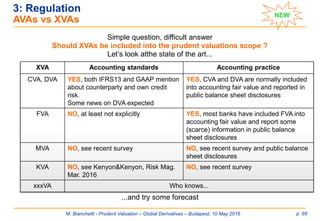

3. Regulation

o Overview

o The Capital Requirement Regulation 575/2013

o The EBA Regulatory Technical Standards

o AVAs vs XVAs

o Prudent valuation reporting

o Prudent valuation data NEW

NEW](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-2-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 3

Summary [2]

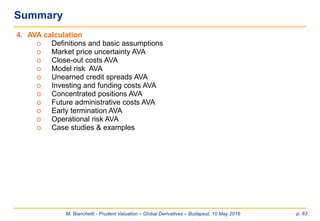

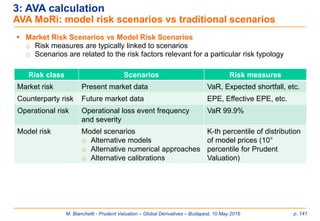

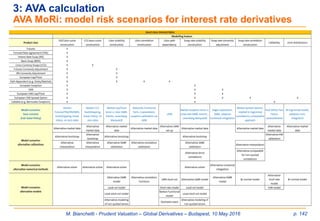

4. AVA calculation

o Definitions and basic assumptions

o Market price uncertainty AVA

o Close-out costs AVA

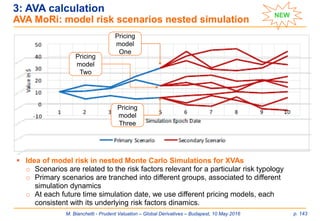

o Model risk AVA

o Unearned credit spreads AVA

o Investing and funding costs AVA

o Concentrated positions AVA

o Future administrative costs AVA

o Early termination AVA

o Operational risk AVA

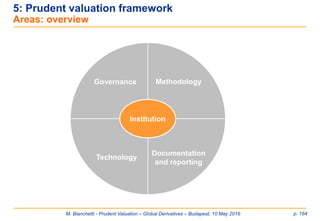

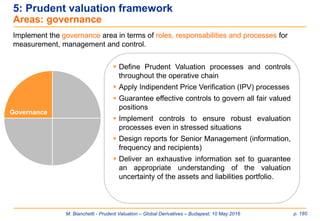

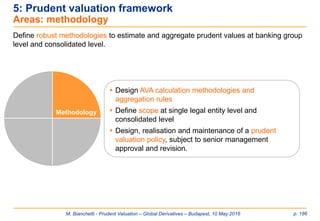

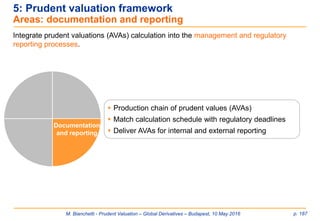

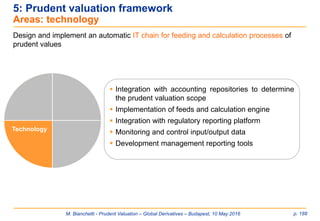

5. Prudent valuation framework

o Implementation

o Methodological framework

o Operational framework

o IT framework

o Documentation & reporting

o Example of prudent valuation framework

6. Conclusions

7. References

8. Glossary

NEW](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-3-320.jpg)

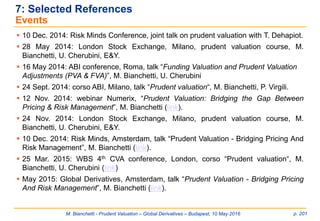

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 7

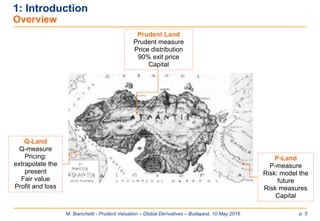

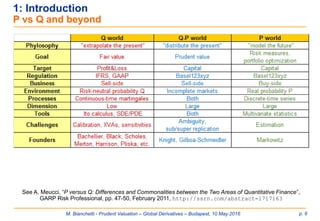

The idea of prudent valuation dates back to Basel 2 regulation (see BCBS,

“International Convergence of Capital Measurement and Capital Standards – A revised

framework”, June 2004).

In particular, sec. VI (“Trading book issues”), ch. B (“Prudent valuation guidance”), par.

690-701 set the requirements for prudent valuation in terms of

o systems and controls,

o valuation methodologies,

o valuation adjustments or reserves, impacting regulatory capital (not P&L).

The CRR inherited most of the contents in its art. 105.

In more recent times, prudent valuation has been required by the Financial Stability

Agency (FSA) to UK institutions, see refs. below.

o Financial Services Authority, “Dear CEO Letter: Valuation and Product Control”, August 2008,

http://www.fsa.gov.uk/pubs/ceo/valuation.pdf

o Financial Services Authority, “Product Control Findings and Prudent Valuation Presentation”, November 2010,

http://www.fsa.gov.uk/pubs/other/pcfindings.pdf

o Financial Services Authority, “Regulatory Prudent Valuation Return”, Policy Statement 12/7, April 2012,

http://www.fsa.gov.uk/library/policy/policy/2012/12-07.shtml

1: Introduction

Prudent valuation history [1/3]](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-7-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 8

1: Introduction

Prudent valuation history [2/3]

August 2008

FSA “Dear

CEO letter”

November 2010

FSA “Product Control

Findings and Prudent

Valuation Presentation”

April 2012

FSA “Regulatory Prudent

Valuation Return”, Policy

Statement

2008 2009 2010 2011 20122006 20072004 2005

June 2004

BCBS “International Convergence

of Capital Measurement and

Capital Standards” (Basel 2)](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-8-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 9

1: Introduction

Prudent valuation history [3/3]

13 November 2012

EBA Discussion

Paper

(EBA/DP/2012/03)

10 July 2013

EBA Consultation

Paper

(EBA/CP/2013/28)

1 Jan. 2014

CRR

575/2013

31 March 2014

EBA Final Draft RTS

and first application of

prudent valuation

28 Jan. 2016

EBA RTS

published on

OJEU

8 November 2013

EBA Quantitative

Impact Study

2012 2013 2014 2015

23 Jan. 2015

EBA Final Draft

RTS amended

Prudent valuation in

place

2016

28 October 2015

EU commission

adoption of EBA RTS

NEW](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-9-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 16

2: Theoretical background

A simple example [1]

Take a very simple financial product, that is an equity linked note promising to pay a

participation to the increase in some stock market index in five years.

The replicating portfolio of the product is made up by:

o A zero coupon bond paying the Libor with five years maturity

o A zero coupon bond paying the credit risk spread of the issuer with five years

maturity

o An equity option with five years exercise time

The main sources of valuation uncertainty are the following.

o The calibration of the five year zero coupon Libor, using fixed income market

data and bootstrapping techniques. This valuation problem is common to other

fixed income products.

o The calibration of the five year zero coupon credit spread, using the issuer’s or

comparable CDS and bond data, and bootstrapping techniques.

o The calibration of the five year equity volatility, using equity options’ market data

and bootstrapping techniques. Typically, exchange traded or OTC derivatives do

not have a liquid market for 5 years maturity and we must extend implied

volatility beyond the traded maturities.](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-16-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 17

2: Theoretical background

A simple example [2]

There are actually other risk sources, mostly the correlations among the risk factors

involved.

o Correlation between equity and bonds

It could seem that this should not affect the pricing problem, since it is made under

the Forward Martingale Measure (FMM), but the volatility of the forward price

depends on correlation.

o Correlation between underlying asset and volatility

This is relevant in cases in which the underlying asset and its volatility co-move in

directions leading to a decrease of the embedded option. This is not the case of

this product, which is long both in the underlying asset and its volatility, while the

equity market and volatility are known to be negatively correlated.

o Correlation between the embedded option and the credit quality of the issuer

Actually the embedded option is a vulnerable option whose value is affected by the

positive correlation between the exposure (the exercise of the option) and the

default probability of the issuer.](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-17-320.jpg)

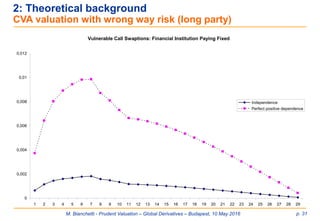

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 29

2: Theoretical background

CVA valuation with wrong way risk

Now assume perfect dependence between the underlying asset and default of the

counterparty. In this case, we have the Fréchet bound 𝒞 𝑥, 𝑦 ≤ 𝑀𝑖𝑛 𝑥; 𝑦 .

In this case, the CVA can be computed in closed form as

CVA = LgdBmax[k*(tj) – k,0]A(t, tj, tn) [GB(tj-1) – GB(tj)]

– LgdB PayerSwaption(.;max(k*(tj),k))

where k*(tj) is defined from Q((sr(tj,tn) > k*(tj)) = GB(tj-1) – GB(tj), and

is the swap annuity.

𝐴(𝑡; 𝑡𝑗, 𝑡 𝑛) =

𝑖=𝑗

𝑛−1

𝑃 𝑡, 𝑡𝑖−1 𝜏𝑖](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-29-320.jpg)

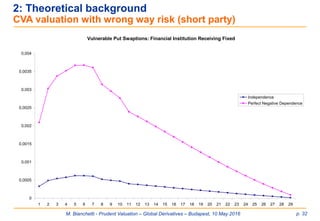

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 30

2: Theoretical background

CVA valuation with wrong way risk

o For the short end of the contract the worst scenario is perfect negative dependence

between the underlying asset and default of the counter party. In this case, we have

the Fréchet bound 𝒞 𝑥, 𝑦 > 𝑀𝑖𝑛 𝑥 + 𝑦 − 1; 0 .

In this case, the CVA can be computed in closed form as

CVA = LgdA[ReceiverSwaption(.;min(k*(tj),k)) – Receiver swaption(.;k)]

+ LGDA max[k – k*(tj),0](1 – GA(tj – 1) – GA(tj))](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-30-320.jpg)

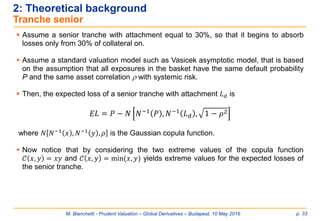

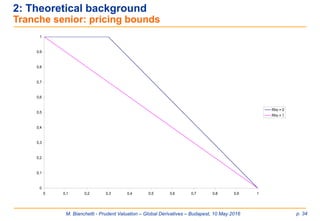

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 35

2: Theoretical background

Rainbow options

Assume a call option on the minimum of a set of assets (Everest). This can be priced

with a Choquet integral using the copula as the Choquet integral

From the point of view of the issuer, we can compute the conservative value in closed

form, for a bivariate product

dTSQTSQTSQCTtP

TKSSSCall

K

N

N

))((),...)((),)((,

),),,...,(min(

21

21

)*,max(;,

;,*;,

,,

2

11*

*],max[

2

*

11* 2

KKtSC

KtSCKtSC

dSQTtPdSQTtPC

KK

KK

K

K

KK

1

1 ](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-35-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 39

Market

Data

Models

Estim

ates

Fair Value

accounting AVA

(Additional

Valuation

Adjustment)

IFRS 13

Prudent valuation

Prudent value

Deducted from Common

Equity Tier 1 capital

CRR article 105 requisites

Policies &

procedures

Control

systems

Prudent

valuation

principles

3: Regulation

CRR 575/2013 [1/8]](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-39-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 40

3: Regulation

CRR 575/2013 [2/8]

Art. 34

Prudent valuation

scope

Systems and

controls

Valuation

Valuation

adjustments

Art. 105

CRR

575/2013

CRR Prudent Valuation Tree

Prudent valuation

principles

Degree of certainty, art. 105.1

S&C requirements, art. 105.2

Revaluation frequency art. 105.3

Mark to market, art. 105.4-5

Mark to model, art. 105.6-7

IPV, art. 105.8

Valuation adjustments, art. 105.9-10

Illiquid positions, art. 105.11

Other valuation adj., art. 105.12

Complex products, art. 105.13](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-40-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 41

CRR art. 34: scope and target

o Scope: all assets measured at fair value

o Target: CET1 capital (not P&L)

3: Regulation

CRR 575/2013 [3/8]](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-41-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 42

CRR art. 105.1, scope and degree of certainty: all positions are subject to prudent

valuation, achieving an appropriate degree of certainty with regard to:

o the dynamic nature of the positions,

o the demands of prudential soundness, and

o the mode of operation and purpose of capital requirements in respect of trading book

positions.

CRR art 105.2, systems and controls: institutions establish and maintain systems and

controls to ensure prudent and reliable valuations, including at least.

o Documented policies and procedures for the valuation process, including:

• clearly defined responsibilities of the various areas involved in the determination of the

valuation,

• sources of market information and review of their reliability,

• guidelines for the use of unobservable inputs that reflect the assumptions of authority on

the elements used by market participants to determine the price of the position,

• frequency of independent valuation,

• timing of closing prices,

• procedures for the correction of assessments,

• procedures for the reconciliation of month end and ad hoc.

o Clear and independent (of the front office) reporting lines for the department in charge of the

valuation process.

3: Regulation

CRR 575/2013 [4/8]](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-42-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 43

CRR art 105.3, revaluation frequency: institutions revalue trading book positions at

least daily

CRR art 105.4-5, mark to market: institutions mark their positions to market whenever

possible, using the more prudent side of bid and offer unless they can close out at mid

market.

CRR art 105.6, mark to model: where marking to market is not possible, institutions

must conservatively mark to model their positions and portfolios.

3: Regulation

CRR 575/2013 [5/8]](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-43-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 44

CRR art 105.7, mark to model:

o senior management must be aware of the fair-valued positions marked to model and must

understand the materiality of the uncertainty of the risk/performance of the business;

o source market inputs, where possible, in line with market prices, and assess the

appropriateness of market inputs and model parameters on a frequent basis;

o use valuation methodologies which are accepted market practice;

o where the model is developed by the institution itself, it must be based on appropriate

assumptions, assessed and challenged by suitably qualified parties independent of the

development process;

o have in place formal change control procedures, hold a secure copy of the model and use

it periodically to check valuations;

o risk management must be aware of the weaknesses of the models used and how best to

reflect those in the valuation output;

o models are subject to periodic review to determine the accuracy of their performance,

including assessment of the continued appropriateness of assumptions, analysis of profit

and loss versus risk factors, and comparison of actual close out values to model outputs;

o the model must be developed or approved independently

of the trading desk and independently tested, including

validation of the mathematics, assumptions and software

implementation.

3: Regulation

CRR 575/2013 [6/8]

Very detailed article

regarding valuation

in general](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-44-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 45

CRR art. 105.8, independent price verification (IPV): institutions perform independent

price verification in addition to daily marking to market/model. Verification of market

prices and model inputs must be performed by unit independent from units that benefit

from the trading book, at least monthly, or more frequently depending on the nature of

the market or trading activity. Where independent pricing sources are not available or

pricing sources are more subjective, prudent measures such as valuation adjustments

may be appropriate.

CRR art 105.9-10: valuation adjustments: institutions establish and maintain

procedures for considering valuation adjustments, and formally consider the following:

unearned credit spreads, close-out costs, operational risks, market price uncertainty,

early termination, investing and funding costs, future administrative costs and, where

relevant, model risk.

CRR art 105.11, illiquid/concentrated positions: Institutions shall establish and

maintain procedures for calculating an adjustment to the current valuation of any less

liquid positions, which can in particular arise from market events or institution-related

situations such as concentrated positions and/or positions for which the originally

intended holding period has been exceeded.

3: Regulation

CRR 575/2013 [7/8]](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-45-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 46

CRR art. 105.12, other valuation adjustments:

institutions must consider whether to apply a valuation adjustment also:

o when using third party valuations,

o when marking to model,

o for less liquid positions, including an ongoing basis review their continued suitability,

o for uncertainty of parameter inputs used by models.

CRR art. 105.13, complex products: institutions must explicitly assess the need for

valuation adjustments to reflect the model risk associated with using:

o a possibly incorrect valuation methodology

o unobservable (and possibly incorrect) calibration parameters in the valuation model.

3: Regulation

CRR 575/2013 [8/8]](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-46-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 47

3: Regulation

Fair Value Vs Prudent Value [1]

Fair Value

o Regulation: IFRS13

o Application: balance sheet

o Percentile: 50% (expected

value)

o The price that would be received

to sell an asset or paid to

transfer a liability in an orderly

transaction between market

participants at the measurement

date

o Must include all the factors that

a market participants would use,

acting in their economic best

interest.

o Atoms: single trades.

o Fair value adjustments

o Non-entity specific

Prudent value

o Regulation: CRR/EBA

o Application: CET1

o Percentile: 90%

o Must reflect the exit price at which

the institution can trade within the

capital calculation time horizon.

o Atoms: valuation positions subject

to a specific source of price

unertainty

o Entity specific

o Subject to diversification benefit

(50% weight for MPU, CoCo, MoRi

AVAs)](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-47-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 48

3: Regulation

Fair Value Vs Prudent Value [2]

Why capital and not P&L ?

P&L is accounted under accounting standards

o EU listed companies: use IFRS (International Financial Reporting Standards),

established and maintained by the IASB (International Accounting Standards

Board) see www.ifrs.org

o US listed companies: use GAAP (Generally Accepted Accounting Standards),

established and maintained by the FASB (Financial Accounting Standards Board),

see www.fasb.org

o Convergence towards IFRS is in progress

Both IFRS and GAAP define the fair value as an exit price, not as a prudent price. Fair

value must be fair, not prudent.

Thus, regulators have decided to account for prudent price through capital, instead of

altering the accounting standards.](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-48-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 52

3: Regulation

EBA RTS: prudent valuation scope [1/9]

General rules

Region of application: since the CRR is an EU directive, prudent valuation applies to

all institutions within EU countries. In case of institution made of a central holding and

one or more subsidiaries, prudent valuation applies to those individual subsidiaries

included in EU countries.

Scope of application: the CRR art. 5, defines the prudent valuation scope as including

all trading book positions. However, the CRR art. 34 requires that institutions apply the

standards of art. 105 to all assets measured at fair value. The combination of the above

CRR articles 34 and 105 implies that the prudent valuation scope includes all fair-valued

positions, regardless of whether they are held in the trading book or banking book.

The positions at fair value held in both trading and banking books are the following:

Assets Liabilities

Financial assets held for trading (HFT) Financial liabilities held for trading (HFT)

Financial assets at fair value Financial liabilities at fair value

Financial assets available for sale (AFS) (for

the portion not subject to prudential filters)](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-52-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 53

3: Regulation

EBA RTS: prudent valuation scope [2/9]

Positions excluded:

o the EBA RTS, art. 4.2 and 8.1, allow Institutions to exclude partially or totally from the

prudent valuation scope those positions for which a change in their accounting fair

value has only a partial or zero impact on Common Equity Tier 1 capital. These

positions must be included in proportion to the impact of the relevant valuation

change on CET1 capital.

o In particular these positions are the following:

1. positions subject to prudential filters,

2. exactly matching, offsetting positions (back to back),

3. positions in hedge accounting.

o Notice that, since the size of the positions above may be relevant, the prudent

valuation scope is the primary driver of the AVA figures.

o How to compute inclusion/exclusion in practice ? See next slides.](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-53-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 54

3: Regulation

EBA RTS: prudent valuation scope [3/9]

1. Positions subject to prudential filers

o Positions subject to prudential filters refer to the "Financial assets available for sale"

(AFS). The inclusion/exclusion of these positions from the prudent valuation scope

of application follows the CRR requirements.

o The exact percentages of partial inclusions follows the transitional provisions that

each local Regulator issued in compliance with the above CRR requirements.

o Partial inclusion means, for instance, that if 40% of fair value gains and losses are

filtered in CET1, the residual 60% of fair value gains and losses are included in the

prudent valuation scope. In case of 100% filter, the position is completely excluded

by prudent valuation.

Position under prudential filters (AFS) Inclusion

Government bonds issued by EU countries 0%

Other debt securities (excluding the EU

government bonds above)

Partial inclusion depending on the sign of

the reserve and on local prescriptions

Equity

Partial inclusion depending on the sign of

the reserve and on local prescriptions](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-54-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 55

Transitional provisions issued by national regulators.

3: Regulation

EBA RTS: prudent valuation scope [4/9]

Circolare 285 Banca d’Italia

The applicable percentage following art. 467, par. 3 CRR is:

a) 20% since 1 Jan. 2014 to 31 Dec. 2014

b) 40% since 1 Jan. 2015 to 31 Dec. 2015

c) 60% since 1 Jan. 2016 to 31 Dec. 2016

d) 80% since 1 Jan. 2017 to 31 Dec. 2017

Local

regulation

in Italy

Article 467 CRR

[…] institutions shall include in the calculation of their Common

Equity Tier 1 items only the applicable percentage](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-55-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 56

3: Regulation

EBA RTS: prudent valuation scope [5/9]

Institutions may not include in own funds unrealized gains and losses related to AFS

positions with central administrations.

Circolare 285 Banca d’Italia

The applicable percentage following art. 468, par. 3 CRR is:

a) 100% 1 Jan. 2014 to 31 Dec. 2014

b) 60% since 1 Jan. 2015 to 31 Dec. 2015

c) 40% since 1 Jan. 2016 to 31 Dec. 2016

d) 20% since 1 Jan. 2017 to 31 Dec. 2017

Article 468 CRR

[…] institutions shall remove in the calculation of their Common

Equity Tier 1 items only the applicable percentage

Local

regulation

in Italy](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-56-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 57

3: Regulation

EBA RTS: prudent valuation scope [6/9]

According to Regulation (EU) 2016/445 of the European Central Bank of 14 Mar 2016

(published OJEU on 26 Mar. 2016), art. 14 and 15, the corresponding art. 467 and 468

of CRR (setting prudential filters for AFS positions) are modified such that AFS positions

in EU government Bonds shall no longer subject to 100% filter, but shall be subject to

standard prudential filters holding for other AFS position:

Inclusion of unrealized losses (art. 14 -> art. 467 CRR):

o 60% in [1/1/2016 – 31/12/2016]

o 80% in [1/1/2017 – 31/12/2017]

Exclusion of unrealized gains (art. 15 -> art. 468 CRR):

o 40% in [1/1/2016 – 31/12/2016]

o 20% in [1/1/2017 – 31/12/2017]

First application date: Q4-2016

This regulatory change will change substantially the AVA figures for institutions

with huge positions in EU govies (more or less all banks...).

NEW](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-57-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 58

3: Regulation

EBA RTS: prudent valuation scope [7/9]

2. Exactly matching, offsetting positions (back to back)

o Back to back positions are groups of trades with total null valuation exposure to

market risk factors (interest rates, volatility, etc.), since any variation in the relevant

market valuation inputs generates opposite variations in the value of the trades in

the group, such that the total value is constant. In other words, the group has null

total sensitivity to market risk factors.

o We stress that back to back positions are neutral w.r.t. other risk factors, such as

counterparty defaults, since the trades into the group may be subscribed with

different counterparties.

o From a prudent valuation point of view:

• Simplified approach: 100% exclusion (EBA RTS art. 4.2)

• Core approach: AVAs must be calculated based on the proportion of the

accounting valuation change that impacts CET1 capital (EBA RTS art. 8.1). In

practice:

• AVA MPU, CoCo and MoRi are null,

• AVA UCS, IFC, CoPo, FAC, EaT, OpR must be computed on the total

valuation exposure of the back to back portfolio.](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-58-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 59

3: Regulation

EBA RTS: prudent valuation scope [8/9]

3. Hedge accounting positions

o Hedge accounting positions are characterized by a hedged instrument (e.g. one ore

more securities, loans or mortgages, etc.) and an hedging instrument (e.g. one ore

more interest rate swaps, credit default swaps, etc.).

o The total package of hedged + hedging instruments has, by construction, a reduced

sensitivity to the underlying risk factors.

o From a prudent valuation point of view, all AVAs must be computed on the total

valuation exposure of the hedge accounting portfolio.](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-59-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 60

3: Regulation

EBA RTS: prudent valuation scope [9/9]

Positions subject

to prudential

filters (AFS)

Positions in

hedge

accounting

Positions for which a

change in their

accounting fair value

has only a partial or

zero impact on CET 1

Art. 4.2 and 8.1

EBA RTS Prudent Valuation scope: exclusions

Positions in

back to back

EU Gov. bonds

Other bonds

Equity

General criteria

for exclusion

Positions excluded

% of

exclusion

100% until Sept. 16

Partial, phase in

Partial, phase in

Simplified appr.

Partial, residual exposure

of hedged + hedging items

Core appr.

100%

Partial, residual exposure

to UCS, IFC, CoPo, FAC,

EaT, OpR AVAs](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-60-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 62

3: Regulation

EBA RTS: core approach [1/3]

Core Approach (EBA RTS, sec. 3)

Institutions that at individual or consolidated level exceed the EUR15bn threshold must

apply the core approach.

Each AVA is the excess of valuation adjustments required to achieve the identified

prudent value, over any adjustment applied in the institution’s fair value that can be

identified as addressing the same source of valuation uncertainty as the AVA.

Whenever possible, the prudent value of a position is linked to the 90% percentile of its

price distribution. In practice for AVAs i) Market price uncertainty ii) Close-out costs iii)

Unearned credit spreads, the Institutions must compute the prudent value using the

available market data and the 90% target confidence.

Whenever insufficient data exists to construct a plausible range of values, institutions

shall use an expert-based approach using qualitative and quantitative information

available to achieve a 90% level of certainty in the prudent value.

Additional Valuation

Adjustments](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-62-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 63

3: Regulation

EBA RTS: core approach [2/3]

Core approach

Additional Valuation Adjustments

Market

Price

Uncertainty

(MPU)

Art. 9

Close Out

Costs

(CoCo)

Art. 10

Model Risk

(MoRi)

Art. 11

Unearned

Credit

Spread

(UCS)

Art. 12

Investing &

Funding

Cost

(IFC)

Art. 13

Concen-

trated

Positions

(CoPo)

Art. 14

Future

Admin

Costs

(FAC)

Art. 15

Early

Termination

(EaT)

Art. 16

Main

AVAs

UCS/IFC

AVAs

Other

AVAs

Operational

Risk

(OpR)

Art. 17

The AVA hierarchy

Market risk factors

50% weights for diversification

Market risk factors

Split onto main AVAs

Non-market risk factors

100% weights, no diversification](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-63-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 64

3: Regulation

EBA RTS: core approach [3/3]

Example of AVA calculation and aggregation

under the core approach.

IFC and UCS AVAs are split into their MPU, CoCo and

MoRi components and pre-aggregated to the

corresponding AVAs, then the total AVA is obtained from

the aggregation of the other seven residual AVAs. In order

to show toy but realistic figures, we assumed the principal

AVAs equal to 1/7 of the 99% x 0.1% of the total FV under

the core approach. AVA OpR has been calculated as for a

non-AMA Institution. In the last line, we also add a

possible AVA fall-back calculated on the remaining 1% x

0.1% of the total FV.

Above

threshold](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-64-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 65

3: Regulation

EBA RTS: fall-back approach [1/2]

Fall back approach (EBA RTS, art. 7.2.b)

Institutions that exceed the EUR15bn threshold but cannot calculate the core approach

AVAs for certain positions, are allowed to apply a «fall-back approach» (actualy very

capital intensive), and compute AVAs for those positions as the sum of:

100% of the net unrealised profit (NUP)

10% of the notional value in case of derivatives;

25% of the absolute difference between the fair value (FV) and the net unrealised

profit for non-derivatives.

In formulas:

"unrealised profit shall mean the change, where positive, in fair value since trade

inception, determined on a first-in-first-out basis.”

A𝑉𝐴 𝑓𝑏 = 100% 𝑁𝑈𝑃+

+ 10% 𝑁 𝐷𝑒𝑟 + 25% 𝐹𝑉 − 𝑁𝑈𝑃+

𝑁𝑜𝑛−𝐷𝑒𝑟

𝑁𝑈𝑃+

: = 𝑚𝑎𝑥

𝑖=1

𝑁 𝑓𝑏

𝑁𝑈𝑃𝑖 , 0 , 𝑁 𝐷𝑒𝑟 =

𝑖=1

𝑁 𝑓𝑏

𝑁𝑖 , 𝐹𝑉 =

𝑖=1

𝑁 𝑓𝑏

𝐹𝑉𝑖 .](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-65-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 66

3: Regulation

EBA RTS: fall-back approach [2/2]

Example of AVA

calculation under the

fall-back approach. We

assume to apply the

Fall-Back approach to

the 1% portion of the

previous core portfolio.

The net unrealized

P&Ls are the 0.1% of

the fair values, positive

for derivatives and

negative for bonds. The

notional for derivatives

is assumed 10 times

the fair value. The AVA

Fall-Back is then

summed to the

remaining 99% of the

previous AVA core to

obtain the total AVA.](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-66-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 67

The core approach is mandatory only for institutions above the threshold of €15 bln.

Institutions below the threshold may choose between simplified and core approaches.

Which one is more convenient (generate smaller capital absorption) ?

There is no precise mathematical relation between the simplified and core AVAs.

The actual figures depend principally on the actual positions

included in the prudent valuation scope.

3: Regulation

Simplified vs core approaches [1/2]](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-67-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 70

Recently, two regulators proposed a consultation on enhancements to the reporting of

prudent valuation figures.

The industry (ISDA, IIF, AFME, etc.) is actively discussing the proposed template and

comments to BCBS are expected. Main issues are the following:

o Partial overlapping and consistency of AVA definitions under BCBS and EBA RTS

o Different AVA scopes of applications, since EBA RTS allows for many exclusions.

o AVAs break down by asset class is problematic for EU Institutions because EBA RTS

requires AVA calculation at valuation exposure level. For example, AVA MPU for some

risk factor (e.g. IR/vols and FX rates/vols) naturally include multiple asset classes.

1. BCBS Consultative Document, “Pillar 3 disclosure requirements –

consolidated and enhanced framework”, March 2016, issued for

comment by 10 June 2016.

Template PV1, in particular, aims to disclose prudent valuation

figures under Pillar 3, consistently with previous BCBS

requirements:

o BCBS “International Convergence of Capital Measurement and

Capital Standards” (Basel 2, comprehensive version) June 2006,

paragraphs 698-701.

o BCBS “Supervisory guidance for assessing banks’ financial

instrument fair value practices”, April 2009 (in particular Principle

10).

3: Regulation

Prudent valuation reporting [1/3]

NEW](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-70-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 71

Template PV1 proposed in BCBS Consultative Document,

“Pillar 3 disclosure requirements – consolidated and enhanced framework”, March 2016, issued for comment by 10 June 2016.

3: Regulation

Prudent valuation reporting [2/3]

NEW](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-71-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 72

2. EBA consultation paper (EBA/CP/2016/02), ”Draft

implementing Technical Standards amending Commission

Implementing Regulation (EU) 680/2014 on supervisory

reporting of institutions”, 4 March 2016, issued for comment

by 31 March 2016.

The proposed amendement of prudent valuation

supervisory reporting is articulated into four new templates.

Template C 32.01: fair valued asset and liabilities

o Rows: accounting categorisation (HFT, AFS, etc.)

o Columns: fair value amounts of inclusions and

exclusions according to EBA RTS

Template C 32.02: core approach

o Rows: break down by portfolio/trade class (vanilla/exotic), diversification benefit, fall back app.

o Columns: AVAs and fair value adjustments according to EBA RTS.

Template C 32.03: focus on AVA MoRi

Template C 32.01: focus on AVA CoPo

Main issues are the following:

breakdown by portfolio/trade class (vanilla/exotic) is not consistent with AVA calculation by

valuation exposures,

amount of data required

3: Regulation

Prudent valuation reporting [3/3]

NEW](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-72-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 73

FV under prudent valuation scope = FV asset & liabilities – FV under prudential filters

3: Regulation

Prudent valuation data: QIS [1/3]](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-73-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 74

The EBA conducted a QIS to estimate the total impact of the requirements of the RTS

including 59 banks across 15 jurisdictions, with the following results.

Small banks: < 15 €/bln

Medium banks: 15 - 100 €/bln

Large banks: > 100 €/bln

Average

227 €/mln

per bank

3: Regulation

Prudent valuation data: QIS [2/3]](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-74-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 75

According to EBA: [*]

approximately 6,500 credit institutions across EEA Member States (as of 2013) report

supervisory data to their respective competent authorities.

Total value of assets: approximately EUR 42,000 billion.

Approximately 750 institutions (11%) are above the EUR 15 billion threshold.

[*] European Banking Authority, Consultation Paper, “Draft Implementing Technical Standards amending

Commission Implementing Regulation (EU) 680/2014 on supervisory reporting of institutions”, 4 March 2016,

https://www.eba.europa.eu/-/eba-seeks-comments-on-reporting-of-prudent-valuation-

information

3: Regulation

Prudent valuation data: QIS [3/3]](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-75-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 76

3: Regulation

Prudent valuation data: 2014-2015 [1/3]

Source: elaboration of public data (in collaboration with Ernst Young).

NEW](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-76-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 77

3: Regulation

Prudent valuation data: 2014-2015 [2/3]

Source: elaboration of public data (in collaboration with Ernst Young).

NEW](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-77-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 78

Comments

Fair value is given by FV assets + FV liablities including

o Held for trading (HFT)

o Fair Value Option (FVO)

o Hedging Derivatives (HD)

o Available For Sale (AFS)

Fair value for prudent valuation has been estimated from fair value excluding HD and

AFS (100%, no AFS filters applied, slightly underestimated).

AVA/CET1 figures are rather different, ranging from negligible to important %.

AVA core / AVA simplified > 1 in a few cases, thus AVA simplified is neither an AVA

cap nor an AVA floor.

Prudent valuation not driven by L3 instruments: moving from AVA/L3 to AVA /(L2+L3)

changes the figures by a factor of 100.

2014-2015 average AVAs double the 2013 QIS result (500 vs 227 mln€).

3: Regulation

Prudent valuation data: 2014-2015 [3/3]

NEW](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-78-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 79

1. XVAs

3: Regulation

Prudent valuation data: survey [1/4]

Restricted access to clients only

Dec.2015

30 respondents (18 GSIBs, 15 UK)

60 questions

EBA RTS not yet in place at the time

One third does not account FVA in fair

value, more than half does account AVA

IFC in prudent value.

MVA and KVA are not accounted both in

fair and prudent values.

NEW](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-79-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 80

1. XVAs (cont’d)

3: Regulation

Prudent valuation data: survey [2/4]

Only 30% use a spread term structure

«Peer estimate» is a possible answer to

the question «what is an exit price for

FVA ?»

Possible use of Markit XVA service

Both funding spreads sources and term

structures vary considerably, both for

FVA (Fair Value) and for AVA IFC

(prudent value)

NEW](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-80-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 81

2. P&L variance test

3: Regulation

Prudent valuation data: survey [3/4]

The P&L variance test is difficult to run

and pass in case of many relevant risk

factors, and may lead to huge AVA MPU.

60% ignore the P&Lvariance test

Only 7% run extensive application

Only 14% apply with quarterly frequency

NEW](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-81-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 82

3. Other

3: Regulation

Prudent valuation data: survey [4/4]

One half does apply/does not apply

offsetting between AVAs and other

regulatory capital reserves.

Possible offsets should be clarified, to

avoid possible capital double countings.

One third reduces the valuation

exposure.

NEW](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-82-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 84

4: AVA calculation

Definitions and basic assumptions [1]

In other words, a valuation position will display valuation exposures to its valuation

inputs. Clearly the degree of valuation exposure to a valuation input depends on the

particular valuation position.

Definitions (EBA RTS art. 2)

Item Definition Example

Valuation

position

A portfolio of financial instruments or

commodities measured at fair value, held in

both trading and non-trading books

E.g. a portfolio of

derivatives

Valuation

input

A set of parameters (observable or non-

observable) that influences the fair value of a

valuation position

E.g. yield curve,volatility

cube, market/historical

correlations, prepayment,

etc.

Valuation

exposure

The amount of a valuation position which is

sensitive to the change in a valuation input

E.g. the trades in portfolio

above sensible to the

valuation inputs above.](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-84-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 85

4: AVA calculation

Definitions and basic assumptions [2]

Fair value

In general, we denote the fair value of a valuation position 𝑝𝑖 at time t with 𝐹𝑉 𝑡, 𝑝𝑖 or,

shortly, with 𝐹𝑉𝑖 𝑡 , with 𝑖 = 1, … , 𝑁 𝑝. Given a set of valuation positions subject to

prudent valuation, we denote the total fair value as

𝐹𝑉 𝑡 =

𝑖=1

𝑁 𝑝

𝐹𝑉𝑖 𝑡

In the context of prudent valuation, we consider the following properties of fair value FV.

FV is positive for assets (𝐹𝑉𝑖 𝑡 > 0) and negative for liabilities (𝐹𝑉𝑖 𝑡 < 0).

Financial institutions have appropriate internal IPV process in place (EBA RTS, p. 7).

FV is computed by the institution consistently with the applicable financial reporting

standards, e.g. IFRS13, and with its internal fair value policy.

The institution possibly applies and reports a number of valuation adjustments to the

FV, according to its internal fair value policy.](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-85-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 86

4: AVA calculation

Definitions and basic assumptions [3]

Fair value (cont’d)

The FV of a valuation position may be subject to the sources of uncertainty

mentioned in the CRR, art. 105.10-11, and thus associated to a specific AVA under

the core approach described in the EBA RTS.

According to EBA RTS art. 8.3, the FV of a valuation position associated to a specific

AVA under the core approach must include all the fair value adjustments possibly

applied by the institution associated to the same source of valuation uncertainty as

the specific AVA. In case a fair value adjustment cannot be associated to the same

source of valuation uncertainty of a specific AVA, it must not be included in the FV for

the specific AVA calculation. In case of impossible association with any AVA, the fair

value adjustment cannot be included at all in the prudent valuations scope.](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-86-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 87

4: AVA calculation

Definitions and basic assumptions [4]

Fair value (cont’d)

Fair value for derivatives

In general, we may consider the fair value for derivatives split into various

components,

𝐹𝑉 𝑡 = 𝑉0 𝑡 + 𝑉𝐴𝑑𝑗 𝑡

𝑉𝐴𝑑𝑗 𝑡 = 𝑉𝑏𝐶𝑉𝐴 𝑡 + 𝑉𝐹𝑉𝐴 𝑡 + 𝑉𝐵𝑖𝑑𝐴𝑠𝑘 𝑡 + 𝑉 𝑀𝑜𝑑𝑒𝑙𝑅𝑖𝑠𝑘 𝑡 + ⋯

where

o 𝑉0 𝑡 is the “base” fair value component at valuation time t, as if the contract were

covered by a perfect CSA;

o the other components gathered in 𝑉𝐴𝑑𝑗 𝑡 corresponds to the value of the various

risk components underlying the financial instrument, such as the bilateral

counterparty risk 𝑉𝑏𝐶𝑉𝐴 𝑡 , funding risk 𝑉𝐹𝑉𝐴 𝑡 , bid-ask 𝑉𝐵𝑖𝑑𝐴𝑠𝑘 𝑡 , model risk

𝑉 𝑀𝑜𝑑𝑒𝑙𝑅𝑖𝑠𝑘 𝑡 , etc. Such components may be considered or not in the FV or in in

𝑉𝐴𝑑𝑗 𝑡 according to the fair value policy of the institution.](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-87-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 88

4: AVA calculation

Definitions and basic assumptions [5]

Fair value (cont’d)

Fair value for securities

We consider the fair value for securities, instead, as a single value, without splitting

into distinct components. In other words, the value of the various risk components is

included in the credit spread associated to the security.](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-88-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 89

4: AVA calculation

Definitions and basic assumptions [6]

Valuation input

The FV of a valuation position 𝑝𝑖 depends on its valuation inputs, denoted with

𝑢𝑗, 𝑗 = 1, … , 𝑁 𝑢,

The FV may be also denoted as 𝐹𝑉(𝑡, 𝑝𝑖, 𝑢1, … , 𝑢 𝑁 𝑢

). We stress that different

valuation positions depend, in general, on different valuation inputs.

The valuation input 𝑢𝑗 is associated to a single elementary risk factor, or source of

valuation uncertainty.](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-89-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 90

4: AVA calculation

Definitions and basic assumptions [7]

Valuation exposure

The valuation exposure of a valuation position 𝑝𝑖 to the valuation input 𝑢𝑗 is the

amount of that valuation position which is sensitive to the change in the valuation

input 𝑢𝑗.

The valuation exposure can be also associated to the sensitivity of the valuation

position 𝑝𝑖 to the valuation input 𝑢𝑗.

In a wider sense, the valuation exposure is anything that measures the dependency

of the FV of the valuation position 𝑝𝑖 to the valuation input 𝑢𝑗.](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-90-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 91

4: AVA calculation

Definitions and basic assumptions [8]

Prudent value

We denote the prudent value of category k for a valuation position 𝑝𝑖 associated to

the source of valuation uncertainty 𝑢𝑗 at time t with 𝑃𝑉 (𝑡, 𝑝𝑖, 𝑢𝑗, 𝑘) or, shortly, with

𝑃𝑉𝑖𝑗𝑘 𝑡 , with 𝑗 = 1, … , 𝑁 𝑢 and 𝑘 = 1, … , 𝑁𝐴𝑉𝐴. The category is the AVA type (MPU,

CoCo, etc…).

Degree of certainty

The CRR (article 105.1) requires a prudent value that achieves an “… appropriate

degree of certainty”. The EBA RTS specifies the appropriate degree of certainty as

follows.

o AVA MPU, CoCo e MoRi (art. 9-11):

• where possible, the prudent value of a position is linked to a range of

plausible values and a specified target level of certainty (90%);

• in all other cases, an expert-based approach is allowed, using qualitative

and quantitative information available to achieve an equivalent level of

certainty as above (90%).

o AVA UCS and IFC (art. 12-13): these AVAs must be split into their MPU, CoCo

and MoRi components, and aggregated to the corresponding MPU, CoCo and

MoRi AVAs, respectively. Thus, the same level of certainty in the prudent value

(90%) must be statistically achieved.](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-91-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 92

4: AVA calculation

Definitions and basic assumptions [9]

Prudent value (cont’d)

o Other AVAs (CoPo, FAC, ET, OpR, art. 14-17): it must be statistically achieved

the same level of certainty in the prudent value (90%) as for the previous AVAs

(art. 8.3).

o For positions where there is valuation uncertainty but it is not possible to

statistically achieve a specified level of certainty, the same target degree of

certainty in the prudent value (90%) is required.

o “The EBA accepts that for the majority of positions where there is valuation

uncertainty, it is not possible to statistically achieve a specified level of

certainty; however, specifying a target level is believed to be the most

appropriate way to achieve greater consistency in the interpretation of a

“prudent’ value”.”

In conclusion, the same degree of certainty in the prudent value (90%)

must be achieved for all AVAs.](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-92-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 93

4: AVA calculation

Definitions and basic assumptions [10]

Prudent value (cont’d)

o Notice that, by definition, the prudent value is always equal to or lower than the

fair value, both for assets and liabilities. Taking into account the FV definition

above we have, for both assets and liabilities,

𝑃𝑉𝑖𝑗𝑘 𝑡 ≤ 𝐹𝑉𝑖 𝑡 ∀ 𝑖 = 1, … , 𝑁 𝑝, 𝑗 = 1, … , 𝑁 𝑢, 𝑘 = 1, … , 𝑁𝐴𝑉𝐴

o Hence, PV is generally positive for assets (𝑃𝑉𝑖𝑗𝑘 𝑡 > 0) and negative for

liabilities (𝑃𝑉𝑖𝑗𝑘 𝑡 < 0). This is not strictly true in all cases, since some asset

(e.g. an OTC swap) may have positive FV and negative PV (not viceversa).](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-93-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 94

4: AVA calculation

Definitions and basic assumptions [11]

Additional Valuation Adjustment (AVA)

Simplified approach

Given the total fair value of assets and liabilities, 𝐹𝑉𝐴𝑠𝑠𝑒𝑡𝑠 𝑡 > 0, 𝐹𝑉𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 𝑡 < 0,

the total AVA under the simplified approach is given by the following expression

𝐴𝑉𝐴 𝑡 = 0.1% × 𝐹𝑉𝐴𝑠𝑠𝑒𝑡𝑠 + 𝐹𝑉𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠

where

𝐹𝑉𝐴𝑠𝑠𝑒𝑡𝑠 ≔

𝑖=1

𝑁 𝐴𝑠𝑠𝑒𝑡𝑠

𝐹𝑉𝑖 𝑡 ,

𝐹𝑉𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 ≔

𝑖=1

𝑁 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠

𝐹𝑉𝑖 𝑡 .](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-94-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 95

4: AVA calculation

Definitions and basic assumptions [12]

Additional Valuation Adjustment (AVA) (cont’d)

Core approach

Given the fair value of a valuation position 𝑝𝑖, 𝐹𝑉𝑖 𝑡 , and the corresponding prudent

value of category k associated to the source of valuation uncertainty 𝑢𝑗, 𝑃𝑉𝑖𝑗𝑘 𝑡 , the

AVA under the core approach is given by the following expressions

𝐴𝑃𝑉𝐴 𝑡, 𝑝𝑖, 𝑢𝑗, 𝑘 : = 𝑤 𝑘 𝐹𝑉 𝑡, 𝑝𝑖 − 𝑃𝑉 𝑡, 𝑝𝑖, 𝑢𝑗, 𝑘 ,

𝐴𝑉𝐴 𝑡, 𝑘 : =

𝑖=1

𝑁 𝑝

𝑗=1

𝑁 𝑢

𝐴𝑃𝑉𝐴 𝑡, 𝑝𝑖, 𝑢𝑗, 𝑘 ,

where:

o 𝑤 𝑘 is the aggregation weight, such that 𝒘 = 0.5,0.5,0.5,1,1,1,1 for the seven

AVAs MPU, CoCo, MoRi, CoPo, FAC, ET, OpR, respectively.

o 𝐴𝑃𝑉𝐴𝑖𝑗𝑘 𝑡 ≔ 𝐴𝑃𝑉𝐴 𝑡, 𝑝𝑖, 𝑢𝑗, 𝑘 is the k-th AVA for valuation position 𝑝𝑖 and source

of valuation uncertainty 𝑢𝑗 at time t, weighted for aggregation;

o 𝐴𝑉𝐴 𝑡, 𝑘 is the total k-th category level AVA associated to all relevant sources of

valuation uncertainty 𝑢1, … , 𝑢 𝑁 𝑢

and valuation positions 𝑝1, … , 𝑝 𝑁 𝑝

. Also this AVA is

already weighted for aggregation by construction of 𝐴𝑃𝑉𝐴𝑖𝑗𝑘 𝑡 .](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-95-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 96

4: AVA calculation

Definitions and basic assumptions [13]

Additional Valuation Adjustment (AVA) (cont’d)

Notice that:

𝐴𝑉𝐴 𝑘 𝑡 always include the aggregation weight 𝑤 𝑘 at any level (valuation exposure,

total AVA, total PVA);

𝐴𝑉𝐴 𝑘 𝑡 ≥ 0 ∀ 𝑘 at any level (valuation exposure, total AVA, total PVA), both pre and

post aggregation;

𝐴𝑉𝐴 𝑘 𝑡 = 0 when the fair value is already prudent w.r.t. the 𝐴𝑉𝐴𝑗 source of valuation

uncertainty, 𝐹𝑉𝑖 𝑡 = 𝑃𝑉𝑖𝑗𝑘 𝑡 ;

the previous expressions holds both for assets (𝐹𝑉i 𝑡 > 0) and liabilities (𝐹𝑉i 𝑡 <

0).](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-96-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 97

4: AVA calculation

Definitions and basic assumptions [14]

Additional Valuation Adjustment (AVA) (cont’d)

AVA for derivatives

Remind that for derivatives the total value may be split across different components

𝐹𝑉 𝑡 = 𝑉0 𝑡 + 𝑉𝐴𝑑𝑗 𝑡

𝑉𝐴𝑑𝑗 𝑡 = 𝑉𝑏𝐶𝑉𝐴 𝑡 + 𝑉𝐹𝑉𝐴 𝑡 + 𝑉𝐵𝑖𝑑𝐴𝑠𝑘 𝑡 + 𝑉 𝑀𝑜𝑑𝑒𝑙𝑅𝑖𝑠𝑘 𝑡 + ⋯

We assume that such components are not strongly correlated. In particular, we

assume that the market value is not strongly correlated with credit and funding risk.

In this case, also the AVAs results to be split across the same components

𝐴𝑃𝑉𝐴 𝑡, 𝑝𝑖, 𝑢𝑗, 𝑘 = 𝐴𝑃𝑉𝐴0 𝑡, 𝑝𝑖, 𝑢𝑗, 𝑘 + 𝐴𝑃𝑉𝐴 𝑡, 𝑝𝑖, 𝑢𝑗, 𝐶𝑉𝐴 + 𝐴𝑃𝑉𝐴 𝑡, 𝑝𝑖, 𝑢𝑗, 𝐹𝑉𝐴 + ⋯](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-97-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 98

4: AVA calculation

Definitions and basic assumptions [15]

Prudent Valuation Adjustment (PVA)

The total Prudent Valuation Adjustment (PVA), to be deduced from the CET1, is

computed as follows.

𝑃𝑉𝐴 𝑡 ≔

𝐴𝑉𝐴(𝑡) Simplified approach,

𝑘=1

𝑁 𝐴𝑉𝐴

𝐴𝑉𝐴 𝑘 𝑡 Core approach.

The detailed AVA aggregation rules under the core approach are discussed within the

detailed AVA calculation rules in the following.](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-98-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 99

4: AVA calculation

Definitions and basic assumptions [16]

AVA aggregation

The total AVA under the core approach is computed using the following algorithm.

CoPo, FAC, EaT, OpR AVAs are aggregated each as the sum of its corresponding

individual components at valuation positions level, each weighted at 100%.

UCS and IFC AVAs are decomposed each into 3 components related to MPU, CoCo

and MoRi uncertainties, which are taken into account in the total MPU, CoCo and

MoRi AVA aggregation discussed below.

MPU, CoCo and MoRi AVAS are aggregated each as the sum of:

o its individual components at valuation positions level

o the corresponding UCS and IFC AVA contributions above,

o all weighted at 50%.

The total AVA is computed as the simple sum of the residual MPU, CoCo, MoRi,

CoPo FAC, EaT, OpR AVAs determined above.

In conclusion, the final aggregation includes 50% of MPU, MoRi, CoCo, UCS and IFC

AVAs (5 out of 9), and 100% of CoPo FAC, EaT, OpR AVAs (4 out of 9).](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-99-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 100

4: AVA calculation

Definitions and basic assumptions [17]

Definitions summary

Item Definition Comments

Fair value 𝐹𝑉 𝑡 =

𝑖=1

𝑁 𝑝

𝐹𝑉𝑖 𝑡 i = index for valuation positions

Prudent Value

𝑃𝑉𝑖𝑗𝑘 𝑡 ≤ 𝐹𝑉𝑖 𝑡

∀ 𝑖 = 1, … , 𝑁 𝑝, 𝑗 = 1, … , 𝑁 𝑢, ∀ 𝑘 = 1, … , 𝑁𝐴𝑉𝐴

o j = index for risk factors

o k = index for AVAs

Additional

Valuation

Adjustment

(simplified)

𝐴𝑉𝐴 𝑡 = 0.1%

𝑖=1

𝑁 𝐴𝑠𝑠𝑒𝑡𝑠

𝐹𝑉𝑖 𝑡 +

𝑖=1

𝑁 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠

𝐹𝑉𝑖 𝑡

𝐴𝑉𝐴 𝑡 is the total valuation

adjustment at time t

Additional

Valuation

Adjustment

(core)

𝐴𝑃𝑉𝐴𝑖𝑗𝑘 𝑡 ∶= 𝑤 𝑘 𝐹𝑉𝑖 𝑡 − 𝑃𝑉𝑖𝑗𝑘 𝑡 ,

𝐴𝑉𝐴 𝑘 𝑡 : =

𝑖=1

𝑁 𝑝

𝑗=1

𝑁 𝑢

𝐴𝑃𝑉𝐴𝑖𝑗𝑘 𝑡

o 𝐴𝑃𝑉𝐴𝑖𝑗𝑘 𝑡 is the k-th AVA

associated to source of

valuation uncertainty j and

valuation position i at time t,

o 𝐴𝑉𝐴 𝑘 𝑡 is the total k-th AVA at t

Prudent

Valuation

Adjustment

𝑃𝑉𝐴 𝑡 ≔

𝐴𝑉𝐴(𝑡) Simplified

𝑘=1

𝑁 𝐴𝑉𝐴

𝐴𝑉𝐴 𝑘 𝑡 Core

𝑃𝑉𝐴 𝑡 is the total valuation

adjustment at time t](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-100-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 101

Price distribution, fair value, fair value adjustment, prudent value, AVA

What about real

price distributions...?

Fair value

(mean)Fair value

adjusted

Prudent value

(quantile)

Fair value adjustment

AVA

4: AVA calculation

Definitions and basic assumptions [18]](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-101-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 104

4: AVA calculation

AVA Market Price Uncertainty (MPU) [1]

AVA definition

AVA Market Price Uncertainty (MPU) refers to the valuation uncertainty of a valuation

exposure arising from uncertainty of a valuation input.

This kind of uncertainty is rather common in price evaluation and may appear in

different situations, for example:

o when the financial instrument is marked to market (e.g. a bond listed), and there

are multiple reliable price contributors;

o when the financial instrument is marked to model using some valuation input (e.g.

an OTC IRS valued using multiple yield curves based on IRS market quotes), and

there are multiple price contributors for the valuation inputs (e.g. multiple IRS

market makers).

AVA main references

o EBA RTS, article 9.

o EBA FAQs 6.1, 21, 23, 23.1, 28, 30, 31, 40.1, 40.3.](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-104-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 105

4: AVA calculation

AVA Market Price Uncertainty (MPU) [2]

AVA scope of application

Within the general prudent valuation scope (see before), AVA MPU regards in

particular those valuation positions without either a firm tradable price, or a price that

can be determined from reliable data based on a liquid two-way market, and such

that at least one valuation input has material valuation uncertainty.

AVA MPU shall be computed for all valuation positions 𝑝𝑖, 𝑖 = 1, … , 𝑁 𝑝 showing a

valuation exposure to a valuation input 𝑢𝑗, 𝑗 = 1, … , 𝑁 𝑢 (valuation exposure level).

We stress that a single valuation position 𝑝𝑖 may show a valuation exposure to either

none, or one, or a few, or many, or all valuation inputs 𝑢𝑗. Thus we may have

A𝑃𝑉𝐴 𝑀𝑃𝑈 𝑡, 𝑝𝑖, 𝑢𝑗1

= 0 and 𝐴𝑃𝑉𝐴 𝑀𝑃𝑈 𝑡, 𝑝𝑖, 𝑢𝑗2

≠ 0 for the same valuation position

𝑝𝑖 and two different valuation inputs 𝑢𝑗1

≠ 𝑢𝑗2

.

AVA Fair Value

The FV of the trades subject to AVA MPU may include or not the effect of possible

MPU. In some particular cases, Institutions may account FV adjustments in their

balance sheets to cover possible losses related to MPU. In this case the FV subject

to prudent valuation for AVA MPU must include these FV adjustments, or, in other

words, such FV adjustments must be subtracted from the AVA MPU (keeping the AVA

non-negative).](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-105-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 106

4: AVA calculation

AVA Market Price Uncertainty (MPU) [3]

Does the valuation position have a valuation

exposure 𝑝𝑖, 𝑖 = 1, … , 𝑁𝑝, to uncertainty of

valuation inputs 𝑢𝑗, 𝑗 = 1, … , 𝑁 𝑢?

o Is there firm evidence of a tradable price for the valuation

exposure 𝑝𝑖 ?

o Or can the price for the valuation exposure 𝑝𝑖 be determined

from reliable data based on a liquid two-way market (as

defined in art. 338 of CRR) ?

𝐴𝑃𝑉𝐴 𝑀𝑃𝑈 𝑡, 𝑝𝑖, 𝑢𝑗 = 0

YES

Compute individual 𝐴𝑃𝑉𝐴 𝑀𝑃𝑈 𝑡, 𝑝𝑖, 𝑢𝑗

for each valuation exposure 𝑝𝑖 to

each valuation input 𝑢𝑗

Do sources of market

data indicate no

material valuation

uncertainty ?

YES

YES

NO

NO

AVA Market Price Uncertainty (MPU) (EBA RTS, article 9) refers to the valuation uncertainty of a

valuation exposure arising from uncertainty of a valuation input.

NO

Continue](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-106-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 107

4: AVA calculation

AVA Market Price Uncertainty (MPU) [4]

o Use the data sources defined in Art. 3.

o Calculate AVAs on valuation exposures 𝑝𝑖 related to each valuation input 𝑢𝑗 used in the

relevant valuation model.

o For non-derivative valuation positions, or derivative positions which are marked to market,

refer to the instrument price, or decompose into each valuation input required to calculate

the exit price, treated separately.

o If a valuation input 𝑢𝑗 consists of a (D-dimensional) matrix of parameters, 𝑢𝑗

𝛼𝛽𝛾…

, calculate

𝐴𝑃𝑉𝐴 𝑀𝑃𝑈 𝑡, 𝑝𝑖, 𝑢𝑗 based on the valuation exposures related to each matrix element 𝑢𝑗

𝛼𝛽𝛾…

.

o If a valuation input 𝑢𝑗 does not refer to tradable instruments, map the valuation input and

the related valuation exposure to a set of market tradable instruments.

Do you reduce the number

of parameters of the

valuation input 𝑢𝑗 (D-dim.

matrix) for the purpose of

calculating AVAs ?

Continue

NO

P&L

variance

test

Positive

YES

Negative

Subject to independent

control function review

and internal validation on

at least an annual basis](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-107-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 108

4: AVA calculation

AVA Market Price Uncertainty (MPU) [5]

Estimate a point

ො𝑢𝑗 within the

range with 90%

confidence to exit

the valuation

exposure at that

price or better.

Use expert-based

approach using

qualitative and

quantitative

information

available to achieve

a prudent value ො𝑢𝑗

with confidence

level equivalent to

90%.

Do sufficient data exists to

construct a range of

plausible values for a

valuation input 𝑢𝑗?

YES

NO

Notify competent

authorities of the

valuation

exposures for

which this

approach is

applied, and the

methodology used

to determine the

AVA.

Estimate a point

ො𝑢𝑗 within the

range with 90%

confidence that

the mid value that

could be achieved

in exiting the

valuation

exposure would

be at that price or

better.

Continue

Is the range of

plausible values

of 𝑢𝑗 is based on

exit prices ?

Is the range of

plausible values

of 𝑢𝑗 is based on

mid prices ?

NO

YES](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-108-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 109

4: AVA calculation

AVA Market Price Uncertainty (MPU) [6]

Compute individual AVA MPU

𝐴𝑃𝑉𝐴 𝑀𝑃𝑈 𝑡, 𝑝𝑖, 𝑢𝑗 = 𝑤 𝑀𝑃𝑈 𝐹𝑉 𝑡, 𝑝𝑖, 𝑢𝑗 − 𝑃𝑉 𝑀𝑃𝑈 𝑡, 𝑝𝑖, 𝑢𝑗

Apply the valuation input uncertainties ො𝑢𝑗 to valuation

exposures 𝑝𝑖 and compute prudent value MPUs

By revaluation:

𝑃𝑉 𝑀𝑃𝑈 𝑡, 𝑝𝑖, 𝑢𝑗 = 𝐹𝑉 𝑀𝑃𝑈 𝑡, 𝑝𝑖, ො𝑢𝑗

or (when the uncertain input is the

instrument price):

𝑃𝑉 𝑀𝑃𝑈 𝑡, 𝑝𝑖, 𝑢𝑗 = ො𝑢𝑗

By exposure

𝑃𝑉 𝑀𝑃𝑈 𝑡, 𝑝𝑖, 𝑢𝑗 = 𝐹𝑉 𝑡, 𝑝𝑖, 𝑢𝑗 −

𝜕𝐹𝑉

𝜕𝑢𝑗

ො𝑢𝑗 − 𝑢𝑗

Compute total category level AVA MPU

𝐴𝑉𝐴 𝑀𝑃𝑈 𝑡 =

𝑖=1

𝑁 𝑝

𝑗=1

𝑁 𝑢

𝐴𝑃𝑉𝐴 𝑀𝑃𝑈 𝑡, 𝑝𝑖, 𝑢𝑗](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-109-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 110

4: AVA calculation

AVA Market Price Uncertainty (MPU) [7]

AVA calculation

o Securities

• Impaired/defaulted securities

𝐴𝑉𝐴 𝑀𝑃𝑈 𝑡 = 0 if the FV is already conservative and does not depend on

uncertain market data, otherwise go to next cases.

• Liquid securities accounted at Fair Value Level 1

𝐴𝑉𝐴 𝑀𝑃𝑈 𝑡 = 0, if the FV is calculated on market tradable prices with negligible

bid-ask, otherwise go to next cases.

• Contributed securities accounted at Fair Value Level 1

a possible approach is

A𝑉𝐴 𝑀𝑃𝑈 𝑡 = 𝑤 𝑀𝑃𝑈 ൝

+0.9 × 𝐹𝑉 𝑡 − 𝑉𝑏𝑖𝑑

𝑚𝑖𝑛

𝑡 long positions,

−0.9 × 𝐹𝑉 𝑡 − 𝑉𝑎𝑠𝑘

𝑚𝑎𝑥

𝑡 short positions.

where 𝑉𝑏𝑖𝑑

𝑚𝑖𝑛

𝑡 /𝑉𝑏𝑖𝑑

𝑚𝑖𝑛

𝑡 are the lowest/highest bid/ask prices quoted at time t,

and 𝑤 𝑀𝑃𝑈 = 0.5.

• Securities accounted at Fair Value Level 2 or 3

AVA MPU shall be computed via sensitivity or full revaluation based on relevant

risk factors, in particular credit spread and interest rate curves, using prudent

MPUs.](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-110-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 111

4: AVA calculation

AVA Market Price Uncertainty (MPU) [8]

AVA calculation (cont’d)

o Derivatives

AVA MPU is computed via sensitivity or full revaluation based on relevant risk

factors.

MPU estimation

AVA MPU calculation is based on the estimation of MPUs of relevant (possibly all)

risk factors, including volatilities and correlations.

Possible sources of MPUs are the following.

o Front office traders active in their respective markets.

o Appropriate selection of multiple contributors (brokers, market makers) available

from data providers (i.e. Bloomberg or Reuters).

o Consensus price services (e.g. Markit).

o Collateral counterparty valuations for derivatives.

o Historical series of prices and market data](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-111-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 112

4: AVA calculation

AVA Market Price Uncertainty (MPU) [9]

Examples

o Bond for which there exist multiple price contributors.

o IRS valued using multiple yield curves based on market quotations (Fras, Futures,

OIS, IRS, Basis IRS, etc.) for which there exist multiple market makers.](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-112-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 113

4: AVA calculation

AVA Market Price Uncertainty (MPU) [10]

Case study of AVA MPU calculation for a security.

• Top left: market bid and ask prices. FV is

computed as average mid price = 162.25.

• Bottom left: ranking and percentiles of mid prices,

AVA MPU for long and short positions, equal to

0.14 and 0.12, respectively.

• Top right: distribution chart.](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-113-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 114

4: AVA calculation

AVA Market Price Uncertainty (MPU) [11]

Examples with sensitivities.

See EBA RTS sec. 4.1.1 and ref. [23].](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-114-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 115

4: AVA calculation

AVA Market Price Uncertainty (MPU) [12]

P&L variance test

Notation

𝑅𝑖𝑗, 𝑖 = 1, … , 𝑁 𝑅, 𝑗 = 0, … , 𝑁 𝑑 = i-th risk factor (scalar, vector or matrix element,

generically indexed by i with some ordering) for j-th date (backward time ordered, j =

0 = today, j = 1 = yesterday business day, etc….).

Δ𝑅𝑖𝑗 ≔ 𝑅𝑖𝑗 − 𝑅𝑖𝑗−1 = j-th daily variation of risk factor 𝑅𝑖𝑗.

𝑉𝑗 = fair value of today’s valuation exposure at j-th date (static portfolio).

𝛿𝑖𝑗 ≔ Τ𝜕𝑉𝑗 𝜕𝑅𝑖𝑗 = first-order sensitivity of today’s valuation exposure to risk factor 𝑅𝑖𝑗

(delta, vega, rho, etc.).

Discussion

We know the valuation exposure and its fair value at today’s date, 𝑉0. Instead, it’s much

more difficult to recompute the past fair values of the present valuation exposure,

𝑉1, … , 𝑉𝑁 𝑑

. Thus, we approximate such values using first order Taylor expansion and

today’s risk factors sensitivities as follows

𝑉𝑗 ≅ 𝑉𝑗−1 +

𝑖=1

𝑁 𝑅

𝛿𝑖𝑗 Δ𝑅𝑖𝑗 + ⋯ ≅ 𝑉𝑗−1 +

𝑖=1

𝑁 𝑅

𝛿𝑖,0 Δ𝑅𝑖𝑗.](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-115-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 116

4: AVA calculation

AVA Market Price Uncertainty (MPU) [13]

P&L variance test (cont’d)

Notice that we’re assuming that first order sensitivities are fairly constant w.r.t. the risk

factors levels, 𝛿𝑖,𝑗 ≅ 𝛿𝑖,0 ∀ 𝑗. This is consistent with first order expansion and the static

portfolio assumption. Second order sensitivities (gamma in particular) can be introduced

in the Taylor expansion if required.

Hence we may define the j-th daily profit & loss of the valuation exposure as

𝑃𝐿𝑗: = 𝑉𝑗 − 𝑉𝑗−1 ≅

𝑖=1

𝑁 𝑅

𝛿𝑖,0 Δ𝑅𝑖𝑗, 𝑗 = 1, … , 𝑁 𝑑,

and we may compute the variance of the historical series as

𝑉𝑎𝑟 𝑃𝐿 = 𝑉𝑎𝑟 𝑃𝐿1, … , 𝑃𝐿 𝑁 𝑑

,

Where the EBA RTS requires 𝑁 𝑑 = 100.](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-116-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 117

4: AVA calculation

AVA Market Price Uncertainty (MPU) [14]

P&L variance test (cont’d)

The calculations above may refer to both unreduced and reduced sets of risk factors as

well. Denoting reduced quantities with a hat, the reduced set is characterized by a lower

number of risk factors, 𝑁 𝑅 < 𝑁 𝑅. We may calculate the profit & loss of the reduced

valuation exposure as

𝑃𝐿𝑗: = 𝑉𝑗 − 𝑉𝑗−1 ≅

𝑖=1

𝑁 𝑅

መ𝛿𝑖,0 Δ𝑅𝑖𝑗, 𝑗 = 1, … , 𝑁 𝑑,

with the constrain on the total reduced and unreduced sensitivities,

𝑖=1

𝑁 𝑅

መ𝛿𝑖,0 =

𝑖=1

𝑁 𝑅

𝛿𝑖,0 ,

for each single risk factor class (e.g. delta, vega, etc.).](https://image.slidesharecdn.com/prudentvaluation-long-v1-160602205124/85/Prudent-Valuation-117-320.jpg)

![M. Bianchetti - Prudent Valuation – Global Derivatives – Budapest, 10 May 2016 p. 118

4: AVA calculation

AVA Market Price Uncertainty (MPU) [15]

P&L variance test (cont’d)

Finally, the P&L variance ratio test required by EBA RTS [1], art. 9 can be calculated as

𝑃𝐿 𝑣𝑎𝑟𝑖𝑎𝑛𝑐𝑒 𝑟𝑎𝑡𝑖𝑜 =

𝑉𝑎𝑟 𝑃𝐿 − 𝑃𝐿

𝑉𝑎𝑟 𝑃𝐿

≤ 0.1,

where

𝑉𝑎𝑟 𝑃𝐿 − 𝑃𝐿 = 𝑉𝑎𝑟 𝑃𝐿1 − 𝑃𝐿1, … , 𝑃𝐿 𝑁 𝑑

− 𝑃𝐿 𝑁 𝑑

.

Comments

The approach above is based on common approximations and requires, beyond the

present value and sensitivities of the valuation exposures, just the historical series of