This document provides an overview of Q4 and annual financial results for 2011, as well as an outlook for 2012. Key highlights include:

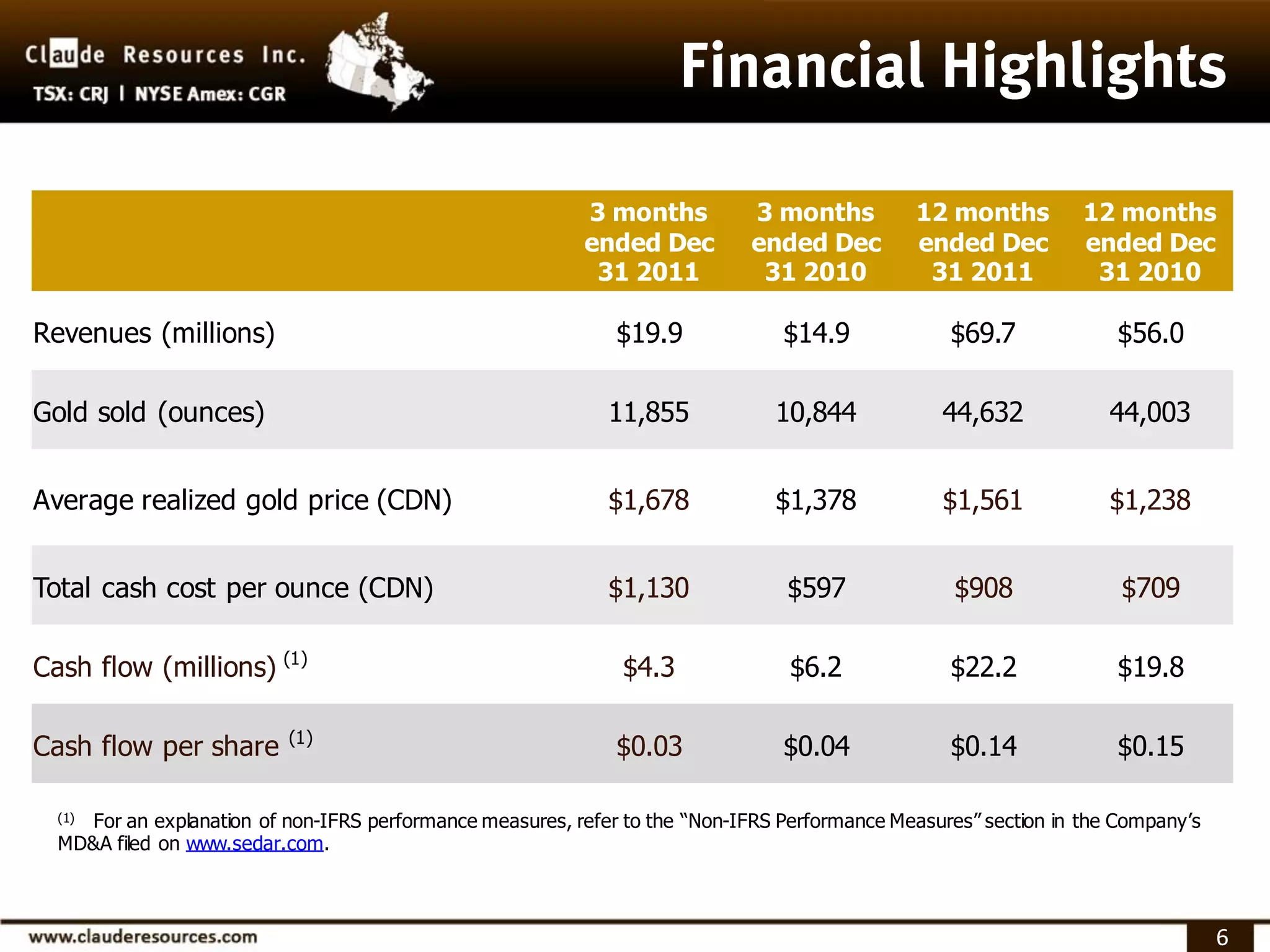

- Revenues of $19.9 million for Q4 2011 and $69.7 million for the full year.

- Gold production of 11,855 ounces for Q4 2011 and 44,632 ounces for the full year.

- Cash costs per ounce of $1,130 for Q4 2011 and $908 for the full year.

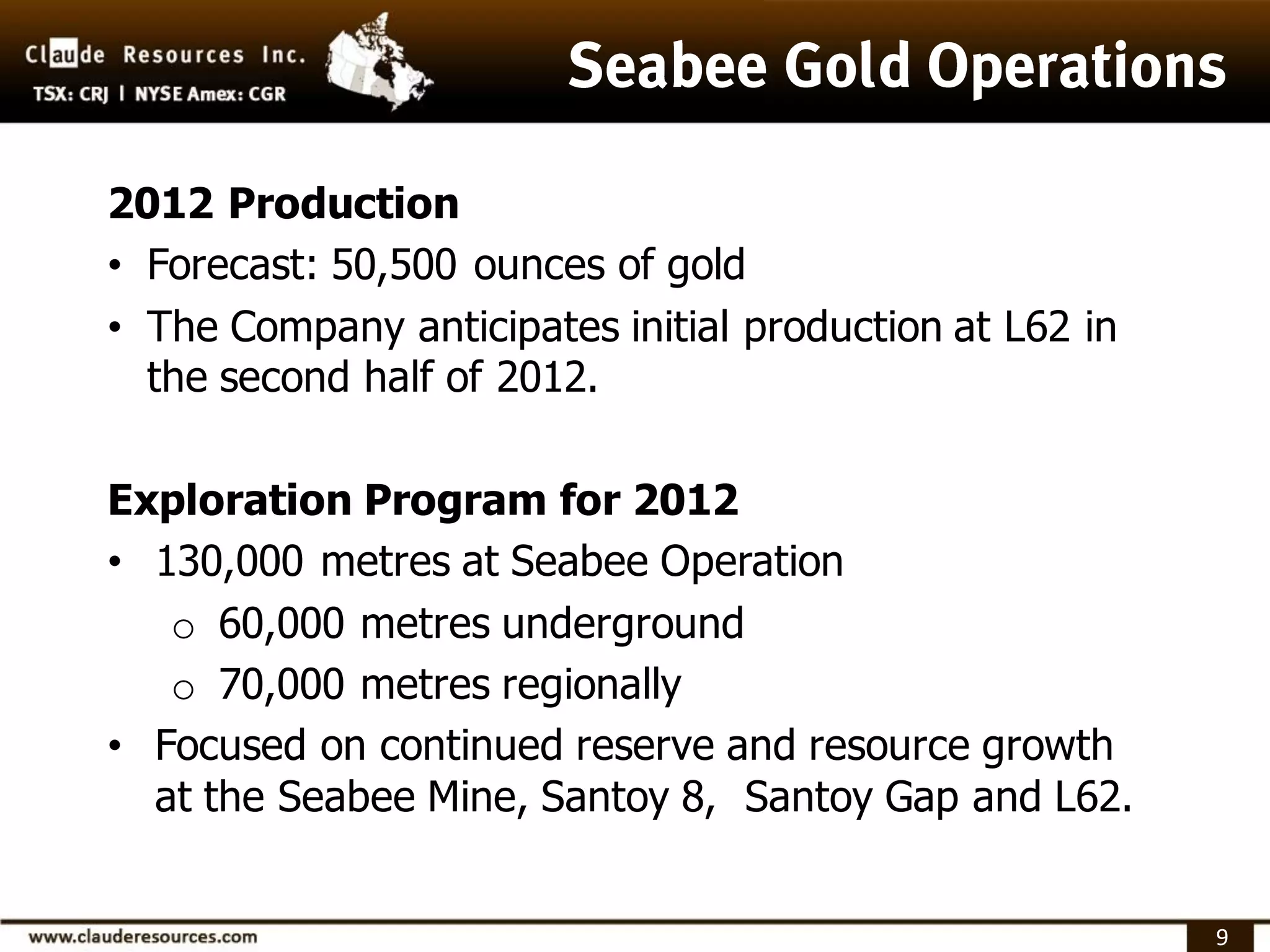

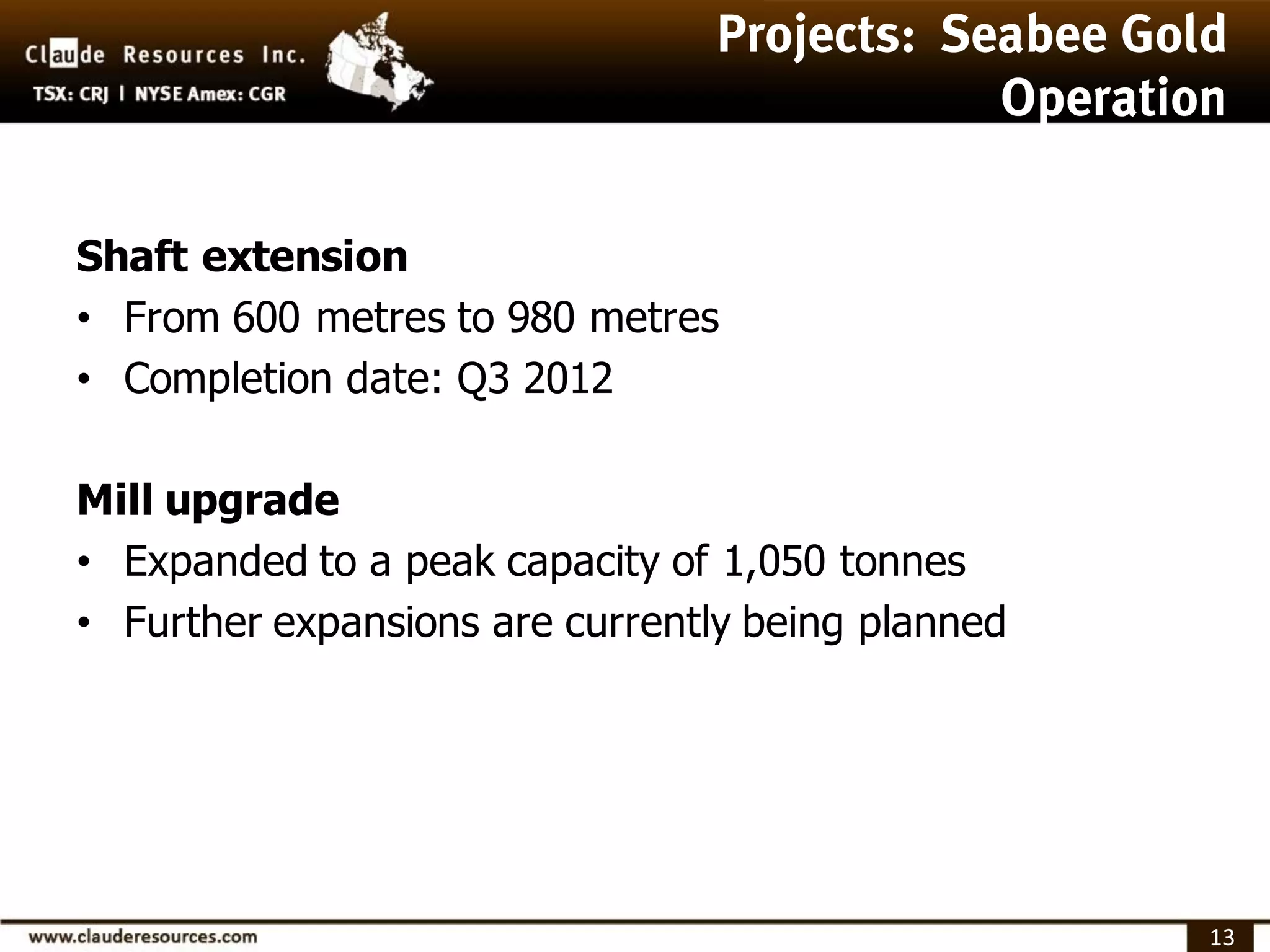

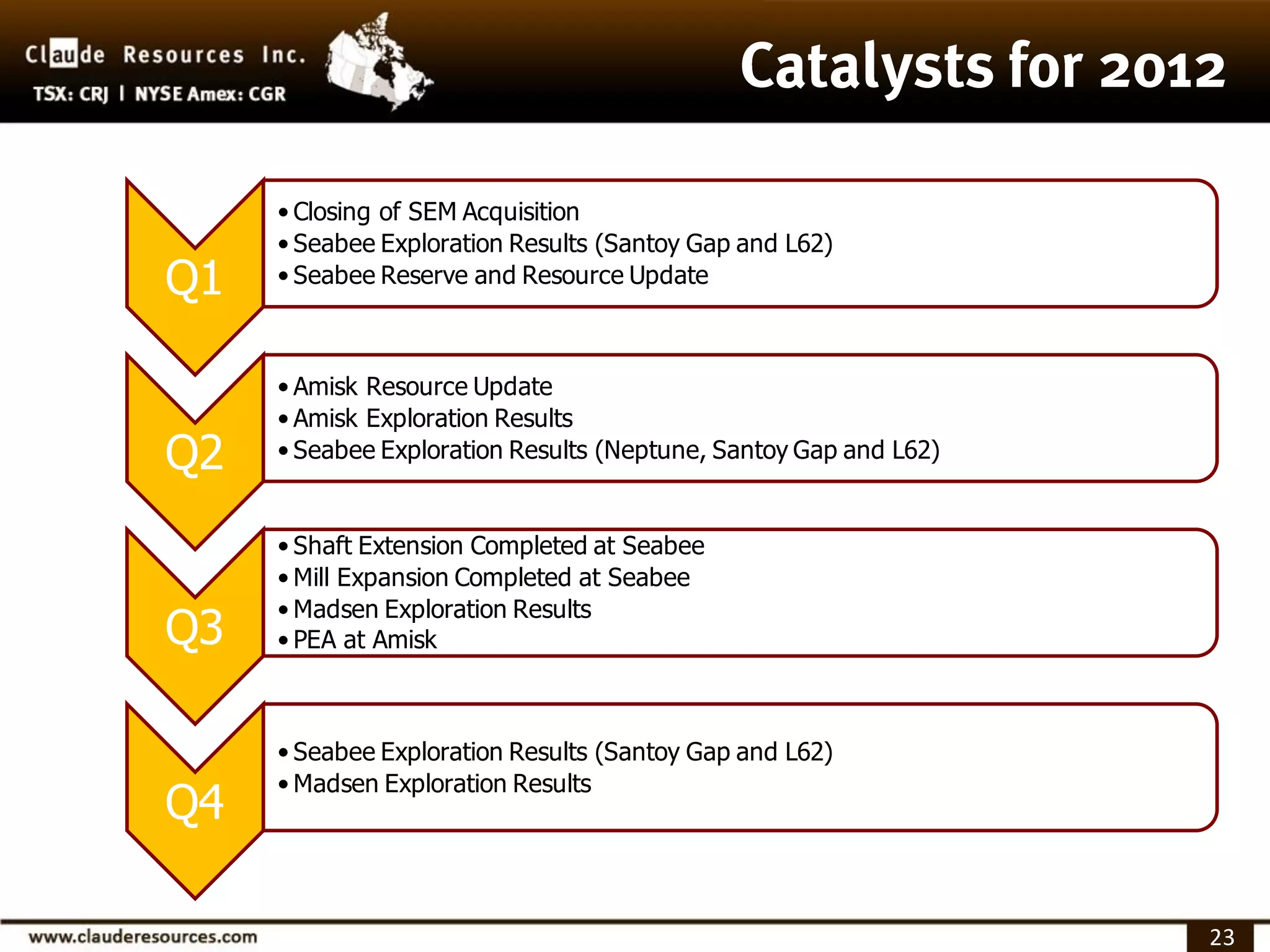

- Forecast gold production of 50,500 ounces for 2012 with initial production from the L62 zone in the second half of the year.

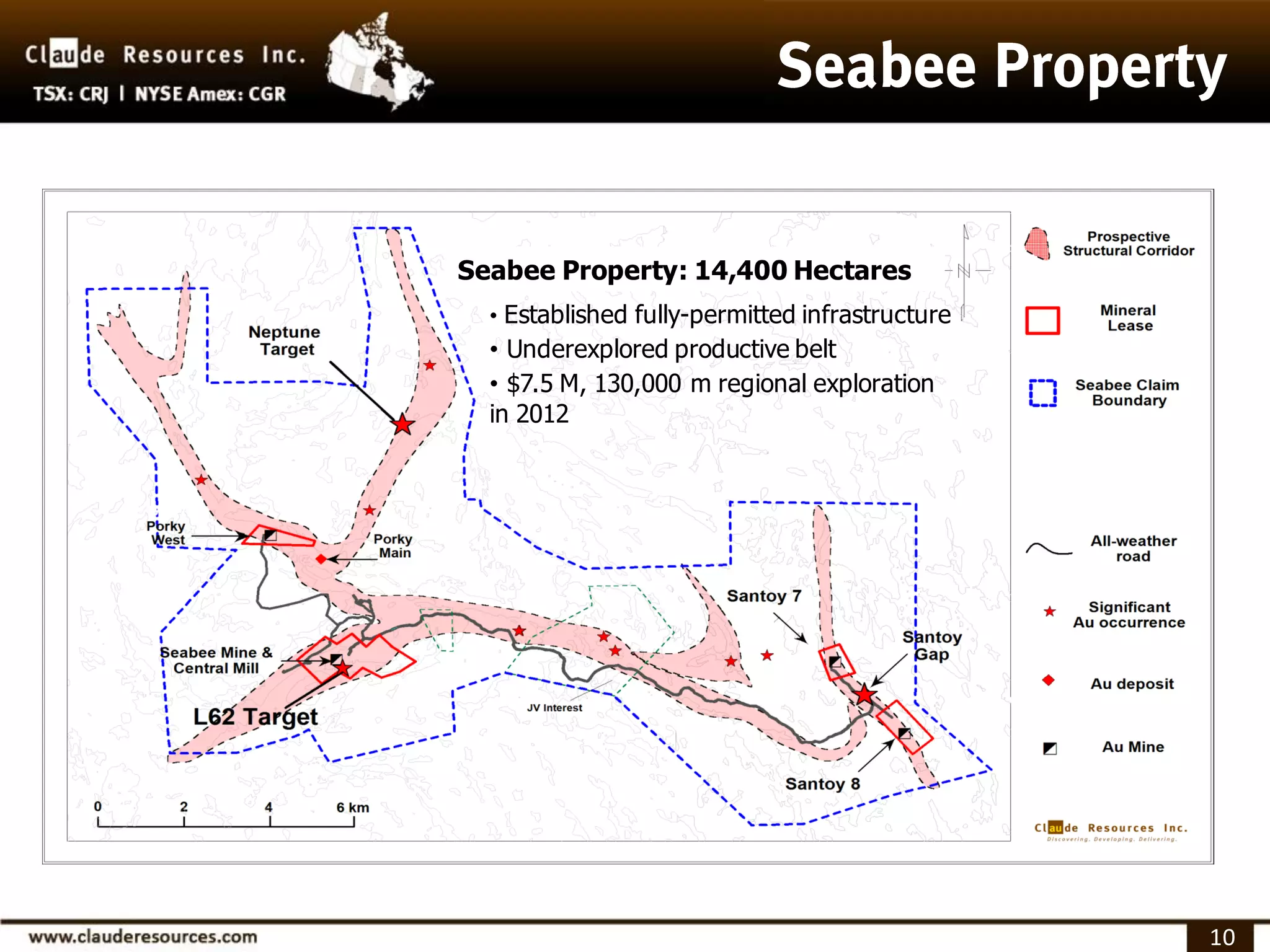

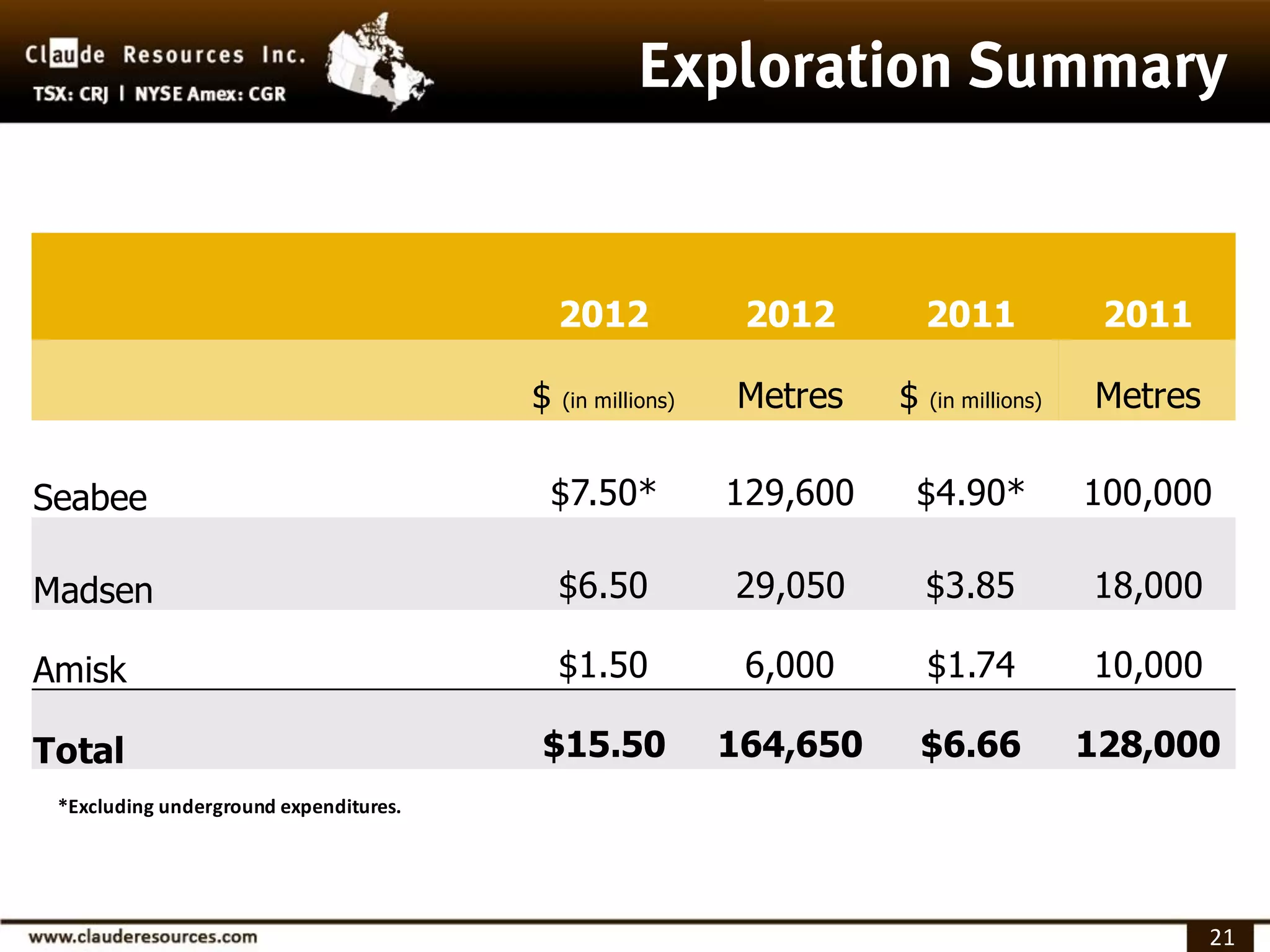

- Exploration program of 130,000 meters of drilling at Seab