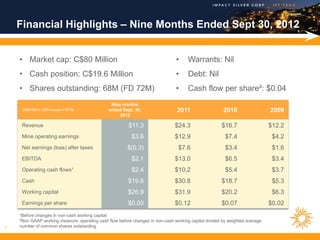

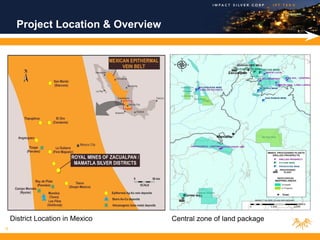

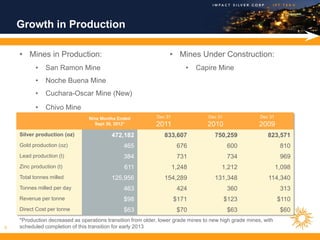

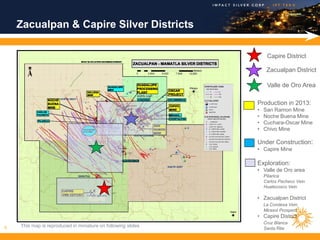

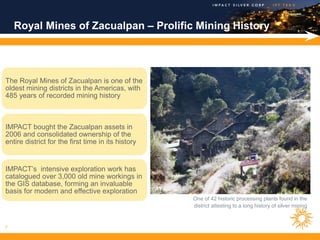

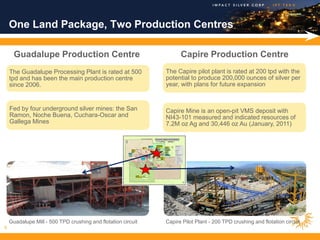

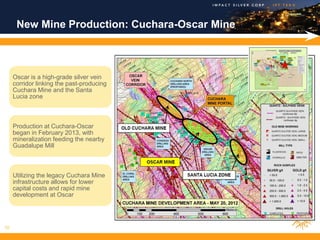

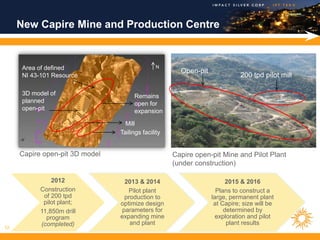

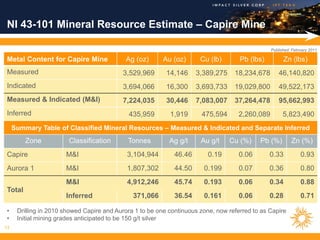

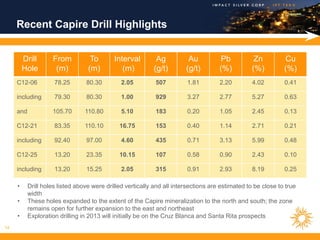

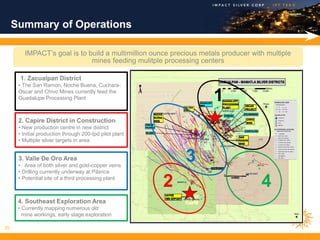

This presentation summarizes IMPACT Silver Corp., a silver mining and exploration company. It highlights IMPACT's profitable silver production in Mexico, strong financial position with $19.6 million in cash and no debt, and construction of a new mining district. The presentation provides an overview of IMPACT's management team, board of directors, project locations, growth in production, and exploration targets to drive future growth.