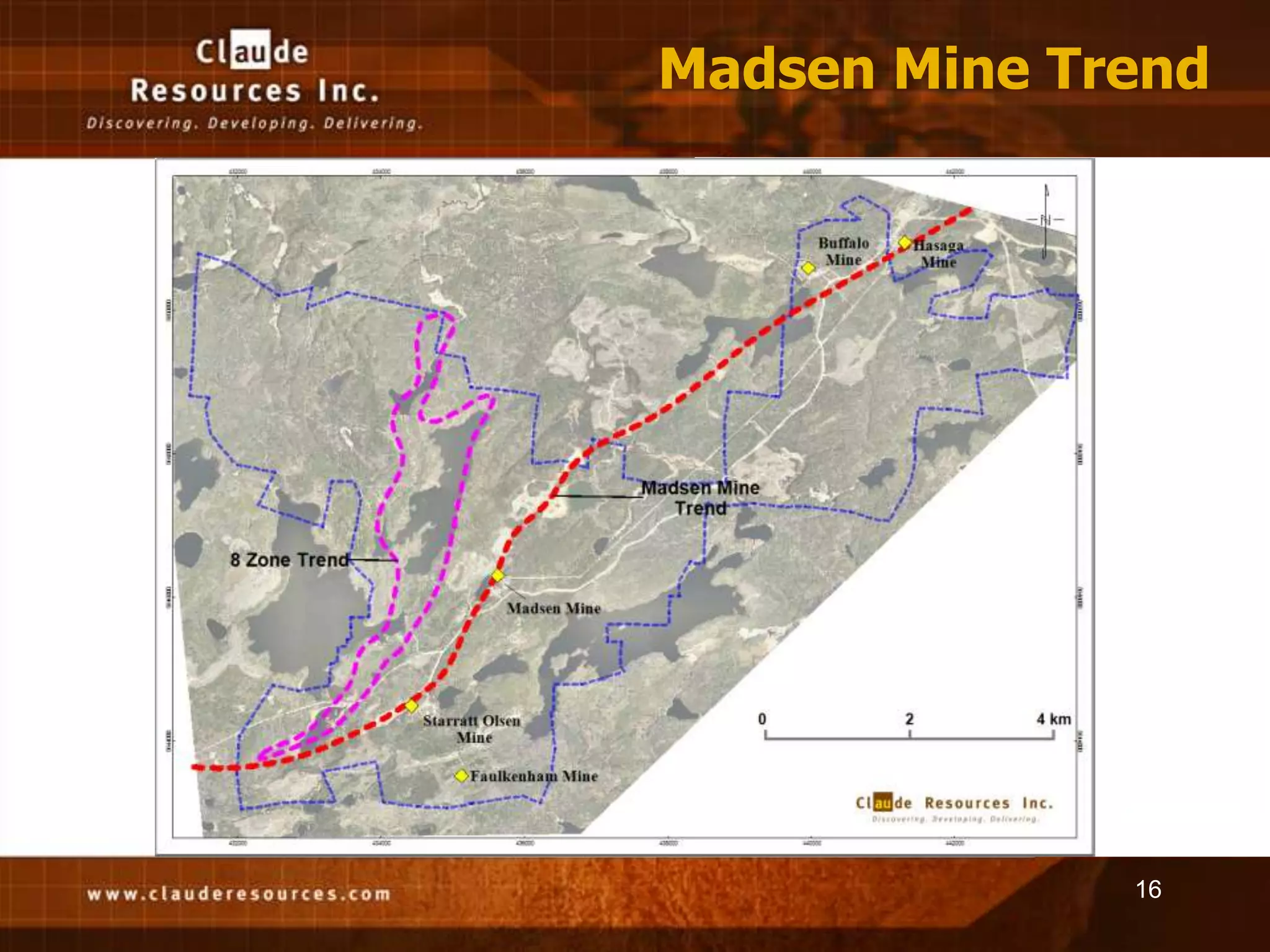

A bright future lies ahead for the company as it works to increase gold production and resource base at its Canadian projects over the coming years. The company has three projects in Canada with the potential to produce over 100,000 ounces of gold per year. Exploration success could significantly grow the resource base, which currently stands at over 3 million ounces. The company aims to leverage its cash flow, exploration upside, management team, and strong balance sheet to provide a great risk-reward investment opportunity.